加密货币市场以剧烈波动而闻名,周末更是如此,因为在周末里波动可以被放大。在刚刚过去的周末里,加密货币再度上演大暴动。

北京时间6月18日,比特币自2020年12月以来首次跌破20000美元的关键门槛,该关口此前被视为“价值技术”支撑线,也被视为投资者的“心理”支撑线。

On 18 June Beijing time, for the first time since December 2020, Bitcoin broke the key threshold of US$ 20,000, which had previously been seen as a “value technology” support line and also as an “psychological” support line for investors.

接着,6月19日午后,比特币再下破至18000美元关口,最低跌至约17597美元。在此期间,以太坊日内一度下跌19%,至881美元/枚,为2021年1月以来的最低水平。

Then, in the afternoon of 19 June, Bitcoin fell down to $18,000, down to about $175,97. During this period, the Ethio Day fell by 19 per cent to $881, the lowest level since January 2021.

截止发稿,比特币与其他加密货币有所反弹,结束了连续12天的下跌态势。比特币周日早些时候一度上涨12%,收复了周六的大部分失地,目前回到20000美元关口上方。以太坊日内一度暴涨15%,报1147美元/枚。

By the end of the release, Bitcoin rebounded with other encrypted currencies, ending 12 consecutive days of decline. Bitcoin rose by 12% earlier on Sunday, recovering most of the land lost on Saturday, and is now back above the $20,000 gate.

专注于加密货币的对冲基金Pantera Capital的合伙人Paul Veradittakit表示:

Paul Veraditakit, partner of the hedge fund Pantera Capital, which focuses on encrypted currency, says:

“我认为我们开始触及机构投资者看到买入机会的底部附近的水平。”

“I think we're starting to touch the level of institutional investors near the bottom of the buy-in.”

根据CoinGecko的数据,在刚刚过去的周末里,交易量比平时要大,截至纽约时间周日中午的24小时内,比特币交易量接近400亿美元。相比之下,上周六和周日,交易量分别为256亿美元和225亿美元。

According to CoinGecko, over the weekend just now, transactions were larger than usual, with Bitcoin trading close to $40 billion within 24 hours of noon on New York Sunday. Compared to last Saturday and Sunday, the volume was $25.6 billion and $22.5 billion, respectively.

不过,即使周日反弹,比特币本月仍下跌了近40%,较11月创下的历史高点下跌了70%以上。今年以来加密货币市场价值缩水超过1万亿美元,一些较小的代币已经下跌了90%。最近一轮的压力自算法稳定币TerrUSD(即UST)与美元的脱锚开始发酵并继续。随后,加密货币贷款机构Celsius决定停止取款。加密货币对冲基金Three Arrows Capital蒙受巨额损失,并表示正在考虑出售资产或进行救助,而另一家贷方Babel Finance上周五紧随Celsius的脚步。

The last round of pressure to stabilize the currency, Terrusd (i.e., UST) with the dollar, started fermenting and continuing. Then, the crypto-currency lending agency, Celsius, decided to stop the withdrawal. The encrypt currency hedge fund, Three Arrows Capital, suffered huge losses and indicated that it was considering selling assets or bailing out, while the other lender, Babel Finance, followed Celsius’s footsteps last Friday.

分析师警告称,这种喘息可能只是短暂的,整体基调仍然负面,货币紧缩带来了宏观阻力,且加密货币内部的危机也引发了人们对不断加剧的困境的担忧。

Analysts have warned that this breathing may be brief, that the overall tone remains negative, that monetary tightening has created macro resistance, and that the crisis within encrypted currencies has raised concerns about the growing dilemma.

Fairlead Strategies的管理合伙人兼创始人Katie Stockton表示,比特币一度突破了18300美元的技术支撑位,如果连续每周跌破该水平将增加跌至下一个支撑位13900美元的风险。她还表示,短期的“反趋势”技术信号“为近期反弹提供了一些希望” 。不过,她警告不要逢低买入,因为“势头非常负面”。

The management partner and founder of Fairlead Strategies, Katie Stockton, said that Bitcoin had once broken the 18,300-dollar technical support position, increasing the risk of falling to the next 13,900-dollar support position if it fell every week. She also said that the short-term “anti-trend” technology signal “gives some hope for a recent rebound.”

Twitter的Crypto社区里的其他声音将20000美元作为比特币价格的关键支点,如果在接下来的几天内重新守稳该关口,则可以获得支撑;否则,它可能是某种市场上限。

Other voices in the community of Crypto on Twitter use US$ 20,000 as a key support point for Bitcoin prices, which could be supported if the crossing were re-established within the next few days; otherwise, it could be some kind of market ceiling.

