作者 |?Conor Ryder,Kaiko 分析师

♪ Conor Ryder, Kaiko Analyst ♪

编译 | 黑米@白泽研究院

@Blackzawa Institute

加密市场正在崩溃,某些承担着大风险的公司正面临着后果。

The encryption market is collapsing and some companies with high risks are facing consequences.

管理着约 120 亿美元资产的最大 DeFi 借贷平台之一的?Celsius 上周日宣布,他们将暂停所有提款,引发了投资者对该公司“资不抵债”的广泛恐慌。

One of the largest deFi lending platforms managing about $12 billion in assets? Celsius announced last week that they would suspend all withdrawals, causing widespread fear among investors of the company's “unindebtedness”.

这两天也有传言称,三箭资本(3AC)正在努力争取偿付能力。与最大的市场参与者交织在一起的大机构究竟是如何处于雷曼式的结局?

There have also been rumours over the past two days that three arrow capital (3ACs) is struggling for solvency. How does the big institutions that are interwoven with the largest market players end up in the Lehman way?

糟糕的资产管理、看跌的市场条件和以太坊的衍生品共同造成了一场具有灾难性后果的风暴。

Poor asset management, depressed market conditions and etherm derivatives together caused a storm with catastrophic consequences.

让我们通过数据来看看以太坊的流动性衍生品代币 stETH 是如何引发数十亿美元的流动性问题的。

So let's look at the data to see how the adrenaline liquid derivative stETH has triggered billions of dollars of liquidity problems.

今年晚些时候,以太坊主网将完成合并(the Merge)的过程,从工作量证明(PoW)过渡到权益证明(PoS)。在合并之前,投资者可以质押 ETH 以确保新的 PoS 链的安全,也可以为他们自己赚取收益。然而,这种收益是以流动性不足为代价的,因为在网络完成过渡之前,质押者无法赎回他们质押的 ETH,更有怀疑者担心今年甚至可能不会完成合并。为了成为新链上的验证者,直接通过以太坊进行质押也需要 32 ETH 的高额门槛。

Later this year, ETA will complete the merger process, moving from PoW to PoS. Before the merger, investors can pledge ETH to ensure the security of the new PS chain, or they can earn their own earnings. However, this gain comes at the cost of insufficient liquidity, because the pledgeers cannot redeem the ETH they have pledged before the network completes the transition, and more skeptics fear that the merger may not even be completed this year. To be a certificationer on the new chain, a high threshold of 32 ETH is also needed to make the pledge directly via the thongs.

所以,一些小型投资者开始进入 Lido Finance:一个去中心化的质押平台,旨在为 ETH 质押提供流动性解决方案。Lido?提供了与 ETH 1:1 的衍生品代币?stETH(无需 32 ETH 的要求),还提供了与直接在 PoS 链上质押类似的收益(约 4% 的年利率)。在以太坊合并完成后,在 Lido 质押的 ETH(stETH)可以通过 Lido 完全赎回,为质押者提供在 PoS 链质押的所有好处,却不会有流动性不足和进入门槛高等缺点。stETH 还可以提供其他功能,例如借贷、质押(是的,你可以二次质押 stETH)和交易。

So, some small investors have started entering Lido Finance: a decentralised pledge platform designed to provide a liquidity solution for the ETH pledge. Lido? provides derivative coins with ETH 1:1?stETH (which does not require 32 ETH requirements) and offers benefits similar to those pledged directly in the PS chain (approximately 4% annual interest rate). After completion of the merger, the ETH (stethH) in Lido pledges can be fully redeemed through Lido, providing all the benefits of the pledge to the grantor in the PS chain without being deficient in liquidity and high entry thresholds. StETH can also provide other functions, such as lending, pledge (Yes, you can double pledge STETH) and trading.

如今,Lido 上有超过 400 万个 ETH 质押在其中,使其成为最大的单一质押服务,约占所有质押 ETH 的 32%。

Today, Lido has more than 4 million ETH pledges in it, making it the largest single pledge service, accounting for about 32 per cent of all ETH pledges.

