合约交易通俗来说就是投资者只需要判断未来币种价格,不需要持有加密货币即可盈利,这么做风险也很大,对于自控力比较弱的投资者来讲,可能会上瘾,同时也会造成资产损失。因此懂得币圈合约交易怎么玩?十分重要,想要完好合约交易就要适度使用杠杆、设置止损订单等,否则很容易导致爆仓,这也就是为什么大家都说币圈合约很可怕的原因。作为新手来说最主要的还是弄懂币圈合约交易的入门教程,下面币圈子小编为大家详细说说。

It is common to say that investors simply need to determine the price of the future currency and do not need to hold an encrypted currency to make a profit. It is also risky to do so, and it may become addictive for less self-controlive investors, as well as cause asset loss. So you know how currency contracts are going to work. It's important that you use leverage, hold down damage orders, etc., if you want to make a good contract deal, it can easily lead to a bust, which is why everyone says that currency contracts are terrible.

币圈合约交易主要会涉及杠杆,懂得其中概念,玩合约交易并不会很难,当前玩合约交易的的交易所很多,比如欧易、币安、火币等等,下面是在欧易交易所玩BTC合约交易的详细教程:

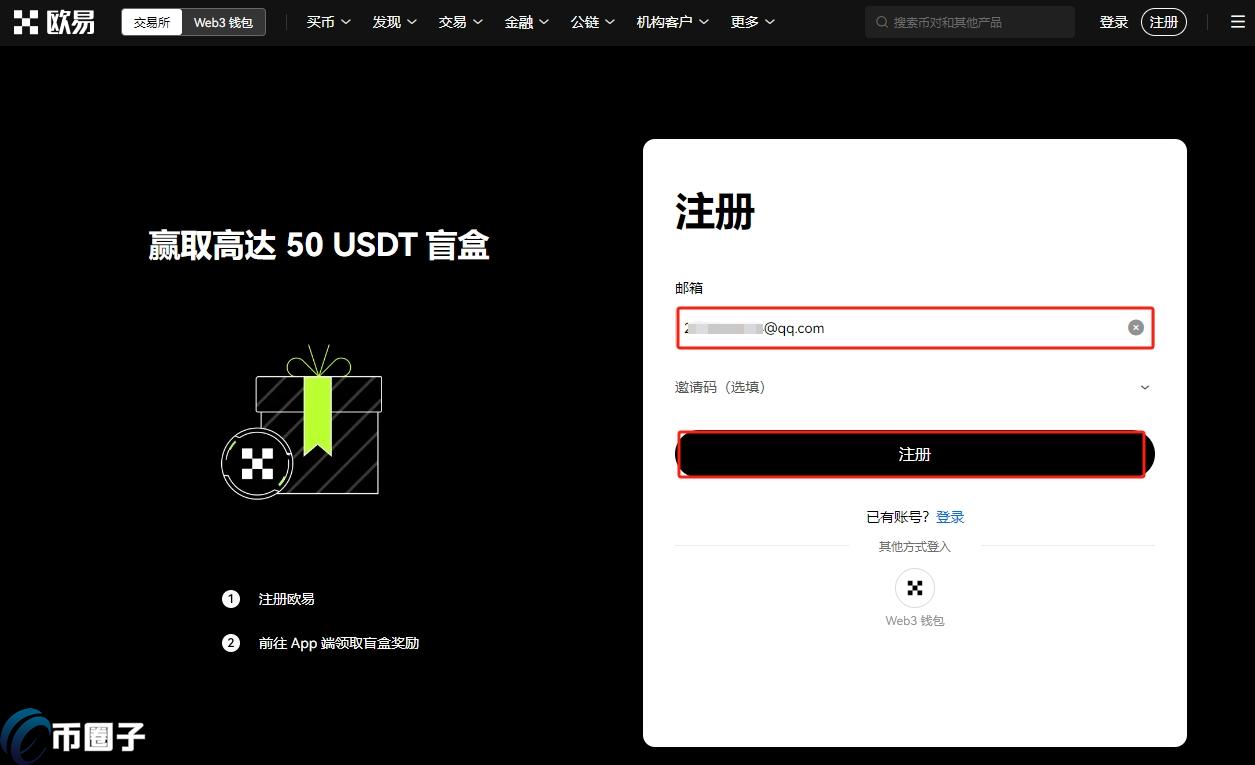

Currency-circle contract transactions will involve leverage, and it won't be difficult to play contract transactions. There are many exchanges at present, such as , 1. 打开欧易OKX交易所官网,点击页面右上方【注册】按钮进入注册页面,在首页输入邮箱地址。 1. Open the E-O-E-Href ="https://www.120btc.com/exchange/okx/"target="_blank"cras="infotextkey" >OKX Exchange

