如果你想入门支付产品,或者想从事支付相关的行业内容,你可以选择从概念开始,并逐步建立完整的支付知识体系。本篇文章里,作者就相对完整地总结了一个支付知识体系框架,感兴趣的话,就一起来看看吧。

If you want to start paying for a product, or if you want to do something about it, you can choose to start with a concept and build up a complete system of knowledge about payment. In this article, the authors summarize, in a relatively complete way, a framework of knowledge about payment systems.

很多朋友加我微信的第一句话是,“陈老师,我是支付小白,想学习支付应该怎么开始啊?”

The first words of a lot of friends and my letters are, "Miss Chen, I'm paying White. How should I start paying?"

本章就是系统性的从概念入手逐步过渡到支付整体框架,帮助一个支付小白快速对支付体系建立一个整体的认知,并且在最后搭建一个支付宏观大厦,为接下来的一步一步深度学习打下知识框架。

This chapter is a systematic step-by-step transition from a conceptual approach to an overall framework for payment, helping a pay-for-white fast-track understanding of a pay-for-payments system to build a whole, and finally building a pay-for-mortality macro-building to provide a knowledge framework for further learning at a step-by-step level.

如果你对支付该兴趣,还不知道如何下手,那就以此文为“支付体系知识框架”赶紧读一下吧……

If you're interested in paying and you don't know how to do it, read it as a “knowledge framework for payment systems”...

支付的本质就是货币在收付款人之间的转移,那为什么会转移呢,就是因为发生了经济活动有了交易。

The essence of the payments is that the currency is transferred between the payors, and why it is transferred because economic activity is traded.

就如我们口渴了去超市买了一瓶水,这就是经济活动,我们使用银行卡“支付工具”在超市的pos机上刷卡完成了支付;这个过程转移的是电子账户货币,也就是我们的银行结算账户里的钱,转移到了商户的银行结算账户。

Just as we were thirsty to go to the supermarket to buy a bottle of water, that is economic activity, we used the bank card “payment tool” to complete the payment on the supermarket's posse; this process transferred the money from the electronic account, that is, our bank settlement account, to the bank settlement account of the merchant.

所以支付是在经济活动中,依赖于货币(交换媒介),使用支付工具,通过转移货币,实现商品与货币的价值交换,这个过程就是支付的过程。

Payments are therefore made in economic activities, dependent on money (exchange media), using payment instruments to exchange the value of goods and currencies through currency transfers, a process that is the process of payment.

我们日常生活购买生活用品,企业之间的采购,银行与银行之间的债务清偿,国家与国家之间的国债买卖等的实现都依赖支付。

The purchase of household goods in our daily lives, inter-firm purchases, the settlement of debts between banks and banks, the sale and sale of State debt between the State and the State, etc. are all dependent on payment.

所以支付首先有主体,在一定的经济活动下有了交易行为,然后使用支付工具实现支付,支付指令通过支付系统进行传输,支付系统推动资金在账户之间完成转移。

Thus, payments are made primarily by means of transactions under certain economic activities, and then by means of payment instruments, the payment orders are transmitted through the payment system, which facilitates the transfer of funds between accounts.

要想对一个事物有非常深刻的认识,并且能够灵活的把握;那么对其基础的概念的理解会起到非常关键的底层作用;来认识这几个重要的支付概念。

To have a very deep understanding of one thing and to be flexible in its grasp; then understanding the underlying concepts can play a very critical role at the bottom; and to recognize these important concepts of payment.

支付是社会经济活动引起的资金转移行为。支付体系是实现资金转移的制度和技术安排的有机组合。按照转账支付的进程,支付体系的四个基本概念依次是结算账户、支付工具、支付清算系统以及资金清算方式。

The payment system is an organic combination of systems and technical arrangements for the transfer of funds. In accordance with the transfer process, the four basic concepts of the payment system are, in turn, the settlement of accounts, payment instruments, payment clearance systems and the liquidation of funds.

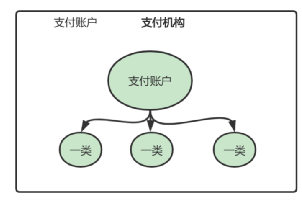

结算账户:以支付主体名义开立的结算账户,其功能是存储资金、记录资金收付情况,是资金转移行为的基础。目前,主要的结算账户类型包括:以银行卡为主体的个人结算账户、以活期存款为主体的单位银行结算账户、个人在第三方支付机构开立的虚拟账户以及预付卡账户等。

Settlement Account: is a clearing account opened in the name of the paying entity, the function of which is to store funds, record their receipt and disbursement, and is the basis for the transfer of funds. At present, the main settlement account types include personal settlement accounts that are the subject of a bank card, unit bank settlement accounts that are the subject of a demand deposit, virtual accounts opened by individuals in a third-party paying institution and prepaid card accounts.

支付工具:是支付指令的载体。支付指令是付(收)款人支付(收取)资金的意思表示。经济活动中的银行票据和结算凭证、银行卡和预付卡的签购单以及网上支付中提供的输入界面等都属于支付工具的范畴。

Payment Tool: is the carrier of payment instructions. Payment instructions are intended to mean payment (receipt) of funds by the payee.

支付清算系统:是实现支付指令在收付款银行、不同结算主体之间传输的基础设施。各类支付清算系统通常以标准化的磁码、报文或电子信息等格式进行支付信息传输。目前,我国各类支付清算系统承担着每天数以亿计的支付指令的信息传输。

资金清算方式:是支付清算系统对通过其传输的支付指令进行资金结算处理的手段与规则。各类支付清算系统中最常用的两类资金清算方式是:逐笔全额实时结算和批量净额轧差结算。同时,也有针对不同业务采取不同资金清算方式的混合结算方式。

The two types of funds that are most commonly used in the various payment clearing systems are: full-time, written and volume-by-volume settlements. At the same time, there is a combination of different financial liquidation modalities for different operations.

了解一个事物最先要了解的就是这个事物所涉及到的概念。

The first thing to know about a thing is the concept it involves.

支付是一个现代企业的标配能力,除非这家企业只接受现金或者线下的银行转账。

Payment is a modern enterprise's bid capacity, unless the enterprise only receives cash or offline bank transfers.

