搬砖这个词如果有在数字货币圈里头应该不难听到,通常会想到的都是交易所间的搬砖。因为各交易所间的价格不一,导致中间有机会进行套利,比方说币安的比特币价格如果高于Bitifinex,便可以由Bitifinex购入比特币后再到币安转卖,反之亦然。

If the word bricks were to be heard in a digital currency ring, it was usually thought of as inter-exchange bricks. Because prices varied from exchange to exchange, there was an opportunity for arbitrage in the middle, for example, if Bitfinex’s price was higher than Bitfinex, then Bitfinex could buy it into bitcoins and then resell it, and vice versa.

这种方式其实跟传统低买高卖的贸易方式很像,差别就在搬砖通常全部都由电脑即时达成,而且这种搬砖方式通常有低风险的特性,不管如何经过一轮手上的币都会变多,需要承担的风险就是当币值下跌的时候手上的币可能变得一文不值,另外也有可能因为延迟抢不到其中一边的的单而导致亏损。

This approach is similar to the traditional low-cost and high-sales trade, where the difference is that moving bricks is usually done immediately by computers, and this type of moving bricks usually carries a low-risk feature, regardless of how it goes through a round of currencies, and the risk is that the currency in hand may become worthless when the value of the currency falls, and may also result in losses due to delays that do not capture one side of the list.

值得一提的是,通常因为交易所间的汇款会收取高昂的手续费,也会耗去不少时间,因此如果要进行交易所间的搬砖套利,会同时在两交易所中事先储值好要搬得币种,以利在汇差产生时便即时下单交易。例如如果要在币安与Bitifinex 间进行比特币与USDT 的搬砖,则必须要在两交易所内事先储值好USDT 与BTC,当币安价格高于Bitifinex 时,立刻卖出币安里的BTC,并同时卖出Bitifinex内的USDT。

It is worth noting that, often because of the high transaction fees and the time spent on inter-exchange remittances, if the exchange were to move brick arbitrage, the exchange would have to pre-position the value in both exchanges in order to facilitate a single transaction as soon as the transfer was made. If, for example, Bitfinex and Bitfinex were to move bricks between coins, it would be necessary to pre-position USDT and BTC in both exchanges, and to sell BTC in Bitifinex as soon as the price of the currency was higher than Bitifinex, and to sell USDT in Bitifinex at the same time.

但这里要介绍的是另外一种搬砖方式─交易所之内的搬砖,我们以币安交易所为例,币安交易所上面有四种交易对:BNB/BTC/ETH/USDT,如果交易对间产生价差,便可以透过中间价差来赚取微薄的利润。

But here is another way of moving bricks within the exchange, where, for example, there are four types of transactions: BNB/BTC/ETH/USDT, and where the transaction produces price differentials, we can make small profits through intermediate price differentials.

但实际上还需要扣去交易所交易的手续费,以刚刚提的币安交易所为例,它的手续费约0.1%,以BNB付款的手续费约0.075%,再以注册推荐码反佣20%计算后大约0.06%。(持有500BNB可以反佣40%)。

In practice, however, there is also a need to deduct transaction fees from the exchange, for example, in the case of the currency exchange just mentioned, which costs about 0.1%, in the case of BNB payments about 0.075%, and then in the case of the RIN 20%, in the case of RACs about 0.06%. (with 500 BNBs available 40%.)

交易流程以上图Hello Coin的例子来说,首先以BTC 购入100 Hello,再把手上的100 Hello 转成ETH 卖出,完成一个流程便可以赚到约4% 的价差,而且最后的BTC<-> ETH 交易对在本金足够而且节省手续费的情形下可以不做。以一般人能够取得的币安手续费约0.06%*2=0.12%,只要价差超过0.12%就可以启动自动交易了!

In the case of the transaction flow chart Hello Coin above, first, buy 100 Hello with BTC, then sell 100 Hello with ETH, and complete a process with a price difference of about 4%, and lastly BTC<-> ETH transactions can be avoided if the sum is sufficient and the fee is saved. About 0.06%*2 = 0.12% of the fee is available to ordinary people, and automatic transactions can be started if the price difference exceeds 0.12%!

以上图为例,搬砖利润的计算公式如下

For example, the formula used to calculate the profit from moving bricks is as follows:

ETH Ask/BTC Bid*ETHBTC=0.0026/0.0001*0.04=1.04

能够搬的数量就是

min(BTC Bid Amount,ETH Ask Amount)

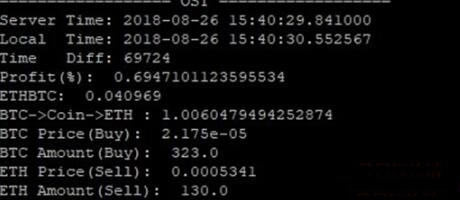

实际来看OST曾出现的状况,在这情形下搬一次砖大概有

0.0005341/0.00002175*0.040969=1.006947

0.7%左右的收益!!