2.而后输入手机号,点击“立即验证”

Then enter the cell number and click "Certify immediately"

3.选择居住国家/地区,勾选服务条款、《风险与合规披露》及隐私政策与声明

3. Selection of country/area of residence, ticking of service terms, Risk and Compliance Disclosure and privacy policies and statements

4.创建密码需要符合长度为 8-32 个字符、1 个小写字母、1 个大写字母、1 个数字、1 个符号,如:!@ # $ %等条件

4. Create passwords with 8-32 characters, 1 lowercase letter, 1 capital letter, 1 number, 1 symbol, e. g.! @#$%

5.注册账号后需要进行身份认证才可进行交易,在首页找到“资产管理”——“身份认证”即可根据提示进行操作

Registration accounts require identification before transactions can be carried out, and “asset management” — “identity certification” can be found on the front page to operate on the basis of instructions.

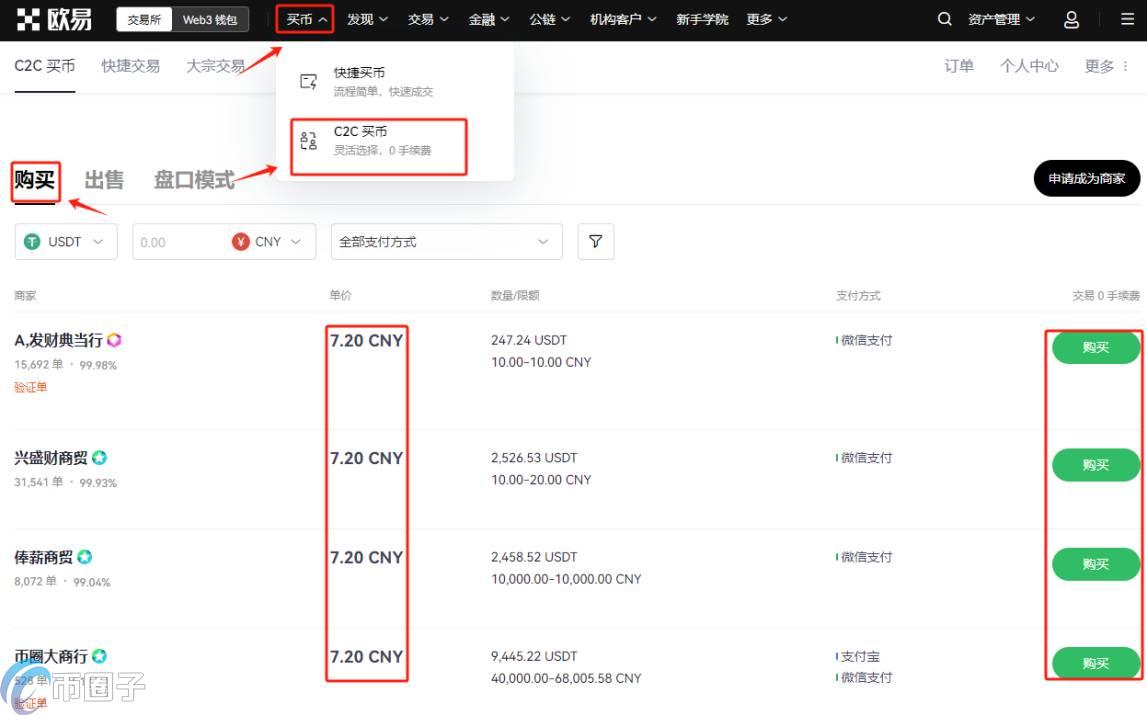

6.认证完成后即可进行交易,在首页点击“买币”——“C2C买币”,选择合适商家后,根据提示进行操作即可

Once authentication has been completed, transactions can be made. Once the appropriate vendor has been selected by clicking on the front page " Buying the money" - "C2C Buying the money", the operation can be performed on the basis of the instructions.