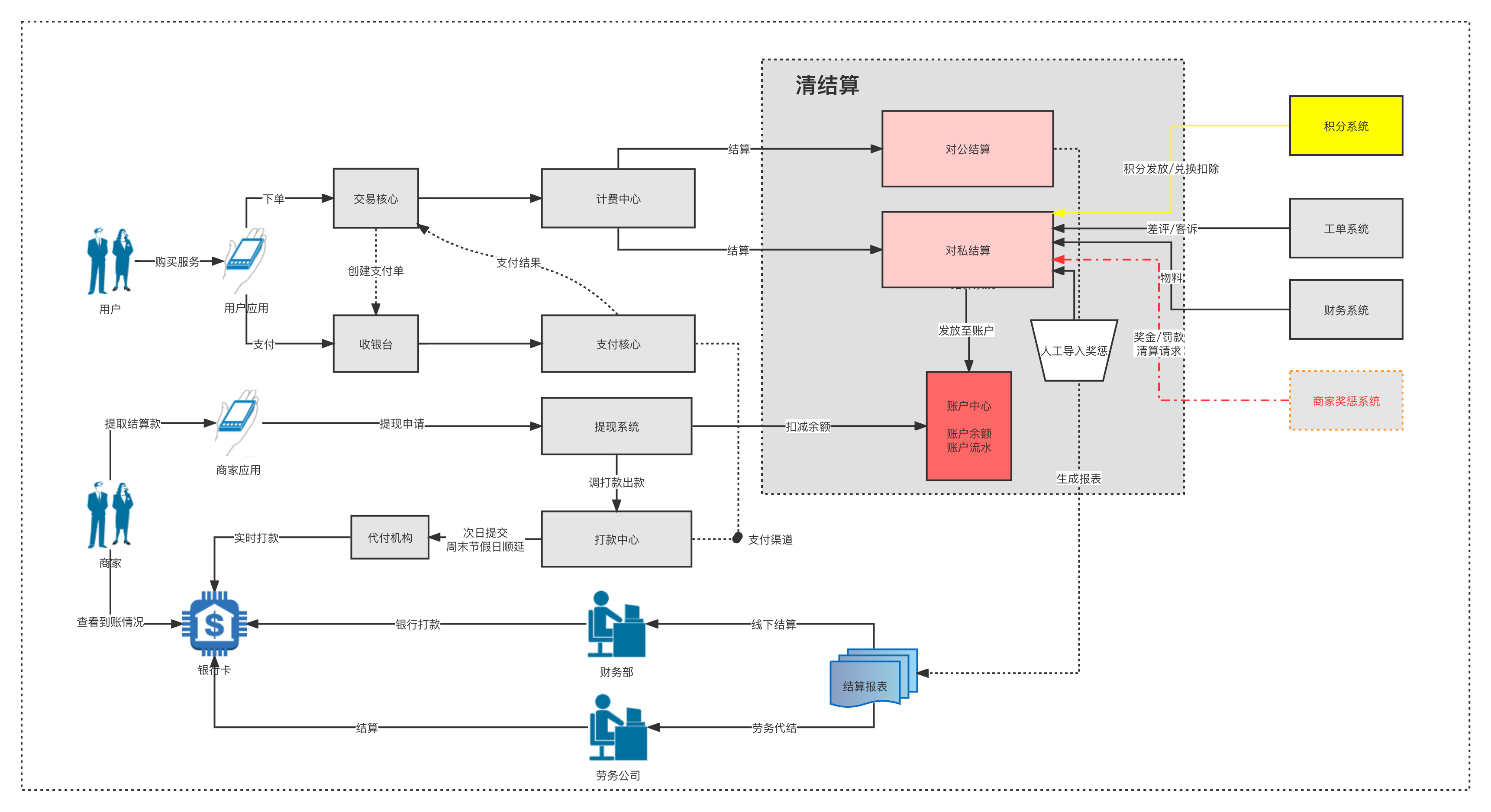

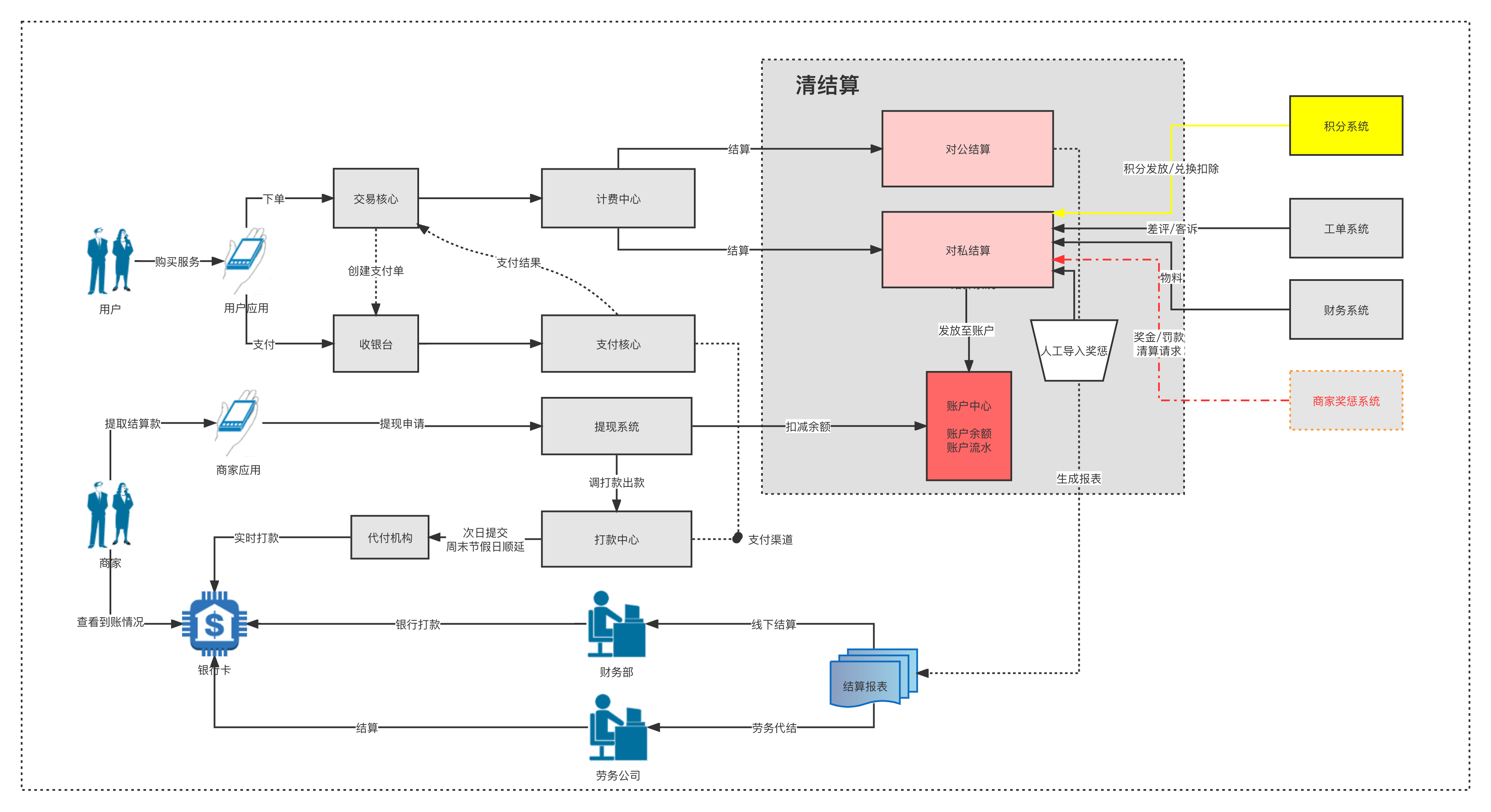

随着支付的不断发展和我国电子支付基础设施体系的完善,目前一家企业想要接入支付能力,实现线上电子化交易模式,已经非常容易;可以自己建设计入支付产品需要的基础系统,也可以接入更便捷的支付SaaS平台完成改造;总之现代企业实现一个简单的支付体系,基本离不开(图1-2)所示的“线上交易框架”。

With the continued development of payments and the improvement of our electronic payment infrastructure system, it is now very easy for an enterprise to access capacity to pay and achieve online electronic trading models; to build its own basic system that takes into account the need to pay for products, or to access a more accessible payment for SaaS platform to complete the transformation; and, in general, to achieve a simple payment system that is essentially linked to the “line trading framework” as shown in figure 1-2.

图1-1:普通企业典型的支付结算业务流程架构

1)支付应用

1) Payment application

就是我们可以直接用来操作支付的网页或者移动软件,常见的有:微信app,支付宝app,银联闪付APP。

It's the web pages or mobile software that we can use directly to operate payments, most commonly: micro-apps, pay-a-vapps, Silver Union flash APPs.

2)支付场景

2) Payment scene

在什么情况下去进行支付交易:

Under what circumstances is the payment transaction to be made:

- 线上场景:在线购物,手机电话充值,购买水电费,会员购买等;

- 线下场景:线下扫码付款,pos机刷卡支付等。

3)交易类型

3) transaction type

- 支付:购买商品或者服务进行付款;

- 退款:已经购买的订单进行逆向的退回;

- 充值:将银行卡里的钱充到账户余额里;

- 提现:将账户里的余额提到银行卡里;

- 打款:特指利用付款通道给商家结算,将资金付给商家的结算卡;

- 打款退回:原打款的逆向退回,一般因为打款失败;

- 转账:指将银行账户的钱转给另一个银行账户,泛指账户之间余额的转移;

- 调拨:公司将一个银行账户里的钱转到另一个银行账户用于付款业务;

- 归集:公司将众多的收款账户里收的钱全部转到一个账户进行统一管理。

4)支付类型(按通道类型)

4) Type of payment (by channel type)

- 快捷支付:在当前应用直接绑定银行卡即可支付;

- 网关支付:从当前应用跳转到银行的网上银行进行支付;

- 代扣:授权对方按照协议定期直接扣除账户里的资金,如会员自动续费;

- 认证支付:是指付款人提交银行卡相关信息(如卡号、密码、CVN2、有效期、预留手机号等要素),由第三方支付平台经过付款人发卡行进行验证,使用第三方支付平台短信验证或发卡行手机短信验证等辅助认证以完成支付交易的支付方式。

5)支付类型(按业务双方类型)

5) Type of payment (by type of business)

- B2C:个人与企业之间的收付;

- B2B:企业与企业对公户之间的收付;

- 跨境:不同国家之间的用户之间的收付。

6)支付方式

6) Method of payment

主要指站在用户视角在支付时收银台可以选择的支付手段,例如常见的微信支付,支付宝支付,还有其他的支付方式银行卡支付:使用快捷支付或者网关支付,绑定银行卡进行付款。

Mainly, they refer to the means of payment available at the cashier at the time of payment from the user's point of view, such as the usual micro-mail payments, payment of treasures, and other means of payment of bank cards: payments are made using fast-track payments or gateways, and bank cards are tied up for payment.

- 余额支付:商户平台为用户开通的虚拟账户,用户使用账户里的预充值余额付款;

- 白条支付:使用预授权的额度进行付款;

- 分期支付:按照约定定期分多次进行付款。

7)支付产品

7) Payment for products

支付产品是支付公司按照行业特点或者业务特点将银行的支付通道进行包装成体验更好的支付产品,更容易满足特定类型商户的支付场景。

The payment product is that the paying company packaged the bank's payment route to a better payment product in accordance with industry or business characteristics, and it is easier to meet the payment scenes of particular types of businesses.

- 快捷支付:支付公司将银行的快捷支付通道包装成的产品,无需跳转网银直接绑卡支付;

- 网关支付:通过第三方机构跳转到对应银行的网上银行完成支付的方式;

- 红包:这是很有用户场景的支付产品,像微信红包,本质是将转账进行的包装;

- 平安见证宝:平安银行推出了用于解决“二清”问题的分账产品。

图1-2:微信支付产品

图1-3:支付宝支付产品

聚合支付:四方支付公司将多家三方支付公司的支付产品包装到一起,成为一个支付产品。

Aggregation payments: Quadripartite payers package the payment products of multiple tripartite payers together as a payment product.

图1-4:聚合支付主扫被扫

8)收银台类型

8) Type of cashier

收银台就是直接面向用户,用户完成付款的线上场所。

The cashier is the on-line location where payments are made directly to the user.

- PC收银台:在电脑上完成支付的收银台;

- H5收银台:手机内的H5网页上完成支付的收银台;

- API收银台:提供给商户商户自己进行包装成自己收银台的收银台底层接口;

- 硬件收银台:pos机,mpos机等硬件设备,支付卡牌;

- SDK收银台:( Software Development Kit,软件开发工具包)也叫做支付SDK,指由商业银行或者第三方支付机构提供的具有收银台功能集合的软件工具包,接入者可以集成到自己的支付平台中完成收银台的建设。

9)支付通道

9) pays for the channel

支付通道就是用来完成各类支付的支付接口集合。

The payment channel is a collection of payment interfaces used to complete all types of payments.

- 三方支付通道:由三方支付公司向商户提供的支付接口或者三方支付本身,像微信通道,支付宝通道;

- 银行支付通:银行直接提供的支付接口;像快捷支付通道,网关支付通道,代扣通道,垫资通道;

- 其他类通道:广义来说能够作为支付手段使交易完成的都可以成为通道,比如卡,券,余额支付。

10)通道类型

10) Channel Type

单从银行通道来说,根据支付的特点及业务特点主要有以下几类:

In terms of banking channels alone, the following categories are found, depending on the characteristics of payments and operations:

- 收单类通道:专门用来收款的银行通道;

- 打款类通道:专门用来打款的银行通道;

- 垫资类通道:使用信用备付金账户进行付款的付款通道;

- 跨境类通道:进行跨境支付的银行通道;

- 预授权类通道:可以实现持卡人在宾馆、酒店或出租公司消费,消费与结算不在同一时间完成,特约单位通过POS预先向发卡机构索要授权的行为的通道。

11)通道成本(费率)

11) corridor cost (rate)

就指通道使用方基于交易规模为通道支付的通道使用费,比如我们常说的千6手续费,就是笔交易收取千分之六的手续费。

This refers to access fees paid by the user of the channel for the channel on the basis of the scale of the transaction, such as, as we often say, a charge of six per thousand for the transaction.

12)通道接入方式

12) Access to the channel

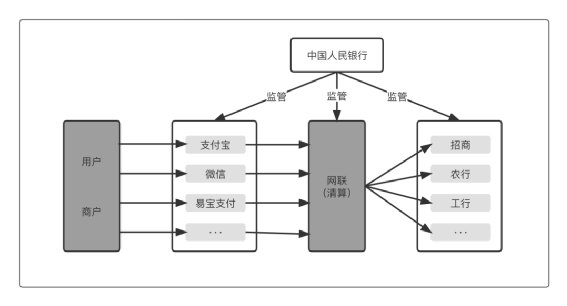

直联:与通道提供方直接对接接入,如直接入微信,接入支付宝间联:通过一个中介方接入另一家的通道,如三方支付通过网联接入各家银行的通道。

Direct connection: direct access to the channel provider, e.g. direct access to micro-mail, access to the payment bond: access to the other channel through one intermediary, e.g., a three-way payment to the bank through the network.

图1-5:支付参与者链接层级关系

银企直联:特指企业直接接入对公户的开户行,管理自己的对公户,进行余额查询,转账等。

Silver Direct Association: refers specifically to the direct access of enterprises to the opening of public accounts, the management of their own public accounts, balance inquiries, transfers, etc.

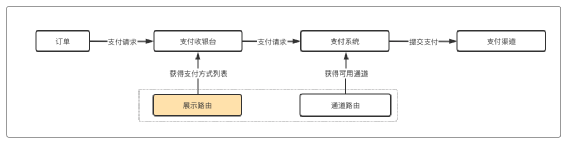

13)支付路由

13) payment route

用户在发起支付请求时,通过预配置好的规则向收银台挑选出一条最优的支付通道;通道的主要目的:节约成本,提升用户体验,确保渠道可用。

When initiating a request for payment, the user selects an optimal payment channel from the cash register through pre-positioned rules; the main purpose of the channel is to save costs, enhance user experience and ensure access.

14)支付限额

14) Payment limit

限额的主要目的是风险防范;如可用单笔限额,日累计限额,月累计限额。

The main purpose of the limits is risk protection; if a single limit is available, the cumulative limit for the day and the cumulative limit for the month.

线上交易是支付的前置,买卖双方只有完成了商品或者服务的采购,完成了价格的谈判,合同的签订才真正到了兑付债权的环节;所以做好支付的前提也需要做好交易过程,给用户提供优秀的线上采购体验,建设完善的交易流程,以及交易与支付的无缝衔接。

On-line transactions are pre-payments, and only when buyers and sellers have completed the purchase of goods or services and the negotiation of prices has the contract actually reached the point of paying their claims; thus, the prerequisites for payment also require a good transaction process, an excellent online procurement experience for users, a well-established transaction process, and a seamless link between the transaction and the payment.

