(报告出品方:华安证券)

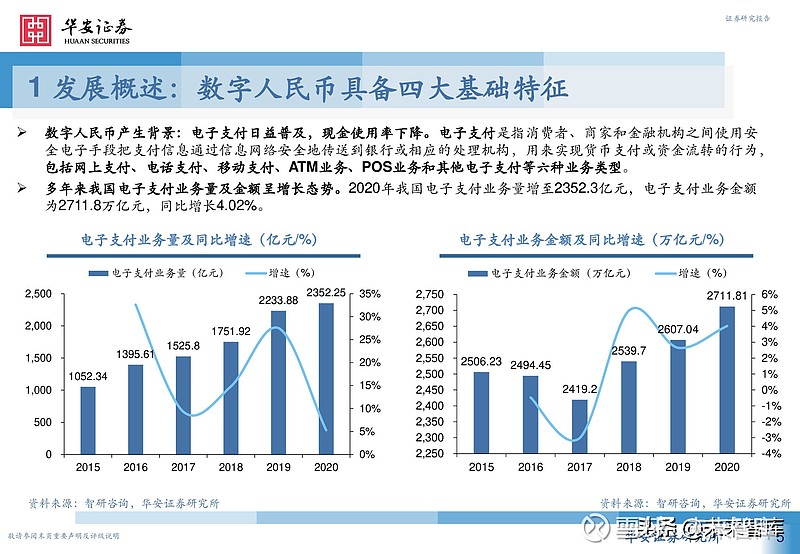

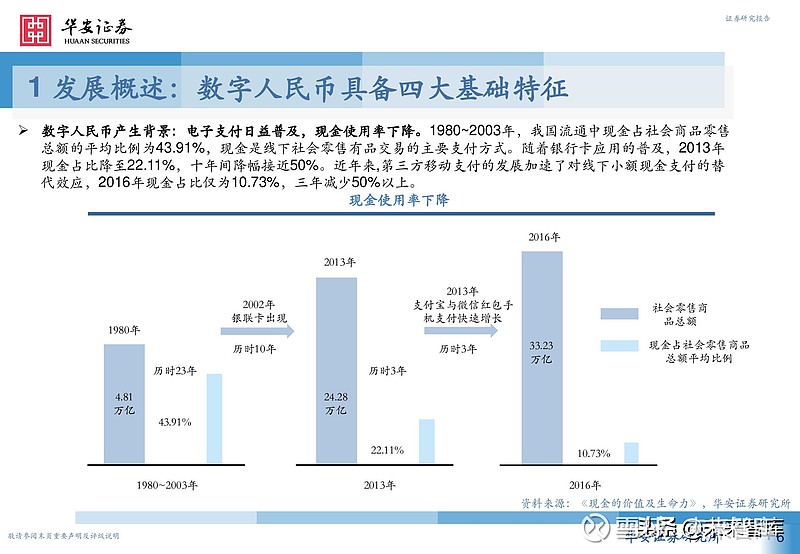

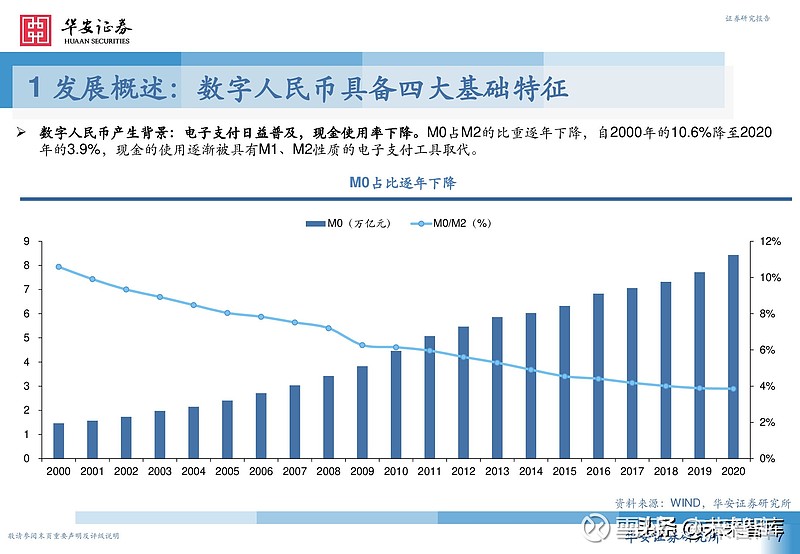

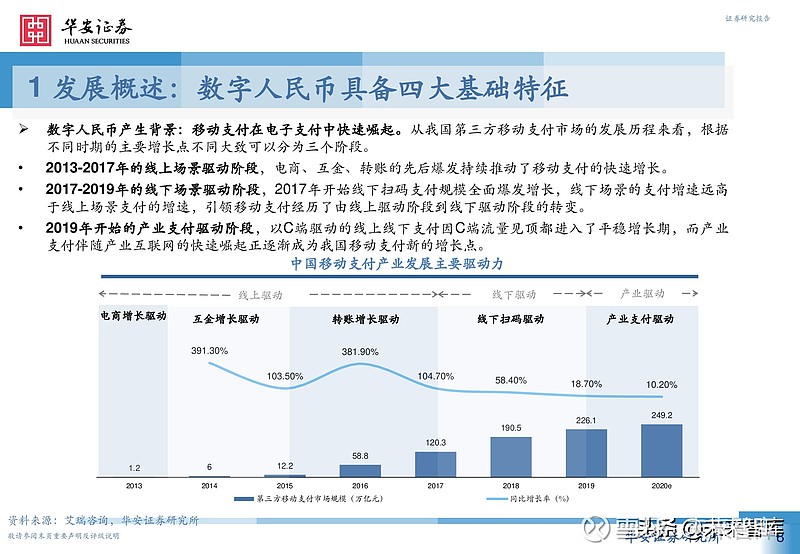

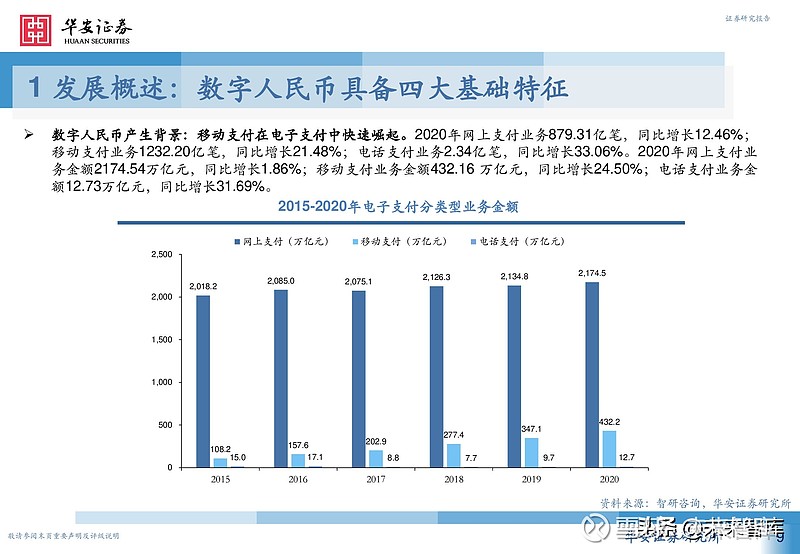

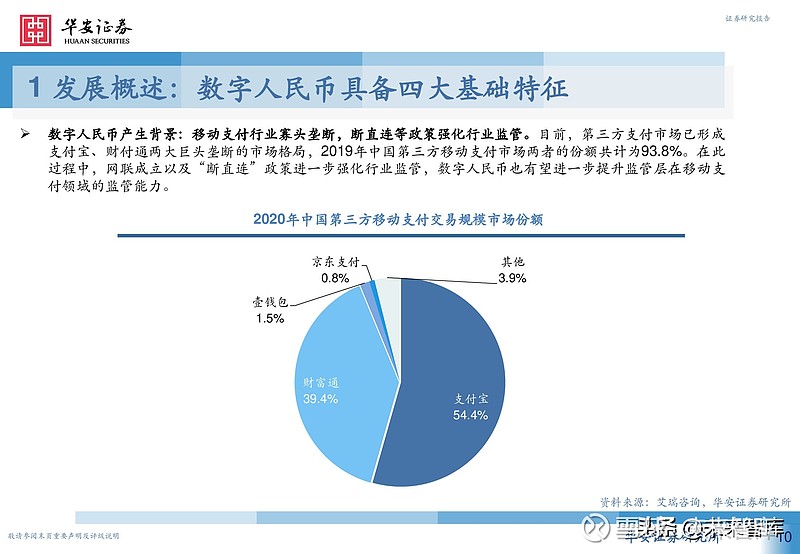

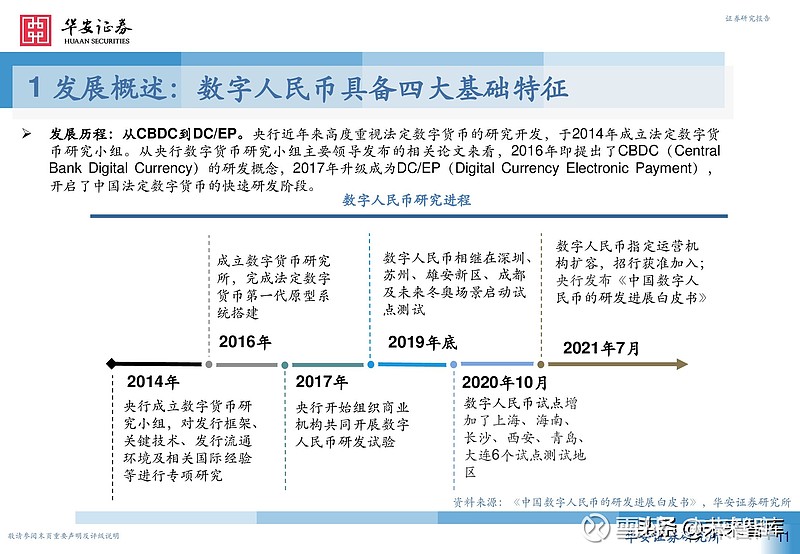

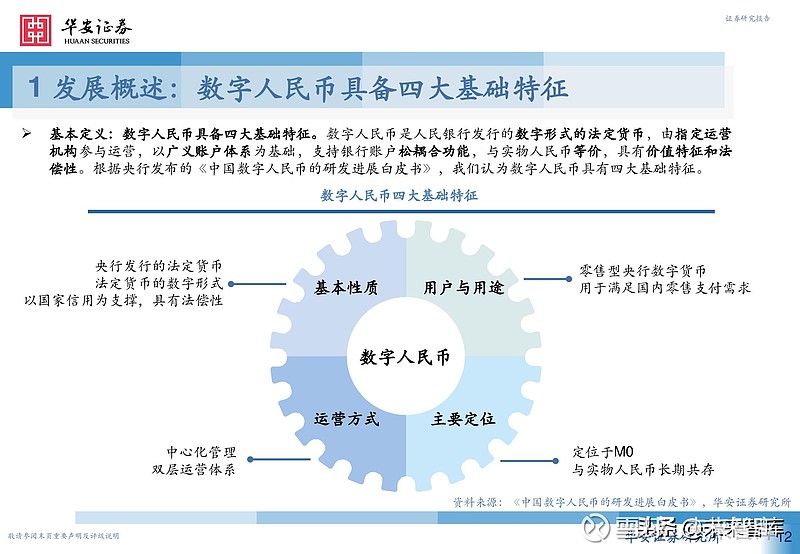

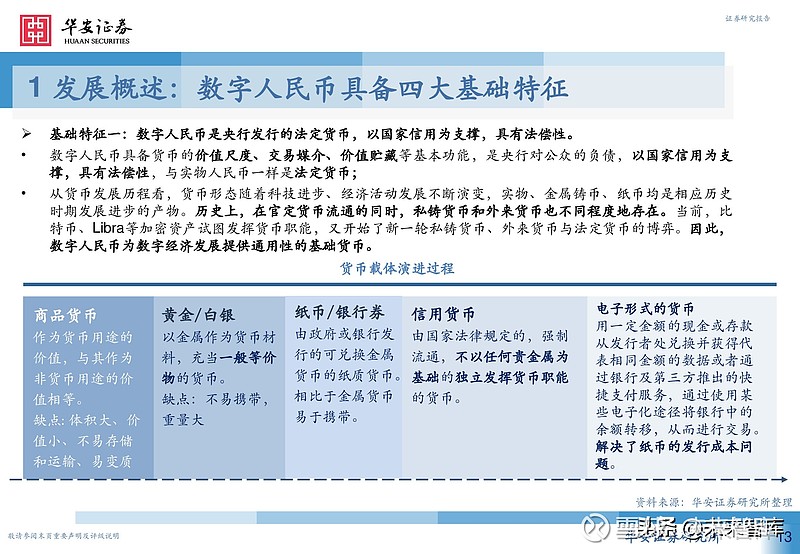

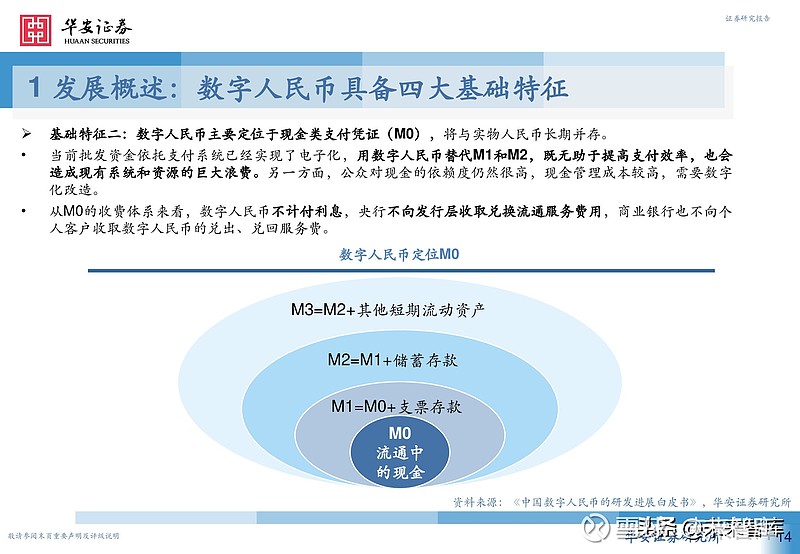

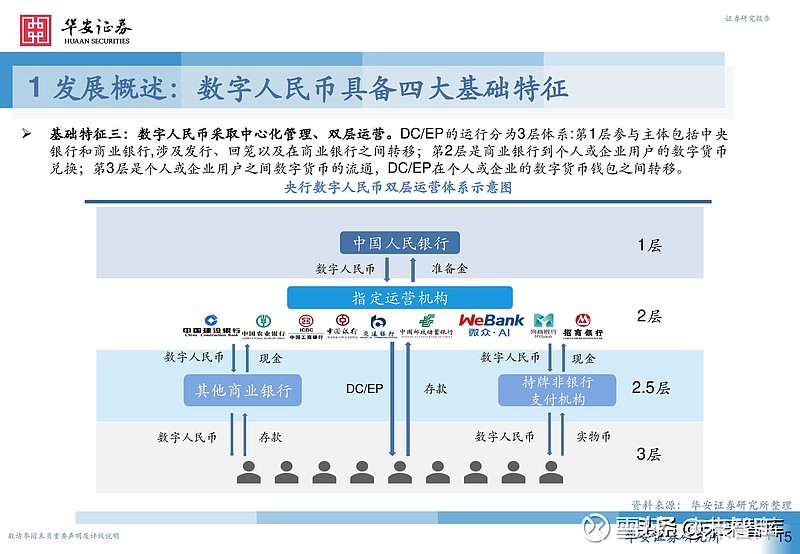

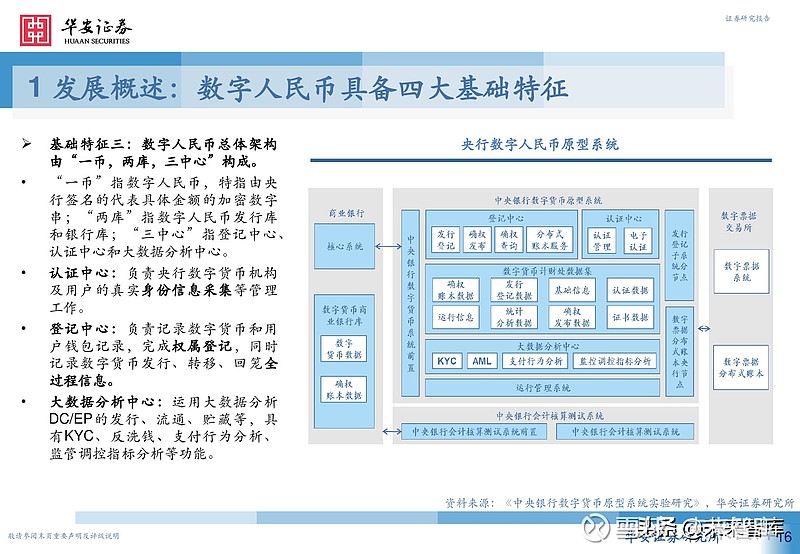

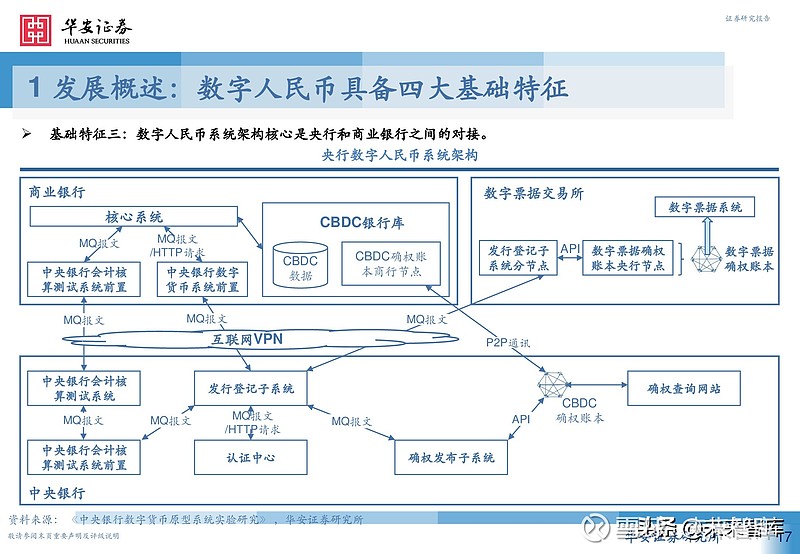

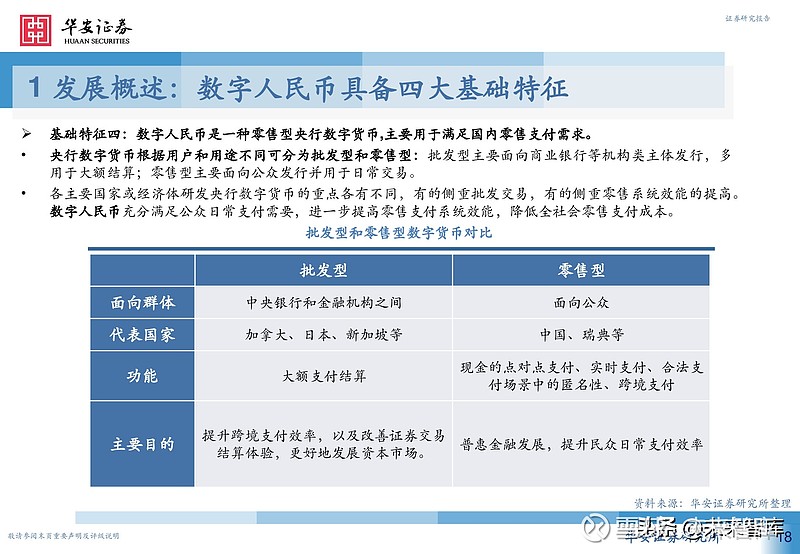

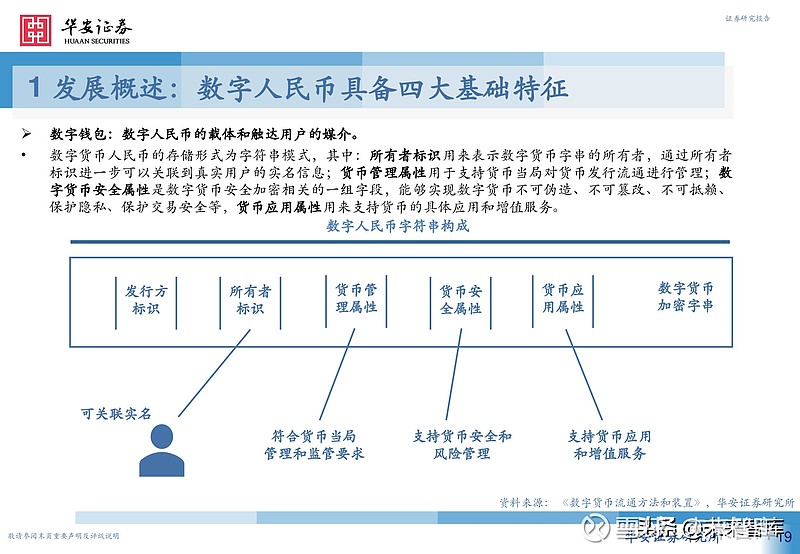

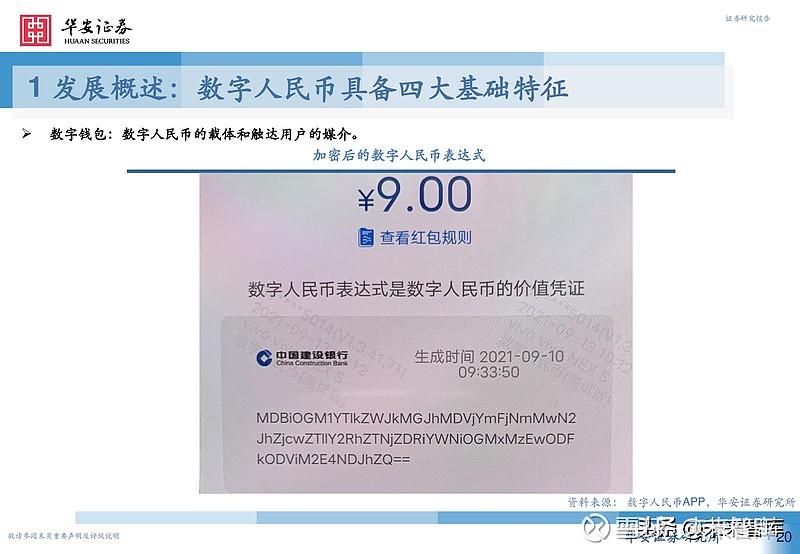

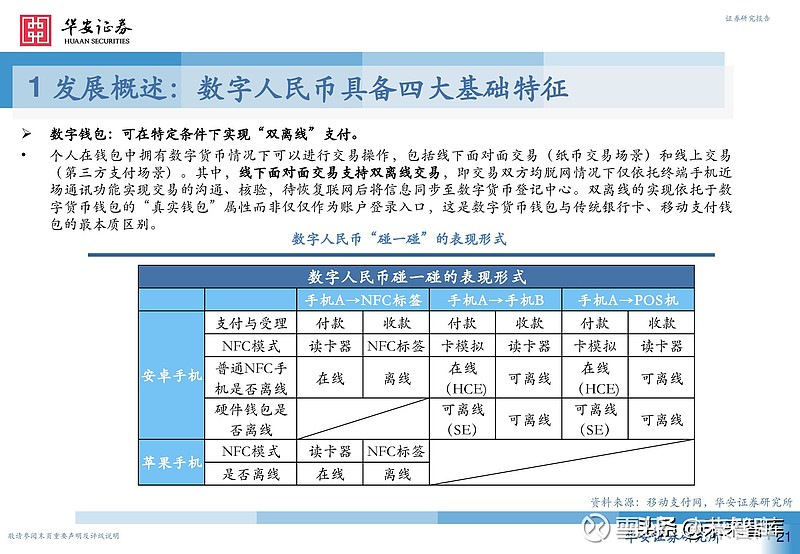

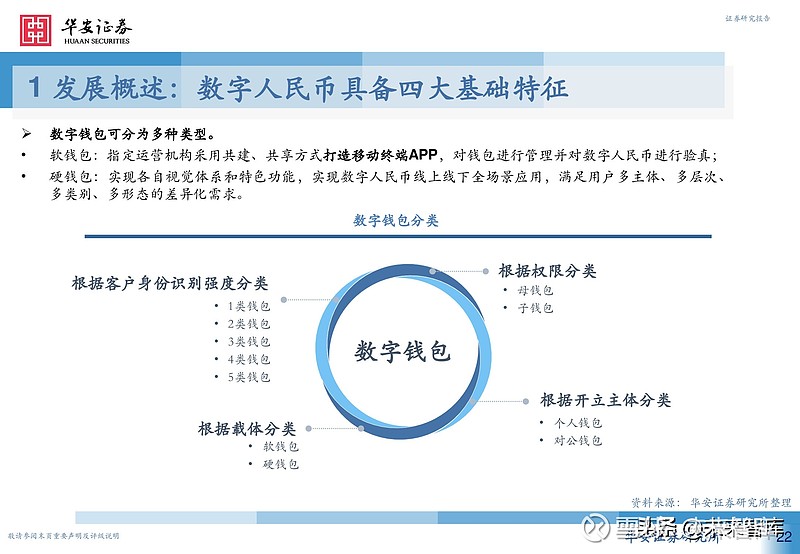

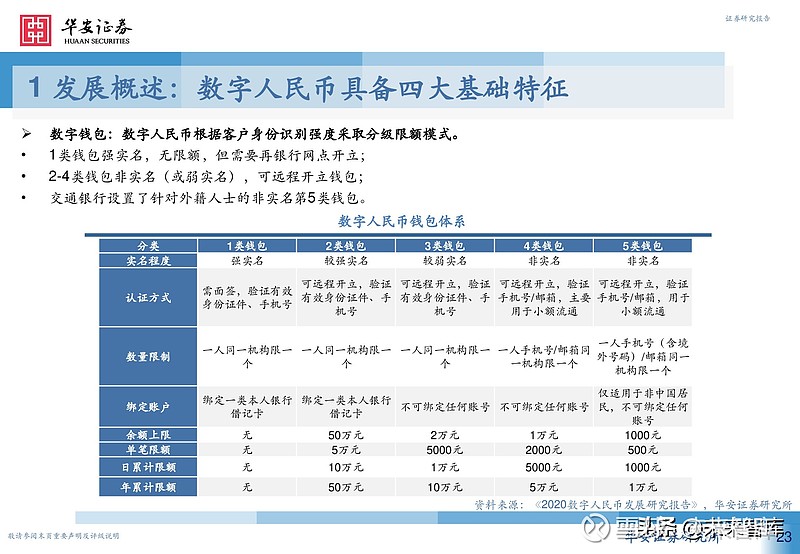

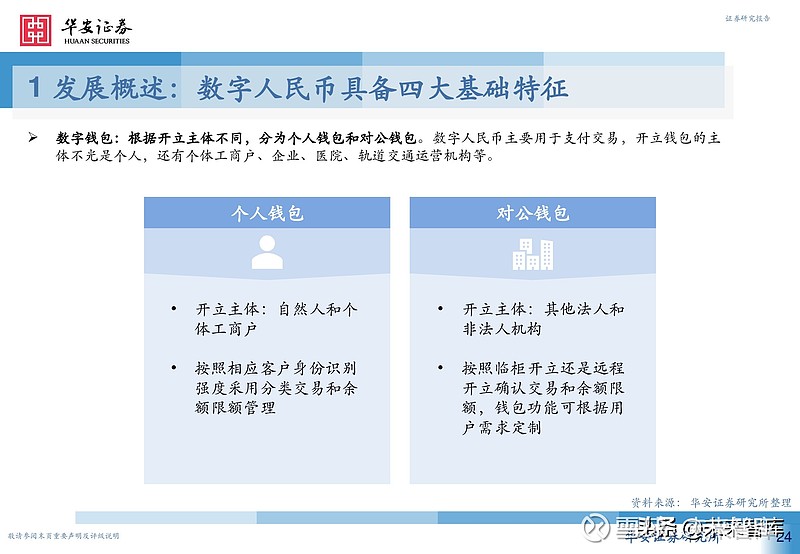

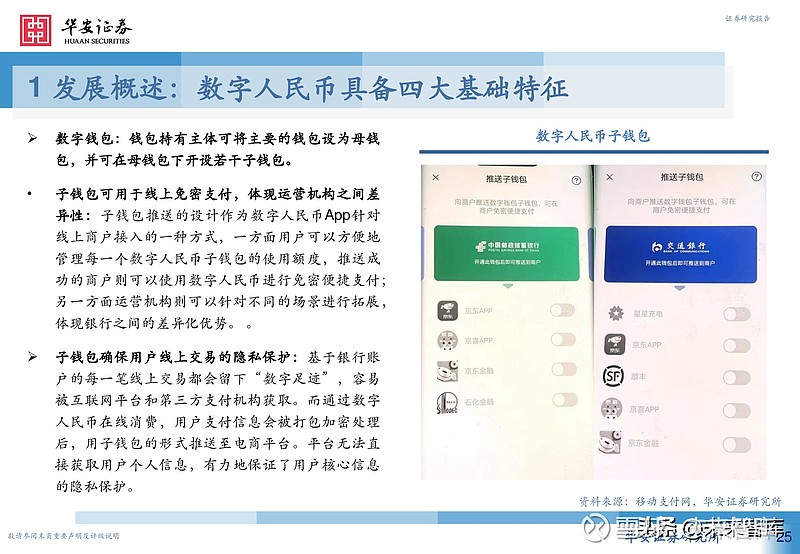

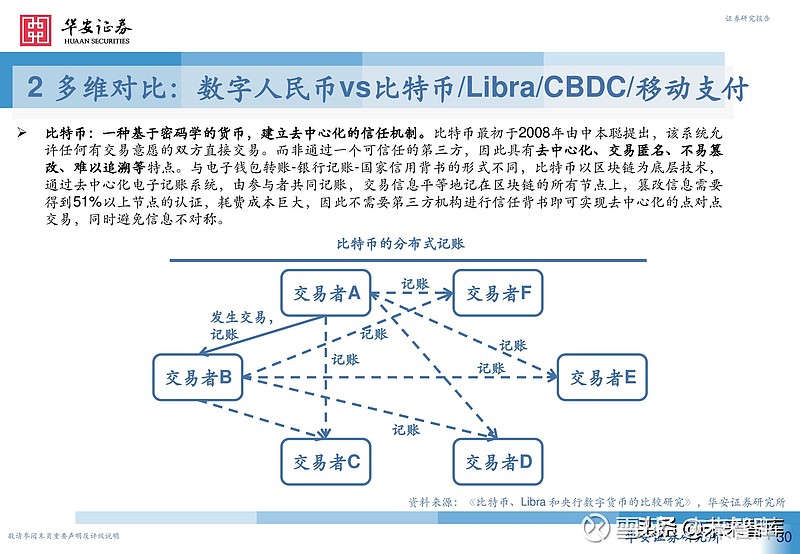

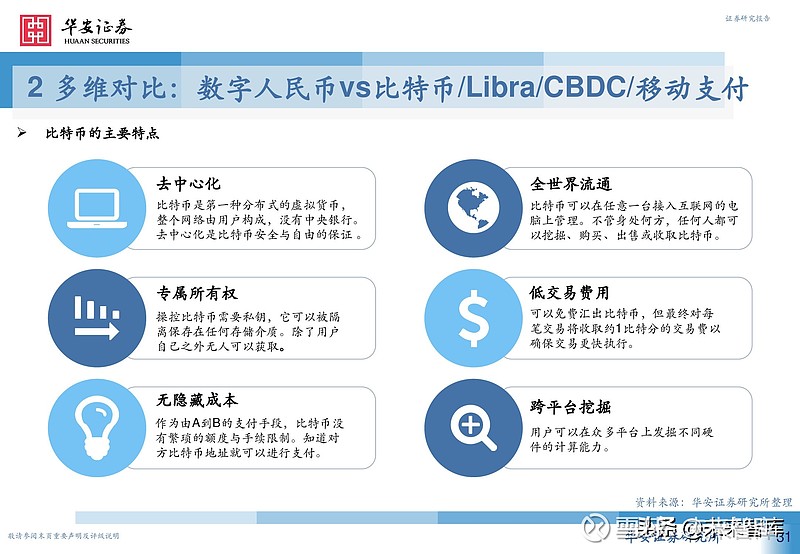

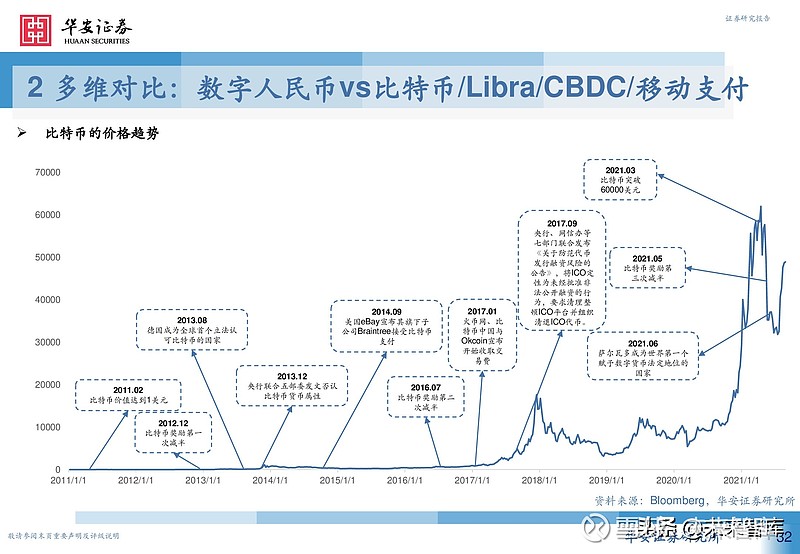

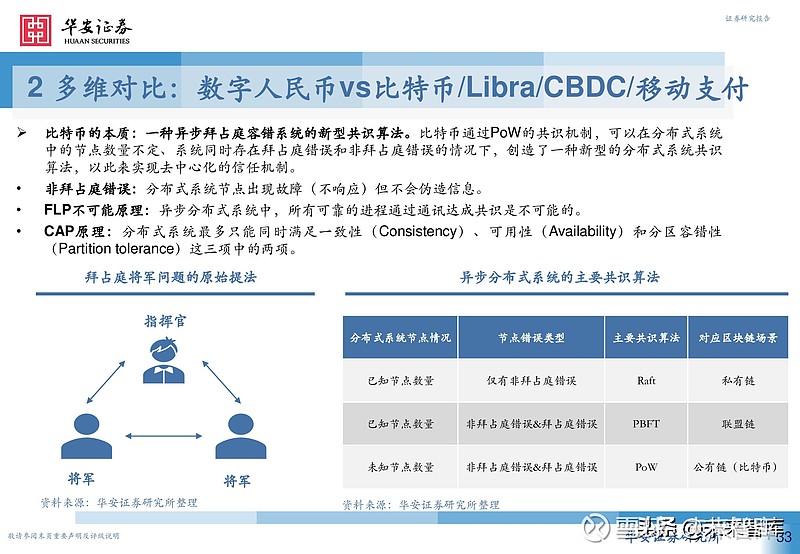

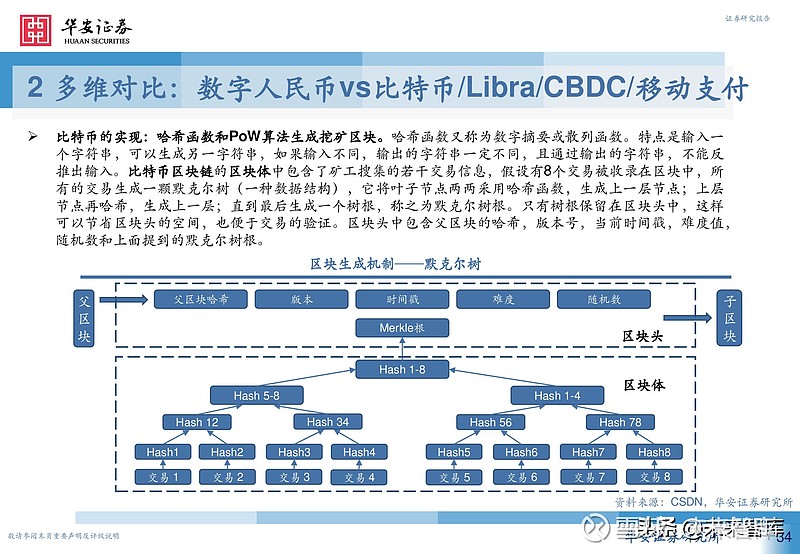

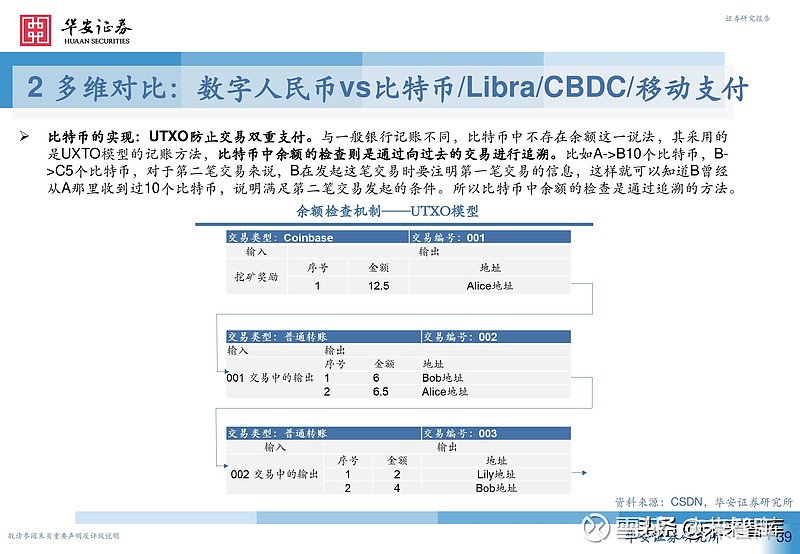

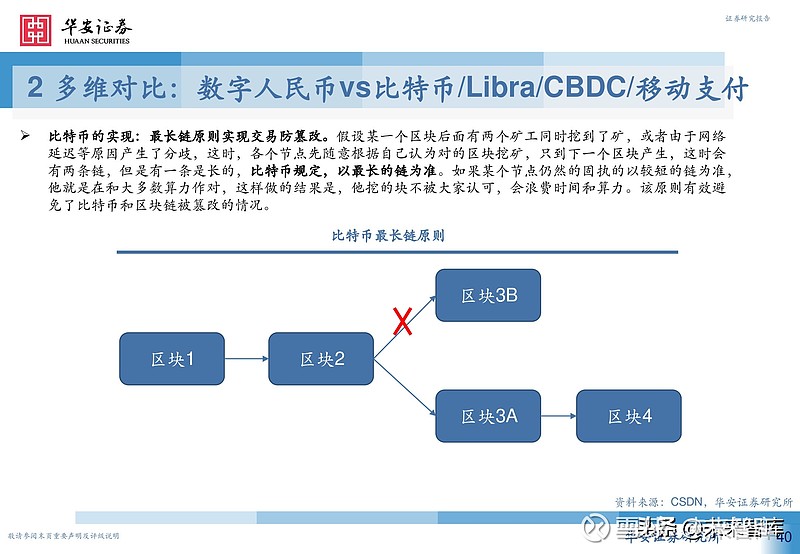

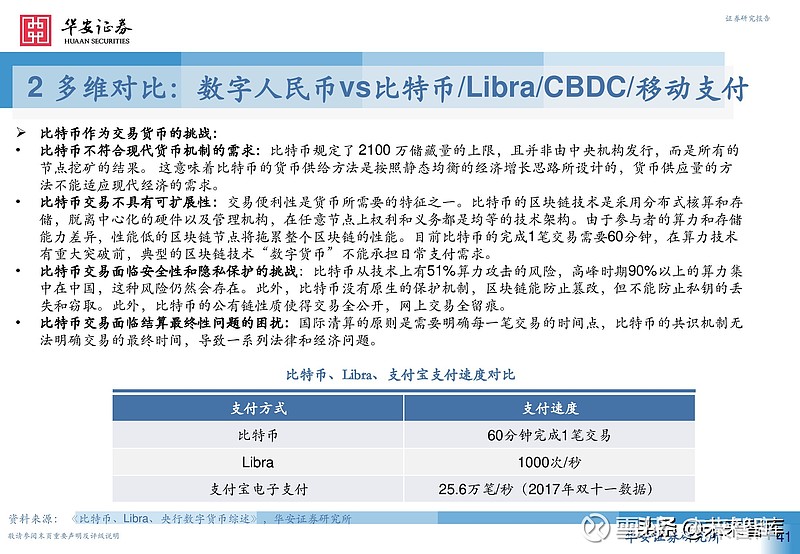

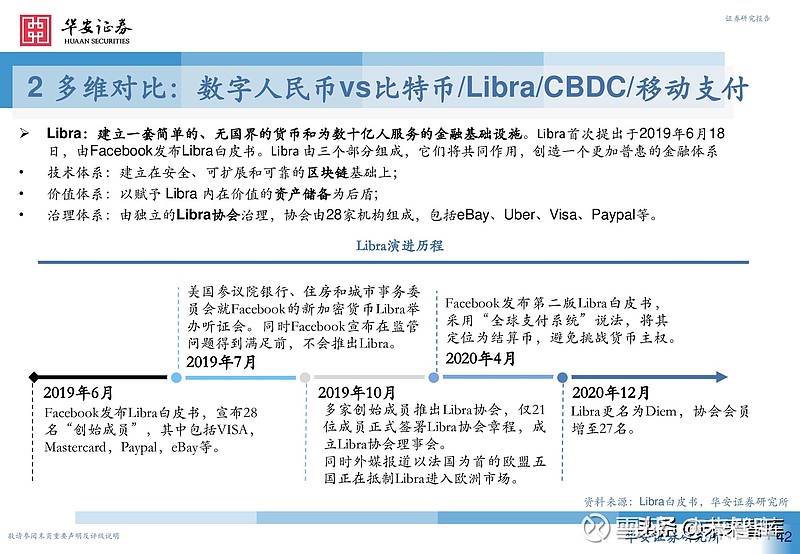

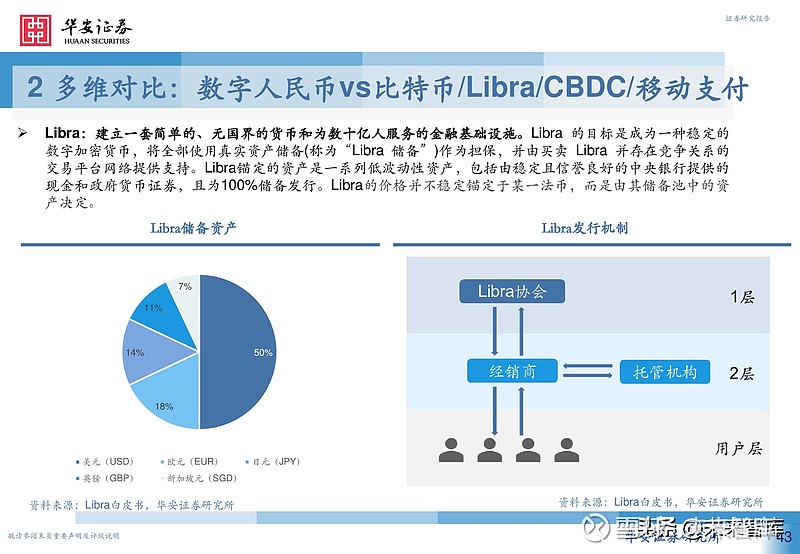

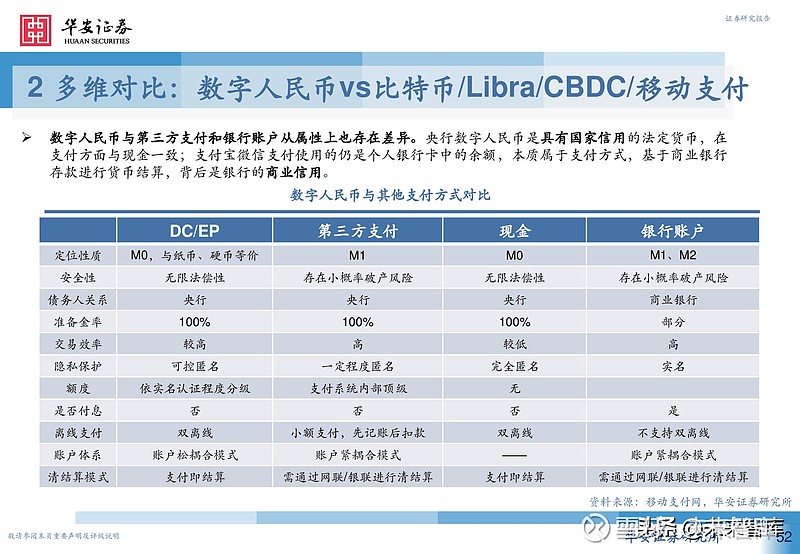

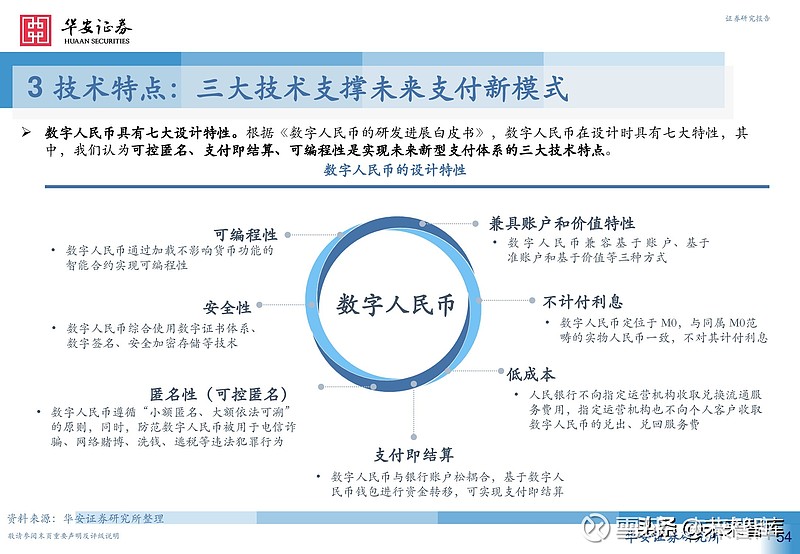

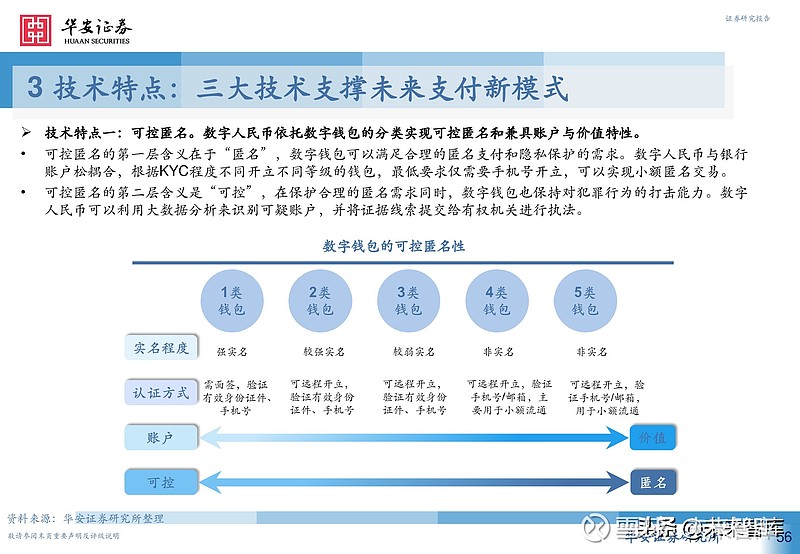

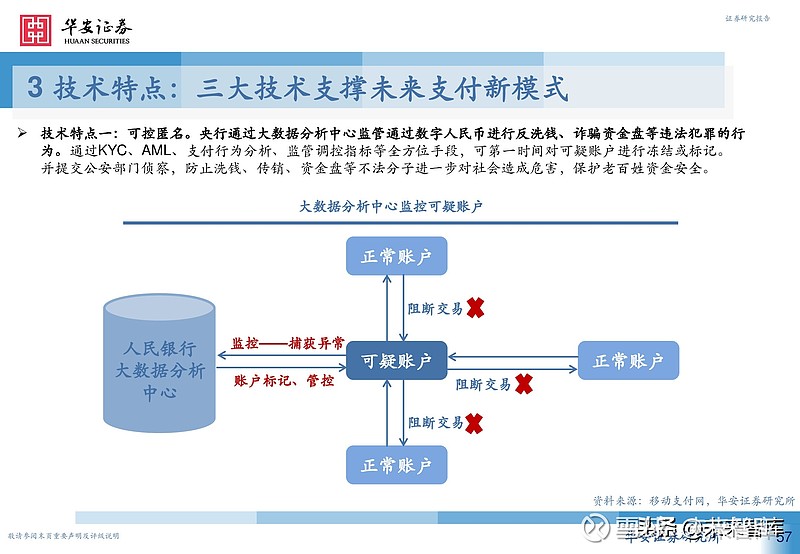

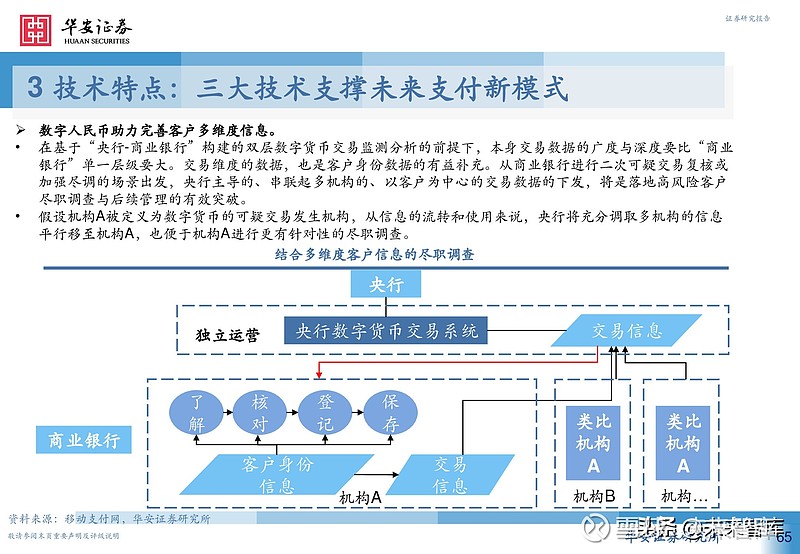

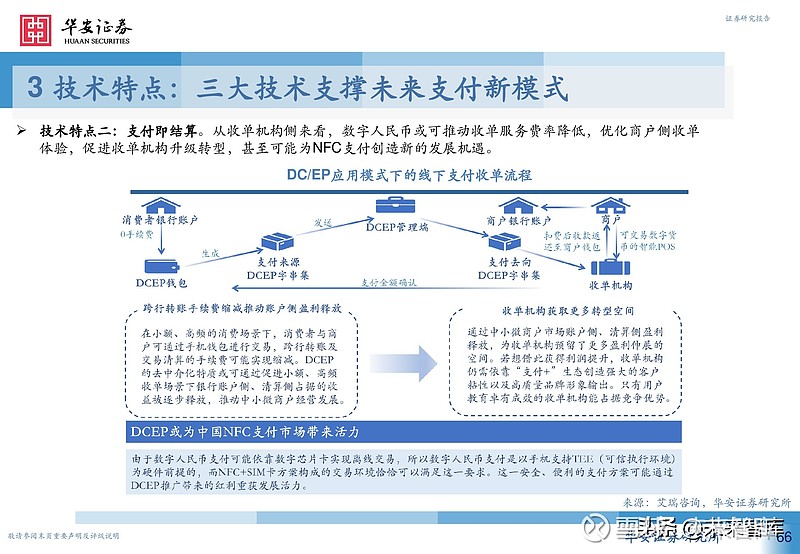

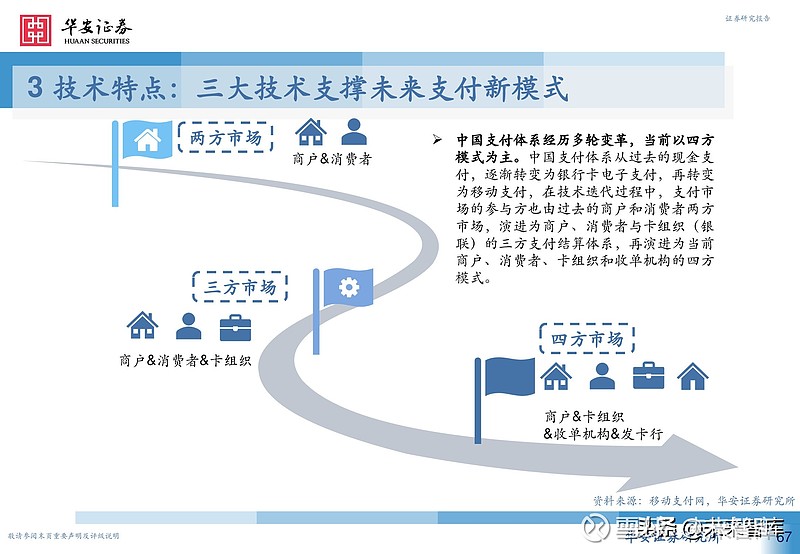

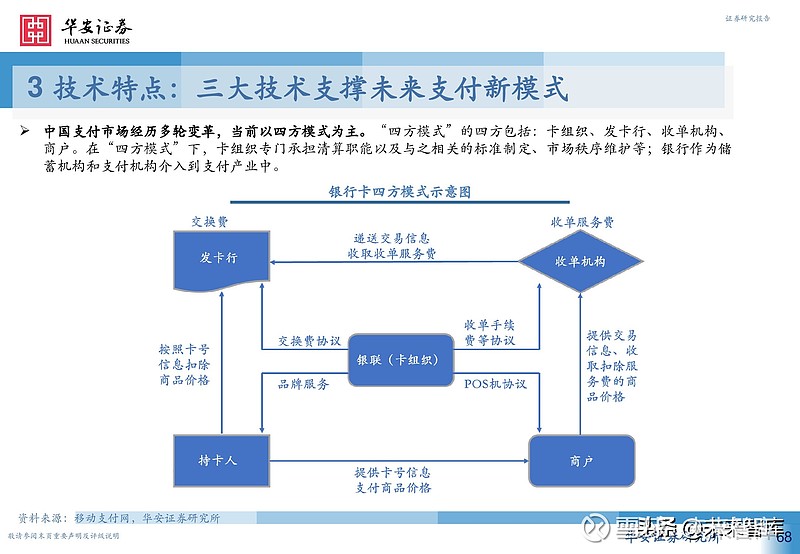

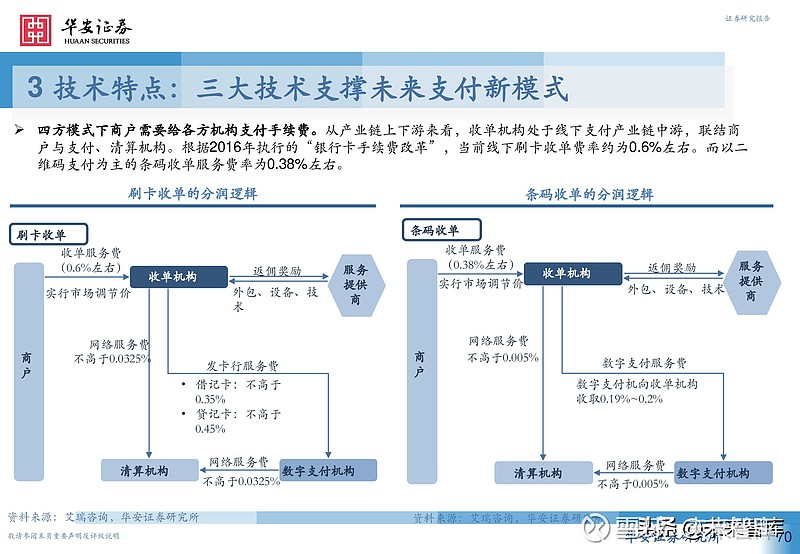

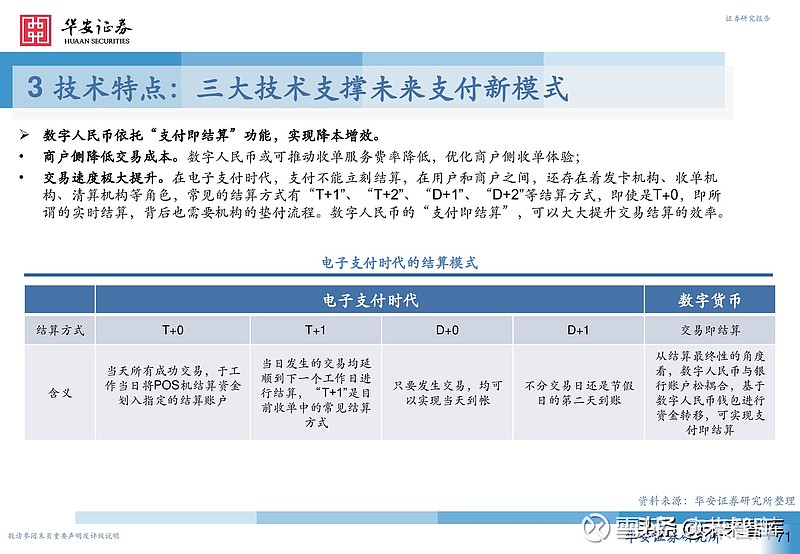

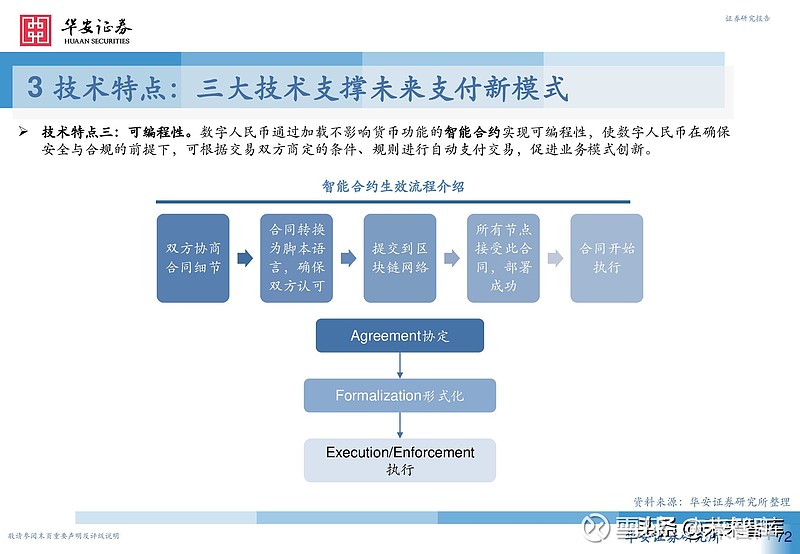

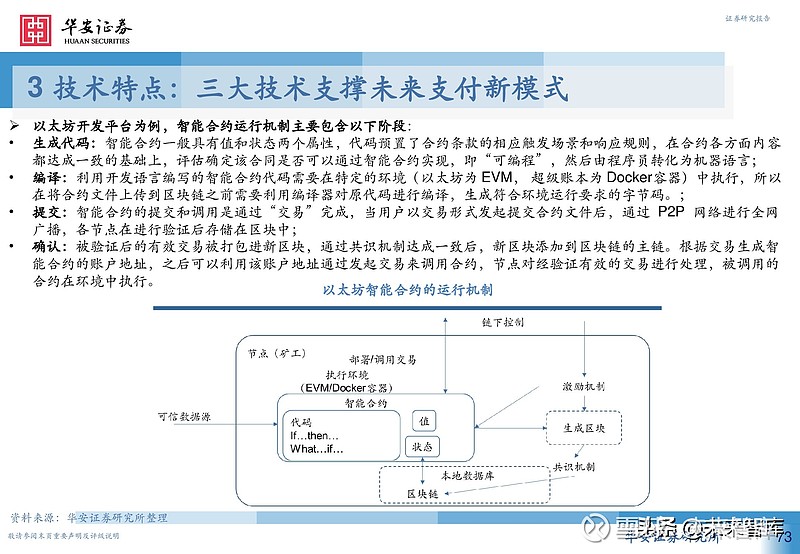

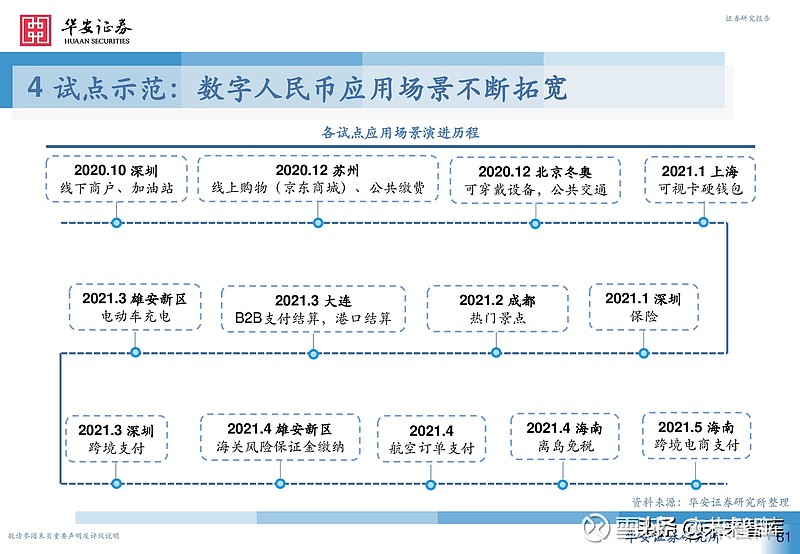

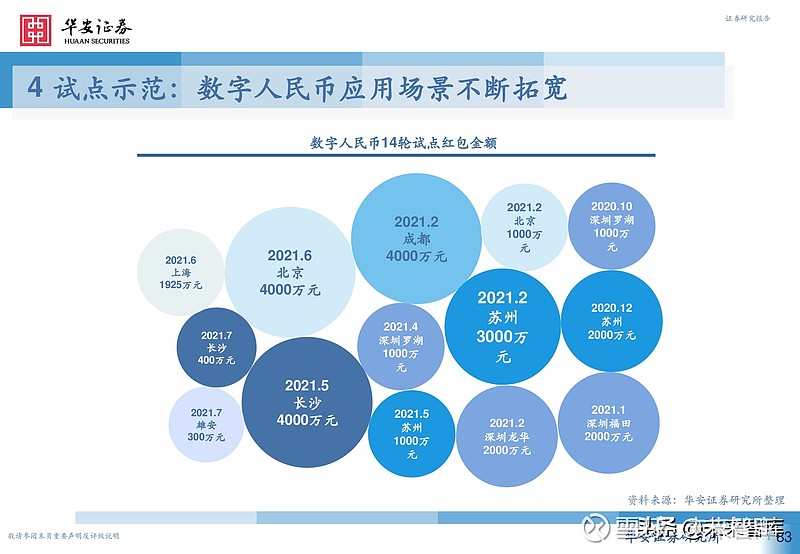

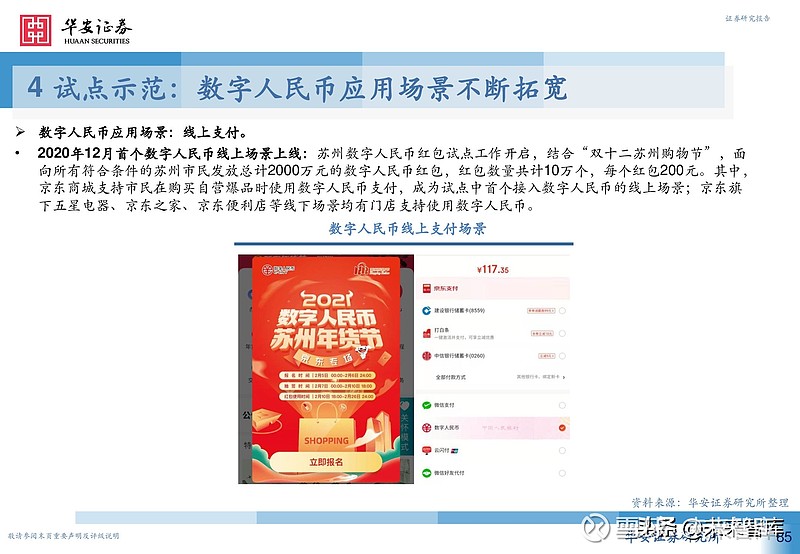

(Reporter: 基本定义:数字人民币是人民银行发行的数字形式的法定货币,由指定运营机构参与运营,以广义账户体系为基础,支持银行账户松耦合功能,与实物人民币等价,具有价值特征和法 偿性。根据央行发布的《中国数字人民币的研发进展白皮书》,我们认为数字人民币具有四大基础特征。 Basic definition: Digital renminbi is the legal currency in the form of figures issued by the People’s Bank and is operated with the participation of designated operators, based on a broad system of accounts, which supports bank account coupling functions that are equivalent to real renminbis and have value characteristics and legal & nbsp; and is compensatory. According to the White Paper on the Progress of Research and Development of Chinese Digital renminbi, published by the Central Bank, we believe that digital renminbi has four basic features. 基础特征一:数字人民币是央行发行的法定货币,以国家信用为支撑,具有法偿性。 Basic characteristic one: The digital renminbi is the legal currency issued by the Central Bank and is supported by State credit and is legal in nature. 数字人民币具备货币的价值尺度、交易媒介、价值贮藏等基本功能,是央行对公众的负债,以国家信用为支 撑,具有法偿性,与实物人民币一样是法定货币; 从货币发展历程看,货币形态随着科技进步、经济活动发展不断演变,实物、金属铸币、纸币均是相应历史 时期发展进步的产物。历史上,在官定货币流通的同时,私铸货币和外来货币也不同程度地存在。当前,比 特币、Libra等加密资产试图发挥货币职能,又开始了新一轮私铸货币、外来货币与法定货币的博弈。因此, 数字人民币为数字经济发展提供通用性的基础货币。 Digital renminbi has the basic function of monetary value scale, trade medium, value deposit, etc., which is the central bank’s liability to the public, with state credit as a subsidised & nbsp; maintenance, legal remunerative, as in kind, is the legal currency; monetary development history in monetary form, as scientific and technological progress and economic activity evolves, and in kind, metal molars and banknotes are the corresponding historical & nbsp; the result of the progressive development of the period. Historically, private and foreign currencies have existed to varying degrees in parallel with official currency circulation. 