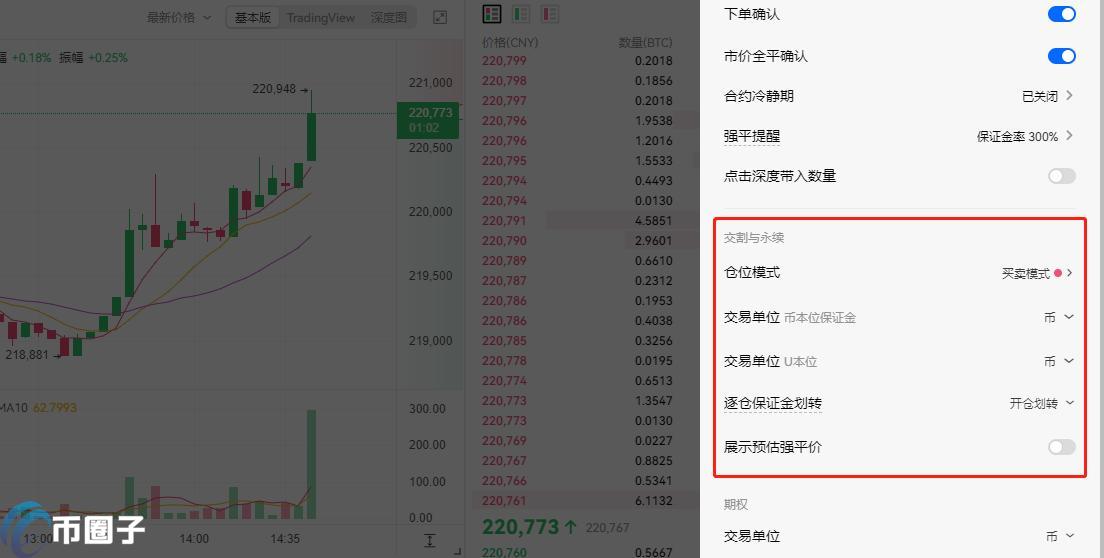

7.如果想要进行合约交易,需要将账户模式开通并设置为单币种保证金模式或跨币种保证金模式。

If a contractual transaction is to be made, the account model needs to be opened up and set up as a single-currency bond model or a cross-currency bond model.

