开年以来,比特币的走势堪称惨烈。

继1月21日遭遇闪崩后,比特币1月22日从39000美元上方跳水,跌穿36000美元关口,为2021年7月份以来首次,最低触及34042美元,一度跌逾10%。

Following a collapse on 21 January, Bitcoin jumped above $39,000 on 22 January and fell through the $36,000 gate for the first time since July 2021, reaching a minimum of $34,042, or more than 10 per cent at a time.

图片来源:OKEx

Image source: OKEx

资金疯狂涌出,币圈一度呈现崩盘态势,虚拟货币市场其他数十个主流币种同时一泻千里。

The funds have been ravaging, the currency circles have been collapsing for a while, and the other dozen mainstream currencies in the virtual currency market have been pouring in at the same time.

65亿元资金灰飞烟灭

$6.5 billion worth of money is wasted

1月23日凌晨,比特币再次下跌,不少做多的投资者遭遇爆仓。比特粉数据显示,截至1月23日1时,一日内全网超31万人爆仓,约合人民币65.34亿元的资金灰飞烟灭。

In the early hours of 23 January, bitcoin fell again, with a number of well-doing investors falling into a silo. Bitmeal data show that, as of 1 January, more than 310,000 people were in a silo, amounting to $6,534 million worth of money.

图片来源:比特粉

Source: Bit powder.

据业内人士分析,比特币已经跌破前期重要支撑位,空头势强,套牢盘众多,后市仍有下跌势能。从矿工生产和抛售累积数据可以看到,矿工生产量略有上升,但抛售量依然处于高位,说明矿工抛售情绪浓厚。

According to industry sources, Bitcoin has fallen from its pre-existing position of vital support, with a strong head and a large number of lock-ups, and the city has continued to fall. Data from the cumulative production and sale of miners show a slight increase in miner production, but sales remain high, suggesting that miners have a strong selling mood.

alternative.me数据显示,1月23日,虚拟货币市场恐慌与贪婪指数为19,市场情绪极度恐慌。币coin数据显示,比特币RSI 14(买卖相对强弱指数)为31.29,场内卖盘力量走强。综合来看,市场恐慌情绪进一步加深,场内卖盘力量有所增强,市场看空情绪浓厚。

On January 23, the virtual currency market's panic and greed index was 19 and the market's mood panic was extremely high. The currency coin data show that the Bitcoin RSI 14 (the relative strength and weakness of sales) was 31.29, and that there was a strong in-house sales capacity.

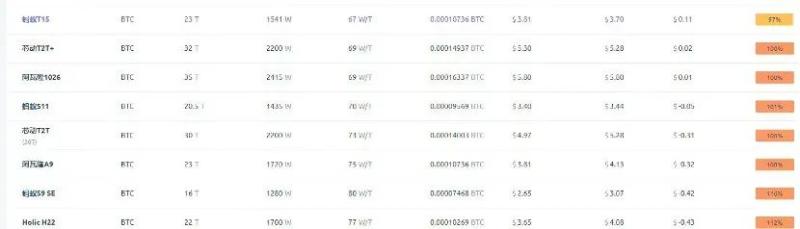

严重依赖币价的矿工,也损失惨重。根据鱼池数据,以以每度电0.1美元的电费计算,芯动T2T、阿瓦隆1026、蚂蚁S11和蚂蚁S9等多款主流矿机已经全部突破关机价格(挖矿的成本价),电费占比超过100%,即开机就亏损。

Heavyly reliant miners also lose a lot of money. According to fish pool data, at a cost of US$ 0.1 per degree of electricity, multiple mainstream mining machines, such as T2T, Avalon 1026, ant S11 and ant S9, have been completely cut off (cost of mining), with electricity costs exceeding 100%, i.e., loss on the switch.

图片来源:鱼池

Source: Fish ponds.

比特币遇10年来最差开年

{\bord0\shad0\alphaH3D}It's the worst year in ten years.

2021年11月,比特币创出了69040美元的新高,随后一路下跌,截至目前,比特币较最高点跌幅近50%。虚拟货币总市值由2021年11月9日创下的2.93万亿美元历史高点,缩水至1.98万亿美元。

In November 2021, Bitcoin reached a new high of $69040, and then fell all the way down. To date, Bitcoin has fallen by almost 50% from its highest point. The total market value of the virtual currency has shrunk from a historic high of $293 trillion on 9 November 2021 to $1.98 trillion.

