文|巴比特资讯

Ventrée Babbitt info.

对于比特币等密码货币资产的未来行情,我们可通过一些估值方法,帮助我们评估资产是处于低估还是高估位置。可惜的是,任何估值方法,都是存在漏洞的,因为市场是动态的,而随着市场上使用它们的人越来越多,这些信号往往会随时间而变弱。总体而言,我们正处在评估密码资产价值的石器时代,因此,我们需采用各种较为靠谱的评估模型,帮助我们更好地判断市场走向,同时应保持怀疑的态度。

Unfortunately, any valuation method is flawed, because the market is dynamic, and these signals tend to weaken over time as more and more people use them in the market. Overall, we are in the stone age of assessing the value of cryptographic assets, so we need to use a variety of more nuanced assessment models to help us better judge the course of the market, while remaining sceptical.

与常规行情分析不同,本系列文章仅会通过评估模型和行业情况,判断资产当前是否高估或低估,至于是否买入或卖出,这些均需投资者自行进行评估。

Unlike conventional BAS, this series of articles will only assess whether assets are currently overestimated or underestimated by assessing models and industry, and whether they are bought or sold will require an investor's own assessment.

(注:项目的成熟度越大,被控盘的可能性也就越小,因此,相关的数据分析也就越有参考价值)

(Note: The more mature the project, the less likely the accused will be and therefore the more relevant data analysis will be of reference value)

可参考的指标

市值(MARKET CAP):市场价格乘以币流通量(即网络价值)

Market value (MARKET CAP): market price multiplied by currency circulation (i.e. network value)

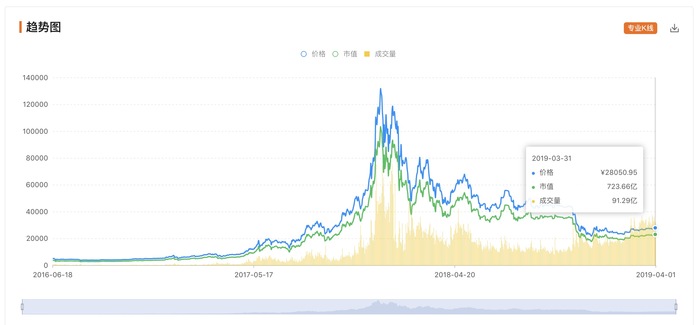

根据qkl123提供的数据显示,当前,比特币网络的市值约为723.66亿美元。

According to data provided by qkl123, the current market value of the Bitcoin network is approximately $72.366 billion.

(数据来自:qkl123)

(data from: qkl123)

比特币活跃地址数:评估比特币市值的重要参考指标之一,我们可使用梅特卡夫定律(Metcalfe’s Law)或Odlyzko定律来评估比特币市值。

Bitcoin Active Addresses: One of the key reference indicators for assessing the market value of Bitcoin, we can use Metcalfe’ s Law or Odlyzko to assess the market value of Bitco.

梅特卡夫定律是计算网络价值的有效参考方式,其原公式为:网络价值=c * n^2 ;

Metcalf Law is an effective reference for the calculation of network value, the original formula being: network value = c * n 2;

而Odlyzko定律公式,则把n^2改为了n * log n,而后者在以太坊创始人Vitalik看来,是更符合区块链网络价值评估的公式。

On the other hand, the Odlyzko legal formula changed from n2 to n*lognn, which, in the view of the founder of Ethio Vitalik, is a formula more in line with the value assessment of the block chain network.

其中的n,就是指活跃地址数了,通过历史数据,我们可计算出一个c值,然后用于衡量网络每天的理论价值。

N is the number of active addresses, and through historical data we can calculate a value of c and then measure the theoretical value of the network on a daily basis.