8.您可继续进行合约设置,个性化选择交易单位,下单模式。

8. You can continue the contract setting, personalize the selection of the transaction unit, next mode.

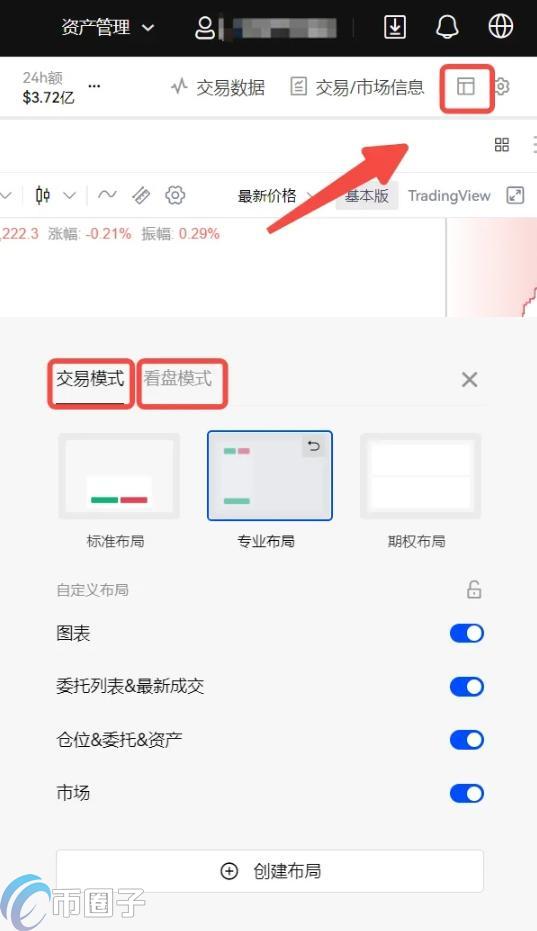

9.您可自定义设置交易模式和看板模式,此处选择专业布局。

9. You can customize the transaction mode and watchboard mode and select the professional layout here.

10.交割合约分为USDT保证金交割合约,币本位保证金交割合约,这里以币本位保证金当周交割合约为例。首先将我们的数字资产从资金账户划转到交易账户,如已完成则无须进行额外划转操作。

10. The contract of surrender is divided into USDT bonds and currency bonds, for example, on the week of the deposit. First, our digital assets are transferred from the fund account to the transaction account and, if completed, no additional transfer is required.

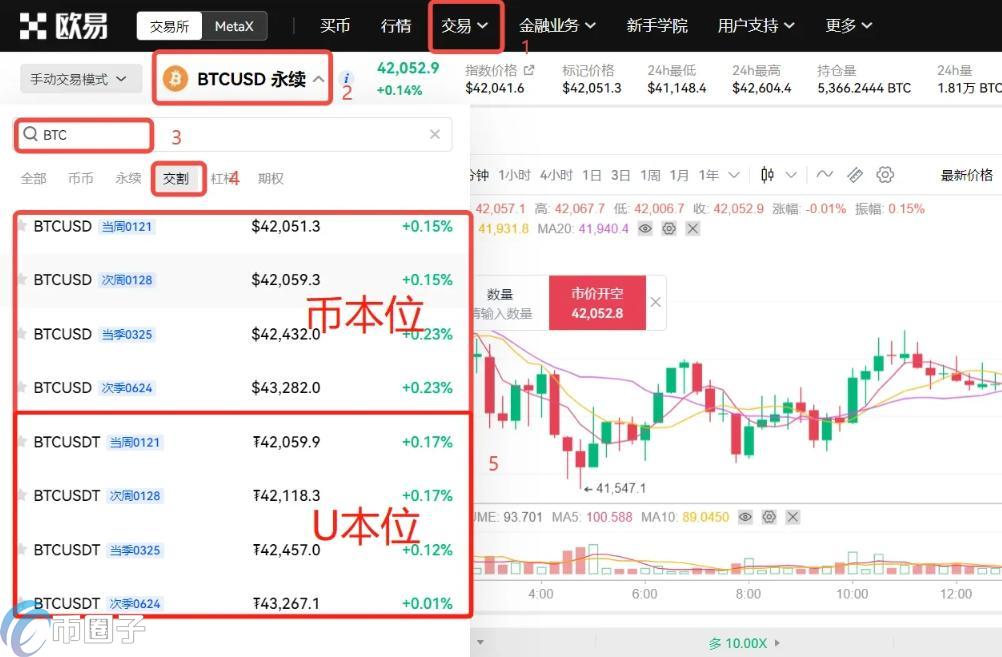

11.在交易页面点击币对右侧的下拉按钮,在搜索框输入币种,在保证金交易处选择交割,选择合约周期为当周、次周、当季或次季的币本位/U本位合约。此处以当季币本位合约为例

Click on the transaction page to pull the currency down to the right, enter the currency in the search box, select the delivery point at the bond trading place, and select the currency/U local contract for the current week, week, season or season. Here, for example, the local currency contract for the current season.

12.在选择账户模式、委托类型,输入价格、数量,点击买入开多(看涨)或卖出开空(看空)。未成交的委托挂单可单击撤单撤销委托。此处以开多为例。

If you select an account mode, a commission type, enter a price, quantity, click to buy more open (look up) or sell open (see empty). An unsold order can be dropped by clicking to cancel the order. Many examples are given here.

