机构的吸收继续提振人们的情绪,并在主流中积极地宣传比特币。

Institutional absorption continues to boost people's feelings and to actively promote Bitcoin in the mainstream.

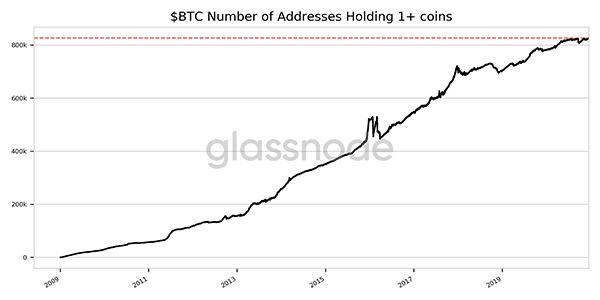

根据链上分析资源Glassnode的统计,包含整个硬币或更多硬币的比特币钱包数量达到了历史新高。截至周日,近827,000个钱包的余额为1 BTC或更多。

On the basis of a chain-based analysis of the resource Glassnode, the number of bits of wallets containing the entire coin or more has reached an all-time high. As of Sunday, nearly 827,000 wallets had a balance of 1 BTC or more.

余额至少为1 BTC的比特币钱包,持续走高

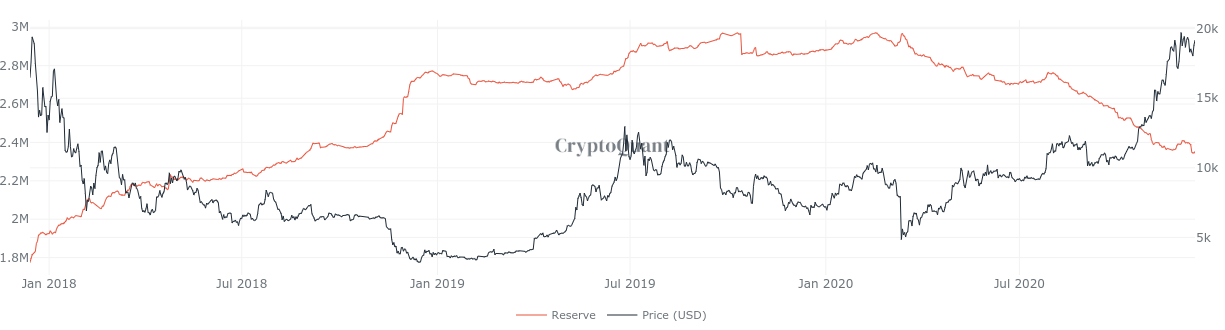

在企业投资的叙事中,获取整个比特币的困难已成为社交媒体上越来越热门的话题。结合数据显示,尽管最近价格有所上涨,但硬币仍继续离开交易所进行冷藏。

In the narrative of business investment, the difficulty of obtaining the entire bitcoin has become an increasingly popular topic in social media. Combined with data, coins continue to leave the exchange for cooling, despite recent price increases.

比特币交易所余额历史图表

摩根大通(JPMorgan)的策略师在一份报告中表示,MassMutual以1亿美元的 比特币(BTC)收购表明,保险公司和养老基金现在正在采用比特币。分析人士认为,这类机构投资者通常在投资风格上比较保守,因此近期的投资额相当可观。

According to a report by JPMorgan’s strategist, MassMutual’s $100 million Bitcoin (BTC) acquisition suggests that insurance companies and pension funds are now using Bitcoin. Analysts argue that such institutional investors are generally conservative in their investment style, so that recent investments are considerable.

策略师表示,即使美国,日本,英国和欧元区的养老基金和保险公司将其资产的1%保留在比特币中,也可能意味着约有6,000亿美元的额外资金流入比特币。

According to the strategists, even if the United States, Japan, the United Kingdom and euro zone pension funds and insurance companies retain 1 per cent of their assets in bitcoin, this could mean an additional flow of about $600 billion into bitcoin.

