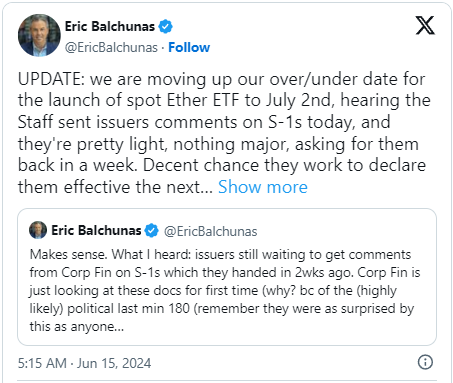

彭博社ETF分析师 Eric Balchunas 宣布,业界高度期待的现货以太坊ETF预计将于7月2日启动交易。

Eric Balchunas, an ETF analyst at Bloomberg, announced that the industry's high-awaited spot

据 Balchunas 透露,美国证券交易委员会(SEC)已经就 S-1 文件向ETF发行方发出了简短的评论,并要求其在一周内回复。

Balchunas disclosed that the United States Securities and Exchange Commission (SEC) had sent a brief comment to the ETF issuer on the S-1 document and requested a response within one week.

SEC的这一举动显示,很可能在下周宣布ETF生效,允许相关产品在假期周末前开始交易。

This move by SEC suggests that it is likely that the ETF will be declared effective next week, allowing the products to start trading before the holiday weekend.

SEC 审批流程接近完成

SEC approval process nearing completion

SEC 已经批准了包括贝莱德、富达、VanEck 在内的8家以太坊ETF发行人的 19b-4 表格。然而,ETF要正式上市交易,SEC 还必须批准 S-1 表格。

The SEC has approved 19b-4 forms for eight ETA ETF issuers, including Belede, Fuda, Van Eckk. However, in order for the ETF to be officially listed, the SEC must also approve the S-1 form.

美国证券交易委员会主席 Gary Gensler 最近暗示,以太坊ETF的S-1表格很可能在今年夏季获得批准,这一预测在他本周早些时候的参议院拨款委员会听证会上得到了确认。

The recent suggestion by the Chairman of the United States Securities and Exchange Commission, Gary Gensler, that the ETF S-1 form was likely to be approved this summer was confirmed by his Senate Appropriations Committee hearing earlier this week.

以太坊价格预期与市场反应

expected to react to the market at Taib prices

资产管理公司 VanEck 预测,到2030年,以太坊(ETH)的价格可能达到22,000美元,这是基于预计该货币将产生660亿美元的“自由现金流”。

The asset management firm Van Eck predicts that by 2030, the price of the Taiyo (ETH) could reach $22,000, based on a “free cash flow” of $66 billion expected from the currency.

现货以太坊ETF的推出预计将吸引大量机构资本,渣打银行的 Geoff Kendrick 估计,第一年的资金流入可能在150亿至450亿美元之间。

The roll-out of the ETF in Taiyo is expected to attract significant institutional capital, and Geoff Kendrick of the Chartered Bank estimates that the first year of capital inflows could range from $15 billion to $45 billion.

总部位于新加坡的加密货币交易公司 QCP Capital 预测,现货以太坊ETF的批准可能会引发ETH价格的大幅上涨,涨幅可能达到60%,这与1月份现货比特币ETF获批后市场的反应类似。

trading firm QCP Capital, based in Singapore, predicts that the approval of the on-the-shelf ETF could trigger a significant increase in ETH prices, possibly up to 60 per cent, similar to the January spot bit currency /a>ETF's response to the market after it was granted.

结语

随着现货以太坊ETF的上市日期日益临近,市场预期这一金融创新将为以太坊带来新的投资热潮。SEC 的批准不仅为投资者提供了新的投资渠道,也可能推动以太坊价格的显著上涨。业界正密切关注 SEC 的最终决定,以及这一决策对加密货币市场的深远影响。

As the current ETF market is approaching, the market expects that this financial innovation will bring a new wave of investment to Ether. The SEC’s approval not only provides investors with new investment channels, but may also drive a significant rise in the prices of etherms. 以上就是以太坊现货ETF获批在即,分析师预计7月2日开始交易的详细内容,更多请关注php中文网其它相关文章!

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论