13.挂单成交后,可在持仓界面中可查看订单的相关数据,例如保证金、收益、收益率、预估强平价等。

13. Once signed, relevant data on orders, such as bonds, returns, rates of return, projected over-parities, etc., can be viewed at the warehouse interface.

14.您可在持仓界面设置止盈止损,还可选择平仓,输入平仓价格和平仓数量确定平仓,或选择市价全平完成平仓操作。

14. You can set up a warehouse interface to stop the excess and stop the losses. You can also choose to level the warehouse, enter a flat price and ascertain the number of silos, or choose a full market price to complete the silo operation.

15.永续合约分为USDT保证金永续合约,币本位保证金永续合约,这里以USDT保证金永续合约为例。同样,将我们的数字资产从资金账户划转到交易账户,如已完成则无须进行额外划转操作。

15. In the same way, our digital assets are transferred from the fund account to the transaction account, without additional transfer operations if completed.

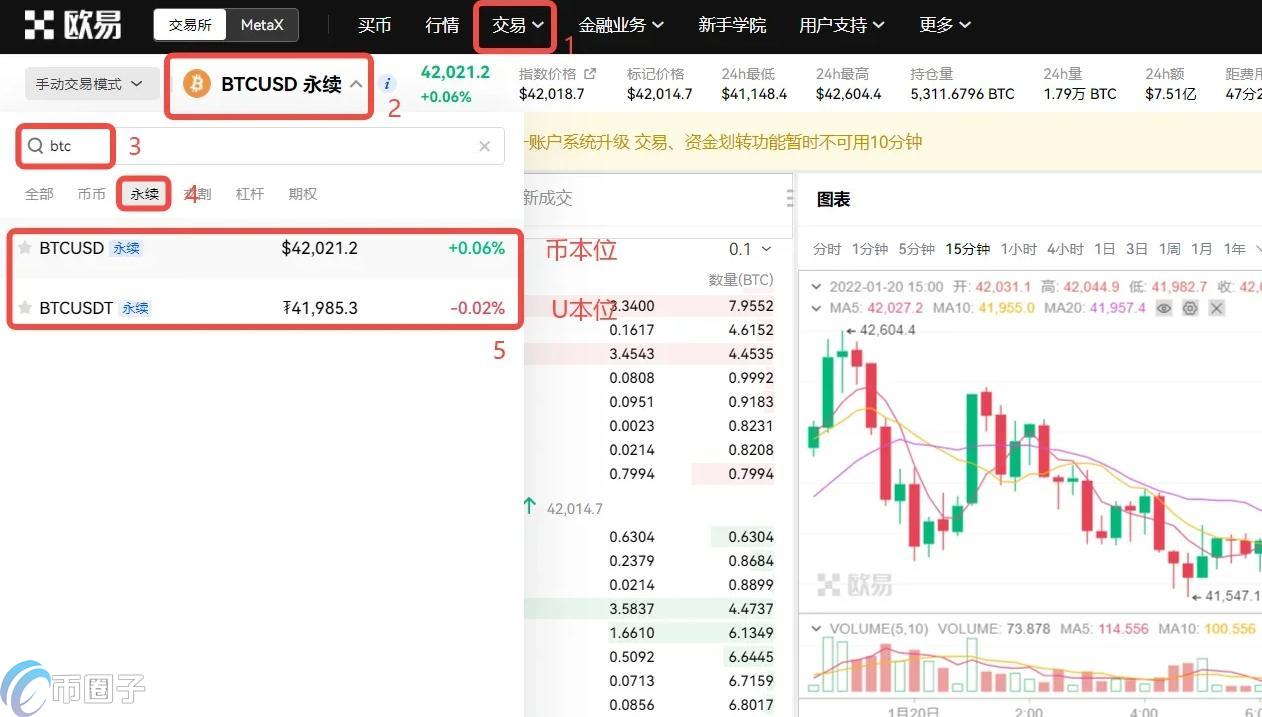

16.在交易页面点击币对右侧的下拉按钮,在搜索框输入币种,在保证金交易处选择永续,选择币种对应的币本位/U本位合约。此处以U本位合约为例

Click on the transaction page to pull the currency down to the right, enter the currency in the search box, select the constant value at the bond trading place, and select the currency/U-bit contract. Take the U-bit contract as an example.