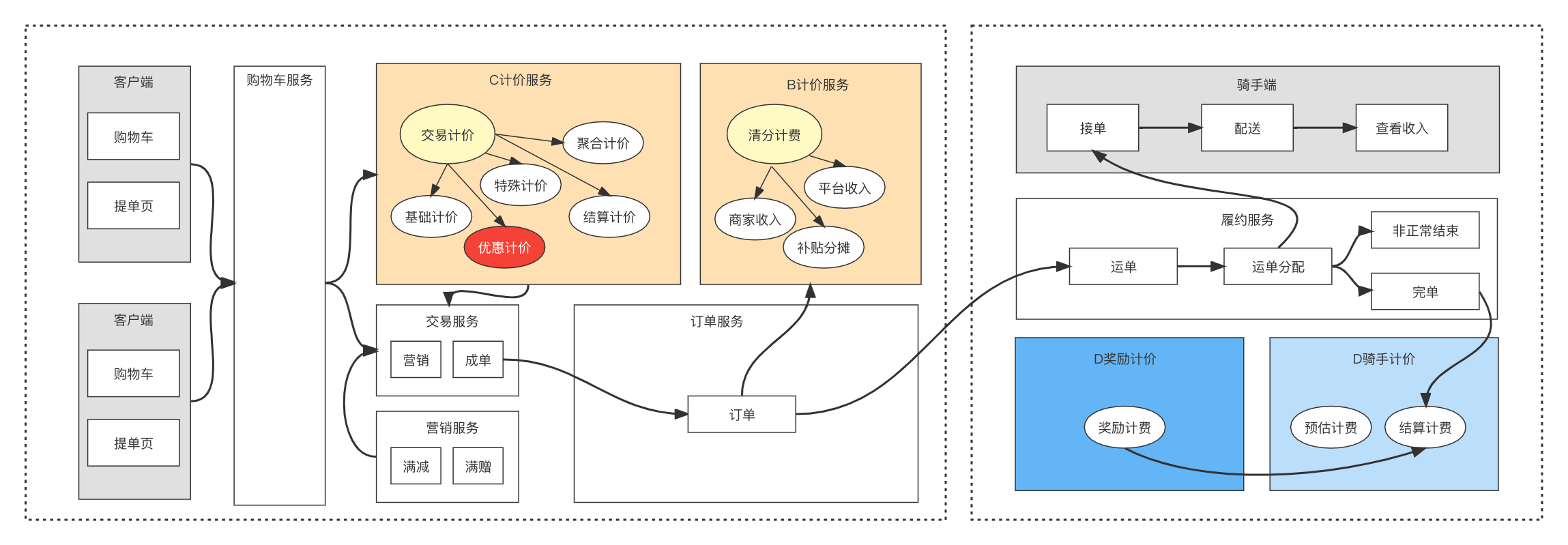

就像(图1-8)所示,一个外卖交易流程,从采购到下单再到支付,最后完成计费结算的业务框架的典型模型。

As shown in figure 1-8, an out-of-sale transaction process, from procurement to billing to payment, is a typical model of the business framework that finalizes the billing settlement.

图1-6:典型的交易业务流程架构

15)购物车

15) Shopping car

在购物过程中用于暂时管理已经挑选好的待结算的商品的线上购物管理工具。

Online shopping management tools used in the shopping process for the temporary management of selected pending commodities.

16)计价

16) Prices

是针对用户已经选定的商品计算优惠已经最终应付金额的计算过程,一般由单独的计价系统完成。

It is the process of calculating the final amount payable for the goods selected by the user, which is generally done by a separate pricing system.

17)订单

17 Order >/strang >

用户购买服务或者商品生成的记录,记录用户信息,商品信息等交易信息。

Users purchase records generated by services or goods, record transactions such as user information, commodity information, etc.

18)履约

18) Compliance

用户完成支付以后平台按照约定交付商品或者服务的过程。

The user completes the process by which the Platform delivers goods or services as agreed after payment.

19)账单

19) Bills

账单是基于订单信息创建的用于支付收款的单据,主要记录订单信息,用户信息,金额信息;一个订单可以对应多个账单。

The bill is a document created on the basis of order information for collection purposes, which records mainly order information, user information, amount information; one order can be matched to multiple bills.

20)支付明细

20) payment details

就是用户对账单的支付记录,比如一个100元的账单,用户用微信支付了60元,使用了一张20元优惠券,又满减了20元,所以就有三条支付明细。

It is the payment record of the user's statements, such as a $100 bill, that the user paid $60 with a micromail, used a $20 coupon and reduced it by $20, so that there were three payment details.

21)三方流水号(外部流水号)

21) Triangular Stream (External Stream)

支付成功后,渠道方返回的支付成功唯一的单号。

After the payment has been successful, the only single successful payment from the channel has been successful.

22)支付协议

22) Payment Agreement

支付协议是平台与支付通道之间约定的支付参数,发起支付请求时传送这些参数。

The payment agreement is the agreed payment parameters between the platform and the payment route, which are transmitted when the request for payment is initiated.

23)协议封装

23) Agreement encapsulation

因为收银台调用通道前用户提交的支付信息并不全,需要将一切其他的信息进行查询获取,比如设备信息,其他的一些必填参数;获得所有信息后有渠道清算对这些信息进行组合到一起,然后再提交给支付渠道完成支付请求的提交;这个过程称为协议的封装。

Because of the incompleteness of payment information submitted by pre-channel users at the cashier's counter, all other information, such as equipment information, and some of the other mandatory parameters, would need to be solicited; all information obtained would need to be combined in a clean-up and then submitted to the payment channel to complete the submission of the payment request; this process would be called the seal of the agreement.

24)支付状态

24) Payment status

待支付、支付成功、支付失败、支付异常。

Outstanding payments, successful payments, failed payments, irregular payments.

交易开始那一刻就注定了各方利益,谁带来的客户,谁提供了商品,谁提供了服务,这是一个协同的商业社会,也必然造成协同的利益纠缠;最终利益的分割和交付势必需要一个庞大的独立的体系完成,这个体系就是清结算,完成各方利益的清分、记账、和资金结算。

The moment the transaction begins, the interests of the parties are bound, the customers who bring it, the customers who provide the goods, the providers who provide the services, which is a coordinated commercial society, and which inevitably leads to the entanglement of the benefits; the division and delivery of the final benefits will necessarily require a large, independent system, which is a clearing, accounting, and financial settlement of the interests of the parties.

对于一个典型的清结算来说,我们可以简单的说最低标准就是要实现“算明白、记明白、结明白”就合格了,不是么!比如(图1-9)所示;业务之下,所呈现的系统形态,都是当下最好的选择。

For a typical settlement, we can simply say that the minimum standard is to achieve “arithmetic, remembering, and sorting” that is qualified, can't we? As shown in figure 1-9); under operations, the form of the system is the best option at the moment.

图1-7:典型的清结算业务流程架构

25)清算

25) Liquidation

数据搜集、清分、支付指令转发的过程。

The process of data collection, identification and transmission of payment instructions.

26)清分

26

算清楚应该给谁多少钱记账,计算各对象应收应付的过程。

It is clear who should be charged how much, and the process of calculating the accounts receivable from each object.

27)费用项

27) fee item

是指为不同的交易场景中发生的内容款项设定唯一名称,比如交易手续费、商家结算收入、抽佣等。

It refers to the creation of a unique name for content payments that occur in different trading scenes, such as transaction fees, merchant settlement income, salaried maids, etc.

28)入账规则

28) Rule of entry

为不同业务下产生的不同费用项设定计入账户的规则,入什么账户,什么方向,需不需要冻结等。

Set rules for the recording of accounts for different items of costs incurred under different operations, which accounts to enter and which directions need to be frozen, etc.

29)入账

29)

将清分结果计入对应对象的账户中的过程。

The process of recording the results in the accounts of the counterpart.

30)分账

30)

将一笔资金按照合同规则拆分成多份给到对应对象,对账务完成拆分的过程。

One fund was split into multiple parts to counterparts in accordance with the contract rules, and the reconciliation process was completed.

31)商户计费

31) Business accounts

计算为商户收付的每一笔交易应该收取的手续费。

Calculates the fees to be charged for each transaction received by the comptoir.

32)收费模式

32) Charge mode

就是跟商户约定按照什么方式收取手续费,什么时候收,怎么收;有实收、后收、预付、预付实扣等模式。

It is an agreement with the merchants as to the manner in which the fees are collected, when and how; there are modes of collection, after-collection, advance payment, advance deduction, etc.

33)计费策略

33) costing strategy

商户手续费计算模型,常见的有:单笔固定比例、单笔固定费额、固定费额+固定比例、单笔区间费额/费率、累计阶梯套餐A、累计阶梯套餐B、单笔拆分。

Models for calculating household fees are common: single fixed rates, single fixed rates, fixed rates + fixed rates, single block rates/rates, accumulated staircases A, accumulated staircases B, single splits.

34)结算

34) Settlement

按照约定,基于交易结果交付资金的过程;这个过程可以是将资金计入对应的账户,或者将真实资金支付给对象的银行账户。

As agreed, the process of delivering funds on the basis of the outcome of the transaction may be the recording of the funds in the corresponding account or the payment of the true funds to the bank account of the addressee.

35)结算周期

35) Settlement cycle

跟商户约定好的结算时间,实时结算,第二天结算,下个月1号结算等结算模式:就是怎么结算的问题,比如用户自己发起结算请求,平台主动定期主动给商家结算,平台按照交易逐笔给商家结算。

The settlement time agreed with the comptoir, the real-time settlement, the next day the settlement, the settlement mode of next month's settlement, etc.: is a question of how to settle the settlement, such as when the user initiates the settlement request itself, the platform takes the initiative to settle it regularly, and the platform settles it on a case-by-case basis according to the transaction.

36)对账

36) Reconciliation

按照一定规则完成各方数据核对的过程,一般是帐证实之间的相互核对,确保一致。

The process of completing the reconciliation of data between the parties in accordance with certain rules generally involves cross-checking between confirmations of accounts to ensure consistency.

37)对平

37)

对账过程中核对数据相互一致不存在差异的核对结果类型。

Types of reconciliations where the reconciliations are consistent and do not differ during the reconciliation process.

38)单边

38) Unilateral

两方核对数据之间有一方没有数据的核对结果类型,比如平台与微信核对,微信侧数据存在,而平台不存在该笔数据。

On one side, there is no type of data reconciliation between the two parties, such as the platform and the micro-mail, where micro-side data exist, and the platform does not exist.

39)差错处理

39) Error processing

是指在对账发现差异之后,按照实际差异原因和处理方式对差异进行消除处理的过程。

is the process by which differences are eliminated in accordance with the actual causes and treatment of variances after reconciliations have been found.

40)差错处理类型

40) error processing type

就是如何处理差错的分类;比如平台掉单了跟银行不一致,银行有平台没有,则差错处理类型就是“平台补单”。

It is the classification of how to deal with errors; for example, when the platform falls out of line with the bank, when the bank has a platform, the type of mishandling is the Platform Bill.

41)交易对账

41) transaction reconciliation

是对交易信息数据进行核对的核对环节,或者说是对支付指令进行核对。

This is a reconciliation of transactional information data, or a check of payment instructions.

42)资金对账

42) Fund reconciliation

是对支付涉及的银行账户或者支付账户实际资金变动信息进行的核对,或者说是对资金流进行的核对。

It is the reconciliation of the bank account to which the payment relates or of the actual movements of funds to which the payment relates, or the reconciliation of the flow of funds.

43)长短款

43) Long term

就是平台与银行之间的应收应付和实收实付之间存在差异,这个差额就是长款或者短款。

It is the difference between the accounts receivable and payments received from the Platform and the banks, which is either long or short.

44)清算文件

44) liquidation document

银行或者三方支付机构提供给商家的一个交易周期内的交易记录明细文件。

An itemized record of transactions during a trading cycle provided to the business by a bank or a tripartite paying agency.

45)结算文件

45) Settlement file

银行或者三方支付机构提供给商家的一个交易周期内的银行账户或者支付账户实际资金变动明细。

A breakdown of the actual movements of funds in a bank account or payment account provided by a bank or a tripartite paying agency to a merchant during a transaction cycle.

46)账务类型

46) Account Type

就是根据业务类型确定的记账类型;比如渠道收款账务,渠道收款手续费账务等。

It is the type of account that is accounted for according to the type of operation; for example, the channel receipt account, the channel receipt processing fee account, etc.

47)账务流水

47) The flow of accounts

基于业务发生记录生成的某账务类型的账务明细记录。

An account breakdown of an account type based on the business occurrence record.