而由此衍生出来的一个比率,被称为NVM比率,其公式如下:

The resulting ratio, known as the NVM ratio, is based on the following formula:

当实际市值大于预估市值时,这个NVM比率会大于0小于1,则表明市值被高估,当这个NVM比率小于0大于-1时,则表明市值被低估,值偏离的越大,则说明高估或低估程度越大。

When the actual market value is greater than the estimated market value, the NVM ratio is greater than zero and less than one, indicating that the market value is overestimated, and the greater the deviation, the greater the overvaluation or underestimation.

我们可直接通过观察活跃地址数来帮助我们判断比特币的估值。根据blockchain.com提供的数据显示,比特币近期的活跃地址数与2017年7-8月份的活跃地址数相当,这表明这两个时期,比特币的实际估值应该是接近的。

We can help us judge the valuation of Bitcoin directly by observing the number of active addresses. According to the data provided by Blockchai.com, the recent number of active addresses of Bitcoins corresponds to the number of active addresses in July-August 2017, suggesting that the actual valuation of Bitcoins should be close in both periods.

(数据来自blockchain.com)

(Data from Blockchain.com)

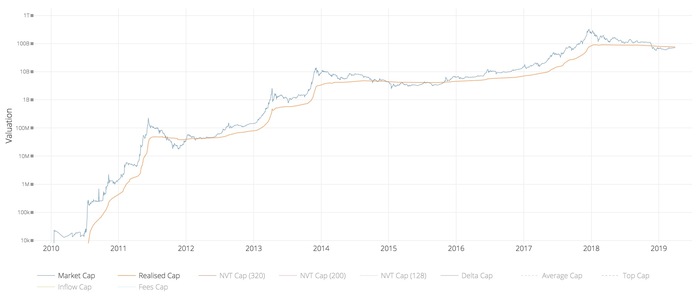

已实现市值(REALISED CAP):流通中所有币的价值,以它们最后一次移动时的价格进行计算,换言之,该值是投资者在比特币市场总共投入资金的近似值。 (提出者:Coinmetrics)

Realized market value (REALISED CAP): The value of all the currencies in circulation is calculated at the price at which they were last moved, in other words, the approximation of the total amount of money invested by investors in the Bitcoin market. (Proposer: Coinmetrics)

(数据来自woobull.com)

(data from woobull.com)

通过观察数据,我们可发现,从2018年1月份开始,比特币的已实现市值(REALISED CAP)一直在下降,其从高点的906亿美元,降低到当前约760.85亿美元(值得注意的是,几天前,BTC的已实现市值达到了阶段性的最低点760.01亿美元)。

By way of observation data, we can see that the realized market value of Bitcoin (REALISED CAP) has been declining since January 2018, from $90.6 billion at a high point to the current level of approximately $76.08 billion (It is worth noting that, a few days ago, the realized market value of BTC reached a milestone of $76.01 billion).

可以说,在2018年11月份之前,比特币的已实现市值(REALISED CAP)一直低于比特币的实际市值,这说明当时比特币的价格还处在被高估的阶段,而在之后,已实现市值(REALISED CAP)实现了反超。而在当前,两者已接近于相等。

It can be said that by November 2018, the realized market value of Bitcoin (REALISED CAP) had been below the actual market value of Bitcoin, indicating that the price of bitcoin was still being overestimated at that time, and that since then the realized market value (REALISED CAP) had been reversed. At present, the two are close to being equal.

该指标的最新数据表明:当前比特币价格与其市场平均价格基本相当。

The latest data for this indicator show that the current price of bitcoins is roughly the same as its average market price.

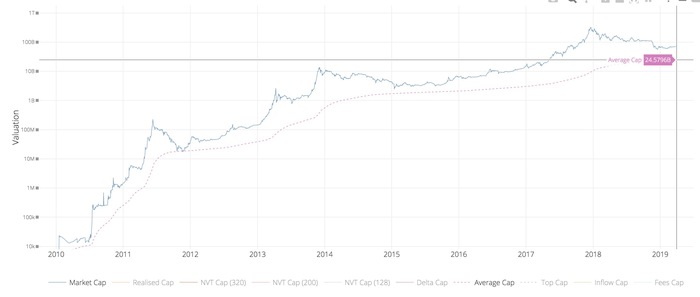

平均市值(AVERAGE CAP):这是市值的“永久”移动平均值。计算方式为每日市值的累积总和,除以以天为单位的市场年龄。

Average market value (AVERAGE CAP): This is market value & ldquo; permanent & rdquo; moving average. Calculated as the cumulative sum of daily market value, divided by the market age in days.