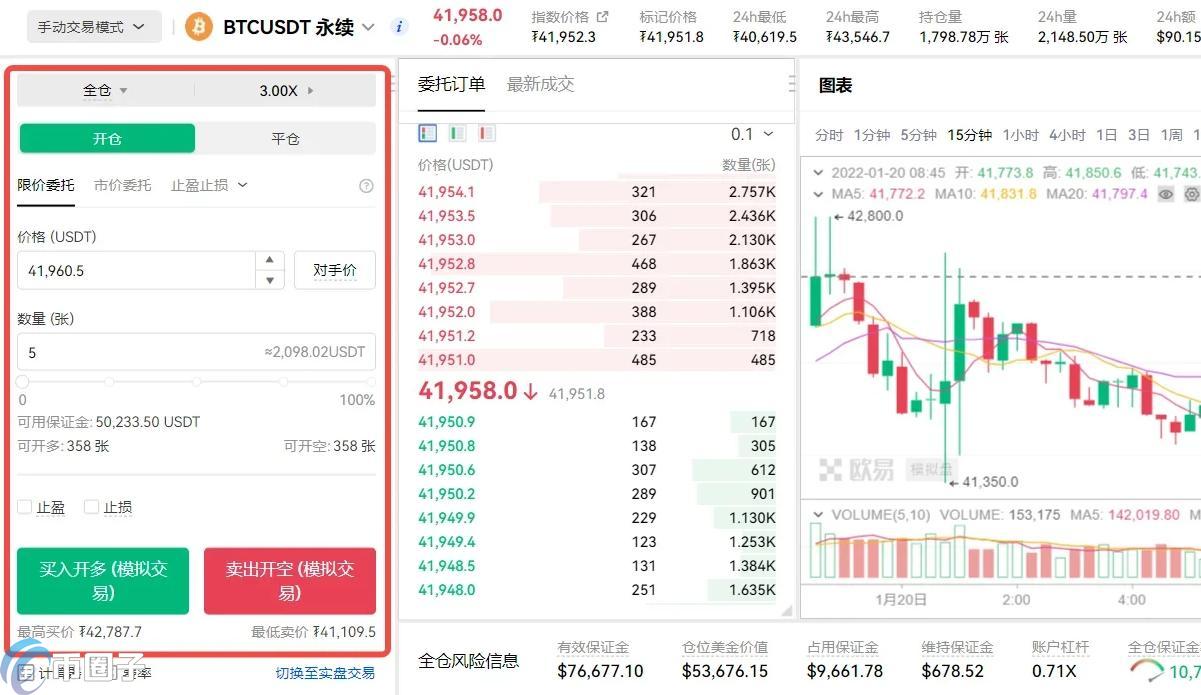

17.选择账户模式、委托类型,输入价格、数量,点击买入开多(看涨)或卖出开空(看空)。未成交的委托挂单可单击撤单撤销委托。此处以开空为例。

Select the account mode, the type of commission, enter the price, the quantity, click on the purchase of more open (look up) or the sale open (see empty). Unsold order to cancel the order. This is an example.

18.挂单成交后,可在持仓界面中可查看订单的相关数据,例如保证金、收益、收益率、预估强平价等。

18. When a single transaction is made, relevant data on orders, such as bonds, returns, rates of return, projected over-parities, etc., can be viewed at the warehouse interface.

19.您可在持仓界面设置止盈止损,还可选择平仓,输入平仓价格和平仓数量确定平仓,或选择市价全平完成平仓操作。

19. You can set up a warehouse interface to stop the excess and stop the losses. You can also choose to level the warehouse, enter a flat price and ascertain the number of silos, or choose a full market price to complete the silo operation.