机构的这些投资可能增强了华尔街传统投资者的信心,他们现在可以轻松地将投资组合的绝大部分分配给比特币。

These investments by institutions may enhance the confidence of traditional Wall Street investors, who can now easily allocate the bulk of their portfolio to Bitcoin.

比特币价格重新回到了19,200美元的水平,并继续在一个区间内交易,为山寨币提供了稳步上涨的机会。 既然有几个基本因素有利于比特币和山寨币恢复其上升趋势,投资者将很好奇地看到BTC是否最终会夺回20,000美元以上的历史新高。 我们挑选研究一下排名前几位的加密货币图表

The price of the bitcoin has returned to a level of US$ 19,200 and continues to be traded in one block, providing a chance for a steady rise in the mountain currency. Since there are several basic factors conducive to the return of the bitcoin and the mountain coin to its upward trend, investors will be curious to see whether the BTC will eventually recover the historic height of more than US$ 20,000.

比特币(BTC)在12月11日跌破了25天的指数移动平均线(18,492美元),但这被证明是一个陷阱。价格迅速上涨并上涨至12月12日的20天均线上方。

Bitcoin fell down the 25-day average index movement line on 11 December ($18,492), but this proved to be a trap. Prices rose rapidly and went up to the 20-day average on 12 December.

12月13日烛台和今天的十字星烛台上的一根长灯芯表明,空头正试图捍卫19,500美元的上方阻力。但是,积极的是,多头并没有放弃太多。

On December 13, a long light core on the candlestick and today's cross-star candlestick shows that the empty head is trying to defend the upward resistance of $19,500. But, positively, many have not given up too much.

如果多头可以将价格推高至19,500美元上方至20,000美元的上方阻力区,它将完成一个上行三角形图案,目标价格为2.1万-2.2万美元。

If the price can be pushed up to $19,500 to $20,000 in the upper resistance area, it will complete a top-line triangle with a target price of $21,000 to $22,000.

相反,如果价格再次被拒绝在当前水平,空头将BTC / USD货币对降至三角形趋势线以下,则有可能将下跌至52日移动平均线17000美元附近。

Conversely, if prices are again rejected at the current level and the BTC/USD currency is left empty below the triangle trend line, it is likely to fall close to the 52-day moving average line of $17,000.

以太(ETH)于12月13日冲出下降通道,这可能是修正结束的第一个信号。如果多头将当前的跌幅买入到25日均线560美元附近,并且不允许价格维持在通道内,则表明上涨。

The Ether (Ether) runs out of the drop route on December 13, which may be the first sign of the end of the correction. If one buys the current fall close to the 25-day average line of $560 and does not allow the price to remain in the corridor, it indicates an increase.

ETH / USDT货币对处于形成上升三角形模式的早期阶段,将在突破时完成并收于623美元上方。这种看涨设置的目标价格为750美元附近。逐渐上涨的25天EMA和RSI高于55表明多头具有优势。

The ETH/USDT currency, which is in the early stages of forming an upscaling triangle, will be completed and collected above $623 at the time of the breakthrough. The target price for this increase is around $750. The 25-day rise in the EMA and RSI above 55 suggests a multi-faceted advantage.

莱特币(LTC)在12月11日从52天均线70美元附近反弹,多头在12月14日将价格推高至25天均线77.5美元以上。这表明积累处于较低水平。

LTC rebounded on 11 December from the vicinity of the 52-day mean line of $70 and, on 14 December, pushed prices up to over $77.5 of the 25-day mean line, indicating a low level of accumulation.

LTC / USD对可能处于形成一个大的对称三角形的初期,该三角形通常充当延续模式。空头可能会捍卫三角形的阻力线,而多头可能会在支撑线的弱势上买进。

LTC/USD may be in the early stages of forming a large symmetric triangle, which usually serves as a continuation model. Empty head may defend the triangle’s resistance line, while multiple headage may be bought in the weakness of the support line.