为了支持对 stETH 日益增长的需求,去中心化交易所 Curve 为 stETH-ETH 对引入了流动性池,以便投资者可以轻松地将其 ETH 以合理的价格转换为 stETH,或者流动性池提供流动性,并以 CRV 代币的形式获得收益。

In order to support the growing demand for stETH, the decentralized exchange Curve introduced a liquidity pool for stETH-ETH so that investors could easily convert their ETH to stETH at a reasonable price, or the liquidity pool could provide liquidity and gain returns in the form of CRV tokens.

然而,Lido/stETH 的迅速崛起以及 Terra 的崩溃导致了 stETH-ETH 汇率出现了一些问题。5 月,stETH 开始以低于 ETH 5% 的价格交易,引发了最初的担忧。上周,这种折扣再次出现,引发了?Celsius?流动性问题的开始。

However, the rapid rise of Lido/stETH and the collapse of Terra led to problems with the stETH-ETH exchange rate. In May, stETH started trading at less than 5% of ETH, causing initial concern. Last week, the discount reappeared, triggering the problem of liquidity?

随着 Terra 的崩盘,投资者开始涌向以太坊,stETH 的折扣开始出现。stETH 是 ETH 的衍生品,因此跨市场流动性不高,这导致投资者恐慌性地将他们的 stETH 换成 ETH,将 ETH 从 Curve 流动性池中撤出,并导致两种资产之间的不平衡。该池目前是有史以来最不平衡的,大约 80% stETH 和 20% ETH。

With the collapse of Terra, investors began to rush into Etherm, and the spotH discounts began to appear. StETH is a derivative of ETH, so cross-market liquidity is low, leading investors panicously to replace their stETH with ETH, to withdraw ETH from the Curve liquidity pool, and to create an imbalance between the two assets. The pool is currently the most imbalanced in history, with about 80% of stETH and 20% of ETH.

与 TerraUSD(UST)不同,stETH 不需要维持其挂钩。stETH 只是用户在 Lido 中质押的 ETH 数量的 1:1 代币表示。作为去中心化的质押服务,Lido 不得不兑现合并后的 stETH 赎回。

Unlike TerraUSD (UST), the stETH does not have to maintain the link. The stETH is only the amount of ETH pledged by the user in Lido in 1:1. As a decentralised pledge service, Lido has to redeem the merged stETH.

因此,stETH 折扣的问题集中在流动性上。在正常的市场条件下,stETH-ETH 流动性池实现了资产之间的高效交换,让利益相关者能够在想要退出 stETH 时轻松兑现 ETH。

Thus, the problem with the stETH discount is centred on liquidity. Under normal market conditions, the stETH-ETH liquidity pool allows for an efficient exchange of assets, allowing stakeholders to easily cash in when they want to quit stETH.

只有折扣和糟糕的市场条件相结合,才给像?Celsius?这样代表客户管理资金的协议带来了严重问题。在上个月极其看跌的价格走势以及他们可能接触 Terra 的消息公开后,Celsius 用户越来越多地寻求赎回 ETH。然而,很明显,由于持有的 stETH 缺乏流动性,Celsius 将难以满足这些赎回要求。

Only a combination of discounts and poor market conditions has created serious problems with agreements to manage funds on behalf of clients, such as Celsius. After the extremely depressed price trends last month and the disclosure of information about their possible access to Terra, Celsius users have increasingly sought to redeem ETH. However, it is clear that Celsius will find it difficult to meet these demands because of the lack of mobility in holding stETH.

虽然尚不完全清楚?Celsius?持有的 ETH 到底有多少被转换成了 stETH,但根据 Dune Analytics 提供的公开钱包信息,估计约为 4.75 亿美元。该平台此后停止了所有提款,几乎证实了投资者的担忧。

Although it is not entirely clear how many of the ETHs held by Celsius are converted to stETH, it is estimated to be approximately $475 million based on open wallet information provided by Dune Analytics. The platform has since stopped all withdrawals, almost confirming investors’ concerns.