(数据来自woobull.com)

(data from woobull.com)

根据图表数据显示,比特币的平均市值(AVERAGE CAP)一直在增长,当前值为245.79亿美元。但由于其“滞后”的性质,这一指标本身无法用于行情分析,但它会是下一个指标的重要组成部分。

According to chart data, the average market value of Bitcoin (AVERAGE CAP) has been increasing, with a current value of $24.579 billion, but because of its & ldquo; lag & rdquo; by its very nature, this indicator cannot be used in its own right, but it will be an important part of the next indicator.

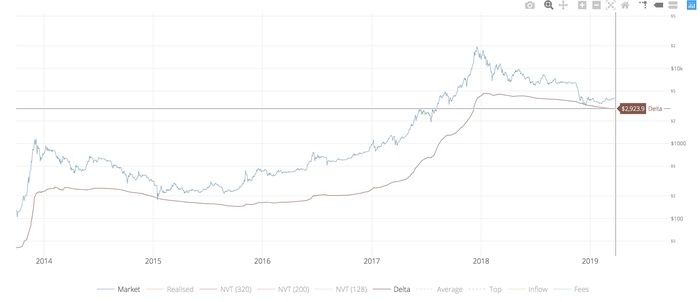

DELTA市值:所谓DELTA市值,就是已实现市值(REALISED CAP)减去平均市值(AVERAGE CAP),该值有助于交易者捕捉市场底部,交易者也可通过跟踪已实现市值和平均市值之间的振荡,来作为市场顶部和牛市阶段开始的时间指示器。(这一实验性评估方案的提出者,是 David Puell)

Market value of DELTA: The market value of DELTA is the realized market value (REALISED CAP) minus the average market value (AVERAGE CAP), which helps traders capture the bottom of the market and can also be used as a time indicator for the start of the top-of-the-market and cattle phases by tracking the oscillations between the realized market value and the average market value. (The proposer of this experimental assessment programme is David Puell)

(数据来自woobull.com)

(data from woobull.com)

根据数据显示,比特币的DELTA市值在2018年1月份达到历史高点的788亿美元,此后开始缓慢下降,至近日达到1年以来的最低点514.8亿美元,然后在今日略有回升。

According to the data, the market value of DeLTA in Bitcoin, which reached a historic high of $78.8 billion in January 2018, has since begun to decline slowly, reaching a recent low of $51.48 billion in one year, before recovering slightly today.

我们可以观察到,在2018年12月中旬,DELTA市值与比特币实际市值相交了,历史上,2011年和2015年初有两次相交,这代表市场触及了阶段性底部,而当前,两者的差距又在逐渐拉大,这是一个偏积极的信号。

It can be observed that in mid-December 2018, the market value of DELTA was linked to the actual market value of Bitcoin, and that historically, there were two interactions between 2011 and early 2015, representing the market at the bottom of the phase, while the gap between the two is gradually widening, which is a positive sign.

但也要注意的是,delta cap与比特币实际市值相交,并不能保证我们未来不会继续下跌,市场是在不断变动的。

But it is also important to note that Delta cap, which intersects with the real market value of Bitcoin, does not guarantee that we will not continue to fall in the future and that the market is constantly changing.

但当前的DELTA市值指标告诉我们:短期市场是偏向健康状态的。

But the current market value indicators for DELTA tell us that short-term markets are in a state of health bias.