About 0.7% of the proceeds!

接着了解基本原理后,便可以把所有的流程都透过程式完成,这里要注意的是,建议使用websocket 而非一般的API来接收数据。websocket 跟一般的API不同的是:一般API需要从本地端发出请求后服务器才会回传资讯,而websocket 就像是订阅制的用户一样,一旦服务器数据有改变,服务器便会自动推播数据到用户端,在时间上自然没有那么即时。

After learning the underlying principles, it is possible to complete all the processes through the program, noting that websocket, rather than the usual API, is proposed to receive data. Unlike the usual API, websocket is that normally APIs need to send requests from local sources before sending information back, and websocket, like subscriber users, automatically transmits data to the user as soon as the server data changes.

来试跑一下程式,你实际上会发现完全抢不到单阿~也可以发现已经有很多组人马在竞标了。因为抢不到单,索性就用市价单去抢看看有没有利润,最后被我顶出这么大一根。

Try running the program, you'll actually find that you can't get a single one. And you'll find that there's already a lot of teams competing. Because you don't get a single one, you use the market price list to find out if there's a profit, and I'll take one of those.

查看了原始数据,因为屡次抢不到,直接用市价单去抢抢看,看能不能加减喝到一点汤,可以发现在23:55:56发生可以套利的价差时,马上有多组机器人进场抢单,很不幸的……..红色框起来的是我,最后一名……

Looked at the original data, because it was impossible to do it again and again, and went straight to the market price list, to see if you could get a little soup on top of it. It was found that, at 23:55:56, when there was a arbitrable price difference, there were several robots coming in, unfortunately & Hellip; & Hellip;..the red frame was me, the last & & Hellip; & Hellip; & Hellip;

为了找寻原因,索性Ping了一下币安的服务器,假设网站跟后台是在同个ip的状况下,延迟大约落在14~57ms中间,似乎有点太高了,或许是这个原因造成的。

In order to find a reason, Soy Ping took a look at the currency server, assuming that the site was in the same position as backstage and that the delay fell between 14 and 57ms, which seemed to be too high, perhaps because of this.

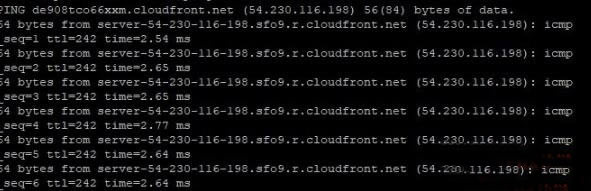

上网查了资料后,可以发现Binance 的主机在洛杉矶,因此在AWS上选了便宜的而且服务器同样在洛杉矶的试用主机,再次Ping了一下币安的主机,延迟降到2.6ms左右。

After checking the data online, it became possible to discover that Binance's mainframe was in Los Angeles, so a cheap pilot mainframe was selected on AWS and the server was also in Los Angeles. Once again, Ping had a currency security mainframe, which was delayed to about 2.6ms.

即使设下了时间差,推播出的时间点跟接受端的时间压到20ms,实际上还是抢不到………任何一笔。

Even if the time difference was set, the timing of the broadcast and the time of the receiving end had run to 20 ms, there was practically no & Hellip; & Hellip; & Hellip; any sum.

仔细想想搬砖这件事情本质上就是Winner takes all.,赢家全拿。只要世界上有任何一个团队在做,而他们拥有相对低的延迟与手续费、甚至是交易所的专有线路,那么所有有利润的套利单通通会被他们垄断掉,一般玩家就跟我一样只能望着市价单兴叹,毕竟在我们看到限价单的时候,往往另一组团队早已完成交易了。

Think about it as Winner takes all. Winner wins all. As long as there is a team in the world that has relatively low delays and fees, and even exclusive lines in the exchange, all profitable arbitrage will be monopolized, and the players, like me, will look to the market, after all the time when we see the price limits, another team has already done the deal.

以上就是什么是数字货币搬砖?搬砖利润的计算公式介绍的详细内容,更多关于数字货币搬砖的资料请关注脚本之家其它相关文章!

What is this? The details of the formula used to calculate the profit of moving the bricks, and more information about moving the bricks in the digital currency, please pay attention to other relevant script house articles!

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论