48)账户类型

48) Account Type

基于业务需要将账户分成不同的类型便于管理,账户本身并没有实质性区别;像结算账户,付款账户,运营账户,营销账户,收入账户等。

There are no substantive differences in the accounts themselves based on business needs that divide accounts into different types for ease of management; such as clearing accounts, payment accounts, operating accounts, marketing accounts, revenue accounts, etc.

49)账户权限

49) account privileges

迎合业务需要对某类型或者某个账户设定的功能可用性;能否透支、能否收款、能否付款。

Compatibility requires functional availability of a certain type or account; overdraftability; collectability; and paymentability.

50)账户余额

50) account balance

账户里的资金数量账户流水:账户余额变化的明细记录。

The amount of funds in the account flows into the account: a breakdown of the changes in the account balance.

51)轧差

51 >

正负方向账务变化的相抵的处理方式,就是将过个款项按照流动方向进行汇总的处理操作,比如收款100,手续费6元,那轧差后的净收款就是96元。

The opposite of positive-and-negative changes in the accounts is the processing of a lump-sum amount in the direction of a flow, such as a collection of $100 and a handling fee of $6, resulting in a net collection of $96 after the fall.

52)结转

52) carry-over

指期末结账时将某一账户的余额或差额转入另一账户。这里涉及两个账户,前者是转出账户,后者是转入账户,一般而言,结转后,转出账户将没有余额。

This refers to the transfer of balances or differences from one account to another at the closing of the accounts at the end of the period.

53)日切

53)

通俗的来说就是更换系统记账的时间;系统从当前工作日切换到下一工作日。

In general terms, this is when the system is replaced; the system is switched from the current working day to the following working day.

54)试算平衡

54) Try balancing

是指根据借贷记账法的记账规则和资产与权益(负债和所有者权益) 的恒等关系,通过对所有账户的发生额和余额的汇总计算和比较,来检查账户记录是否正确的一种方法。

is a method of checking the correctness of the account records through the aggregate calculation and comparison of the amounts and balances incurred for all accounts, in accordance with the rules of accounting for borrowing and the constant relationship between assets and equity (liability and owner's interests).

55)结账

55) Closing of accounts

结账是指会计期末将各账户余额结清或结转下期,使各账户记录暂告一个段落的过程。包括虚账户的结清和实账户的结清。

The closing of accounts represents the process of closing or carrying forward account balances at the end of the accounting period so that the records of the accounts are disclosed for the time being. This includes the closing of a false account and the closing of an actual account.

56)银行卡类型

56) type of bank card

借记卡、贷记卡、理财卡。

debit cards, credit cards, financial management cards.

57)银行结算账户分类

57) Bank clearing account classification

一类户、二类户、三类户。

One household, two households, three households.

58)备付金账户

58) allowance account

支付机构或者银行开立在央行的存管账户;原支付机构开立在银行的备付金账户分为存管户、收付户、汇缴户。

The paying agency or bank has a holding account with the central bank; the deposit account with the bank with the original paying institution is divided into depositors, payers and remitters.

59)头寸

59

指的是个人或实体持有或拥有的特定商品、证券、货币等的数量。

It refers to the number of specific commodities, securities, currencies, etc. held or owned by an individual or entity.

60)二清

{\bord0\shad0\alphaH3D}Absolutely clear {\bord0\shad0\alphaH3D}

是指做了2次清算,主要指三方支付公司给商户做了一次清算,资金进入商户的自有账户,这是第一次清算;商户又将资金清算支付给了自己平台的店家的银行账户,这是第二次清算;因为商户没有金融牌照,不能进行代收业务,所以属于“二清违规”。

It refers to two liquidations, the first of which was a liquidation by a tripartite payment company, in which the funds entered into the owner's account; the second of which was the settlement of the funds to the bank account of the owner's own platform; and the second of which was a “two clean-up violation” because the dealer did not have a financial licence plate and could not carry out a surrogate business.

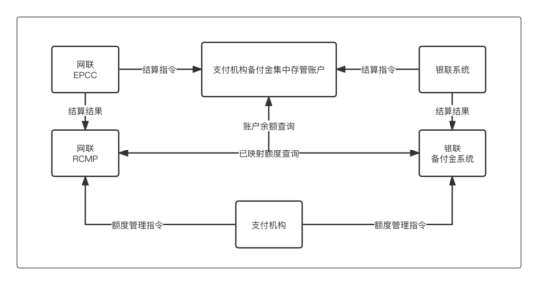

61)备付金集中存管

61) centralization of the provision

就是三方支付代商户收的交易资金放到指定银行指定账户进行监管;2019.1月之前各家银行都可以开设备付金账户,一个支付机构可以开设很多备付金账户,存管比例根据支付机构分级进行设定;之后只能在央行开设一个集中存管账户,100%存管。

It is the transfer of transactional funds received by tripartite payers to designated bank accounts for supervision; the opening of equipment payment accounts by banks until 2019/January, the opening of many reserve accounts by a paying agency, the proportion of which is based on the classification of the paying agency; and the subsequent opening of only one centralized deposit account at the central bank, at 100 per cent.

62)网联银联虚拟账户

62)

断直连后,网联和银联为三方支付机构设立的虚拟额度账户,其中的虚拟金由三方支付机构自主将集中存管户里的实际资金进行分配得到。

After the break-up, the network and the silver union established a virtual line account for the tripartite paying agency, in which the virtual gold is distributed by the tripartite paying agency autonomously from the actual funds held in the centralized custodians.

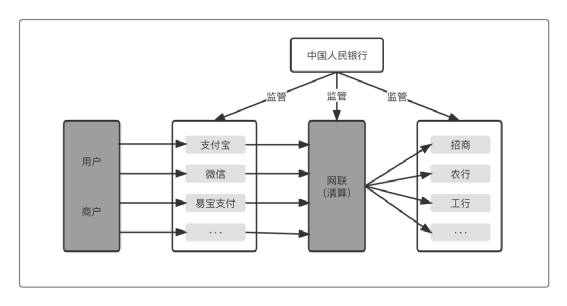

图1-8:网银联业务架构

从咿呀学语开始,我们都是从懵懂无知到博学睿智;同样学习支付也是,从宏观上整体认知支付,可以为更好的掌握支付打下非常坚实的基础,今天我们就泛泛而谈的聊一聊“支付观”。

From the beginning of the linguistic term, we all go from ignorance to intellectual wisdom; the same is true of learning payments, which are paid from the macro level of general awareness and which can provide a very solid basis for better control of payments, and today we talk about the “pay view” in general.

货币是支付的基础,货币在社会的不同阶段拥有不同的职能和形态,从最原始的具体物体为货币下催生的物物交换支付方式,再到铸造技术发展之后的金银铜币的中间媒介支付方式;再到近代国家信用背书下的纸质货币以及票据等近代支付方式;以及目前数字时代的数字货币形态下的互联网支付、数字货币等的现代支付方式。

Currency is the basis for payments, with different functions and patterns of money at different stages of society, ranging from the most primitive specific object to the exchange of material generated under the currency, to the intermediate payment of silver and silver coins after the creation of the technology; to the near-term payment of paper currency and instruments under the credit endorsement of recent countries; and the modern payment of Internet payments, digital money, etc., in the digital currency form of the current digital age.

从历史发展的角度看支付在时间上的变化,能让我们预见未来,从以下这几个方面看支付随着时间的变化,发生了什么样的变化。

The change in the timing of payments from the point of view of historical development allows us to foresee the future in terms of how payments have changed over time.

1)支付定义的演变

1) Evolution of the definition of payment

社会发展的不同,货币的形式和制造技术的变革;支付的定义也会随之发生变化,虽然到目前为止还没有统一的认识,从曾经的物物交换,到现在的资金转移,支付的定义也在随着经济活动的繁荣和技术的变革而不断丰富和更新。

Differences in social development, changes in the form of money and manufacturing technology; and consequent changes in the definition of payments, although to date there has been no uniform understanding that the definition of payments is being enriched and updated as economic activity flourishes and technology changes, from the exchange of goods to the transfer of funds now.

2)支付技术的演变

2) Evolution of payment technology

支付的技术依赖从有形金银货币时代的运输技术,纸质货币的制造和防伪技术,互联网时代的数字货币存储加密和数据传输技术。

The technology for payment relies on transport technology from the time of the physical gold and silver money era, on paper currency manufacturing and forgery-proof technology, and on digital currency storage encryption and data transmission technology from the time of the Internet.

3)支付工具的演变

3) Evolution of payment instruments

从以往的以物换物工具,金银铜币工具,到现代的银行卡、票据、预付卡、互联网支付、移动支付等多样的支付工具。

From previous material exchange tools, gold and silver coin tools, to modern, diverse payment instruments such as bank cards, notes, prepaid cards, Internet payments, mobile payments, etc.

4)支付参与者的演变

4) Evolution of payment participants

从原来的一对一参与者,到后来的钱庄镖局,到当下的央行、支付服务机构等更多的参与群体。

From the original one-to-one participants, to the subsequent money darts, to more participants such as the current central bank, payment services, etc.

5)支付系统的演变

5) Evolution of payment systems

最明显的就是从原来的无系统,到近代的简约系统,再到近代的多层服务组织参与的复杂支付系统,如当下中国清算体系的人行支付系统、银行支付系统、清算机构与支付机构的支付系统、交易发起者的支付系统等。

The most obvious are complex payment systems, which range from the formerly unsystemic to modern-day simple systems, to the participation of modern-day multi-tier service organizations, such as the current Chinese liquidation system, the bank payment system, the settlement and payment system, and the payment system of the sponsors of the transaction.

6)支付时代的演变

6) Evolution of the payment age

不同的社会时期催生了不同的支付时代,我们不妨将他们分为远古以物换物为支付基础的旧支付时代,近代以金银纸币为支付基础的传统支付时代,以及现在以互联网等更多货币形态为基础的数字支付时代。

Different social periods have given rise to different payment times, and we might divide them into old payment times where the payment was based on the exchange of goods, the traditional payment era of recent times when the payment was based on silver and gold notes, and the digital payment age, which is now based on more monetary forms, such as the Internet.

经济活动的发生催生了支付的产生,从空间上看每一次支付都是在众多参与者的协同下完成。

The occurrence of economic activity has led to the creation of payments, each of which, in spatial terms, has been made in coordination with a large number of participants.

1)用户

1) User

是支付交易的消费者和发起者,他们基于生活和社会活动需要,购买商品,购买服务而发起支付动作。

Consumers and sponsors of payment transactions are those who, based on their needs for life and social activities, purchase goods and purchase services to initiate payment actions.

2)商户

2) Businesses

是商品和服务的提供者,并且为个人以及企业用户提供商品交易线下或线上场所以及支付服务。

It is a provider of goods and services and provides a place for individuals as well as business users to trade in goods under or on the line, as well as payment services.

3)非金融支付机构

3) Non-financial payment agencies

是支付服务提供者,包括支付代理商、四方支付机构、三方支付机构等非金融支付机构,他们向商户提供效率更高、体验更好的支付服务解决方案。

They are payment service providers, including payment agents, quadripartite payment agencies and non-financial payment agencies, such as tripartite payment agencies, that provide businesses with more efficient and experienced payment service solutions.

4)清算机构

4) Clearing house

是支付过程中跨行清算的重要参与者,实现银行与银行之间清算指令的传输交换以及向人行支付系统发起清分。

It is an important participant in cross-line liquidation in the payment process, the transfer of liquidation instructions between banks and banks and the initiation of segregation of points in the bank payment system.

5)银行

Bank 5

金融基础提供者,为个人以及企业提供最基础的结算服务以及其他金融服务。

Financial base providers, providing the most basic settlement services and other financial services for individuals as well as enterprises.

6)央行

6) Central Bank

货币发行、支付政策、资金监管的履行者,向社会提供最基础的法律政策支持以及支付基础设施,包含大小额支付系统以及清算账户基础等基础能力。

Compellers of money issuance, payment policies, funds regulation, provision of the most basic legal and policy support to society and payment infrastructure, including basic capabilities such as large and small payment systems and the basis for clearing accounts.

