公司董事涉嫌挪用资金购买比特币矿机、擅自转移公司资金、私刻公章……案件最新进展来了。

The director of the company is suspected of misappropriation of funds for the purchase of the Bitcoin mine, unauthorized transfer of company funds, and private public seals... The latest developments in the case have taken place.

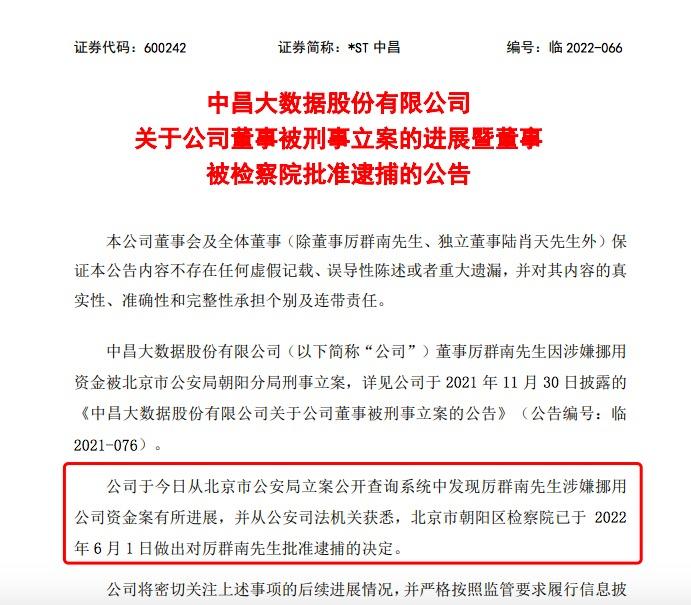

6月2日晚间,*ST中昌公告称,公司董事厉群南因涉嫌挪用资金被北京市公安局朝阳分局刑事立案后,公司从公安司法机关获悉,北京市朝阳区检察院于2022年6月1日做出对厉群南批准逮捕的决定。

During the evening of 2 June, *St. Nakachan announced that the director of the company had opened a criminal case against him by the Beijing City Public Security Bureau (PSA) in the Yang district of Beijing on suspicion of misappropriation of funds. The company was informed by the public security judiciary that on 1 June 2022, the prosecutor's office of Beijing city in the Yang district had taken a decision to approve the arrest.

来源:*ST中昌公告

Source: *ST China Proclamation

*ST中昌2021年年报显示,厉群南1982年出生,本科学历,曾任上海云克网络科技有限公司董事;曾任*ST中昌董事长、总经理,现任公司董事。

* According to ST Mid-Chang's 2021 annual report, Ngong Sul was born in 1982 and has been a member of the Board of Directors of Yunk Network Science and Technology Ltd. in Shanghai; he was President, General Manager of ST and is currently a member of the Board of Directors of the Corporation.

涉嫌挪用资金购买矿机、私刻公章

is suspected of misappropriation of funds for the purchase of mining machines, private seals

根据*ST中昌5月14日回复上交所问询函公告,董事、子公司上海云克网络科技有限公司(简称“上海云克”)原负责人厉群南在任职期间,本该用于公司经营的资金被挪为他用,例如厉群南涉嫌挪用资金购买矿机及支付托管费、厉群南自行决策并支付资金进行对外投资、未执行审批流程擅自转移公司资金等。此外,厉群南涉嫌私刻公章,伪造或变造公司文件,以消除前期公司对其以非法侵占目的挪用公司资金的事项。

According to a letter of enquiry sent in response to the request dated 14 May*ST, the funds that were supposed to be used for the company's operations were diverted during the term of office of the director and former head of the subsidiary Shanghai Yunk Network Technology Ltd. (“Shanghai Yunk”), such as the suspected misappropriation of funds for the purchase of mining machines and the payment of trust funds, the self-determination of the south and the payment of funds for the purpose of investing abroad, and the unauthorized transfer of company funds without implementing the approval process.

