每经编辑 杜宇

Every editor, Du-woo.

比特币再次上演价格飙涨大戏。比特币盘中一度突破64000美元,续刷2021年11月以来新高。这是比特币自2021年11月以来最高价格,距离历史最高点68991美元仅一步之遥。

Bitcoin is back on the price boom again. At one point, it was over $64,000 on the plate, continuing to be high since November 2021. This is the highest price in bitcoin since November 2021, just one step away from the historic high of $68991.

随后,比特币涨势回落,截至发稿,比特币报60377.42美元,涨幅5.9%。

This was followed by a fall in Bitcoin, which reported $60,377.42, or 5.9 per cent, as of the date of issuance.

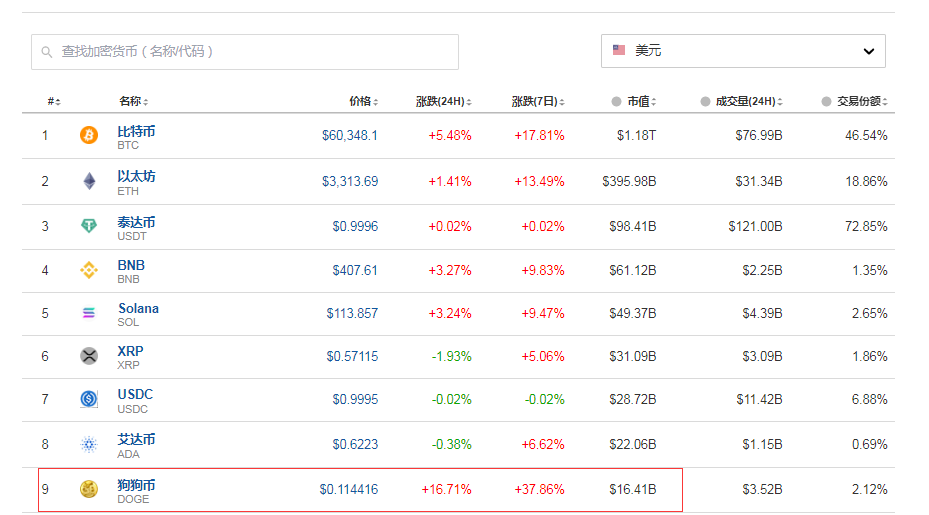

受比特币大涨刺激,加密货币市场集体“狂飙”。以太坊、狗狗币、BNB等均大幅上涨,其中以太币一度达到3331美元,为2022年4月以来的最高水平。

After a huge increase in bitcoin, the encoded currency market collectively “circumcised.” Ether, Dogcoin, BNB, among others, rose sharply, reaching $3331 at one time, the highest level since April 2022.