加密货币合约交易是一项高风险高回报的活动,需要谨慎和深入的市场了解。合约交易操作技巧主要是会技术分析、懂得风险管理、识别趋势跟踪、逆势交易、新闻事件分析、多空双向交易等等,下面是详细介绍:

Encrypted currency contract transactions are a high-risk, high-return activity that requires careful and in-depth market knowledge.

1、技术分析:使用技术分析工具和图表来识别趋势、支撑位和阻力位,以及其他技术指标,如移动平均线、相对强度指标(RSI)等。这有助于制定基于价格图表的交易决策。

Technical analysis: Use of technical analytical tools and graphs to identify trends, support and resistance positions, as well as other technical indicators, such as moving mean lines, relative intensity indicators (RSI) etc., which contribute to the development of trade decision-making based on price charts.

2、风险管理:设定合理的止损和止盈订单,以限制潜在亏损并保护利润。避免过度杠杆和投入过多资金在单个交易中。

Risk management: Set reasonable stop and stop orders to limit potential losses and protect profits. Avoid excessive leverage and investment in individual transactions.

3、趋势跟踪:在市场上识别和跟踪趋势,尤其是长期趋势。趋势跟踪策略可以使交易者在趋势方向上获利。

Trends track: Trends are identified and tracked in the market, especially over the long term.

4、逆势交易:有时候市场可能会出现反弹,逆势交易就是在趋势反转时进行的交易。这需要更高的技巧和注意,因此不适合所有交易者。

4. Reverse trading: Sometimes the market is likely to rebound, and reverse trading is a transaction that takes place when the trend reverses. This requires a higher degree of skill and attention, and therefore is not suitable for all traders.

5、新闻事件分析:关注加密货币市场和相关行业的新闻事件,因为这些事件可能对价格产生重大影响。及时的新闻分析可以帮助你做出更明智的交易决策。

News Events Analysis: Focusing on news events in encrypted money markets and related industries, as they may have a significant impact on prices. Timely news analysis can help you make better business decisions.

6、多空双向交易:有些平台支持多空双向交易,即投资者可以在市场上涨时做多,市场下跌时做空。这使得投资者能够在不同市场情况下获利。

6. Multi-empty two-way transactions: Some platforms support multi-empty two-way transactions, i.e. investors can do more when markets rise and the market falls. This allows investors to profit from different market situations.

7、情绪分析:理解市场的情绪对交易也很重要。例如,过度的贪婪或恐惧可能导致市场的过度波动。情绪分析可以作为决策的参考。

Emotional analysis: Understanding market sentiment is also important for transactions. For example, excessive greed or fear can lead to excessive market volatility. Emotional analysis can serve as a reference for decision-making.

8、定期评估和调整策略:定期回顾和调整你的交易策略。市场条件不断变化,适应新的市场情况是成功交易的关键。

Periodic assessment and adjustment strategies: periodic review and adjustment of your trading strategies. Changing market conditions and adaptation to new market conditions are key to successful transactions.

以上全部内容就是对币圈合约交易怎么玩这一问题的教程解答,标准化合约设计的初衷是为了对冲现货风险而设计的,为了锁定收益成本,对冲现货价格大幅波动的风险,从事大宗商品买卖的公司或个人会在期货市场下相同头寸的空单(多单),用来抵御风险。需要注意的是,币圈合约是一个比较绕的投资方式,如果不能完全弄清楚其中的操作流程以及交易规则的话想要盈利很难,所以大家切记不能盲目操作,以免损失更多的资产。

All of this is an answer to the question of how currency-circumstance transactions play their part. Standardized contracts are designed to capture off-the-shelf risks. Companies or individuals dealing in bulk commodities will be able to protect themselves against risks (many more) in the same position under futures markets in order to identify the cost of earnings, the risk of large swings in spot prices. It is important to note that currency-circumstance contracts are a more round-the-clock investment mode, and it is difficult to make a profit if the operating process and the rules of the transaction are not fully understood.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论