基础特征二:数字人民币主要定位于现金类支付凭证(M0),将与实物人民币长期并存。 Basic characteristic II: The digital renminbi is located mainly in cash-type payment vouchers (M0), and will be permanently co-located with the real renminbi. 当前批发资金依托支付系统已经实现了电子化,用数字人民币替代M1和M2,既无助于提高支付效率,也会 造成现有系统和资源的巨大浪费。另一方面,公众对现金的依赖度仍然很高,现金管理成本较高,需要数字 化改造。 从M0的收费体系来看,数字人民币不计付利息,央行不向发行层收取兑换流通服务费用,商业银行也不向个 人客户收取数字人民币的兑出、兑回服务费。 On the other hand, public dependence on cash remains high, and cash management costs are high, requiring a number & nbsp; transformation. & nbsp; according to M0’s fee system, the digital renminbi does not charge interest, the central bank does not charge the issuing layer for exchange and circulation services, and commercial banks do not charge one & nbsp; and the customer of the digital renminbi for exchange and return services. 基础特征三:数字人民币采取中心化管理、双层运营。 Basic characteristic three: the digital renminbi is managed centrally and operates in two layers. DC/EP的运行分为3层体系:第1层参与主体包括中央 银行和商业银行,涉及发行、回笼以及在商业银行之间转移;第2层是商业银行到个人或企业用户的数字货币 兑换;第3层是个人或企业用户之间数字货币的流通,DC/EP在个人或企业的数字货币钱包之间转移。 DC/EP operates in a three-tier system: the first tier of participants includes central & nbsp; banks and commercial banks, involving distribution, cage return and transfer between commercial banks; the second tier is the digital currency from commercial banks to individual or enterprise users & nbsp; conversion; the third level is the circulation of digital currency between individual or enterprise users, and the DC/EP is the transfer between individual or enterprise digital money wallets. 基础特征四:数字人民币是一种零售型央行数字货币,主要用于满足国内零售支付需求。 Basic characteristic four: The digital renminbi is a retail central bank digital currency used primarily to meet domestic demand for retail payments. 央行数字货币根据用户和用途不同可分为批发型和零售型:批发型主要面向商业银行等机构类主体发行,多 用于大额结算;零售型主要面向公众发行并用于日常交易。 各主要国家或经济体研发央行数字货币的重点各有不同,有的侧重批发交易,有的侧重零售系统效能的提高。 数字人民币充分满足公众日常支付需要,进一步提高零售支付系统效能,降低全社会零售支付成本。 The central bank's digital currency can be divided into wholesale and retail depending on the user and use: the wholesale model is mainly addressed to institutional subjects such as commercial banks, with more than it is used for large settlements; and the retail model is primarily aimed at public distribution and is used for day-to-day transactions. & nbsp; the major countries or economies have different priorities for research and development of central bank's digital currency, with some focusing on wholesale transactions and others on improving the effectiveness of the retail system. & nbsp; the digital renminbi adequately meets the daily payment needs of the public, further improving the effectiveness of retail payment systems and reducing the cost of retail payments across society. 比特币:一种基于密码学的货币,建立去中心化的信任机制。 Bitcoin: a cipher-based currency that establishes decentralised trust mechanisms. 比特币最初于2008年由中本聪提出,该系统允 许任何有交易意愿的双方直接交易。而非通过一个可信任的第三方,因此具有去中心化、交易匿名、不易篡 改、难以追溯等特点。与电子钱包转账-银行记账-国家信用背书的形式不同,比特币以区块链为底层技术, 通过去中心化电子记账系统,由参与者共同记账,交易信息平等地记在区块链的所有节点上,篡改信息需要 得到51%以上节点的认证,耗费成本巨大,因此不需要第三方机构进行信任背书即可实现去中心化的点对点 交易,同时避免信息不对称。 