突破三角形可能会恢复上升趋势,而跌破三角形则表明熊势占上风。稳定的25天EMA和RSI在中点附近暗示几天可能会整固。

Breaking through the triangle is likely to revive the upward trend, while falling through the triangle suggests that the bear has the upper hand. A stable 25-day EMA and RSI suggest near the midpoint that they may be fixed in a few days.

比特币现金(BCH)从12月11日的256美元附近反弹至12月14日的282美元附近。但是,空头积极捍卫这一水平,并将价格推低至52天均线(275美元)以下。

Bitcoin cash (BCH) rebounded from around $256 on 11 December to around $282 on 14 December. However, the empty head actively defended the level and pushed the price below the 52-megaline ($275).

两条移动均线均持平,RSI略低于中点,这表明需要几天的区间波动。价格可能在下行的231美元和上行的280美元之间来回移动。

The two moving average lines are flat, and RSI is slightly below the midpoint, indicating a few days of inter-zone fluctuations. Prices may move back and forth between $231 down and $280 up.

与此假设相反,如果多头能够将价格推高至280美元以上,则BCH / USDT对可能升至300美元,然后升至320美元。但是,如果空头将价格降低到231美元以下,则该货币对可能跌至200美元。

Conversely, BCH/USDT may rise to $300 and then to $320 if more than $280 can be pushed. However, if the empty price falls below $231, the currency may fall to $200.

Chainlink(LINK)在12月11日跌破上升趋势线,但多头在较低的水平上买进,并在12月12日将价格推回上升趋势线之上。这吸引了进一步的买盘,并且altcoin在12月达到了13.28美元的上行阻力位13。

Chainlink (LINK) broke the upward trend line on 11 December, but bought many at lower levels and pushed prices back above the upward trend line on 12 December. This attracted further purchases, and altcoin reached $13.28 in December.

价格从13.28美元回落,跌破移动平均线。这表明空头正在捍卫上方阻力。

Prices have fallen from $13.28 to the moving average, indicating that the void is defending the upper resistance.

两条移动均线均趋于平缓,RSI略低于中点,这表明LINK / USDT对可能维持几天的区间波动。未来几天,价格可能会在13.28美元至11.43美元之间波动。

Both moving mean lines are flattened, and RSI is slightly below the midpoint, indicating that the LINK/USDT fluctuates over possible periods of several days. Prices may fluctuate between $13.28 and $11.43 over the next few days.

跌破11.43美元可能意味着空头已经压制了多头,并可能导致下跌至10美元。相反,突破13.28美元将表明多头的优势。

A fall of $11.43 could mean that the void has been suppressed and could have fallen to $10. Conversely, a break of $13.28 would indicate a multiplicity of advantages.

Polkadot(DOT)的救济机会再次在下降趋势线遇到障碍。这表明市场情绪是负面的,空头正试图以小幅反弹向下跌趋势线出售。

Polkadot (DOT) once again encountered obstacles to relief on the downward trend line. This suggests that market sentiment is negative and empty-handedly trying to sell it on a small rebound.

持平的25天EMA(4.92美元)和RSI刚好在中点下方,暗示了几天的区间波动行为。价格可能会在下行的4.54美元和上行的5.10美元之间盘整。

The flat 25-day EMA ($4.92) and RSI are just below the midpoint, implying a few days of inter-zone fluctuations. Prices may be rounded up between $4.54 below and $5.10 above.

但是,如果空头使价格跌至4.54美元以下,跌势可能会恢复,DOT / USDT对可能跌至4.20美元,然后跌至3.80美元。突破5.10美元将是多头试图占上风的第一个迹象。

However, if a blank drops prices below $4.54, the fall may recover, and DOT/USDT may fall to $4.20 and then $3.80. A break of $5.10 would be the first sign of many attempts to take the upper hand.

以上言论不作为投资建议,盈亏自负。投资有风险,入市需谨慎!

the above remarks are not investment advice and self-inflicted. Investments are risky and market entry requires caution! & nbsp;

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论