Quantum Economics创始人Mati Greenspan表示,20000美元的水平“意义重大”,因为它代表了2017年的高点,“从那时起,它在多个场合既是支撑又是阻力”,“如果我们能够达到并保持在该水平之上,那将是相当看涨的”。

According to Mati Greenspan, founder of Quantum Economics, the level of US$ 20,000 is “significant” because it represents the high point of 2017, “since then, it has been both a support and a resistance on several occasions” and “if we can reach and remain above that level, it will be quite high”.

经历接连的大跌后,现在,不断增加的损失甚至让一些最坚定的投资者看起来像在投降。

After successive drops, rising losses now even make some of the most determined investors seem to be surrendering.

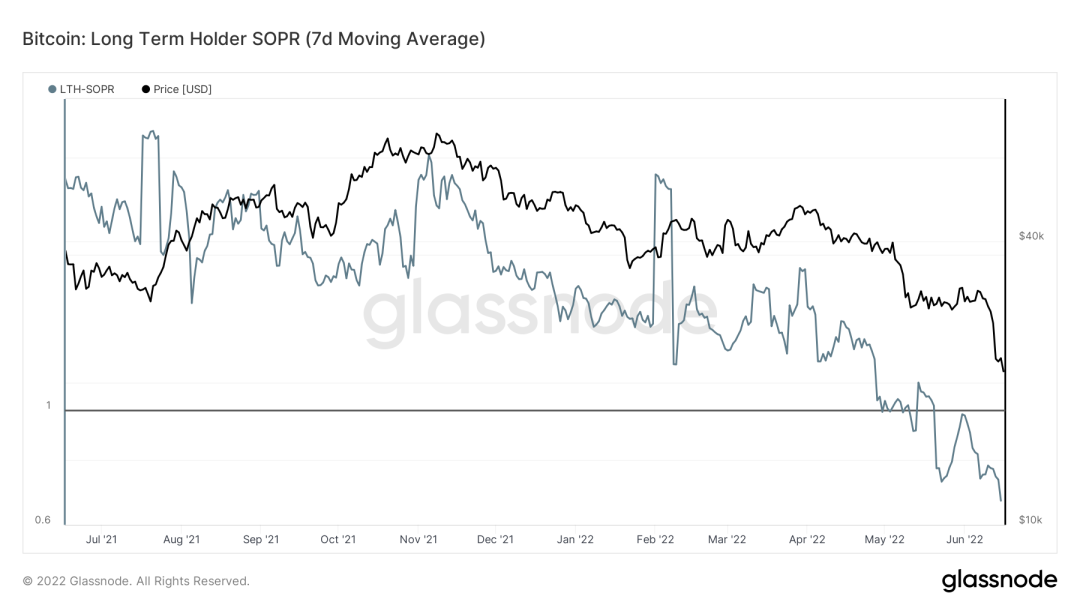

根据Glassnode的数据,一项称为“支出产出利润率”的衡量标准已降至一年来的最低水平,该衡量标准用于跟踪任何一天在区块链上的数字货币市场活动中实现了多少利润。

According to Glasnode data, a measure called the “profit margin of the output of expenditure” has been reduced to the lowest level in a year and is used to track how much profit is achieved on any given day in the digital money market activity in the block chain.

根据Glassnode的说法,支出产出利润率为给定时间范围内的情绪和盈利能力提供了线索,并反映了在链上活动的所有代币的已实现收益程度。它显示了一个平均值,并不一定意味着所有长期持有者都在抛售,也不意味着所有抛售的人都在亏本,但对于一个经历了多次挫折、几乎没有明显的催化剂来帮助它扭转局面的市场来说,这是另一个令人担忧的问题。

According to Glasnode, the profit margin for spending on output provides a clue to the mood and profitability within a given time frame, and reflects the realization of benefits for all the tokens operating on the chain. It shows an average, which does not necessarily mean that all long-term holders are selling, or that all sellers are losing, but it is another matter of concern for a market that has experienced many setbacks, with little apparent catalysts to help it turn around.

Genesis Global Trading的市场洞察主管Noelle Acheson在接受采访时表示:

In an interview with Noelle Acheson, the market insight manager of Genesis Global Trading, said:

“我们已经开始看到长期持有人也在出售。根据链上数据,其中一些似乎是恐慌性抛售,以低于成本的价格退出。”

"We've begun to see long-term holders selling as well. According to the data on the chain, some of them appear to be horribly sold out and exited at a price lower than cost."

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论