Bitcoin was originally proposed in 2008 by China, and the system promised & nbsp; allowed any willing parties to deal directly. Instead of a trusted third party, it was decentralized, anonymous, unmanageable modified and difficult to trace. Unlike electronic wallet transfers, bank accounts, and national credit endorsements, Bitcoin is a bottom-of-line technology, by decentralizing the electronic bookkeeping system, transaction information is recorded equally at all points in the block chain & nbsp; certified by more than 51% of the nodes, which is costly, and thus does not require a trust endorsement by a third-party institution to do centralization & nbsp; and by decentralizing the electronic booking system, transaction information is recorded equally at all points of the block chain & nbsp; and, at the same time, information asymmetries are avoided. Libra:建立一套简单的、无国界的货币和为数十亿人服务的金融基础设施。 Libra: Create a simple, borderless currency and financial infrastructure for billions of people. Libra首次提出于2019年6月18 日,由Facebook发布Libra白皮书。Libra 由三个部分组成,它们将共同作用,创造一个更加普惠的金融体系 ? 技术体系:建立在安全、可扩展和可靠的区块链基础上; ? 价值体系:以赋予 Libra 内在价值的资产储备为后盾; 治理体系:由独立的Libra协会治理,协会由28家机构组成,包括eBay、Uber、Visa、Paypal等。 Libra's first paper was launched on 18 June 2019, by . Libra is composed of three parts, which will work together to create a more inclusive financial system technical systems: based on a secure, scalable and reliable block chain; ? value systems: backed up by & nbsp; value reserves in Libra = value asset reserve; & nbsp: governance by an independent Libra association, composed of 28 institutions, including eBay, Uber, 各国CBDC对比:技术路线存在较大差异。 CBDC comparison: Technology routes vary considerably. CBDC(央行数字货币)的研发计划被多国央行提上日程,目前 已有几个国家(地区)的央行在法定数字货币实践上取得进展。从技术特点来看,定位批发型和零售型的国 家均有。 The CBDC (Central Bank Digital Currency) R & D program is on the agenda of the multinational central banks, now & nbsp; several national (regional) central banks have made progress in legal digital monetary practice. Technically, the location of wholesale and retail countries & nbsp; all. 数字人民币与第三方支付和银行账户从属性上也存在差异。 There are also differences in the properties of the digital renminbi vis-à-vis third-party payments and bank accounts. 央行数字人民币是具有国家信用的法定货币,在 支付方面与现金一致;支付宝微信支付使用的仍是个人银行卡中的余额,本质属于支付方式,基于商业银行 存款进行货币结算,背后是银行的商业信用。 The central bank's digital renminbi is the legal currency with State credit and is consistent with cash in 数字人民币具有七大设计特性。其 中,我们认为可控匿名、支付即结算、可编程性是实现未来新型支付体系的三大技术特点。 Digital renminbi has seven major design features. Its & nbsp; in it, we believe that controlled anonymity, payment, settlement, programming are the three main technical features of a new payment system for the future. 技术特点一:可控匿名。数字人民币依托数字钱包的分类实现可控匿名和兼具账户与价值特性。 Technical feature one: Controllable anonymity. The digital renminbi is classified according to its digital wallet to achieve controlled anonymity and a combination of account and value characteristics. 可控匿名的第一层含义在于“匿名”,数字钱包可以满足合理的匿名支付和隐私保护的需求。数字人民币与银行 账户松耦合,根据KYC程度不同开立不同等级的钱包,最低要求仅需要手机号开立,可以实现小额匿名交易。 可控匿名的第二层含义是“可控”,在保护合理的匿名需求同时,数字钱包也保持对犯罪行为的打击能力。数字 人民币可以利用大数据分析来识别可疑账户,并将证据线索提交给有权机关进行执法。 The first tier of controlled anonymity means “faceless” and digital wallets meet the legitimate need for anonymous payment and privacy protection. The digital renminbi is coupled with bank & nbsp; accounts are loosely coupled with different levels of wallets depending on the level of KYC, and the minimum requirement requires a cell phone number to be opened to enable small anonymous transactions. the controlled anonymous second tier means “controllable”, while protecting the legitimate need for anonymity, digital wallets maintain their ability to combat criminal behaviour. 技术特点二:支付即结算。 Technical feature II: Payments are settled. 