尽管是完全中心化的,但 Celsius 拥有自己的代币——CEL——作为对平台用户的奖励。CEL 永续合约市场几乎立即对公告做出反应,未平仓合约飙升和融资利率暴跌,表明投资者正在增加空头头寸,预计?Celsius?将全面崩溃。

Although completely central, Celsius has its own token, CEL, as a reward for platform users. The CEL contract market almost immediately responded to the bulletin, with unsettled contracts soaring and financing interest rates falling, indicating that investors are increasing their empty positions, and it is expected that Celsius will collapse altogether.

CEL 的价格自今年年初以来由于市场普遍看跌而遭受重创,但在公告发布后价格暴跌至仅 0.17 美元。

CEL prices, which have suffered severely since the beginning of the year as a result of a general decline in the market, fell sharply to only US$ 0.17 after the announcement.

市场对 CEL 代币的反应意味着 Celisus 必须处理偿付能力的问题。他们有哪些选择?

The market response to CEL tokens means that Celisus has to deal with solvency. What are their options?

这显然不是?Celisus?或任何其他面临偿付能力问题的机构的选择。这就是为什么 stETH 折扣仅在你需要即时流动性时才真正重要的原因,如果你是 stETH 的长期持有者,那么你不会关注折扣,因为你可以在以太坊主网完成合并后一次性的 1:1 兑换。

This is obviously not the case: Celisus? or the choice of any other institution facing solvency problems. That is why the stETH discount is really important only when you need immediate liquidity. If you are the long-term holder of stETH, then you will not care about the discount, because you can make a one-to-one exchange once the merger has been completed in Ether.

如果你需要流动性,第一个重点是要检查在公开市场上出售 stETH 是否是一种合适的选择。首先,让我们看看去中心化交易所 Curve,因为它拥有迄今为止流动性最强的 stETH 市场。

If you need mobility, the first point is to check whether selling stETH on the open market is a suitable option. First, let's look at the decentralised exchange Curve, because it has the most mobile stETH market so far.

2022 年 5 月 18 日:

May 18, 2022:

2022 年 6 月 15 日:

June 15, 2022:

今天,只有 116,000 个可用的 ETH(约 1.3 亿美元)可供出售 stETH,如果?Celisus?为获得所需的流动性在此抛售,这绝对会导致 stETH 与 ETH 之间的汇率崩溃。我们可以在上图中看到,一个月前,流动性更容易获得,Curve 池中有 2.91 亿 ETH 可用。

Today, only 116,000 available ETHs (about $130 million) are available for sale, and if Celisus sells them here to get the liquidity needed, this will definitely lead to a collapse of the exchange rate between stETH and ETH. As we can see in the chart above, mobility was more readily available a month ago, with 291 million ETHs available in the Curve pool.

例如,在 Curve 上出售 100,000 个 stETH 换取 ETH 将导致汇率仅为 0.84(这只是?Celisus?持有的总量的 1/4)。

For example, selling 100,000 stETHs on Curve for ETH would result in an exchange rate of 0.84 (this is just 1/4 of the total amount held by Celisus?

接下来我们可以看看在中心化交易所出售 stETH 是否是一种选择。

And then we can see if selling stETH on a central exchange is an option.

我们可以查看 FTX 的市场深度,这是中心化交易所唯一的 stETH 现货市场,看看是否有足够的流动性来支持大量的 stETH 卖单。

We can look at the depth of the FTX market, which is the only spoth spot market on the centralized exchange, to see if there's enough liquidity to support a lot of stETH sales.

我们可以清楚地看到,如果不降低 stETH 的价格,FTX 的市场深度远远无法处理?Celisus?所需的数量级。

We can see clearly that the market depth of FTX is far from being able to handle without lowering the price of stETH?

使用 2% 的市场深度作为中心化交易所可用 stETH 流动性的衡量标准,我们在 6 月 11 日之前观察到 FTX 上只有价值 30 万美元的 stETH 流动性。但在 Celisus 的恐惧席卷市场之后,这个数字下降到不到 5 万美元,而 stETH 持有者现在几乎耗尽了他们在中心化交易所可以找到的所有可用的 stETH 流动性。

Using 2% of market depth as a measure of the stETH liquidity available for a central exchange, we observed only $300,000 of stETH liquidity on FTX by June 11. But after Celisus’ fears swept the market, the figure fell to less than $50,000, and the stETH holders now run out of almost all available stETH liquidity that they can find at a central exchange.