从流程上看每一次交易的发生,每一次支付动作都可以从这样几个维度去描述。

In terms of process, each transaction can be described in terms of the dimensions of each payment action.

1)支付的意识流动

1) Awareness flow of payments

这是交易发生的基础,是人们消费的冲动以及支付的意愿的变化;从看到一个精美的商品到产生了购买的欲望,选择最佳的支付手动进行支付动作。

This is the basis for the transaction, the impulse of people to consume and the change in their willingness to pay; from seeing a fine commodity to creating a desire to buy, choosing the best payment to do it manually.

2)支付的信息流动

2) The flow of information for payments

整个交易过程中的单据的产生和记录,数据的产生和传送;用户购买下单,先生成订单、支付的账单、身份的验证、支付指令的发起以及传输等信息的流动,推动这交易的进程。

The process of this transaction is facilitated by the generation and recording of documents throughout the course of the transaction, the generation and transmission of data; the purchase by the user of the order, the bill of payment, the authentication of the identity, the initiation of the payment order and the flow of information such as the transmission.

3)支付的资金流动

3) Financial flows disbursed

完成最后的债券关系的清偿,消费方付出资金,销售方获得资金,资金在不同参与者的不同账户之间完成最后的转移支付的三流联动,整个支付过程不同的流动之间不是独立的,而是相互关联,意识、信息、资金相互联动。

The liquidation of the final bond relationship, the payment of funds by the consumer, the acquisition of funds by the seller, the completion of the final transfer of funds between the various accounts of the different participants, is not a stand-alone, but an interlinkage between the different flows of the entire payment process and the connection of awareness, information and funds.

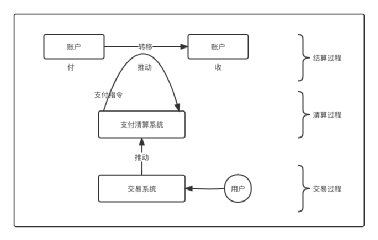

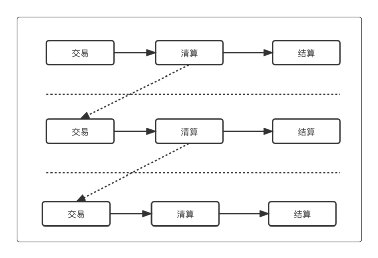

我们将支付在时空上划分成三个阶段,交易,清算,结算;这也是一切支付行为的核心组成框架。

We divide payments into three phases in time and space, transactions, liquidations and settlements; this is also the core constituent framework for all payments.

1)交易

1) Transactions

即用户进行支付的发起、身份的确认、单据的生成等一系列动作。

That is, the user performs a series of actions such as the initiation of payments, identification, document generation, etc.

2)清算

2) Liquidation

是基于生成的交易单据进行数据的交换、归集以及清分的过程;这个过程完成交易本金和手续费的计算以及按照对象汇总生成应收应付金额,并将支付发送给清算方。

It is a process of data exchange, aggregation and segregation based on the generated transaction documents; this process completes the calculation of the transaction principal and fees and generates the amounts due and payable according to the aggregate of the objects and sends the payments to the liquidator.

3)结算

3) Settlement

是按照清分结果完成最后的资金实际转移的过程。

It is the process of completing the final actual transfer of funds based on the results of the classification.

交易、清算、结算的关系如图1-9所示。

The relationships between transactions, liquidations and settlements are shown in figure 1-9.

图1-9:支付通用架构模型

当下的支付体系靠单个企业是无法实现的,需要依赖众多参与者共同完成,所以,交易、清算、结算就在多个参与者之间链接起来,这就是所谓的“信息流”的链接,如图1-10所示。

The current payment system, which cannot be achieved by a single enterprise, depends on a large number of participants, so that transactions, settlements and settlements are linked to multiple participants, which is the link to the so-called “flow of information”, as shown in figure 1-10.

图1-10:支付信息流的链接

从广义上看现代支付是超越系统的,因为支付无处不在,它永生于“观念”从狭义上看,现代支付或是寄生于系统的,以人行支付系统为核心,以商业银行等支付参与组织支付系统为基础,以商业活动企业支付系统为场所,以用户支付应用为起点……通过这样的跨越时空、主体、意识的支付协同网络,成就了现代支付的繁荣。

In a broad sense, modern payments go beyond the system, because they are ubiquitous in the “concept” that, in the narrow sense of the term, modern payments are or are system-based, centred on a pedestrian payment system, based on a payment system for participating organizations, such as commercial banks, based on an enterprise payment system for commercial activities, starting with a user payment application... Through such a coordinated network of payments that spans time, space, subject, consciousness, etc., the prosperity of modern payments has been achieved.

橘生淮南则为橘,生于淮北则为枳;也许不恰当,但可以说明,同一个事物在不同的平台或者场所会有不同的表现和结局同样,我们常说的人各不同,更多也是基于其性格、职业、观念、成就所言;但作为生物而言,我们都是“一个鼻子两个眼,两只胳膊两条腿”没有本质的不同。所以,我们“人”从不同的维度可以划分出不同的个体或者群体。

Orange is an orange, and it is an orange; it may not be appropriate to be born in the North; but it is clear that the same thing will behave and end in different platforms or places. We often say that people are different, more so because of their character, profession, ideas, achievements; but, as organisms, we are all “two eyes with one nose and two legs with two arms” that are not fundamentally different. So, we “humans” can divide individuals or groups from different dimensions.

首先,我们从系统层面来看我们都是社会的一份子,相互协同、竞争以及依赖;从身份的角度看“我们是人”。

First, at the systemic level, we are all part of society, in synergy, competition and dependence; at the identity level, “We are human”.

其次,从角色去看,我们又有不同的角色,同一个个体的“人”可以是丈夫、是教师、是儿子、是别人的男女朋友;不同的人在不同的角色上又拥有不同的信念或者观念,就如作为父亲的角色一样,有些父亲提倡散养,有的父亲提倡精致的养。不同的观念铸就了我们会选择培养不同的能力,去做不同的事情,去适应不同的环境……

Secondly, in terms of roles, we have different roles. The same individual “person” can be a husband, a teacher, a son, or a friend of another man's or woman; different people have different beliefs or beliefs about different roles, as in the case of fathers, some of whom promote separation and some of whom promote fine upbringing. Different ideas are shaped so that we choose to develop different abilities, do different things, adapt to different circumstances.

所以我们要学会从不同的层次去理解同一个事物,这个层次可以是空间上的、也可以是时间上的、更可以是观念上的,同样我们从以下几个不同的层次上去理解和认识账户。

So we have to learn to understand the same thing from different levels, which can be spatial, or temporal, or conceptual, just as we understand and understand accounts from several different levels.

我们总是迷惑什么是账户,我想我们是迷惑于账户的不同角色,迷惑的原因就是没有把握住账户的本质。

We are always confused about what accounts are, and I think we are confused about the different players in the accounts, because they fail to grasp the nature of the accounts.

就像银行的结算账户与微信的零钱账户,看起来是不同的,那是因为其承担了不同的角色,拥有不同的信用和社会职能;但是究其本质,皆为账户,没有不同;有余额,有流水,有流水对余额的更新,如图1-11;所以账户的本质是什么呢?

Like the bank's clearing account and the micro-money account, which appears to be different, because it assumes different roles and has different credit and social functions; but by its very nature, it is all accounts, no different; there is a balance, there is a flow of water, there is a flow of water to update the balance, such as figure 1-11; so what is the nature of the account?

图1-11:账户结构的示意图

首先,我们来看账户存在的意义,那就是电子货币的载体,对经济活动产生的支付信息的记录;这就是账户的本质,存储电子货币,以及支付信息;而货币存在的意义就是“等价物”,也就是支付的媒介;而作为支付媒介,当下的货币或者电子货币本身并没有价值。

First, we look at the meaning of the existence of an account: the carrier of an electronic currency, the recording of payment information generated by an economic activity; the essence of an account, the storage of electronic money, and payment information; the meaning of the existence of a currency is “equivalency”, that is, the medium of payment; and, as a payment medium, the current currency or electronic currency itself has no value.

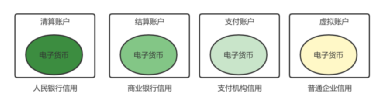

图1-12:货币的媒介作用

其次,为什么可以作为等价物用于交换呢?那就是其本身的“信用”,不同货币的发行者就赋予了不同种类货币的不同的信用,不同种类的货币的存储就产生了不同种类的账户,如图1-13所示;这就是账户的不同之处,不同于存储的货币的不同,不同于货币存储主体的不同,同样不同于货币信用的不同。

Second, why can they be traded as equivalents? That is its own “credit”, where the issuers of different currencies give different kinds of credit to different currencies, and where the storage of different types of currency produces different types of accounts, as shown in figure 1-13; this is the difference between accounts, as opposed to the stored currency, as opposed to the currency depositor, as opposed to the currency credit.

图1-13:不同机构的账户信用

基于账户的本质,我们知道了如何去理解不同种类账户,我们应该从其发行主体,不同货币资产,不同货币信用去区分,如此我们可以将账户做如下的分类和分层。

Given the nature of the accounts, we know how to understand different types of accounts, and we should distinguish them from their issuers, from their monetary assets, from their monetary credit, so that we can classify and stratification the accounts as follows.

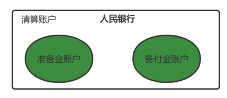

1)人行的清算账户

1) Blank liquidation account

这是拥有国家信用的账户,存储着央行货币资产;又可以分为准备金账户和备付金账户;准备金账户我们应该知道就是各银行在人行存储缴纳的“保证金”,确保银行有一定的抵偿能力,我们经常听到的“降准”就是降低这个准备金账户缴纳的比例;备付金账户我想大家也都知道,就是用于银行间或者其他支付服务组织间支付清算,支付机构在人行的监管账户就是备付金账户,目前要100%存管。

This is a country-credited account with central bank monetary assets; it can also be divided into reserve accounts and reserve accounts; reserve accounts should be known to be “guaranties” deposited by banks on the side bank to ensure that banks have a certain countervailing capacity, and the “reduce” we often hear is a reduction in the percentage of contributions to this reserve account; and reserve accounts, as I think you all know, are used for the liquidation of payments between banks or between other payment service organizations, and the bank-based supervisory account of the paying agency is a reserve account, which is currently held at 100 per cent.

图1-14:央行的清算账户

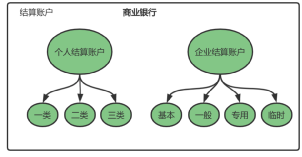

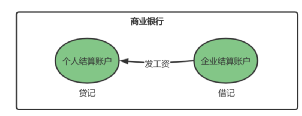

2)银行结算账户

2) Bank clearing account

这是拥有银行信用的账户,存储着银行存款货币资产;又可以分为个人结算账户和企业结算账户;个人结算账户就是以个人为账户开户主体,存储个人存款的账户,按照开户渠道和验证条件的不同可以分为一二三类账户。

This is a bank credit account in which the monetary assets of the bank deposits are stored; it can also be divided into personal settlement accounts and business clearing accounts; it is an account in which the individual accounts are owned by the individual and the individual deposits are stored, which can be divided into one or two types of accounts depending on the channel of the opening and the conditions of verification.

这个就不细讲了,感兴趣大家可以自行搜索;企业结算账户就是以企业为开户主体,存储企业存款的账户,可以分为基本账户,一般账户,专用账户,临时账户四种。

That being said, all interested parties can search for themselves; the business clearing account is an enterprise-owned account in which business deposits are stored, which can be divided into basic accounts, general accounts, exclusive accounts and four temporary accounts.