从收单机构侧来看,数字人民币或可推动收单服务费率降低,优化商户侧收单 体验,促进收单机构升级转型,甚至可能为NFC支付创造新的发展机遇。 On the side of the billing agency, the digital renminbi may contribute to a reduction in the billing service rate, optimizing the commercial side bill & nbsp; and experience, promoting the upgrade of the billing agency, which may even create new development opportunities for NFC payments. 中国支付体系经历多轮变革,当前以四方 模式为主。中国支付体系从过去的现金支 付,逐渐转变为银行卡电子支付,再转变 为移动支付,在技术迭代过程中,支付市 场的参与方也由过去的商户和消费者两方 市场,演进为商户、消费者与卡组织(银 联)的三方支付结算体系,再演进为当前 商户、消费者、卡组织和收单机构的四方 模式。 China’s payment system has undergone many rounds of change and is now dominated by a quadripartite & nbsp; model. China’s payment system has evolved from cash & nbsp; payments have gradually been transformed into electronic payments for bank cards; has been transformed; for mobile payments, the city & nbsp has been paid in the course of technology rotation; participants in the field are also former traders and consumers & nbsp; the market, which has evolved into a tripartite payment settlement system for merchants, consumers and card organizations (Silver & nbsp; Unions), which has evolved into the current & nbsp; a quadripartite & nbsp model for merchants, consumers, card organizations and billing agencies. 技术特点三:可编程性。 Technical characteristic three: programmable nature. 数字人民币通过加载不影响货币功能的智能合约实现可编程性,使数字人民币在确保 安全与合规的前提下,可根据交易双方商定的条件、规则进行自动支付交易,促进业务模式创新。 The digital renminbi is programmed through the loading of smart contracts that do not affect the function of the currency, so that the digital renminbi can, under conditions of security and compliance, engage in automatic payment transactions on terms and rules agreed between the parties to the transaction and promote innovation in the business model. 数字人民币试点有序推进,应用场景范围逐渐扩大。截至2021年6月30日,数字人民币试点受邀白名单用户 已超过 1000 万,试点场景超 132 万个,包括批发零售、餐饮文旅、教育医疗、公共交通、政务缴费、税收 征缴、补贴发放等领域。2020年4月19日,数字人民币第一批试点先行在中国深 圳、苏州、“雄安新区”、成都及未来的冬奥场景进行内部封闭试点测试;2020年10月,数字人民币第二批 试点地名单包括上海、海南、长沙、青岛、大连、西安六地。 As of 30 June 2021, the digital renminbi pilot has been invited to the white list user it has exceeded 1000 10,000, the pilot site super 132 10,000, including wholesale retail, catering travel, education and medical care, public transport, government contributions, taxes & nbsp; collection, subsidies, etc. The first digital renminbi pilot was first tested for internal closure on 19 April 2020 in China's deep & nbsp; Shenzhen, Suzhou, “Yunxun District”, Chengdu and future winter Olympic scenes; in October 2020, the second batch of the digital renminbi & nbsp; and the pilot list includes Shanghai, Hainan, Changsha, Qing Island, Large Company, Xianan. 数字人民币应用场景: Digital renminbi application scene: 自动售卖机及超市 Automatic sales machines and supermarkets 数字人民币首次在线下场景应用——深圳罗湖第一次数字人民币试点:深圳市人民政府向在深个人发放5万个共计 1000万元“礼享罗湖数字人民币红包” ,累计4.76万人领取了红包,使用红包支付的业务量6.28万笔,红包支付金 额876.42万元。该红包可在罗湖区辖内已完成数字人民币系统改造的3389家商户无门槛消费。 The first on-line application of the digital renminbi — the first digital renminbi pilot in Shenzhen Lake: the Shenzhen City People's Government distributes 50,000 & nbsps to deep individuals; 10 million yuan “red bag” & nbsp; cumulatively, 476 million people received a red bag, with a total of 6.28 million operations paid in red parcels, and a red bag payment & nbsp; the sum of 87,642,000 yuan. The red package can be consumed without thresholds for 3,389 businesses that have completed the transformation of the digital renminbi system in the Lake Loi district. 适用场景:地铁站“深圳通自助充值机”、自动售货机、便利店、超市及自助收银机等。 