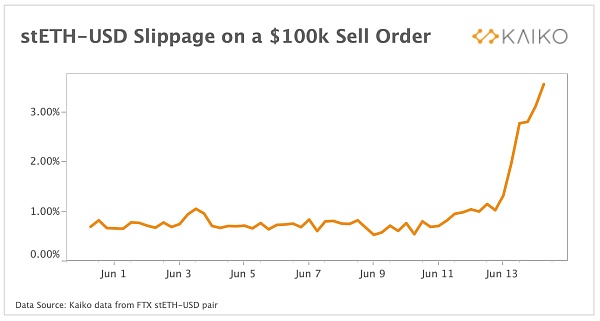

为了说明在 FTX 上仅出售价值 10 万美元的 stETH 会招致的损失,我绘制了交易所中 stETH-USD 对的滑点图,我们可以看到在 FTX 上仅仅出售价值 10 万美元的 stETH 都已经变成完全不可行。该货币对的滑点已增至 3.5%,再加上 stETH 对 ETH 价格的折扣约为 5%,这意味着在中心化交易所出售 stETH 导致 10 万美元的订单损失 8.5%。

In order to account for the loss that would result from selling FTX only $100,000 of stETH, I drew a slide map of the stETH-USD match on the exchange, and we can see that selling only $100,000 of stETH on FTX has become completely unworkable. The sliding point for the currency has increased to 3.5 per cent, plus a discount of about 5 per cent on the ETH price, which means selling stETH on a centralized exchange has resulted in a loss of 8.5 per cent of the orders of $100,000.

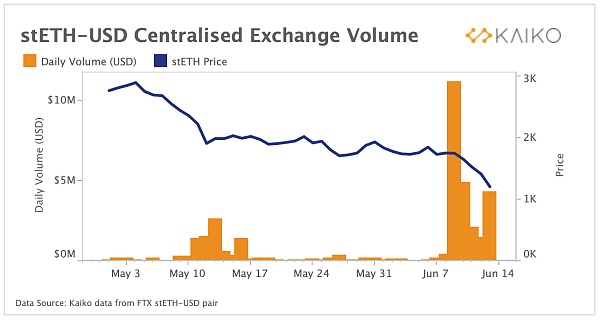

过去几天我们在 FTX 上观察到的现货交易量表明,每日交易量最高为 1000 万美元,此后一直在 100 万美元至 500 万美元之间波动,可能是由于缺乏流动性。Celsius 可能也并不会将其价值约 4.75 亿美元的 stETH 托付在 FTX 上。

The volume of spot transactions that we have observed on FTX over the past few days shows that the maximum volume of transactions per day is $10 million, and it has fluctuated since then between $1 million and $5 million, possibly due to a lack of liquidity. Celsius may also not have entrusted it to FTX with a value of about $475 million.

总体而言,stETH 交易活动由 Curve 主导,占 2022 年总交易量的 98.5%。尽管 stETH 也上架了 Uniswap 和 Sushiswap 等其他去中心化交易所,但交易量和流动性远没有那么高。

Overall, the stETH transaction is dominated by Curve, accounting for 98.5 per cent of the total volume of transactions in 2022. Although stETH is also on other decentralized exchanges such as Uniswap and Sushiswap, the volume and liquidity of transactions is far from that high.

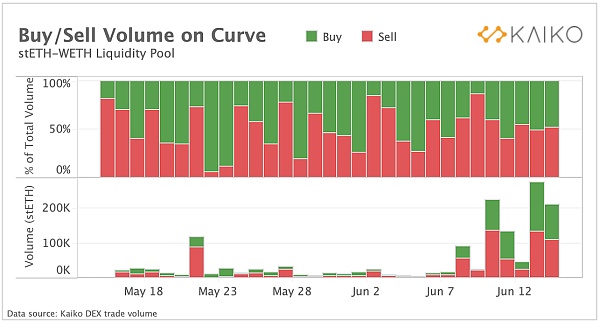

通过观察?Curve 流动性池中的交易量,这里有一些有趣的见解:自 5 月下旬以来,流动性池中 stETH 与 ETH 的相互交换似乎分布相当均匀,这可能表明一些投资者乐于以目前的折扣购买 stETH,以便在可以 1:1 兑换 ETH 时获取利润。出售的 stETH 数量表明,也有很多绝望的卖家愿意接受折扣。尽管以目前的流动性条件已经很难摆脱,但 Celsius 和 3AC 很可能会卖出少量的 stETH 以获取 ETH 用以偿付。