而DELTA市值与平均市值相交,则意味着牛市的到来,根据当前的数据来看,市场距离迎来真正的牛市还有很长的一段时间(可能接近1年),而未来的很长一段时间,大概率会继续盘整,但不排除平台币和IEO的小牛市会间接影响到比特币市场。 (这也意味着,这段时间会是很好的投资时间)

DELTA’s market value is related to the average market value, which means, according to current data, that there is still a long way to go before the real market (possibly close to one year) and that, for a long time to come, it will probably continue to be rounded up, without excluding the indirect impact of the platform coins and the IEO’s calf market on the Bitco market. (This would also mean that this time would be a good investment time.)

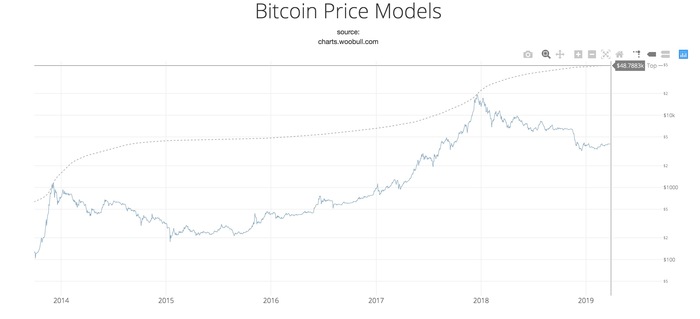

TOP CAP(顶部市值):平均市值乘以35,该指标用于评估下一个牛市的顶部位置,历史上的数据一直与市场行情相匹配。 (提出者是Willy Woo和David Puell)

TOP CAP (top market value): The average market value multiplied by 35 is used to assess the top position of the next cattle market, and historical data have been matched by market dynamics. (The presenters are Willy Woo and David Puell)

需要明确的是,该数据只是基于历史数据对未来进行预测,实际情况会有很大的偏差,根据当前的平均市值(AVERAGE CAP)数据,我们可得出下一个牛市比特币的市值顶点至少会在8600亿美元(约是当前市值的12倍),而由于平均市值(AVERAGE CAP)数据可能会继续增长,则TOP CAP(顶部市值)也会相应地增长。再次提醒,该评估方案依旧是实验性质的,请谨慎参考。

It needs to be made clear that the data are only based on historical data for projections of the future and that there are substantial deviations in the actual situation. On the basis of the current average market value (AVERAGE CAP) data, we can arrive at a market value peak of at least $860 billion (about 12 times the current market value) for the next cow city bitcoin, while the average market value (AVERAGE CAP) data is likely to continue to grow, and the TOP CAP (the top market value) will grow accordingly.

(数据来自woobull.com)

(data from woobull.com)

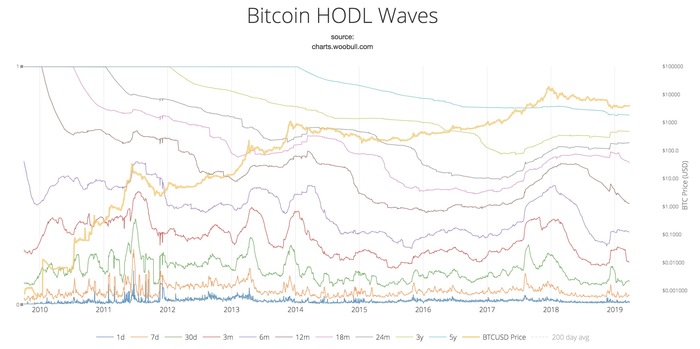

比特币HODL Wave :这是一个由Unchained Capital首创的可视化工具,它显示了钱包中比特币的横剖面,并按它们最近一次移动后的年龄分组。下图中上面的线表示未变动的旧币(供应),而下面的线表示最近转移的币(新的需求)。综合视图,则清楚地显示了每一个牛熊周期的变化。这种可视化工具,有助于投资者准确定位牛市和熊市之间长期振荡期间的市场时机。 更多信息,读者可以看这篇文章《Bitcoin Data Science (Pt. 1): HODL Waves》。

Bitcoinhand HDL Wave: This is a visualization tool initiated by Unchained Capital, which shows the cross-section of bitcoins in wallets and groups them according to the age of their most recent movement. The lines above indicate the old currency (supply) that has not changed, while the lines below indicate the currency that has recently been transferred (new demand).