Applied scenes: the subway station “Hin Shenzhen Tung self-service machine”, ATMs, convenience stores, supermarkets and self-service cash collectors, etc. 线上支付 It's paid online. 2020年12月首个数字人民币线上场景上线:苏州数字人民币红包试点工作开启,结合“双十二苏州购物节”,面 向所有符合条件的苏州市民发放总计2000万元的数字人民币红包,红包数量共计10万个,每个红包200元。其中, 京东商城支持市民在购买自营爆品时使用数字人民币支付,成为试点中首个接入数字人民币的线上场景;京东旗 下五星电器、京东之家、京东便利店等线下场景均有门店支持使用数字人民币。 In December 2020, the first digital renminbi line was launched: the Sioux digital renminbi (DPR) pilot was launched in conjunction with the “Giisu State Shopping Festival”, and a total of 20 million yuan in digital renminbi (GDR) was distributed to all eligible S-5 citizens, amounting to a total of 100,000 yuan in red bags of 200 yuan each. Of these, Gyeongdong Business City supported the use of digital renminbi payments in the purchase of self-detonated explosives, and became the first of the pilot's leading online access to the DPR; Kington; the next five-star appliances, Kinton House, and the Gyeongdong convenience Shop, among others, supported the use of digital renminbi. 校园支付。 Campus pays. 北航校园支付平台开通数字人民币支付通道:结合党费组织特点与校园卡充值流程要求,现已完成全国高校首 笔数字人民币个人党费、首笔校园卡充值费用缴纳工作。 The North Air Campus payment platform has opened up a digital renminbi payment route: combined with party fee organization features and campus card charging process requirements, work has now been completed on the & nbsp for the head of the country's higher education schools; and a digital yuan personal party fee and the first campus card charging fee has been paid. 西安电子科技大学已拓展数字人民币商户120余户:涵盖餐饮、超市、生活服务等各个领域,为师生打造了就 餐、购书购物、打印复印、就医等日常消费活动的数字人民币消费圈。该校下一步将继续探索数字人民币在教 师工资、学生奖助学金发放,以及各类内部补贴发放、报销、会务活动等学校运营场景的应用。 The University of e-Technology in Xian has expanded its digital renminbi business to more than 120 households: it covers all areas of catering, supermarkets, living services, etc., and it has created a digital renminbi consumer circle for teachers and students; it has been used for daily consumer activities, such as meals, book shopping, printing and photocopying, and medical consultations. The University will continue to explore the use of digital renminbi in teaching & nbsp; teachers’ salaries, student grants and grants, as well as various types of in-house subsidies, reimbursements, meetings, etc. ATM 机和柜台开卡机升级改造:830亿市场空间。 ATM machine and counter opener upgrade: 83 billion market space. 数字人民币部署方面,商业银行需对ATM机和柜台 开卡机实现升级,升级内容包含如下方面: With regard to the deployment of the digital renminbi, commercial banks are required to upgrade ATM machines and counters & nbsp; the card openings are upgraded to include the following: 业务层: 硬钱包的申请(柜台开卡机) ;现钞和数字货币的相互兑换(ATM机); 存款和数字货币的相互兑换(ATM机) ; Level of operations: applications for hard wallets (stand-opener) & nbsp; convertible banknotes and digital currencies (ATM); & nbsp; convertible deposits and digital currencies (ATM machines) & nbsp; 软件层: 现钞&数字货币兑换操作系统(ATM机); 对接数字货币发行系统(ATM机和柜台开卡机) Software layer: cash & digital currency exchange operating system (ATM machine); docking digital currency distribution system (ATM machine and counter-opener) 硬件层: 适配不同的银行卡、钱包(ATM机) ;对接各大银行数字货币系统及ATM设备接口 (ATM机和柜台开卡机) ;支持二维码及NFC交互功能(ATM机)。 Hardware layer: suitable for different bank cards, wallets (ATM machines) & nbsp; docking of major banking digital currency systems and ATM device interfaces & nbsp; ATM and counter opening machine) & nbsp; supporting two-dimensional codes and NFC interactive functions (ATM machines). 硬钱包介质:340亿市场空间。 Hard wallet medium: 34 billion market space. 