据公开数据,截至发稿的24小时内,113750人爆仓,爆仓总金额达4.47亿美元(约合人民币32.18亿元)。

According to public data, within 24 hours of the release of 图片来源:金十数据 比特币最近有多疯狂?近一个月涨幅超过40%,创下自2020年12月以来最大月度涨幅。上一次比特币价格站上6万美元,发生在2021年11月,距今已有28个月。 How crazy has Bitcoin been lately? Nearly a month has seen an increase of more than 40%, the largest monthly increase since December 2020. 据界面新闻,这主要与美联储6月降息的可能性、4月“减半”事件、新现货ETF获批上市等因素有关。 According to the interface news, 美国实施降息的预期,增大了高收益或波动性较大的金融产品对投资者的吸引力。 The implementation of interest-reduction expectations in the United States has increased the attractiveness of high-yielding or volatile financial products to investors. 高盛2月公布的报告显示,其预计美联储将在2024年大幅降息,至少降息4次,首次降息将于6月开始。 According to a report released in February by Goldman Sachs, the Fed expects a significant reduction in interest rates by 2024, at least four times, with the first reduction beginning in June. 降息会降低借贷成本,增大市场上的流动性,推动更多资金流入包括比特币在内的其他投资渠道。此外,低利率的储蓄或定期产品对投资者的吸引力将会下降,这也助推了比特币价格进一步走高。 Cuts in interest rates reduce borrowing costs, increase liquidity in the market, and promote greater capital inflows into other investment channels, including Bitcoins. Moreover, low interest rates of savings or fixed-term products will be less attractive to investors, which will also contribute to further increases in Bitcoins prices. 比特币价格快速冲高与BTC ETF(交易所交易基金)于今年1月获批上市有直接关系。 The rapid surge in Bitcoin prices is directly related to the approval of BTC ETF (the Exchange Trading Fund) for listing in January this year. 当地时间1月10日,美国证券交易委员会(SEC)批准11只现货比特币ETF,首批ETF于1月11日开始上市交易。据媒体报道,SEC的这一决定,将允许普通投资者像买卖股票和共同基金一样方便地买卖比特币。 On January 10, local time, the United States Securities and Exchange Commission (SEC) approved 11 spot bitcoin ETFs, the first of which started trading on January 11. According to media reports, SEC’s decision would allow ordinary investors to buy and sell bitcoins as easily as stock and mutual funds. 新举措降低了比特币的购买门槛,也吸引更多机构和散户投资者进入市场。此外,批准上市还提升了加密资产的合法性,从而助推了比特币价格逐渐走高。 The new initiative reduces the purchase threshold for Bitcoin and attracts more institutions and bulk investors to enter the market. In addition, the approval of listings enhances the legitimacy of encrypted assets, thus contributing to the gradual increase in Bitcoin prices. 据中国基金报,数字加密货币基金AltAlpha Digital的联合创始人表示,比特币牛市又回来了。比特币ETF和比特币“下一次减半”史无前例的结合,吸引了大量额外的资金流入。 According to the China Foundation, the co-founder of the Digital Encrypted Monetary Fund, Alt Alpha Digital, said that the city of Bitcoin had returned. The unprecedented combination of Bitcoin ETF and Bitcoin’s “next halved” attracted significant additional capital inflows. 研究公司CCData分析师Jacob Joseph称,比特币ETF这种加密货币敞口基金在数字资产市场中扮演着关键角色。他说,最近有助于推动市场积极情绪的事态发展包括,美国现货比特币ETF交易量创新高,以及MicroStrategy额外购买逾3000枚比特币,所有这些积极因素将比特币推向接近历史高点。 Research company CCData analyst Jacob Joseph claims that an encrypted currency exposure fund, the Bitcoin ETF, plays a key role in the digital asset market. Recent developments, he said, have helped to boost the market’s positive mood, including the high innovation in the volume of United States spot currency ETF transactions and the purchase of over 3,000 extra bitcoins by MicroStrategy, all of which push bitcoins closer to historical heights. 加密货币对冲基金管理公司BitBull Capital的CEO Joe DiPasquale称,ETF的批准和即将到来的比特币“减半”,导致许多稳健的投资者开始购买这项资产,这造成了对比特币的历史性需求。 According to CEO Joe DiPasquale of the cryptobank hedge fund management company Bitbull Capital, the approval of the ETF and the forthcoming “half by half” of Bitcoin led many robust investors to start purchasing the asset, which created historical demand for it. 据CoinMarketCap显示,截至北京时间2月28日晚间,距离比特币减半还有52天18小时。 According to CoinMarketCap, as of the evening of 28 February Beijing time, there were 52 days and 18 hours left to halve Bitcoin. DiPasquale称,不仅MicroStrategy披露了逾1.5亿美元的比特币买入,还有消息称,其他大型投资者也在买入。预计比特币和其他主要数字加密资产今年会有更大的增长。 DiPasquale states that not only did MicroStrategy disclose more than $150 million in bitcoins, but there are also reports that other large investors are buying. Bitcoins and other major digital encryption assets are expected to grow even more this year. 多资产经纪商Tickmill Group的James Harte在给客户的一份报告中表示,随着比特币主要玩家在4月减半事件之前重新把大量现金投入比特币,看起来比特币价格近期可能会继续走高,问题是这种涨势在减半事件后是否会持续,随着比特币的供应放缓,外加最近的ETF获批推动需求大增,涨势在今年很有可能会持续下去,一些评论人士预测到年底会达到10万美元大关。 James Harte, a multi-asset broker, Kickmill Group, stated in a report to clients that, as Bitcoin major players reinvested large amounts of cash in bitcoin before the April halving event, it appears that bitcoin prices will likely continue to rise in the near future. The question is whether this increase will continue after the halving event, and that it will likely continue this year as the supply of bitcoin slows, plus the recent ETF has been approved to boost demand, with some commentators predicting that it will reach the $100,000 mark by the end of the year. 每日经济新闻综合界面新闻、中国基金报、公开资料 Daily Economic News Interface News, China Foundation News, Public Information

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论