图1-15:商业银行的结算账户

3)支付账户

3) Payment account

这是拥有支付机构信用的账户,存储在支付机构的虚拟货币资产;也可以分为个人支付账户和企业支付账户;个人支付账户按照开户渠道和验证要素的不同可以分为一二三类账户,这个也不细讲其不同了。

It is an account with the credit of the paying agency and is stored in a virtual monetary asset of the paying agency; it can also be divided into an individual payment account and an enterprise payment account; the individual payment account can be divided into one or two types of accounts, depending on the channel of opening and the elements of authentication, and this does not differ in any detail.

图1-16:支付机构的支付账户

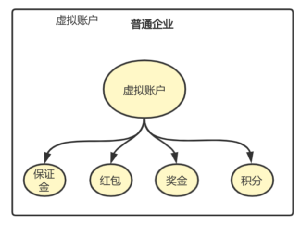

4)企业虚拟账户

4) Business Virtual Account

这是拥有企业信用的账户,存储在企业自建虚拟账户体系的账务记录;这类更灵活,但本身并不具备多么高的信用;企业的信用相对于上面几类账户而言太弱了。

This is an account with the credit of the enterprise, which is stored in the account records of the enterprise's own virtual account system; this is more flexible but does not in itself have a high level of credit; the credit of the enterprise is too weak in relation to the above types of accounts.

图1-17:普通企业的虚拟记账账户

电子账户存在的意义本身就是服务于支付,大大提升了社会经济活动的支付效率,降低了社会的交易成本;不同的电子账户组成了支付的基础;而不同的账户基础又服务于不同的支付场景,那么不同的账户有用于支撑哪些支付行为呢?而支付行为的发生又依赖什么呢?

What is meant by the existence of electronic accounts is in itself to serve payments, significantly improve the efficiency of payment for socio-economic activities and reduce the transaction costs of society; different electronic accounts form the basis for payment; and different account bases serve different payment scenarios, so what are the different accounts used to support payment behaviour? And what is the basis for payment behaviour?

支付行为的发生依赖于账户的同时,也同样依赖于支付工具,依赖于不同的支付清算系统,支付工具比如银行卡,支票,汇票,预付卡等等,我们会在下一篇文章详细讲解支付工具;支付清算系统比如人行的大小额支付系统,银行的支付系统等。

At the same time that payment behaviour depends on the account, it also depends on payment instruments, on different payment clearance systems, such as bank cards, cheques, bills of exchange, prepaid cards, etc., we will elaborate on payment instruments in the next article; and on payment clearance systems such as the bank's petty payment system, the bank's payment system, etc.

1)人行的清算账户

1) Blank liquidation account

用于进行不同组织的资金监管及相互之间的资金清算,比如银行与银行间的资金清算,支付机构与银行间的资金清算;这个支付清算的执行就是依靠借记和贷记不同的清算账户实现;同样清算组织比如银联可以向人行发起即时转账来促成各组织间的账户清算。

It is used to regulate funds of different organizations and to settle funds with each other, such as between banks and banks, and between the paying agency and the bank; the execution of this settlement of payments depends on debits and the crediting of different liquidation accounts; similarly, liquidating organizations, such as the Bank, can initiate instantaneous transfers to facilitate the liquidation of accounts between organizations.

2)银行的结算账户

2) Bank clearing account

用于个人与企业主体间的结算,也是通过贷记或者借记对应账户实现资金的结算;比如企业要给员工发工资,那么银行就可以借记企业对公账户贷记个人结算账户完成工资的发放,如图1-19所示。

The settlement of funds between the individual and the subject of the enterprise is also achieved by crediting or debiting the corresponding account; for example, when an enterprise pays its employees, the bank may borrow the payment of wages from the enterprise to the public account credited to the individual settlement account, as shown in figures 1-19.

图1-18:银行的工资发放账务处理

3)支付机构的支付账户

3) Payment account by paying agency

可以用于个人的消费付款,企业的代收款以及代付款,原理与其他类型账户一样,所以以上不同的账户承载着不同的社会职能,共同支撑这社会的经济活动需要的支付能力和账户基础。

As with other types of accounts, the principle that they can be used for personal consumption payments, surcharges from enterprises and indemnities carries with them different social functions, together with the capacity to pay and the basis of the accounts required to support the economic activities of the society.

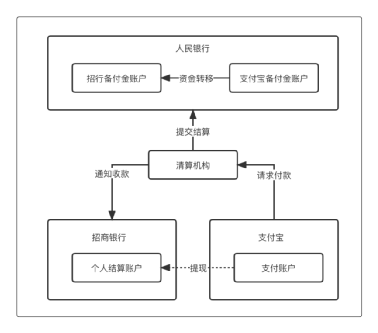

不同的账户不是独立存在的,而是相互协同,分层工作;就像我在支付宝里提现了我的账户余额到我的招商银行卡。

Different accounts do not exist independently, but they work in tandem with each other and in layers; it is as if I had raised the balance of my account in a payment bond to my merchant bank card.

首先,是支付宝要向银联发起付款请求,由银联将转账的支付信息转接给招商银行,支付宝扣减我在支付宝开通的支付账户余额。

First, it is the payment bond that initiates a request for payment to the Federation, which forwards the payment information from the transfer to the requisitioning bank and deducts the balance of the payment account that I have opened for payment.

其次,是招商贷记我的招商个人结算账户账户余额完成入账最后是银联要向人行发起对支付宝和招行的资金清算;人民银行要借记支付宝的备付金账户,贷记招行的备付金账户,完成两家组织在人行的备付金存款的资金转移,如图1-20所示。

Secondly, it is the firm that has been credited to me to complete the recording of the balance of the accounts in the accounts of the applicant's personal settlement account and finally the association is about to initiate the liquidation of the payment of the treasures and the funds called for; the People's Bank is required to borrow the reserve account for the payment of the treasures, credit the reserve account for the requisitions, and complete the transfer of the funds in the bank's reserve deposits of the two organizations, as shown in figures 1-20.

图1-19:支付宝提现流程图

至此整个提现才真正完成。

It is only now that the whole story is truly complete.

我们总是需要用不同的角度去看待事物,同样,我们又需要学会认识同一个事物的不同维度;酒桌上他不能喝酒,你可能认为他不识时务,但他只是因为有胃炎不想因为喝酒而生病,因为生病而让妻子担心,因为妻子担心而影响妻子的司法考试,影响了妻子的司法考试而影响了妻子希望为农民工伸张正义的梦想……

We always have to look at things from different angles. Likewise, we need to learn to understand the different dimensions of the same thing; he can't drink at the table, you may think he's out of time, but he just wants to be sick because he's having stomach fever, he's sick, he worries his wife because he's sick, because his wife's fear affects his wife's judicial exam, it affects his wife's dreams of justice for the rural workers...

人生而不同,而又相同;换个角度,世界大不同!换个层次,必有新的意义!

Life is different and it's the same; the world is different from one angle to another!

锄禾日当午,汗滴禾下土;锄头的发明很大程度上提高了农民耕作的效率,大大的提升了生产力;人类与其他动物最大的区别就是我们会发明和使用工具,工具发明的意义在于对生产力的提升,大大加快了社会的进程。

In the middle of the day, sweat was shed; the invention of hoes had greatly improved the efficiency of farmers'farming and productivity; the greatest difference between humans and other animals was that we would invent and use tools that were meant to increase productivity and significantly accelerate the process of society.

同样社会的经济活动要依赖于市场交易,而交易就需要进行支付行为,而支付就想耕种一样,也需要不同的工具来完成;在不同的时期产生了不同的支付工具,支付工具的意义也就是工具本身的意义,它是为了提升生产力而存在的;而支付工具就是为了提升支付的效率、安全性等而产生的。

Economic activity in the same society depends on market transactions, which require payment behaviour, which, as in the case of farming, requires different instruments; different payment instruments arise at different times, the meaning of which is that of the instrument itself, which exists in order to increase productivity; and payment instruments that arise in order to increase the efficiency, security, etc. of payments.

我们知道货币是支付的媒介,也是拥有不同信用的交换等价物,而货币本身随着历史的发展其形态和作用也在发生着变化;从最早的实物作为货币媒介,到近代的铸币、票据、银票,再到现代的纸币,账户货币;而不同的货币形态用于支付就需要不同的支付工具来完成,比如银行的个人结算账户货币要是用于支付购买商品,怎么进行使用呢?

We know that money is the medium for payment and the equivalent for exchange of different credits, and that the currency itself is changing as history unfolds; from the earliest in kind as the currency medium, to the more recent forms of casting, paper, silver, to modern paper, account currency; and that different currency forms of payment require different payment instruments, such as the use of the bank's personal settlement account currency for the purchase of goods.

那就需要依赖可以转移支付结算账户货币资金的支付工具,比如银行卡,信用卡,拿着银行卡在商家的pos机上一刷,就可以将结算账户里的资金转移给指定对象了。

It would then be necessary to rely on payment instruments, such as bank cards, credit cards, that can transfer money from the clearing account to the designated person with a bank card that is being brushed on a commercial posse.

现代支付工具让支付非常方便,不需要你再去银行柜台,填写一个单子,拿着身份证把钱取出来,然后再去到商场把现金给到商家;同样商家也不需要兑换很多的零钱用于找零,日终再清点货款,然后定期到银行去把钱存到银行的结算户中。

Modern payment instruments make payments very easy and do not require you to go to the bank counter, fill out a list, take out the money with your identity card, and then go to the mall and give the cash to the merchants; similarly, the merchants do not have to exchange much of the change for the purpose of finding a change, collect the money at the end of the day, and then regularly go to the bank and deposit it with the bank's clearing account.

所以说银行卡支付工具的发明,大大提升了银行货币支付的效率,也提升了支付过程的安全性和货币的安全性,因为如果没有银行卡,货币的存取都存在丢失破损等风险。

Thus, the invention of bank card payment instruments has greatly improved the efficiency of bank currency payments and the security of the payment process and of the currency, since in the absence of a bank card, there is a risk of loss, loss, etc., of currency access.

由上我们如何定义支付工具呢,中国支付体系发展报告中是这样定义的:支付工具是传递收付款人支付指令,实现债权债务关系清偿和资金转移的载体。

How do we define the instruments of payment, as defined in China's report on the development of the payment system: the instruments of payment are the vehicles through which the payee's payment instructions are passed and the debt relationship is settled and the funds transferred.

所以说支付工具是一个载体,用于传递支付指令,就如上文提到的银行卡就是支付工具的角色,其本身并不是货币,因为货币是以数字的形态存储在银行的结算账户中,而银行卡只是作为支付工具发起结算账户货币资金转移的请求为了不同场景或者交易市场的支付需要。

Thus, a payment instrument is a vehicle for the transmission of payment instructions, and a bank card, as mentioned above, is a payment tool and is not a currency in itself, since the currency is stored in digital form in the bank's settlement account, whereas a bank card is merely a payment tool for the purpose of initiating a transfer of monetary funds in the settlement account for different scenarios or for payment needs in the trading market.

我们可以发明创造出不同的支付工具,比如我们做公交的公交卡就是支付工具,替代了人工投递纸币,大大提升了乘车的支付效率,我们可以回忆一下在没有公交卡之前,我们遇到过多少次因为没有零钱或者排队买票而出现的不便。

We can invent different payment instruments, such as our bus cards, which are instruments of payment, replacing artificially delivered banknotes, which greatly improves the efficiency of transport payments, and we can recall how many times we encountered inconveniences due to lack of change or waiting to buy tickets prior to the absence of the bus cards.

支付工具经过了改革开发几十年或者对世界先进工具的借鉴和引用,当下支付工具的种类已经琳琅满目了,也极大的满足了社会不同市场的支付需要支付工具可以划分为现金支付工具和非现金支付工具;现金支付工具就是我们的纸币了,非现金支付工具我们可以称其为新型支付工具,更多是以账户货币为基础,用于高效转移账户货币资金的工具。

Payment instruments, which have been reformed for decades or are based on and quoted from the world's most advanced instruments, are already full of current types of payment instruments, and greatly satisfy the fact that payment needs instruments in different markets of society can be divided into cash payment instruments and non-cash payment instruments; cash payment instruments are our banknotes, and non-cash payment instruments can be called new payment instruments, more based on account currencies, for the efficient transfer of account money.

