图片来源:摄图网

Photo source: Photonet

近期以来,比特币“过山车”般的行情引发关注。比特币价格在3月13日触及74000美元历史最高点后,呈现“波浪曲线”增长态势,进入4月以来,比特币价格大跌,4月2日跌破了65000美元,如今更是跌破了60000美元关口。北京时间4月14日,比特币价格遭大规模抛售,价格迅速走低,一度跌破60000美元/枚整数关口,最低下探至59968美元/枚,随后短暂止跌回升。截至发稿前,比特币价格持续震荡,暂报62649美元/枚,24小时跌幅超9%。

In recent times, Bitcoin & ldquón & & rdquón has been a cause for concern. Bitcoin prices & & & & & & & & & & & & & & ; growth trend: since April, Bitcoin prices have fallen sharply , on 2 April, and are now down by $60,000. Beijing time, on 14 April, Bitcot prices were dropped on a massive scale, prices were quickly down, and

在比特币价格暴跌期间,币圈投资者手机里的爆仓短信不断,比特币价格在15分钟内瞬间暴跌5000美元(约合人民币36187元),导致大量看多合约的投资者盘中爆仓。据Coinglass数据,过去24小时,虚拟货币市场共有25.8万人爆仓,爆仓总金额为9.66亿美元(约合人民币69.9亿元),其中多单爆仓7.87亿美元,空单爆仓1.79亿美元。