By observing the volume of transactions in the Curve liquidity pool, there are some interesting insights: since late May, the exchange between stETH and ETH appears to have been fairly evenly distributed, which may indicate that some investors are willing to buy stETH at the current discount in order to earn profits when it is possible to exchange ETH at 1:1. The number of stETHs sold shows that many desperate sellers are willing to accept the discounts. Celsius and 3ACs are likely to sell a small number of stETHs for repayment, despite the fact that the current liquidity conditions are difficult to get out of.

很明显,面临偿付能力问题的机构无法等待以太坊合并来赎回他们持有的 stETH,他们也不能在中心化或去中心化的交易所出售大量的 stETH。这实际上只留下了一个避免完全破产的选择:使用 stETH 作为抵押品,与交易所或做市商签订某种形式的场外交易(OTC)合同。

It is clear that institutions facing solvency problems cannot wait to recover the steths they hold by consummation, nor can they sell large amounts of steths on a centralized or decentralized exchange. This leaves only one option to avoid total bankruptcy: using steth as collateral, entering into some form of off-site (OTC) contract with an exchange or a marketer.

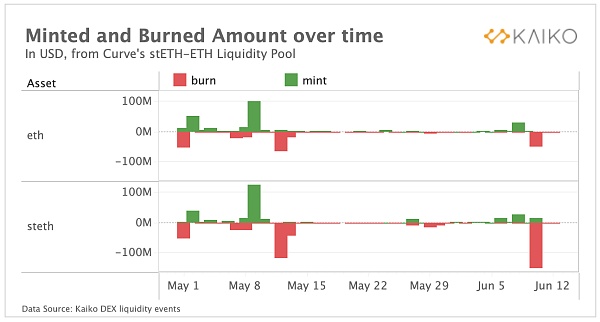

在上周,我们不仅看到了 Celsius 以及加密交易平台 Amber Group 的“绝境求生”,他们都被发现向FTX 发送了大量的 stETH 和其他储备。下图是 Curve stETH-ETH 池中的铸币和销毁,我们观察到上周 stETH 和 ETH 都发生了大量销毁,表明流动性已从 Curve 池中大量撤出。

Last week, not only did we see Celsius and the encrypt trading platform Amber Group, who were found sending large amounts of steth and other reserves to FTX. The figure below is the molars and destruction in the Curve steth-ETH pool, and we observed a massive destruction of steth and ETH last week, suggesting that liquidity had been withdrawn from the Curve pool.

有趣的是,大量的 stETH 从池中被销毁,这表明用户愿意锁定 stETH 折扣,无论是长期持有还是将其换成 ETH。通过链上数据我们可以发现,过去几天,属于 Amber Group 的钱包从 Curve 池中销毁了价值超过 1.5 亿美元的 stETH。然后?Amber Group?将 stETH 发送到 FTX 上。

Interestingly, a lot of stETHs have been destroyed from the pool, indicating that users are willing to lock down the stETH discounts, whether long-term holding or switching them to ETH. From the data on the chain, we can see that, over the past few days, the wallet belonging to Amber Group has been destroyed from the Curve pool for more than $150 million of stETH. Then, Amber Group? Sends the stETH to FTX.

FTX 在从 Celsius 和 Amber 获得大量存款之后,现在已成为除了智能合约以外的?stETH 最大持有者。正如我之前指出的那样,这些存款从未进入 FTX 的现货市场,因为如此巨量的交易很容易被发现。

FTX has now become the largest holder of all the deposits from Celsius and Amber, except for smart contracts. As I noted earlier, these deposits have never entered the FTX spot market, because such huge transactions can easily be detected.