通过查看图表变化,我们可以观察到,在2018年一整年里,市场的需求是在大幅下降的,而在18年年底时,需求则出现了明显反弹(加仓很明显),而进入2019年之后,12-18个月的HODL Wave下降明显,他们可能是上一轮牛市的新入场者,而超过2年的HODLer,则明显非常地佛系。

By looking at the changes in the chart, we can see that demand in the market fell significantly throughout the year 2018, while demand rebounded significantly at the end of the year (the silo was obvious), and after entering the year 2019, the decline in HODL Wave in 12-18 months was significant, and they could be new entrants to the last round of cattle, while the HODLer, more than two years old, was clearly very Buddhist.

从图中我们可以观察看到,3年以上的HODLer,他们的交易经验明显好于新人,在市场处于上升周期时,他们选择减仓,而在市场处于熊市周期时,他们又会进行加仓。

As we can see from the map, HODLer, who has had more than three years of trading experience than newcomers, chooses to soften when the market is in a rising cycle, and when the market is in a bear-market cycle, they do it again.

而图表的HODL Wave数据则告诉我们,目前市场正与15年初的阶段非常相似。

The figure HODL Wave tells us that the market is now very similar to the phase at the beginning of 15 years.

(数据来自woobull.com)

(data from woobull.com)

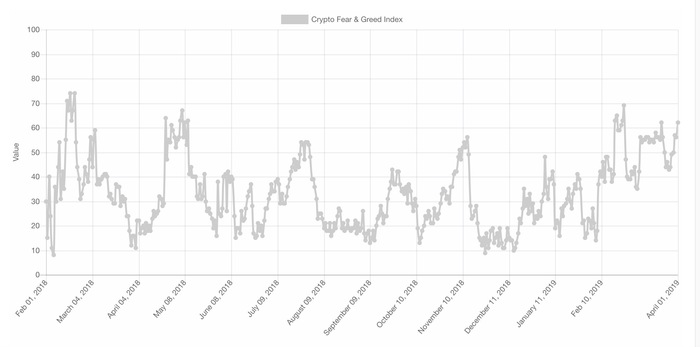

密码货币恐惧与贪婪指数:alternative.me专门针对比特币推出的恐惧和贪婪指数,其指数越高,风险越大,指数越低,风险越小。但由于其数据来源和计算方式并不透明,因此它虽然有参考价值,但不能过于依赖。

The cipher money fear and greed index: the higher the index, the greater the risk, the lower the risk, and the less the risk. Because its data sources and methods of calculation are not transparent, it should not be too dependent, although it has a reference value.

我们可以看到,在2018年11月25日,市场的指数为9,是18年至今的最低值,而在那天,比特币的价格并非是低点,可见,这一指标的准确率并不是很高。

As we can see, on 25 November 2018, the market index was 9 — the lowest value since 18 years — and on that day, the price of Bitcoin was not low, and thus the accuracy of this indicator is not very high.

而当前的市场指数为62,属于刚进入贪婪的范畴,可见市场风险适中。

The current market index of 62, which falls within the category of new greed, shows that market risks are moderate.

谷歌(及百度)趋势:粗略来看,谷歌搜索量与比特币行情是呈成正相关的,因此相关数据可用于参考,但由于多数参与者都是后知后觉型的,因此,此参数具有很大的滞后性。

Google (and 100 degrees) trends: Google search volumes are, in a rough sense, positively related to bitcoins, so that the data can be used for reference purposes, but this parameter has a significant lag since most participants are post-conscious.