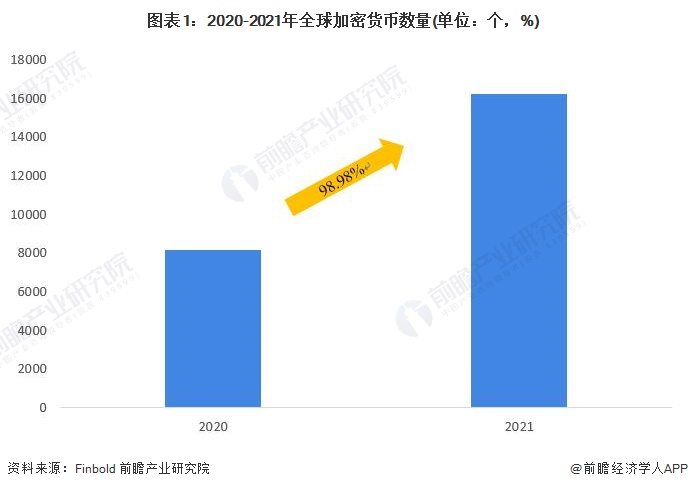

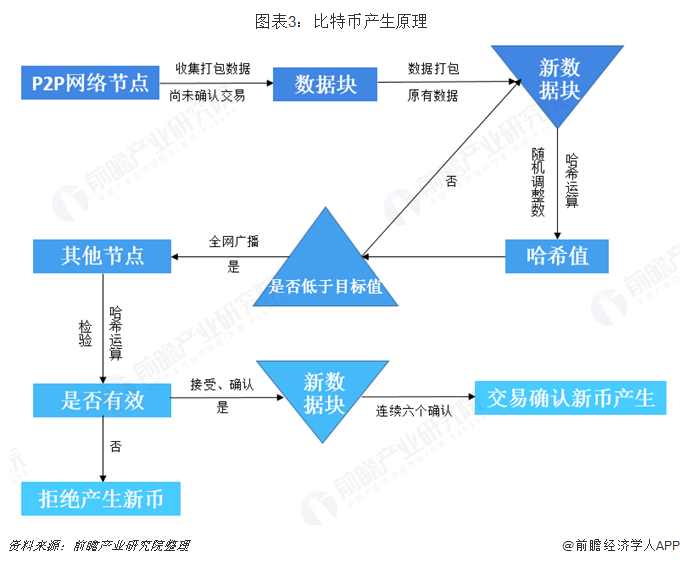

During the period when Bitcoin prices plunged, there was a spatter of text messages in the ring's investor's cell phone, and the price of 一位爆仓者表示:“比特币近期一直在暴涨暴跌中反复切换。过高的价格让比特币变得危险,市场情绪逆转往往发生在一瞬间,钱蒸发得比水还快。” A banger said: &ldquao; Bitcoin has been switching in recent surges and drops. Overprices have made bitcoin dangerous, and market mood reversals often occur at a moment, when 业内人士表示,比特币本周走势低迷,主要由于地缘政治不确定性加剧,市场的避险情绪蔓延至虚拟货币资产。此外,业内人士表示,投资者对比特币“减半”事件的高预期和投机行为可能在“减半”前推高价格,而一旦这些预期未被满足,大量投资者或将倾向于获利了结,导致币价急转直下。 In addition, industry sources say that 从“比特币暴跌”回看加密货币行业发展情况: From & ldquao; Bitcoin Dropped & rdquao; Looking back at developments in the crypto-currency sector: ——全球加密货币数量 目前,全球范围各类加密货币和电子货币的出现,大量加密货币均为非金融机构创立,在区块链上发行与交易、具备独立交易价格。依据Finbold数据显示,2020年,全球加密货币数量仅为8000+个规模,到2021年,直接突破16000个,同比增长98.98%。 At present, a large number of encrypted currencies are being created by non-financial institutions, issued and traded on block chains, with independent transaction prices. According to Finbold data, the number of encrypted currencies worldwide was only 8,000 + sizes in 2020, and by 2021 it was over 16,000, an increase of 98.98 per cent. ——比特币产生原理 — 比特币是一种总量恒定2100万的数字货币,其和互联网一样具有去中心化、全球化、匿名性等特性。比特币的运行离不开两个核心概念:节点以及去中心化账簿。每一台装有比特币客户端的电脑称为一个节点,每一个节点都是平等的,不存在一个中心节点。无数这样的电脑相互连接形成的网络则是一种去中心化账簿。 Bitcoin is a total constant digital currency of 21 million, which, like the Internet, is decentralized, globalized, anonymous, and so on. Bitcoin operates in two core concepts: nodes and decentralized books. Each computer with a Bitcoin client is called a node, and each node is equal, and there is no central node. Numerous of these computers are connected to one another, and the network is a decentralized book. ——比特币市值遥遥领先 — ; 从全球私人数字货币市值排名情况来看,截至2022年1月19日,Bitcoin(比特币)市值为7833.3亿美元,排名第一;其次为Ethereum(以太坊),市值为3654.7亿美元;第三为LATOKEN,市值为2471.8亿美元。 As at 19 January 2022, Bitcoin (bitcoin) had a market value of $783.33 billion, ranking first, followed by Etheeum (Etheria) with a market value of $36.570 billion, and Latoken (Lateken) with a market value of $247.18 billion. 加密货币交易员、独立分析师Rekt Capital表示,“减半”事件发生前,比特币价格将持续回调。在2016年和2020年“减半”周期中,比特币分别下跌38%和20%。 The encrypt currency dealer, independent analyst Rekt Capital, said “ halved & rdquo; before the event, bitcoin prices would continue to rebound. in 2016 and 2020 & & ldquao; halved & rdquao; during the cycle, bitcoins would fall by 38 per cent and 20 per cent, respectively. 摩根大通的一份报告指出,比特币“减半”事件可能会对比特币矿工的盈利能力产生严重的负面影响。报告警告称,比特币的价格可能会因此暴跌至42000美元/枚,较目前价格的潜在下跌空间超36%。 A report by Morgan Chase states that Bitcoin&ldquao; halving & rdquao; events that may have a serious negative impact on the profitability of the miners. The report warns that the price of bitcoin may drop sharply to $42,000, more than 36% of the potential decline in current prices. 注:本文仅作内容传播,不构成任何投资建议。 Note: This paper is for content dissemination only and does not constitute any investment proposal. 前瞻经济学人APP资讯组 Forward-looking Economist APP Information Group 更多本行业研究分析详见前瞻产业研究院《中国数字货币行业市场前瞻与投资战略规划分析报告》。 More detailed information on research in this sector can be found in

同时前瞻产业研究院还提供产业大数据、产业研究报告、产业规划、园区规划、产业招商、产业图谱、智慧招商系统、行业地位证明、IPO咨询/募投可研、专精特新小巨人申报等解决方案。在招股说明书、公司年度报告等任何公开信息披露中引用本篇文章内容,需要获取前瞻产业研究院的正规授权。 更多深度行业分析尽在【前瞻经济学人APP】,还可以与500+经济学家/资深行业研究员交流互动。更多企业数据、企业资讯、企业发展情况尽在【企查猫APP】,性价比最高功能最全的企业查询平台。

广告、内容合作请点这里:寻求合作

咨询·服务

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论