2021年9月2日,公司子公司霍尔果斯云朗网络科技有限公司(简称“云朗网络”)与吴某、陆某签订《投资协议》,以4000万元增资入股江苏盐中通信科技有限公司,持股比例20%,其中包含云朗网络代孙某支付500万元,并为其代持股份,代持股份比例为2.50%;云朗网络实际投资额为3500万元,持股比例为17.50%,该投资系董事厉群南自行决策实施。

On 2 September 2021, the company's subsidiary, Holgos Yunran Network Technology Ltd. (“The Yunan Network”), entered into an Investment Agreement with Wu and Lu, with an investment of 40 million yuan in Jiangsu Salt Communications and Technology Ltd., holding 20 per cent of the shares, which included a payment of 5 million yuan by the Yunang Network's Pro-Sun Sun and a proxy share of 2.50 per cent; the actual investment in the Yunang Network was 35 million yuan, with 17.50 per cent of the shares held, which was implemented at the discretion of the board of directors in the South.

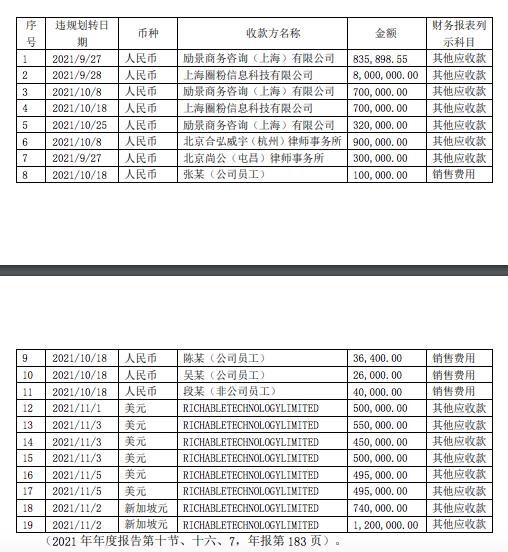

公司检查银行对账单发现,2021年9月22日至12月31日,有19笔资金划转均未按照公司章程及财务管理要求有效执行审批程序,涉及金额为1195.83万人民币、299万美元、194万新加坡元,按2021年12月31日汇率折算人民币共计4017.44万元。

The company's inspection of bank statements found that from 22 September to 31 December 2021, 19 transfers of funds were not carried out effectively in accordance with the company's statutes and financial management requirements, involving an amount of RMB 11,953.83 million, S$ 2.99 million and S$ 1.94 million, with a total of RMB 4,17.44 million converted at the exchange rate of 31 December 2021.

来源:公司公告

Source: Corporate bulletins

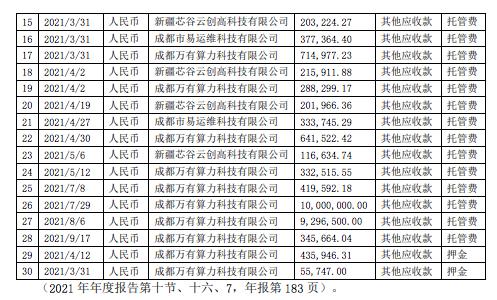

公司检查合同发现,2021年1-9月,公司为购买服务器事项而支付的2781.21万元款项,并未在公司账面或实质形成资产。同时核对该类资产采购合同发现,其采购内容为:神马矿机(型号:M31S-76T44W)、超算服务器(型号S10Pro),均为当下主流的比特币矿机,其用途仅为比特币挖矿,并不能应用于公司经营业务。且公司日常经营无需大规模购置服务器作为业务支撑,仅按需租赁上游行业服务器流量即可。此外,公司为托管费事项而支付的2524.34万元款项,均为托管上述矿机形成的费用,公司为押金事项而支付的49.17万元款项,也为上述矿机托管的押金,总额约为5354.72万元。

The company's inspection contract found that in January-September 2021, the company paid $2.781.21 million for the purchase of servers and did not create assets on the company's books or in substance. A contract for the purchase of assets of this type was checked and found that the purchase of the Mima Miner (model: M31S-76T44W), the super-counting server (model S10Pro), which was the mainstream Bitcoin Mine, was used only for the mining of bitcoins and could not be used for the company's operations. Moreover, the company's daily operation did not require large-scale purchase of servers as support for its operations, and simply leased the flow of servers from the upstream industry as required. In addition, the company's purchase of $25,234 million for hosting fees was the cost of hosting the above-mentioned Miner, the company paid $49.17 million for the deposit, which was also held for deposits for the above-mentioned Miner, for a total of $53.5472 million.