对我来说,场外交易是获得 stETH 流动性回报的唯一途径。场外交易的问题在于它们本质上是链下交易,因此无法找到。所以,我们暂时无法确定这些 stETH 会被如何处理。

For me, off-the-ground transactions are the only way to get a stETH liquidity return. The problem with off-site transactions is that they are essentially chain transactions, so they can't be found. So we can't figure out how these stETHs are going to be handled for a while.

但 FTX 上的以太坊期货市场确实显示出一些有趣的趋势,可能会提供一些见解。我们观察到 FTX 的未平仓合约急剧增加,而其他交易所的未平仓合约随着以太坊价格暴跌而下降。当资产价格崩盘时,我们通常会观察到由于清算增加、期货合约平仓以及价格下跌对实际未平仓数据本身的影响而导致未平仓合约下降。在 FTX 价格下跌的情况下,看到未平仓合约上涨本身很有趣,但是当你考虑到过去几天交易所收到的大量 stETH 和 ETH 存款时,这个趋势就更加有趣了。

But the ETA futures market on FTX does show some interesting trends and may provide some insights. We have observed a sharp increase in FTX’s unsavory contracts, while other exchanges’ unsavory contracts have fallen with the collapse of their prices. When asset prices collapse, we usually observe a decline in unsavory contracts as a result of the impact of increased liquidations, flat futures contracts and falling prices on the actual unsavory data themselves. In the case of falling prices for FTX, it is interesting to see the unsavory contract rise in itself, but this trend is even more interesting when you take into account the large number of STETH and ETH deposits that have been made over the past few days.

猜测:

Celsius?可以通过 FTX 进行场外交易,使用或交换他们的 stETH,并在永续期货市场上做空 ETH 头寸,如果 ETH 下跌,他们可以通过以较低价格平仓合约来获利。暂停提款为他们提供了唯一的机会,他们可能在从该头寸中获利。

Celsius? An off-site transaction can be made through FTX, using or swapping their stETH and emptying the ETH position on the permanent futures market, and if the ETH falls, they can profit by leveling the contract at a lower price. Suspended withdrawals provide them with the only opportunity, and they may profit from that position.

另一种猜测可能只是 FTX 或某些做市商以大幅折扣从 Celsius 获取 stETH,以便在 stETH 可 1:1 兑换 ETH 时获利。他们可能已经通过 FTX 使用 ETH 的空头头寸来对冲价格风险,使损失最小化,确保他们的利润完全来自 stETH 和 ETH 之间的价格差异。

Another guess may be that FTX or some marketer obtains stETH from Celsius at a large discount in order to profit when stETH can exchange ETH at 1:1. They may already have hedged price risk through FTX using ETH empty positions, minimizing losses and ensuring that their profits are derived entirely from price differentials between stETH and ETH.

总而言之,在 FTX 收到大量 stETH 和 ETH 涌入之后会发生什么,谁都猜不透。然而通过数据,可以准确地说,Celsius 不可能在中心化或去中心化交易所直接出售他们所有的 stETH,因此可能不得不将 stETH 用于 OTC 类型的交易中以保持偿付能力。

All in all, what happens after FTX receives a large influx of stETHs and ETHs is hard to guess. However, with the data, Celsius is not likely to sell all of their stETHs directly to a centralized or decentralized exchange, and may therefore have to use stETH in OTC-type transactions in order to maintain solvency.

即使他们确实在这场猛攻中幸存下来,我看不出还会有人能相信?Celsius 可以保证他们的资产安全。也许几年后,我们会将此事视为 DeFi 领域采用的分水岭。

Even if they did survive the offensive, I don't see anyone believing that Celsius can keep their assets safe. Maybe in a few years we'll see this as a watershed in the DeFi field.

<END>

风险提示:

risk hint:

根据央行等部门发布的《关于进一步防范和处置虚拟货币交易炒作风险的通知》,本文内容仅用于信息分享,不对任何经营与投资行为进行推广与背书,请读者严格遵守所在地区法律法规,不参与任何非法金融行为。

According to the Circular on Further Prevention and Handling of Risks from Virtual Currency Transactions, issued by the Central Bank and others, this document is intended only for information-sharing and does not promote or endorse any business or investment activity. Readers are invited to comply strictly with the laws and regulations of their region and not to participate in any illegal financial acts.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论