(数据来自trends.google.com)

(data from trends.google.com)

而更合理的利用方式,是将谷歌趋势当成是接盘指数,在行情处于下降趋势时,指数越高,说明抄底的人越多,而在行情处于上升阶段时,指数越高,则说明接盘的风险越大。查看5年的历史数据,我们看到,在2017年12月份,谷歌趋势的比特币指数达到100,说明这是历史上风险最大的阶段,而当前的谷歌趋势指数为5,说明接盘风险相对较小。

And the more rational way to use it is to think of Google trend as a relay index, and the higher the index is, the higher the bottom is, the higher the bottom is, and the higher the end is, the higher the end is, the greater the risk. Looking at the five-year historical data, in December 2017, we saw that Google trend's bitcoin index reached 100, indicating that it was the most risky phase in history, while the current Google trend index is 5, indicating that the link risk is relatively small.

不会采用的几个指标:

Several indicators not to be used:

-

资金净流入和净流出:该指标概念来自股市,其计算方式可能会存在多种方式,比方说在某一个时间段,价格上涨,则该时间段的成交金额会计算为资金流入,而若价格下跌,则记为资金流出,而另一种方法则是计算主动性买卖单。总的来说,所谓的净流入和净流出计算方式,都是存在不科学性的,会有很大的误导性,当行情上涨时,其显示为净流入,而当行情下跌时,则显示为净流出,其无法用于判断接下来的走势,因此不建议投资者参考这些指标。

Net inflows and net outflows: The concept of the indicator comes from the stock market and can be calculated in a variety of ways, for example, when prices rise over a certain period of time, the amount of the transaction over that period will be counted as an inflow, while if prices fall, it will be recorded as an outflow, while another method of calculating the active purchase and sale list. Overall, the so-called net inflows and net outflows are both unscientific and misleading, and when the movement rises, they are shown as a net inflow, while when the movement falls, they are shown as a net outflow, and they cannot be used to judge the next movement, and investors are therefore not advised to refer to these indicators.

-

大额转账数据:所谓的大额转账,可能会被人视为卖出信号,实际上则可能存在钱包整理以及大户故意诱导散户抛售的可能,因此,大额转账并不能被视为行情的有效参考指标。(除非发生黑客盗取大量交易所资产,或者有人公开表示要抛售,以制造市场恐慌的事件发生)

Data on large transfers: so-called large transfers may be regarded as a sign of sale, but there may actually be the possibility that wallets will be sorted and large households will be tempted to sell them, so that large transfers cannot be considered a valid reference indicator of behaviour. (Unless there is an incident in which hackers steal a large amount of exchange assets, or there is a public offer to sell them in order to create market panic.)

-

交易所交易量变化:由于市场刷量情况过于严重(超过90%的量是不真实的),这导致数据的可参考性大大降低。

Changes in the volume of exchange transactions: This has led to a significant decrease in the availability of data due to excessive market balances (more than 90 per cent is not true).

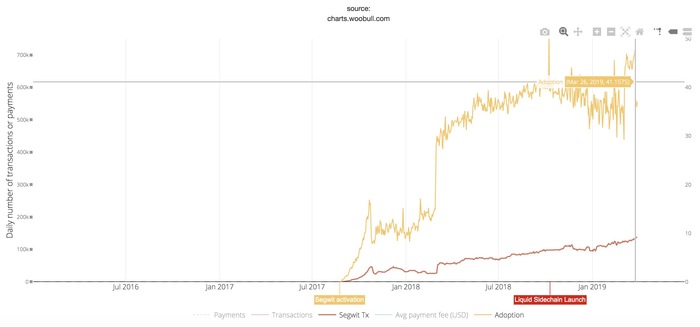

隔离见证、闪电网络、Liquid侧链等扩展型方案的采用情况

Introduction of Extended Programmes such as Isolation Witness, Lightning Network, Liquid Side Chain