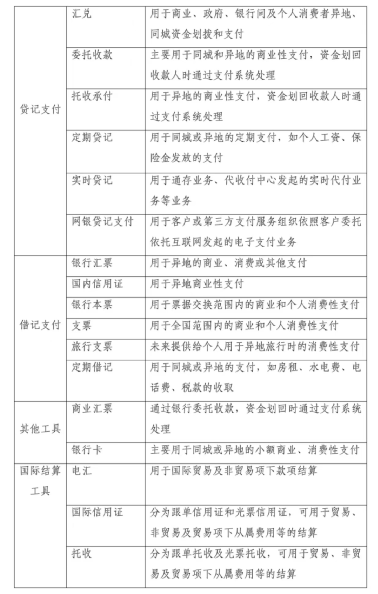

我们知道的有卡基支付工具“银行卡、信用卡、预付卡”,纸质票据支付工具“支票、汇票、本票”等等,如(表1-1)中罗列的目前常见的支付工具。

We know of kaki payment instruments “bank cards, credit cards, prepaid cards”, paper instruments “checks, bills of exchange, promissory notes” and so on, such as the current common payment instruments listed in table 1-1.

表1-1:常见的支付工具

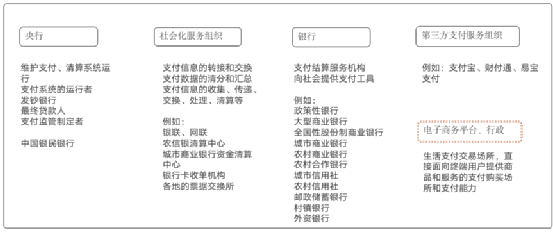

我国支付体系由众多参与者共同构成,其中包括人民银行、商业银行、清算机构、三方支付机构、四方支付机构等组织,本部分只介绍三方支付机构,大家要明白支付是众多组织,众多系统共同协同的结果,要对所参与的组织,涉及到的系统,以及相互之间的关系有所了解。

The payment system in our country is composed of a large number of participants, including the People's Bank, commercial banks, liquidation agencies, tripartite payment agencies and quadripartite payment agencies. This section describes only the tripartite payment agencies. It is important to understand that payments are the result of a combination of organizations, systems, systems and relationships between the organizations involved.

图1-20:支付服务组织、职能及示例

三方支付机构风风雨雨这么多年,相比大家都已经不陌生,特别是头部的那几家企业;今天我们就从几个维度浅谈一下支付机构的一些方面,了解即可也不必过度钻研。

For so many years, the tripartite payment agencies have become more familiar than any other, especially the companies with the head; today we speak from a few dimensions about some aspects of the payment agencies, and it is enough to understand that there is no need for overexploitation.

是指非金融机构在收付款人之间作为中介机构提供下列部分或全部货币资金转移服务∶

A non-financial institution provides, as an intermediary between payers, some or all of the following money transfer services:

1)网络支付

1) Internet payment

指依托公共网络或专用网络在收付款人之间转移货币资金的行为,包括货币汇兑、互联网支付、移动电话支付、固定电话支付、数字电视支付等。

This refers to the transfer of monetary funds between payors on the basis of public or specialized networks, including currency exchange, Internet payments, payments for mobile phones, fixed phone payments, digital television payments, etc.

2)预付卡的发行与受理

2) Distribution and acceptance of prepaid cards

指以营利为目的发行的、在发行机构之外购买商品或服务的预付价值,包括采取磁条、芯片等技术以卡片、密码等形式发行的预付卡。

is the pre-paid value of goods or services purchased outside the issuing agency for profit, including pre-paid cards issued in the form of cards, passwords, etc. using magnets, chips, etc.

3)银行卡收单

3) Bank card receipt

指通过销售点(POS)终端等为银行卡特约商户代收货币资金的行为。

This refers to the collection of monetary funds for banks such as Carter Yorker through the sales point (POS) terminal.

4)中国人民银行确定的其他支付服务。

非金融机构提供支付服务,应当依据本办法规定取得《支付业务许可证》,成为支付机构。支付机构依法接受中国人民银行的监督管理。未经中国人民银行批准,任何非金融机构和个人不得从事或变相从事支付业务。支付机构应当按照《支付业务许可证》核准的业务范围从事经营活动,不得从事核准范围之外的业务,不得将业务外包。支付机构不得转让、出租、出借《支付业务许可证》。

Non-financial institutions shall provide payment services in accordance with the provisions of this scheme and shall obtain a payment business permit and become a payment agency. The paying institutions shall be subject to the supervision and control of the People's Bank of China in accordance with the law. No non-financial institutions or individuals shall engage in or be disguised to perform payment operations without the approval of the People's Bank of China.

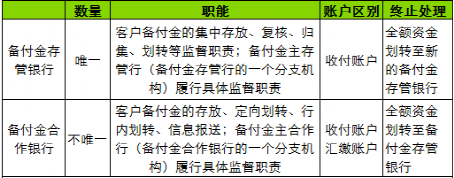

指客户备付金的存放、归集、使用、划转等存管活动。

This refers to management activities such as deposit, collection, use, transfer, etc. of clients'reserves.

客户备付金,是指支付机构为办理客户委托的支付业务而实际收到的预收待付货币资金。客户备付金必须全额缴存至支付机构在备付金银行开立的备付金专用存款账户。

Customer provisions are monetary funds actually received in advance and awaiting payment by the paying agency in order to perform payment operations commissioned by the client.

备付金银行,是指与支付机构签订协议、提供客户备付金存管服务的境内银行业金融机构,包括备付金存管银行和备付金合作银行。

A reserve bank is a banking institution in the country that enters into an agreement with the paying agency and provides the customer's reserve deposit management service, including the reserve deposit holding bank and the reserve cooperating bank.

表1-2:备付金银行分类与职能

专用存款账户,是指支付机构在备付金银行开立的专户存放客户备付金的活期存款账户,包括备付金存管账户、备付金收付账户和备付金汇缴账户。2019.1月以后备付金100%集中存管至人行

Special-purpose deposit accounts are the demand deposit accounts where the paying agency maintains a separate account with a reserve bank for the deposit of a client's allowance, including the reserve deposit management account, the reserve collection account and the reserve transfer account.

支付通道即资金转移的通道,也称为资金渠道、支付通道,所有支付系统建设都需要先建设渠道。

Payment corridors, the conduits for the transfer of funds, are also known as money channels, payment channels, and all payment systems are built first.

通道即支付机构接入银行的支付指令传输及查询等支付服务通信的接口集合。一个支付机构往往要接入支持各种支付类型的的通道类型,以满足用户支付场景的需要。

A payer often has access to the type of channel that supports the various payment types to meet the user’s payment scenario.

是指获得互联网支付业务许可的支付机构,根据客户的真实意愿为其开立的,用于记录预付交易资金余额、客户凭以发起支付指令、反映交易明细信息的电子簿记。支付账户不得透支,不得出借、出租、出售,不得利用支付账户从事或者协助他人从事非法活动。

The payment account is not overdrafted, cannot be loaned, rented or sold, and cannot be used to carry out or assist another person in carrying out illegal activities.

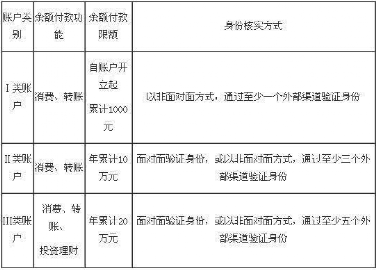

支付账户分一类,二类,三类等级,根据开立时的验证要素数量决定。

Payment accounts are divided into one, two, three levels, determined by the number of validation elements at the time of opening.

表1-3:支付账户分类及说明

支付产品就是支付机构或者银行提供给需要做支付业务的企业使用的,可以用来实现收款或者打款等支付业务的产品;支付产品是一个支付服务的集合,有他的应用场景,有相关的规范以及接入方法;比如我们接入的微信h5支付,网银支付,扫码支付等,都是支付产品详解支付产品。

The payment product is a product that the paying agency or bank provides to the enterprise that needs to do the payment business and that can be used to achieve the payment business, such as collection or borrowing; the payment product is a collection of payment services, his application scene, the relevant specifications and access methods; e.g., the payment of micro-h5 from our access, the payment of Internet money, the payment of scavenging, etc., is a detailed payment of the product.

图1-21:某机构的支付产品

站在整体视角来看支付机构在支付体系中的位置,我们可以看图1-22理解。

Looking at the position of the paying agency in the payment system from a holistic perspective, we can see figures 1-22 to understand.

图1-22:支付机构在支付体系中所在的位置

一个支付机构的组织构成,一般会基于不同的业务职能划分,比如银行合作部,合规部,通道部,退款中心,出款中心,核算中心,开放平台事业部,各行业线(航旅,小额贷,保险,水电缴费等),商户管理中心,企业通用部门(行政,财务,总裁办等)。

The organizational composition of a paying agency is generally based on different lines of business functions, such as the Ministry of Banking Cooperation, the Department of Compliance, the Department of Access, the Refund Centre, the Fundation Centre, the Accounting Centre, the Open Platform Department, the lines of industry (air travel, small loans, insurance, utilities, etc.), the Business Management Centre, the general sector of the enterprise (administration, finance, president office, etc.).

产品线的构成往往取决于公司的产品体系规划,或者说产品架构;各部门各系统之间的职责划分以及协作交互。

The composition of product lines often depends on the company's product system planning, or product architecture; the division of responsibilities among systems across sectors; and the interaction of collaboration.

其实通过上面的架构图大家也应该能猜出来会有哪些职责和产品经理岗位;如果你将来计划去一家支付机构做产品经理的话,你大概率会有以下岗位可以选择,有中意的么?

If you plan to go to a paying agency to become a product manager in the future, would you probably have the following options?

- 通道管理产品经理,主要做收单通道的接入,路由的设计、通道管理的设计、等等,核心职责就是与内外部对接,是支付机构与内外部的桥梁部门;

- 出款产品经理,出款通道的接入和管理,出款产品的设计,为出款性能、准确性、安全性负责;

- 退款产品经理,管理收单逆向业务,负责退款中心的设计和规划,为退款业务负责商户后台产品经理,负责商户后台的规划和设计商户管理产品经理,入网产品经理,工单系统产品经理等负责基础性产品;

- 资金管理产品经理或者清结算产品经理,包含了核算产品经理,账务账务产品经理,计费产品经理,财务处理产品经理,备付金管理产品经理等;

- 开放平台产品经理,主要负责对上游商户对接,输出基础能力的规划和设计;

- 基础支付产品产品经理,主要负责不同支付场景的挖掘以及支付产品的包装和设计,提供具有更好用户体验以及市场竞争力的支付产品解决方案,比如二清合规,快捷支付类,打款类;

- 行业产品经理,针对某垂直领域进行支付场景挖掘和解决方案设计,比如水电煤气领域,保险领域,教育领域等。

本部分重点介绍一个支付基础之上的核心应用型产品“支付产品”,我们对支付方案的选择,更多是对支付产品的选择,各支付服务组织将支付能力包装成可以直接被其他组织接入使用的“支付产品”,就如我们在做支付系统时,向内部业务线提供的支付能力,也可以认为是一款“支付产品”。

This section focuses on the “pay product” of a core application based on payments, our choice of payment options being, more so, payment options, whereby payment services organizations package their capacity to pay into “pay products” that can be accessed directly by other organizations, such as the capacity to pay provided to the internal line of operations when we do payment systems, or a “pay product”.

我们在设计支付体系的时候,往往需要接入一家支付服务提供商,那么我们得到的其实就是提供商提供的支付产品;支付产品本身就是支付解决方案,这一小节我们就聊一聊支付产品。

When we design payment systems, we often need to access a payment service provider, so what we get is a payment product provided by the provider; the payment product itself is a payment solution, and in this subsection we talk about the payment product.