硬件钱包的形态多种多样,但本质在于其具有硬件安全单元,目前所曝光常 见的便是可视卡、指纹卡等卡片形态的硬件钱包。此外,数字人民币的可视卡、可穿戴产品主要针对的是特 定的场景和特定的人群,比如冬奥会场景的智能手环等。我们根据中国人口结构进行测算,假设0-14岁使用 硬钱包的比例是30%,15-64岁由于移动支付习惯,使用硬钱包的比例是20%;65岁以上使用硬钱包的比例 40%,每个数字人民币硬钱包的价值为100元,则这个市场总规模达到338.71亿元。 Hardware wallets are in a variety of forms, but the essence is that they have hardware security units and are now exposed to see also hardware wallets in the form of visual cards, fingerprint cards, etc. Moreover, the digital renminbi's visual cards, wearable products, are predominantly targeted at T set scenes and specific groups, such as smart handring rings for the Winter Olympics. Based on the Chinese population structure, we measure the use of between 0-14 years of age; the proportion of hard wallets between 15-64 years of age and 20 per cent for mobile payment practices; the proportion of hard wallets used over 65 years of age & & nbsp; and 40 per cent of the value of hard wallets per digit is 100 yuan, the total size of the market is 3,3871 million yuan. POS机升级改造:192亿市场空间。 POS machine upgrade: 19.2 billion market space. 从试点过程中的支付方式来看,“扫一扫”和“碰一碰”是主要的两种近程支 付方式。其中“碰一碰”利用NFC技术的近程支付方式,可以在线进行也可以离线进行。在线情况下,可以利用 POS机或专用芯片进行支付,用户打开数字人民币APP,点击设置界面打开NFC,用手机与商户POS机感应区轻轻 “碰一碰”,即可实现支付。为了支持“碰一碰”这种支付方式,商家需对POS机进行升级,以支持NFC感应支付。 2020年银行卡联网机具(POS机)数量有所增长 ,联网机具3833.03 万台,按照POS机升级改造500元/台测算,改 造市场空间约为191.65亿元。 In terms of the way payments are made in the pilot process, “scanning” and “touching” are the two main near-distance payments & nbsp; payment methods. In this case, “touching” the near-distance payment using NFC technology can be done online or offline. On-line, payments can be made using POS machines or special chips can be used; users can open digital renminbi APPs and click on the setup interface to open NFCs; a light & nbsp with the business POS machine; “touching” can be paid. To support the “touching” payment method, merchants will have to upgrade the POS machines to support NFC sense payments. & nbsp; the number of bank card-connected devices (POS machines) increased by & nbsp in 2020; network devices 3833.03 & nbsp; 10,000 stations will be upgraded to & nbsp according to the POS machine upgrading of 500 yuan/stations; and market-building space is approximately $19165 million. 银行IT系统升级:51亿市场空间。 Bank IT system upgrade: 5.1 billion market space. 数字货币的应用促进商业银行进行全面的银行IT系统升级,主要包括: 加密验证:完成数字货币字符串的传输验证,使自助设备具备数字货币交易能力应用系统:实现软/硬钱包开设及回收等业务 ;手机客户端:手机银行APP新增数字人民币模块,并不断扩大子钱包范围(2层);我们根据商业银行的等级以及所处的流通发行层级进行估算,整体市场规模接近51.31亿元。 The application of digital money has facilitated a comprehensive upgrade of the banking system by commercial banks, including, inter alia: encryption validation: completion of transmission validation of the digital currency string, enabling self-service equipment to have a digital currency transactional capability application: realization of operations such as soft/hard wallet opening and recovery & & nbsp; mobile phone client: mobile phone bank APP's new digital renminbi module and expanding the range of wallets (2 floors); we estimate the size of the market as a whole, close to $5,131 million, based on the class of commercial banks and their distribution level. (本文仅供参考,不代表我们的任何投资建议。如需使用相关信息,请参阅报告原文。) (This document is for information purposes only and does not represent any of our investment proposals. For relevant information, please refer to the original version of the report. 详见报告原文。 For details, see the original report. & nbsp; & nbsp; & nbsp; & nbsp; & nbsp; 精选报告来源:【未来智库官网】。 Selected sources: 1 发展概述:数字人民币具备四大基础特征