如果比特币按照当前的基础设施不变,则其理论市值会存在上限,因为其能够拥有的活跃用户数会被限制。而技术方案的应用,可用于提高这种上限,包括隔离见证、大区块扩容等链上扩展型方案,可提高比特币的链上价值上限,而闪电网络、Liquid侧链等off-chain方案,则可相应地为比特币附加价值,因此,这些方案的采用情况,对于比特币的估值而言是有益的。

The theoretical market value of Bitcoin would be capped if it were to remain the same as the current infrastructure, as the number of active users it could have would be limited. The application of technology options, which could be used to raise such ceilings, including extended-chain schemes such as isolation witnesses, block enlargement, etc., could raise the value ceiling on the Bitcoin chain, while the flash network, the Liquid flank chain and the off-chain programmes could add value to the Bitcoin, so that their adoption would be beneficial for the Bitcoin valuation.

根据woobull.com提供的数据显示,隔离见证采用率处于稳步上升的状态,而相应的交易数则一直处于增长的状态,这对比特币的估值而言是有益的,因为若其被完全采用,理论上可扩大比特币市值上限数倍。

According to the data provided by Woobulll.com, the rate of adoption of the isolation witness has been steadily increasing, while the corresponding number of transactions has been increasing, which is useful for the valuation of Bitcoin, since if fully adopted it would theoretically increase the number of times of the Bitcoin market value cap.

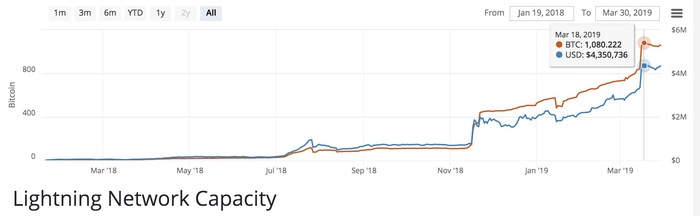

而闪电网络方面,自今年初以来,闪电网络通道的容量呈现了很好的增长趋势,根据bitcoinvisuals提供的数据显示,在3月17日时,闪电网络容量达到历史高点的1080 BTC,当前为1059.8BTC,相比略有回落。

In the case of lightning networks, there has been a good growth in capacity since the beginning of the year, and according to the data provided by bitcoinvisuals, on 17 March the capacity of lightning networks reached a historical high of 1080 BTC, currently 1059.8 BTC, a slight decline.

关于闪电网络、Liquid侧链等off-chain方案对比特币价值的附加,目前市场上尚未有公开的计算方法。

With regard to the addition of the value of the foreign-chain programme, such as the lightning network, the Liquid side chain and so forth, there is currently no open method of calculation available in the market.

但总体而言,基本面的向好对于比特币估值而言都是有益的。

Overall, however, the positive fundamentals are beneficial for the Bitcoin valuation.

总结

通过以上的数据分析方法,我们可以看到,目前比特币处于一个较为健康的状态,其理论市值与实际市值基本相当,而基本面的向好,则有利于比特币估值的增加,而市场距离真正的牛市,还需等待一段较长的时间(6-12个月),至于比特币下一个牛市的峰值,根据Willy Woo和David Puell的研究,则相当于当前比特币市值的12倍,不过,这一方案是根据历史数据总结而出的周期理论,其并不一定适用于下一个牛市,因此,我们只能谨慎参考。

Through the above data analysis, we can see that bitcoin is now in a healthier state, that its theoretical market value is roughly the same as the actual market value, and that good fundamentals are conducive to an increase in the valuation of bitcoin, and that the market distance from the real cattle market requires a longer period of time (6-12 months) than the peak of the next cattle market in bitco, which, according to the studies of Willy Woo and David Puell, is equivalent to 12 times the current market value of bitcoin, although the programme is based on a cyclical theory based on historical data that does not necessarily apply to the next cattle market, so we can only refer to it with caution.

而对于以太坊、eos等主流加密货币,这些估值方案,都可微调后进行应用,但准确性一定不及比特币。

These valuation options can be fine-tuned and applied in mainstream encrypted currencies such as Taiping, eos, but with less accuracy than Bitcoin.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论