最近行情大家也都知道,尤其是前一阵欧美金融机构为了流动性,抛售一切,黄金、比特币这种公认的“避险资产”也暴跌,中国现在来看,当下是疫情影响较小的国家,中国A股、港股和海外美元债券都被抛售。

In recent times, it has become clear to everyone, especially the previous wave of U.S. and U.S. financial institutions that sold everything for liquidity, and the well-known “risk-free assets” of gold, bitcoin, China is now a less affected country, and China's A shares, Hong Kong shares and overseas dollar bonds have been sold.

欢迎关注:投基摸狗

Welcome to Focus: Pitching Dog

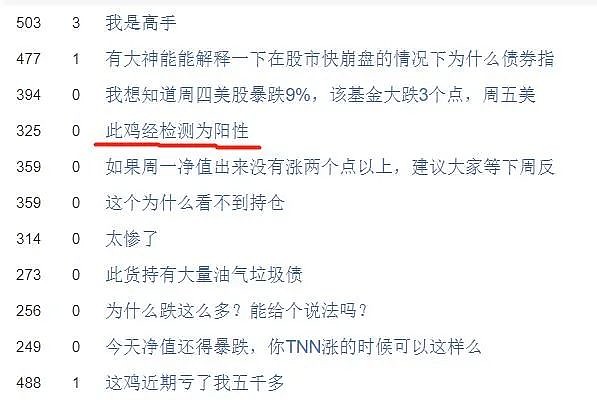

海外美元债券基金净值一个月跌幅接近20%,以至于有些基金投资者都很无奈:

The net value of overseas United States dollar bond funds fell by almost 20 per cent a month, to the point that some of the fund's investors were helpless:

本来买了债券基金是稳健理财,结果一个月跌了20%,谁也接受不了。

The bond fund, which had been bought, was prudent, and as a result, it fell by 20 per cent a month and no one could accept it.

所以我上周买了两笔,很多人不理解,说我咋买这种“垃圾”品种。

So I bought two last week, and a lot of people don't understand how I buy this kind of junk.

我说一下:

I said:

一、现金流

i. Cash flow

我先从自身说起,抛开自身说别的都很虚。

I'll start with myself and leave myself out of everything else.

我觉得我目前仓位适中,五六成仓位还可以,买了两笔QDII债券基金,不影响我现金流,下周如果没有意外,我还会继续买一些。

I think I'm in the middle of a warehouse, 50 or 60 percent of a warehouse, two QDII bond funds, without affecting my cash flow, and I'll buy some more next week if there's no accident.

我本身很强调现金流,大家也知道我最近让大家抄底时候把握节奏,我没有和很多人一样早早就抄底打光子弹,我从现金流角度来说我觉得我可以接受。

I've been focusing my own attention on cash flows, and I've been told that I've been allowed to keep the pace when you've been doing it, and I haven't done it as early as many people have, and I think I can do it from the point of view of cash flows.

二、总有人是错的

II. Someone's always wrong.

你说同一个企业发的债券,国内五六个点,六七个点,国外就要十六七个点,我是不信啊,关键是现在海外市场,国内企业发行面值为100元的债券,交易价格都在七八十元,折价再算上本身的利息,收益率20%的很多啊。

I don't believe you're talking about the same firm issuing bonds at five or six points, six or seven points in the country, and 16 or seven points abroad.

你说是股票我信,股票因为两地不能互通互转,溢价没法平抑,比如AH溢价长期存在,但是债券有到期日总会兑付啊。

You said it was a stock, because the shares were not interchangeable and the premium was not even, like the AH premium was long-standing, but the bonds were paid on maturity.

同一个企业的债券,两地上市交易,收益率差价这样大,总有至少一个是错的:如果企业经营好,那么债券利率应该很低,如果企业经营不好,那么债券利率应该很高,一方高一方低,总有人是错的,至少有一方是错的。

Bonds of the same enterprise, which are traded on both sides of the market, and the difference in yield is so large that at least one is wrong: if the business is well run, then the bond rate should be low, if the business is not well run, then the bond rate should be high, one side low, one side is always wrong, at least one side is wrong.

我甚至极端认为可能两方都错了:国内因为钱多,流动性充裕,拆借利率很低,所以债券被抢购,国外因为流动性不足,金融机构抛售资产,导致债券没人要。

I think it's even possible that both sides are wrong : domestic bonds are bought because money is good, liquidity is good, interest rates are low, foreign bonds are bought, financial institutions sell their assets, so no one wants them.

三、国内投资者在买入

iii. Domestic investors buying

我上周不是买了两笔海外我第一笔是上周二买,周二其实已经开始反弹了,周三、周四也是涨,有人就说泥沼老师,你是短线高手。。

I didn't buy two of my first overseas purchases last Tuesday, but Tuesday actually started to bounce, and Wednesdays and Thursdays rose, and some say you're a short-line master.

我很无奈,我要是短线高手就怪了。

I can't help it. It's weird if I'm a short-line expert.

不过说实话,美元债确实最近开始反弹了,比如网上有人专门统计一下美元债情况(数据来源:美元债跟踪)。

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论