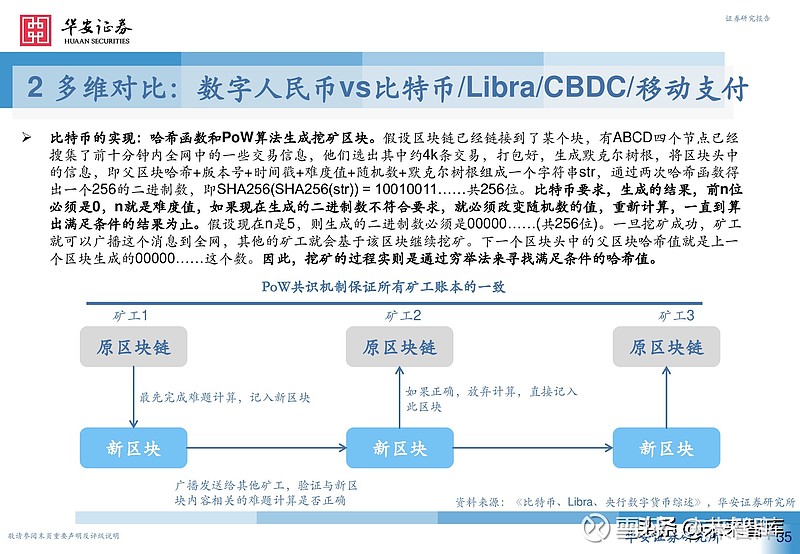

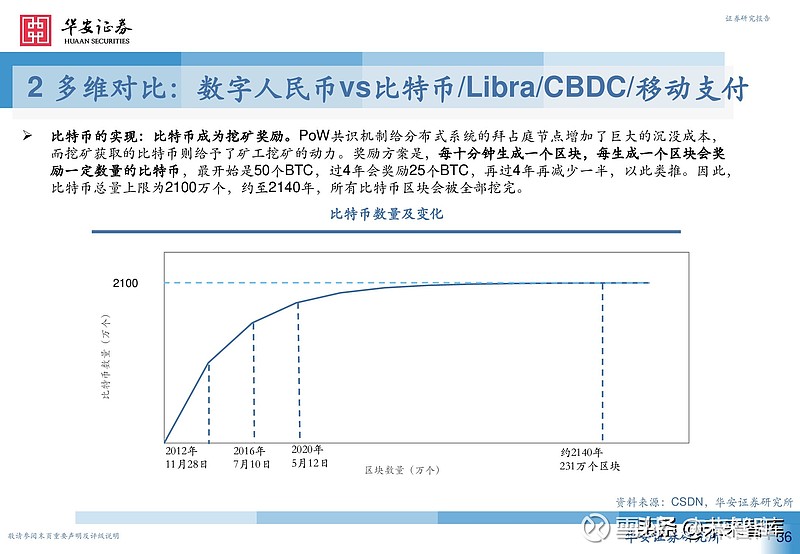

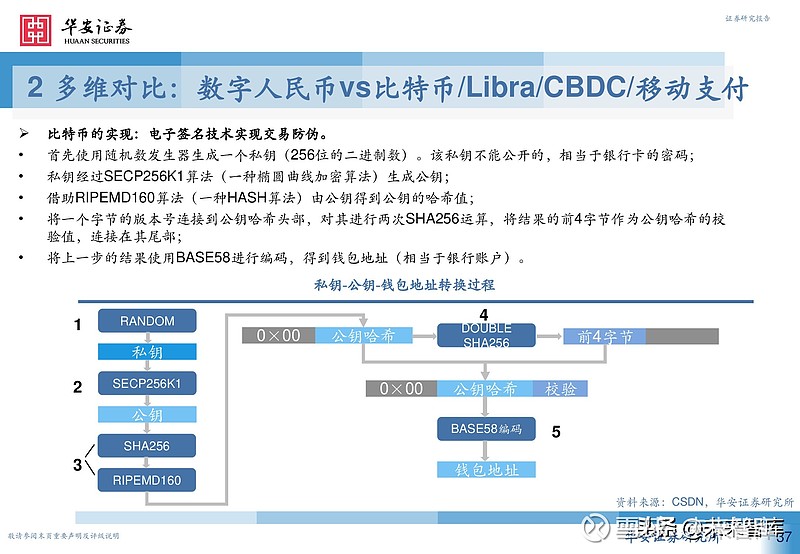

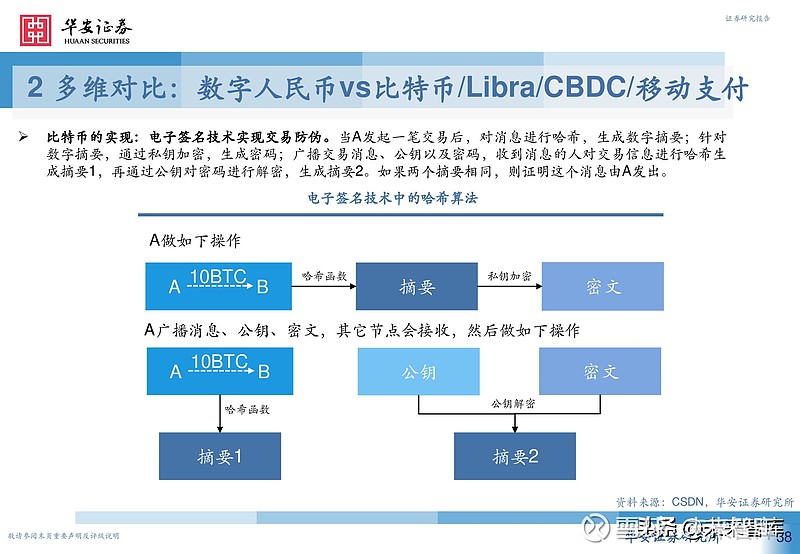

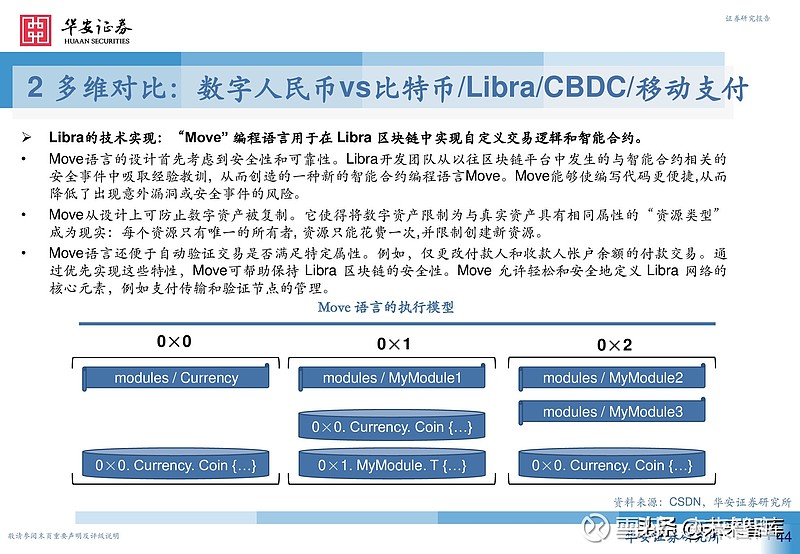

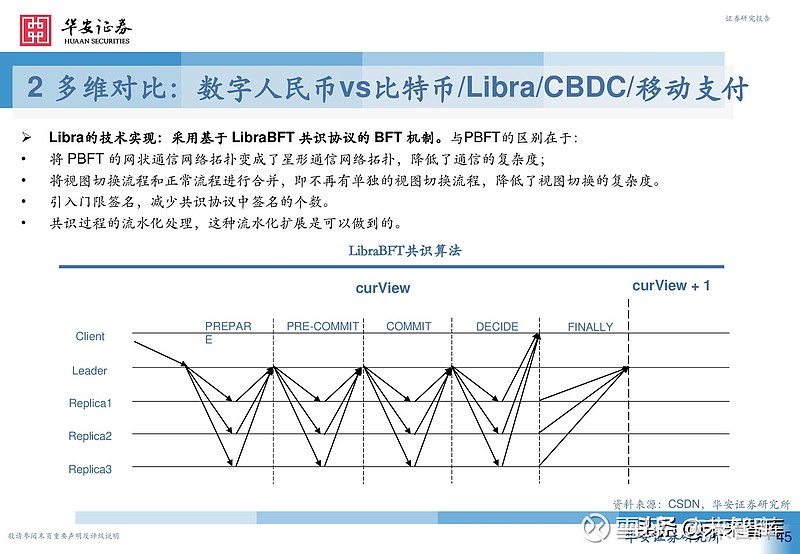

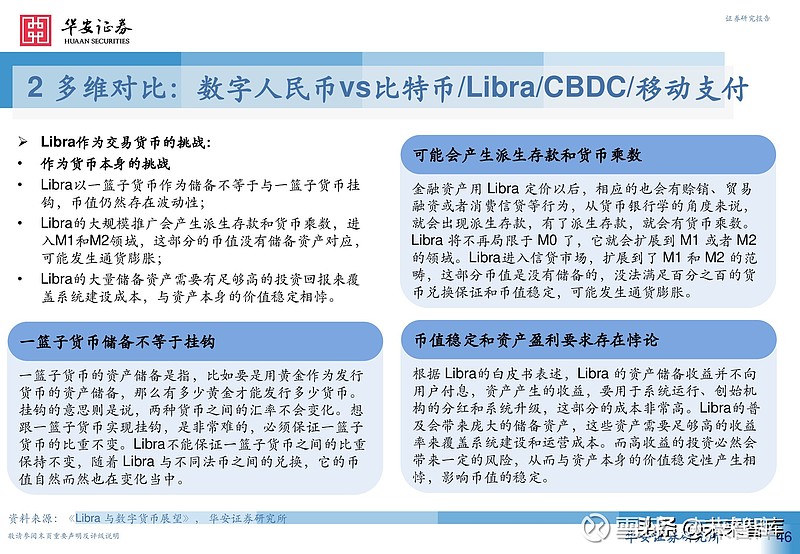

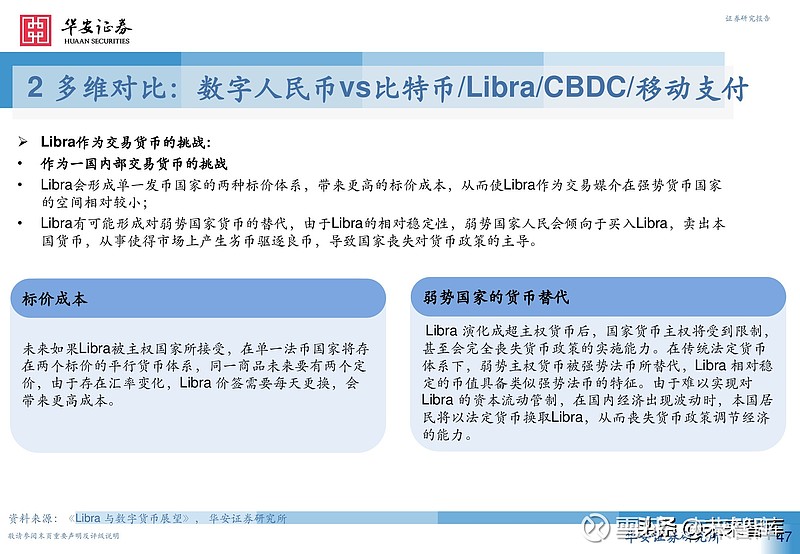

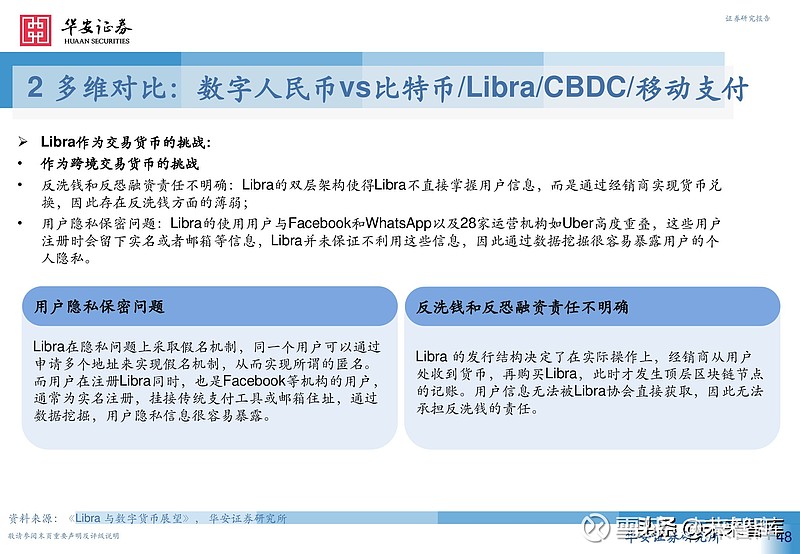