OKEx数据显示,2022年以来,比特币仅有6个交易日上涨,累计跌幅达11.5%,创下2012年以来的最差年度开局表现。

OKEx data show that since 2022, Bitcoin has only increased by six trading days, with a cumulative decline of 11.5 per cent, the worst year since 2012.

剧烈波动背后反映出市场对2022年加密货币的前景态度。此前,多位行业分析师认为,40000美元关口是比特币的强力支撑位,但本月比特币已第二次跌破40000美元关口。

The market’s attitude toward the future of the encrypted currency in 2022 is reflected behind the sharp fluctuations. Prior to that, several industry analysts had argued that the US$40,000 threshold was a strong support position for Bitcoin, but that Bitcoin had fallen at the US$40,000 threshold for the second time this month.

有分析人士表示,虚拟货币暴跌的背后,可能是多因素的共振:包括美联储加息预期(短端利率飙升)、Taper加速预期等。此外,风险因素还包括新冠变异病毒奥密克戎的不断扩散。

According to analysts, behind the fall of the virtual currency could be a multifactorial resonance: the Fed’s expectation of interest hikes (a sharp rise in short-end interest rates), the Taper’s accelerated expectation, and so on. Moreover, risk factors include the proliferation of the new coronal mutation virus Omicron.

此前,虚拟货币量化交易公司Radkl董事总经理吉姆 · 格雷科(Jim Greco)?曾表示,比特币的投资热情在消退,交易活动萎靡。在比特币萎靡不振的情况下,活跃地址(衡量交易活动的指标)的增长也停滞不前。

Previously, Jim Greco, Managing Director of the Virtual Monetary Quantified Trading Company Radkl, had said that Bitco’s investment enthusiasm was waning and trading activity was flimsy. The growth of active addresses (indicators for measuring trading activity) had stalled in the face of a weak bitco.

萨尔瓦多总统发文抄底比特币

The President of El Salvador sent a copy of Debitcoin

1 月22日,中美洲国家萨尔瓦多总统伊布·布克尔在社交媒体上表示,萨尔瓦多已逢低买入410枚比特币。

On 22 January, the President of the Central American State of El Salvador, Ib Buquel, stated in the social media that El Salvador had bought 410 bitcoins at a low cost.

图片来源:社交媒体

Source: Social media.

据新华社报道,2021年9月7日,比特币正式成为了萨尔瓦多的法定货币,这是虚拟货币首次在一个国家获得法定货币的地位。

According to Xinhua, on 7 September 2021, Bitcoin officially became the legal currency of El Salvador, the first time that a virtual currency had acquired the status of a legal currency in a country.

萨尔瓦多议会于2021年6月9日通过一项法案,批准将比特币作为本国法定货币。萨尔瓦多总统纳伊布·布克尔当日也在社交媒体宣布,该国政府已经购买了400枚比特币。以该推文发布时的比特币价格计算,萨尔多瓦购买的虚拟货币总额约为2090万美元。

El Salvador’s Congress passed a bill on 9 June 2021 approving the use of Bitcoin as the national legal currency. El Salvador’s President, Naib Burke, also announced in the social media on that day that the Government had purchased 400 bitcoins.

图片来源:社交媒体

Source: Social media.

此前,世界银行、国际货币基金组织和美洲开发银行等国际金融机构已就萨尔瓦多这一举措带来的金融风险表达担忧。国际货币基金组织(IMF)表示,一些国家选择采用加密货币作为本国货币,或许确实存在安全、易于访问且交易成本低等优点,但是在大多数情况下,风险和成本大于潜在收益。

International financial institutions such as the World Bank, the International Monetary Fund (IMF) and the Inter-American Development Bank (IDB) have previously expressed concern about the financial risks associated with this initiative in El Salvador. The International Monetary Fund (IMF) has indicated that some countries have chosen to use encrypted currencies as national currencies, perhaps with the advantages of security, easy access and low transaction costs, but in most cases the risks and costs are greater than the potential gains.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论