来源:公司公告

Source: Corporate bulletins

公司表示,与上述矿机相关的上海碧晟起诉上海今采案件中,上海碧晟的诉讼请求中提及上海今采“于2021年5月13日上午突然篡改313台矿机的收益账户地址”,而上海今采并未获取相关收益账户地址的收益。

According to the company, in the Shanghai Beacon case against Shanghai Beacon in connection with the above-mentioned mine, it was mentioned in the Shanghai Beacon suit that Shanghai today had “a sudden alteration of the account address of the proceeds of 313 mining machines on the morning of 13 May 2021”, while Shanghai today did not receive the proceeds of the relevant revenue account address.

截至该公告披露日,公司并未盘点到厉群南涉嫌挪用公司资金擅自购买的矿机相关资产;厉群南涉嫌挪用公司资金擅自支付高额托管费,但公司亦未获取相关收益。

As at the date of disclosure of the announcement, the company had not taken stock of the assets associated with the mine purchased by the company on suspicion of misappropriation of the company's funds; nor had the company reaped the proceeds of the high trust charges on suspicion of misappropriation of the company's funds.

公司报案后,北京市公安局朝阳分局于2021年11月11日就厉群南涉嫌挪用公司资金案出具立案告知书,并要求厉群南到公安机关现场接受询问配合调查且给予充分时间,但厉群南一直拒不配合。

After the company reported the incident, on 11 November 2021, the Beijing City Public Security Bureau in Yooyang issued a notice of suspicion of misappropriation of company funds in Ngingang Nam and requested the Gang to go to the public security organs to cooperate with the investigation and to give sufficient time, but it refused to do so.

严重影响公司正常运营

seriously affects the normal operation of the company

根据*ST中昌公告,厉群南负责公司运营期间,公司及各下属公司原管理层经营管理不当,公司部分业务受到不利影响,公司2021年1-6月净亏损2866.12万元,上年同期亏损15.92万元,同比减少17905.60%;其中子公司上海云克2020年1-6月净利润2928.15万元,1-12月净利润7686.20万元,而2021年1-6月净利润仅为988.34万元,2021年上半年同比2020年上半年业绩早已大幅度下滑。

According to the *ST Mid-Chang announcement, during the course of the company's operations, the company and its subordinates were not properly managed and some of its operations were adversely affected. The company lost $28,661.2 million net in January-June 2021, representing a decrease of $17,905.60 per cent from the previous year's deficit of $15.9 million in the same period; of this amount, the subsidiary, Yunkai Shanghai, recorded a net profit of $29,281.5 million in January-June 2020, a net profit of $76,86.2 million in January-December, compared with a net profit of $9,88.34 million in January-June 2021 and a significant decline in performance in the first half of 2021 compared to the first half of 2020.

公司爆发债务危机后,前管理团队未妥善处置且经营管理不善等导致主要客户如我爱我家、主要供应商百度等陆续停止与中昌合作导致了整体业务规模萎缩。厉群南涉嫌挪用上市公司资金,造成公司资金流动性困难,造成公司资金流紧张,无法支付很多业务款项,大量业务停滞,公司随时有现金流断裂的可能。

In the wake of the company’s debt crisis, poor management by the former management team and poor management of operations have led to a contraction in the overall scale of business as major clients, such as my family, major suppliers, and others, have stopped working with Nakachan. The alleged misappropriation of listed company funds in the south has created financial liquidity difficulties for companies, straining the flow of company funds, preventing the payment of much of the business, stagnating a large amount of business, and the company’s exposure to the risk of a break in cash flow at any given time.

为规范公司治理,公司新任管理层于9月底开展对下属公司的核查工作,并对下属公司董监高人员进行重新委派、任命。但在交接过程中,厉群南遣散下属公司员工,同时公司时任监事、时任职工监事以及部分员工拒绝交接部分财务资料及人事资料。在此过程中出现了公章失控、主要客户供应商停止合作、大额应收款项未能及时收回、部分财务资料未能供等情况,导致了在印章管理、销售与收款、采购与付款、收入与成本确认等多个涉及财务报告编制的重要流程的内部控制执行中存在重大缺陷。