支付产品就是支付机构或者银行提供给需要做支付业务的企业使用的,可以用来实现收款或者打款等支付业务的产品;支付产品是一个支付服务的集合,有他的应用场景,有相关的规范以及接入方法;比如我们接入的微信h5支付,网银支付,扫码支付等,都是支付产品。

The payment product is the one that the paying agency or bank provides to the enterprise that needs to do the payment business and that can be used to achieve the payment business, such as collection or payment; the payment product is a collection of payment services, his application scene, the relevant regulations and access methods; e.g., the payment of micro-h5 of our access, the payment of Internet silver, the payment of scavenging, etc., is the payment product.

支付是个特殊领域,国家强监管,需要相关的资质才能从事相关的支付业务,比如收单,出款,先存款等;能够提供支付产品的机构我们常见的就是三方支付机构,比如微信、支付宝、易宝支付等,以及银行,像银行提供的银企直联,资金监管方案等;以及一些四方聚合支付,我们也可以认为再提供一下聚合支付产品给小商户。

Payments are a special area in which the State regulates and requires the relevant qualifications in order to be able to perform payment operations, such as receipt of bills, disbursement of funds, first deposit, etc.; the institutions that can provide payment products are often referred to as tripartite payment agencies, such as micro-letters, payment treasures, payment of treasures, etc., as well as banks, such as banking companies, financial supervision programmes, etc.; and some quadripartite aggregate payments, which we may also consider to be providing aggregate payments to small businesses.

所以当你需要做支付的时候,就可以基于自己的业务模型,去寻找相关的机构选择合适的支付产品接入;以下是微信和易宝支付提供的部分支付产品;我们可以看出来,支付产品都有明显的使用场景特征,这也是支付机构为了实现差异化竞争对基础支付能力做的产品化包装。

So, when you have to make payments, you can look for appropriate payment product access based on your own business model; the following are some of the payment products offered by micro-trust and quilombo payments; as we can see, the payment products have a clear use scene, which is also the product-based packaging of the underlying capacity to pay by the paying agencies in order to achieve differentiated competition.

图1-23:微信的支付产品

要想包装出一款支付产品,最核心的原材料有2个,一个是通道,另一个是账户;毕竟支付的本质我们可以认为是电子货币的转移;那么其中要解决的最核心的问题就是电子货币的存储以及转移所需要的通道;所以我们签约的一款支付产品肯定是解决了这两个问题,账户问题以及支付通道问题。

In order to package a payment product, the core raw material is two, one is a channel and the other is an account; after all, the essence of the payment can be considered to be an electronic currency transfer; then the most central problem to be solved is the storage of electronic currency and the channel needed for the transfer; so one of the payment products that we have signed must have solved these two problems, the account problem and the payment route problem.

所以一款支付产品一般要包含以下内容:

So a payout product typically includes the following:

- 产品介绍:介绍产品适用的业务,产品的特点的信息。

- 接入指引:告你你要想接入应该怎么做。

- API列表:就是产品的实质性内容,接口定义,以及调用方法,这是最核心的内容。

- 其他的文档:一些辅助内容。

上面的内容基本就是一款支付产品所包含的东西了,这些内容一般机构的开放平台都会提供,所以访问相应的官网就可以找到;拿到产品说明文档之后,我们可以从下面三个层次去阅读 。

The contents are basically what is contained in a payment product, which is usually available on the open platform of the institution, so that access to the appropriate network can be found; once the product description file is available, we can read from the following three levels.

第一,先了解他的方案介绍“产品层面”,这一步你基本已经可以知道能不能用,怎么用,适不适用。

First, to learn about his programme's introduction to the “product dimension”, you can basically see if it can be used, how it can be used and how it does not work.

第二,如果有精力可以看下技术文档,主要看他有那些接口,自己交互流程图,这样有助于你设计逻辑流程。

Secondly, if you have the energy to look at the technical files, see mainly the interfaces he has, and interact with his own flow chart, it will help you design the logical process.

第三,如果再有精力,就看下他每个接口的传参和要求,这样会让你本侧的设计更精准和详细。

Thirdly, if you have more energy, look at the references and requirements of each of his interfaces, which will make your design more precise and detailed.

无论多么复杂的支付产品,其实基础都是哪几类通道之上进行场景化的包装产生的,底层通道类型我们看网联,网联提供了“协议支付,商业委托支付,网关支付,认证支付,付款”这5种。

No matter how complex a payment product may be, it is based on a landscaped packaging of the types of corridors that we look at the bottom route type, which provides the five types of “agreement payments, commercial commission payments, gateway payments, authentication payments, payment”.

1)收款类

1) Collection category

收单类支付产品顾名思义就是用来收钱用的,也就是下单支付用的支付产品;比如我们在京东买东西,用微信付款,那么这时候用的就是微信提供给京东的收单支付产品。

The billing-type payment product is by definition used to collect money, i.e., to pay for the bill; for example, we buy things in Kyoto and pay in micromails, and then we use the message to pay for the product.

2)付款类

2) Payment class

付款类其实就是打款产品,前面我们说的是将钱收进来;付款类就是将钱打出去;比如商家的结算账户里的余额要提走,那么用到的就是打款类的支付产品;微信的企业付款,直接付款给用户的微信零钱,也是一款应用场景非常明确的付款产品;其实打款类支付产品和收款类支付产品非常类似,只是方向不同而已。

The payment type is actually a loan product; the payment type is a money-taking product; the payment type is a money-out; for example, the balance in a merchant's settlement account is to be removed, then what is needed is a payment product in the form of a payment product in the form of a payment in the form of a payment in the form of a payment in the form of a payment; the payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in the form of a payment in which the payment of a payment in which the payment is a payment or payment in the payment in the payment in the payment in the form of a payment.

3)代扣

3) Substitution

即商业委托支付,就是用户签订代扣协议,平台按照约定周期定期主动去扣用户的钱;我们常见的会员的自动续费,基金的定投等场景会用到这样的支付产品;这里就不做详细介绍了;基本和收单类以及付款类没有太大区别。

The commercial commissioning, that is, the signing of a surrogate agreement by the user, whereby the platform periodically actively withholds the user's money in accordance with the agreed cycle; the automatic renewal fee for our usual members, where the Fund's scheduled placement is used for the payment product; there is no detailed presentation here; there is no much difference between the basic and the billing categories and the payment categories.

4)跨境支付产品

4) Cross-border payments of products

跨境支付产品就会有非常鲜明的交易特征,那就是“跨境支付”,那么跨境支付跟国内支付有什么不同呢,这也就决定了跨境支付产品的特点,无论是资质问题,清算模式问题,信息流以及资金流都会不同;但根本上还是支付,并没有本质上的不同,还是货币的转移,只不过涉及到了不同的币种问题。

Cross-border payments would have a very distinct character of the transaction, that is, “cross-border payments”, so that cross-border payments would be different from domestic payments, which would also determine the characteristics of cross-border payments, whether in terms of qualifications, liquidation patterns, information flows and financial flows; but there would be no fundamental differences between payments, or currency transfers, but rather different currency issues.

5)银企直联

5)

银企直联就是银行提供给企业的一款产品,直接连接接入银行,通过自建平台管理在该行开通的相关银行账户;产品所实现的能力基本也就是查询账户余额,查询账务流水,申请付款等基本的账户操作;跟收单类产品相似;先了解产品介绍,接入方式,接口文档等内容;完成对接接入即可。

The Bank's direct association is a product provided to an enterprise by a bank that directly connects to the bank and manages the bank accounts opened at the bank through its own platform; the capacity realized by the product is essentially to search account balances, search account streams, apply for payment, etc. for basic account operations; is similar to the receiving product; first to the product description, access patterns, interface documents, etc.; and completes the docking access.

6)钱包产品

6) Wallet Products

钱包大家都用过,比如常见的微信钱包;钱包的最大特点就是账户余额,核心是要为用户开一个可以存钱的账户,而且这个账户可以充值,提现,下单消费等;不像简单的收单通道,只是简单的收钱;钱包的核心职能是管钱。

The wallets have been used by everyone, such as the usual micro-fiche wallets; their greatest feature is the account balance, the core of which is to open a bankable account for users, and the account can be charged, cashed, paid for, etc.; unlike simple billing channels, they are simply collected; and their core function is to manage the money.

7)数字钱包

7) Digital Wallet

数字钱包近期算是比较火了,归根接地也是一款钱包产品,形式和技术实现上跟传统钱包没有本质的区别;最大的区别就是钱包里的钱的属性;感兴趣的大家可以自己去找资料看看。

The digital wallet, which has recently become relatively hot, is also, in the final analysis, a wallet product whose form and technology are not fundamentally different from traditional wallets; the biggest difference is the property of the money in the wallet; interested people can look for the information themselves.

8)分期支付产品

8) amortization of products

分期是一个明确的交易场景,就是一笔交易并不是一次性支付结束,而是分多次完成后续的支付;像消费分期;微信,支付宝都有相应的产品;本质上也是一款收单类支付产品,只不过有一个分期多次支付的鲜明特点而已。

The phasing is a clear scenario in which a transaction is not the end of a one-time payment, but rather the completion of several subsequent payments; as in the case of consumer instalments; as in the case of micro-letters, where payment treasures are matched by products; and as in the case of essentially one bill-based payment product, it is a distinct feature of multiple instalments.

9)分账类

9) Classification

分账产品更多的是要解决二清问题;一笔收单在完成收款以后,需要对款项按照约定比例或者模式分个多方,微信有标准的分账产品;也有成熟的文档,这个大家可以认真看一看。

The split products are more likely to solve the problem of clearing; once a receipt is completed, there is a need to split the amounts according to the agreed scale or pattern, with micro-letters with standard splits; and there are mature documents, which you can look at carefully.

10)支付解决方案类

10) Pay solution class

行业解决型支付产品更能契合这个领域的业务特点,相对通用支付产品来说用户体验更好,与业务场景更加的契合;实现这一点要做的其实就是在支付产品基础之上包装进一些行业特征的交互或者功能。

Industry-based payment products are better suited to business characteristics in this area, better user experience than universal payment products, and more consistent with business scenes; what is needed to achieve this is the interaction or functionality of packaging some industry characteristics on the basis of payment products.

11)二清存管方案

11) Second Clearing Up Programme

这个就不详细说了,大家可以看这一篇文章“二清”详解-支付产品必须知道的“清结算规矩”。

Without going into detail, you can see in this article the “two clears” — the “cleansing rules” that must be known to pay for the product.

12)支付产品的附属

12) Affiliation to the payment of products

当然一个支付产品能不能用,不仅是通道本身,还需要一些附加的能力,比如用户注册入网,绑卡鉴权,交易通知,等等,这里我相信大家通过阅读文中提到的具体支付产品的案例就可以归纳出来。

Of course, the availability of a payment product is not only through the portal itself, but also through additional capabilities, such as user registration on the net, chaining of cards, trade notices, etc., which I believe can be summarized by reading the specific payment cases mentioned in the text.

专栏作家

columnist

陈天宇宙,微信公众号:陈天宇宙,人人都是产品经理专栏作家。多平台支付领域专栏作者,十年资深产品;专注为10万支付产品经理和支付机构以及企业提供深度支付内容和服务!

Chen Tian cosmopolitan, Weibo Public: Chen Tian cosmos, everyone is a columnist for product managers. Multi-platform columnist in the field of payments, a decade-long senior product; dedicated to providing in-depth payment content and services to 100,000 pay managers and payers and companies!

本文原创发布于人人都是产品经理。未经许可,禁止转载。

It was originally published as a product manager.

题图来自Unsplash,基于CC0协议。

The map is from Unsplash and is based on the CC0 agreement.

该文观点仅代表作者本人,人人都是产品经理平台仅提供信息存储空间服务。

It represents only the author himself, and everyone is a product manager platform that provides only information storage space services.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论