In order to regulate corporate governance, the new management of the company undertook a verification exercise of its subsidiaries at the end of September, and reassigned and appointed senior officers of its directors-in-charge. During the handover process, however, staff members of the subordinate companies were discharged from the company in an intensive manner, while the company was at the same time the supervisor, the time supervisor and some of its employees refused to hand over some of the financial and personnel information. In the process, there were instances of uncontrollable public seals, the suspension of cooperation from major client suppliers, the failure to recover large amounts of receivables in a timely manner, and the failure to provide some of the financial information, leading to significant deficiencies in the implementation of internal controls in a number of important processes related to financial reporting, such as stamp management, sales and receipts, procurement and payments, revenue and cost recognition.

截至2021年12月31日,厉群南涉嫌挪用资金该事件事项尚未得到妥善处理,导致公司内部监督环境、重大资产购买决策审批和对外付款审批等内部控制执行中存在重大缺陷,且无法确定董事厉群南被刑事立案所涉事项是否构成关联方交易及关联方资金占用,以及是否存在其他形式的潜在关联交易,与之相关的内部控制运行失效,导致公司2021年度内部控制被会计师事务所出具了否定意见的内控审计报告。

As at 31 December 2021, the matter of suspected misappropriation of funds had not been properly addressed, resulting in significant deficiencies in the implementation of internal controls, such as the corporate internal oversight environment, approval of decisions on the purchase of significant assets and approval of external payments, and the inability to determine whether the subject matter of the criminal case constituted related party transactions and related party funds, as well as the existence of other forms of potentially related transactions, and the failure of related internal controls to function, resulting in internal control audit reports issued by the firm's accounting firm in 2021.

延期回复年报问询函

extension to reply to the annual report inquiry

2022年5月25日,*ST中昌收到上海证券交易所出具的年报信息披露监管问询函。年报显示,公司按组合计提预期信用损失的应收账款余额2.37亿元,坏账准备余额3367.90万元;其他应收款余额2.05亿元,坏账准备余额1644.31万元。公司2021年末预付账款6143.15万元,未计提减值准备。截至审计报告日,年审会计师未能获取充分、适当的审计证据,无法判断应收款项及预付款项的款项性质、真实性、减值准备计提的充分性和可回收性。

On 25 May 2022, *ST Mid-Chang received a regulatory inquiry from the Shanghai Stock Exchange for the disclosure of information on an annual basis. The annual report showed that the company had failed to obtain sufficient and appropriate audit evidence as at the date of the audit report to determine the nature, authenticity, impairment and recoverability of receivables and advance payments.

上交所要求,公司补充披露:结合相关应收账款、其他应收款和预付款项的交易背景、交易对手方情况,说明相关交易是否具有商业实质,是否构成关联交易,是否构成资金占用;结合公司经营、客户、坏账准备计提政策等,说明本期应收账款、其他应收款计提坏账准备的具体情况,是否存在应计提减值但未计提减值情况;上述应收、预付款项是否有相应的原始交易材料支撑,结合与客户、供应商等相关方对账以及回函情况,说明对财务报表的具体影响;结合实际情况,说明本期对预付款项未计提减值准备的原因及合理性。请年审会计师发表意见。

As required by the submission, the company discloses: whether the transaction is of a commercial nature, whether it constitutes a related transaction or whether it constitutes an occupancy of funds, taking into account the transaction background of the related receivables, other receivables and advances, the counterparty to the transaction; whether there is an accrual impairment but not a reduction in the preparation of other receivables for the current period, taking into account the company's business, customers, bad debt preparation policy, etc.; whether the above receivables, the advance payment items are supported by the original transaction material, indicating the specific impact on the financial statements, taking into account the reconciliation with the customer, supplier, etc.; and, taking into account the actual circumstances, the reasons for and reasonableness of the preparation of the advance payment without a reduction in value.

2022年6月1日,*ST中昌公告称,公司收到上述监管问询函后,积极组织相关人员对其中涉及的问题进行逐项落实并进行回复。因涉及事项较多,为保证回复内容的真实、准确、完整,经公司向上海证券交易所申请,公司将延期回复监管问询函。

On 1 June 2022, *St. Chuchang announced that, following receipt of the above-mentioned regulatory inquiry, the company had actively organized a follow-up and response to each of the issues involved.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论