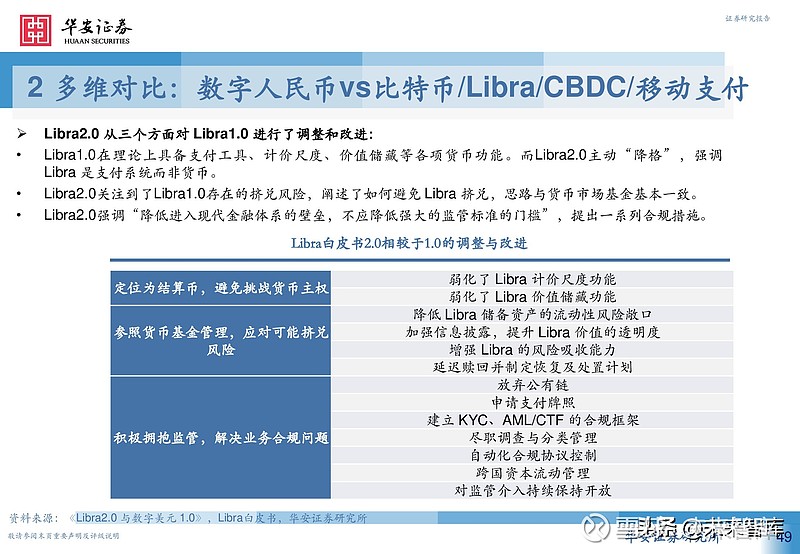

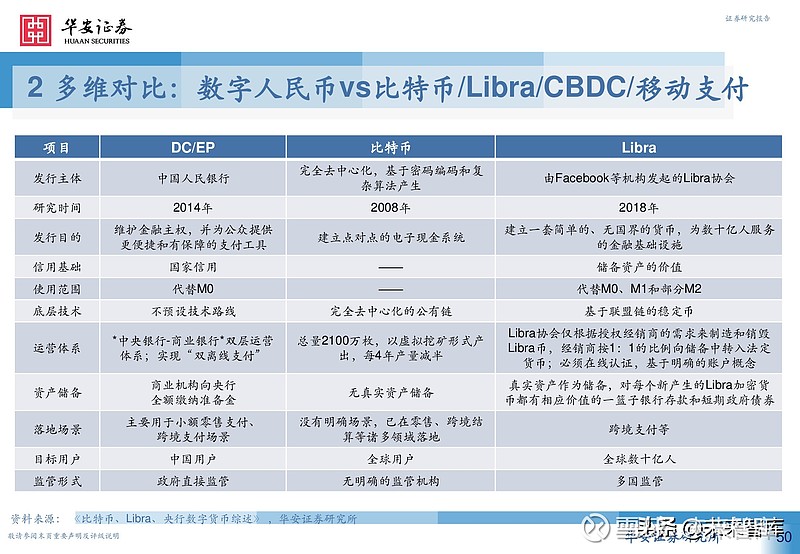

2 多维对比:数字人民币vs比特币/Libra/CBDC/移动支付

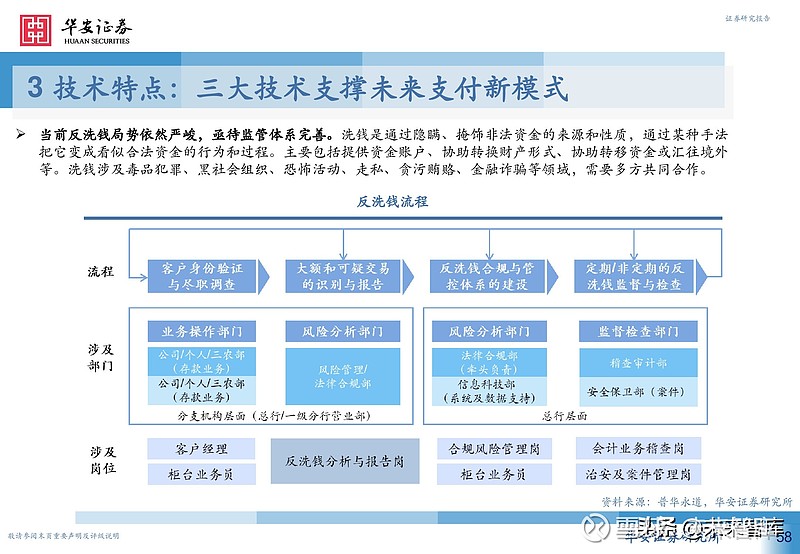

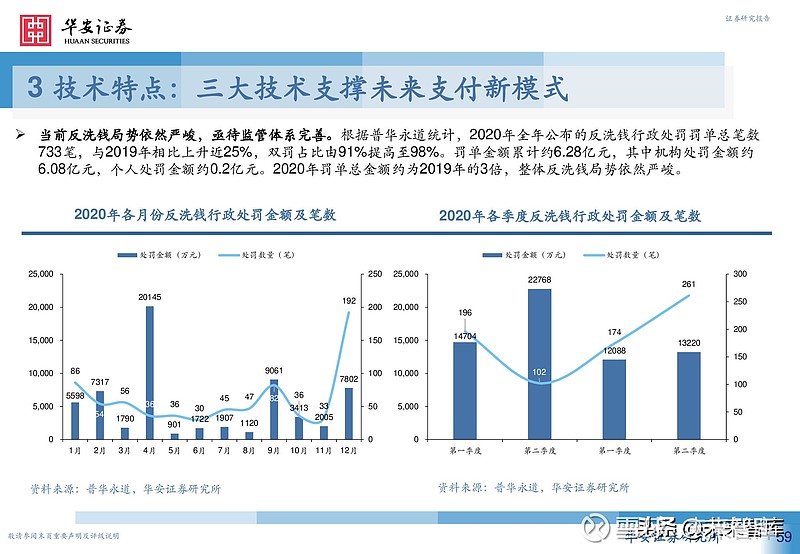

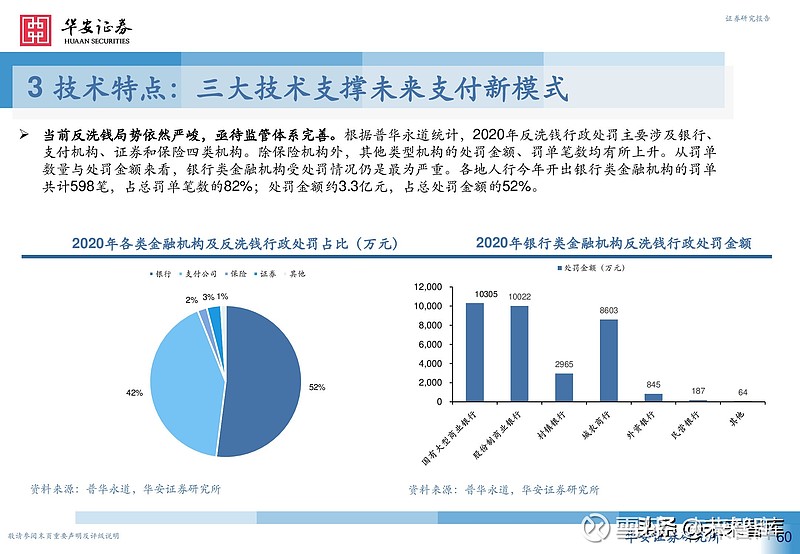

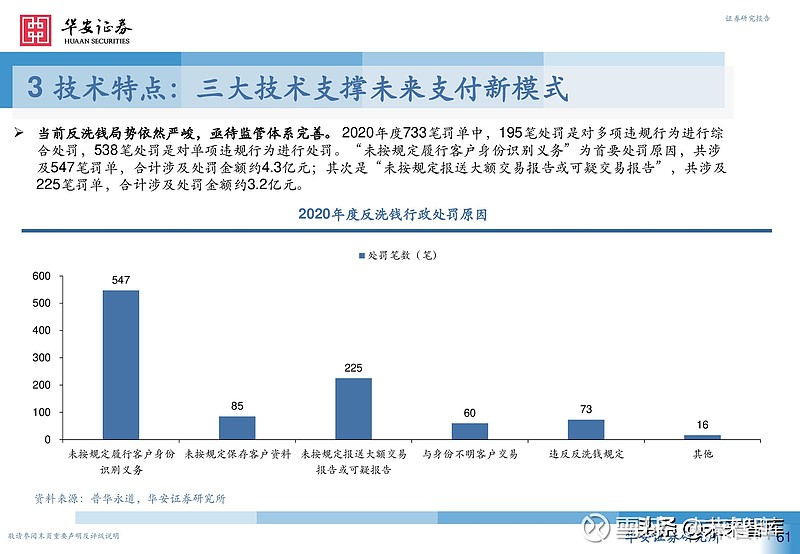

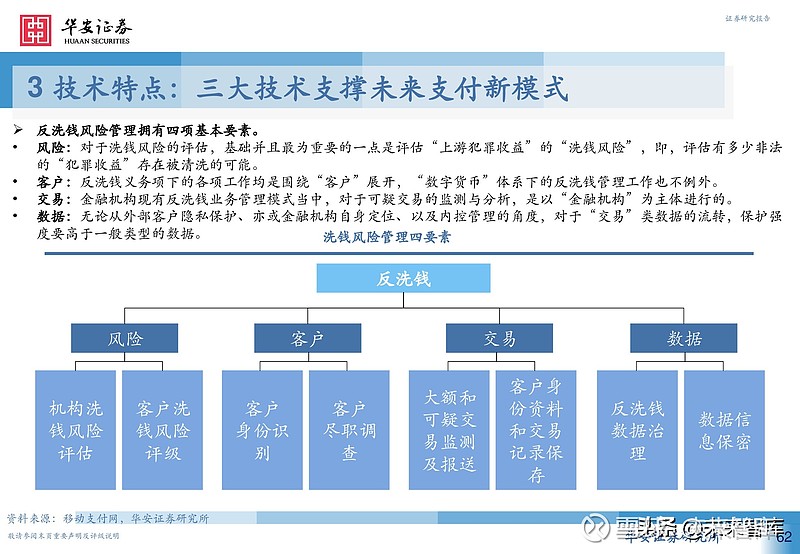

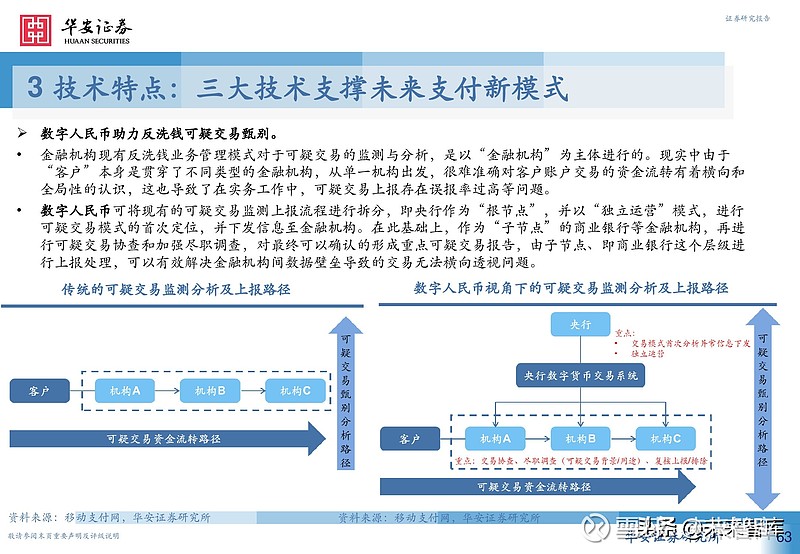

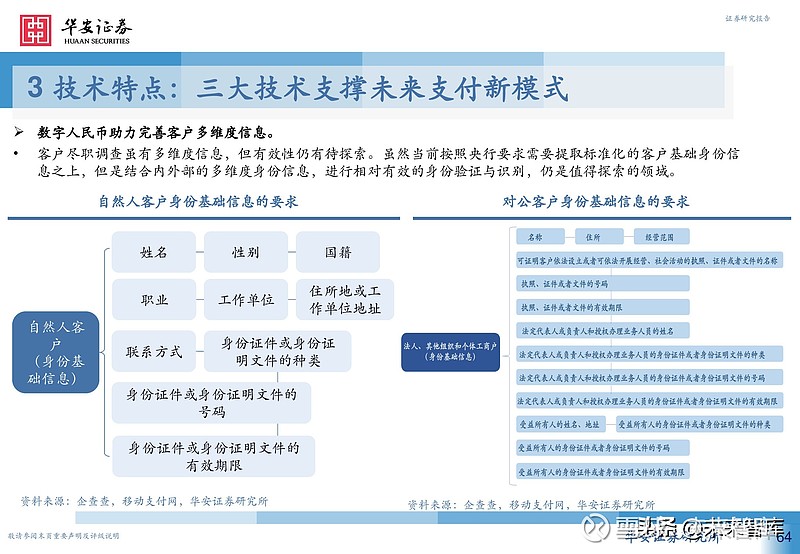

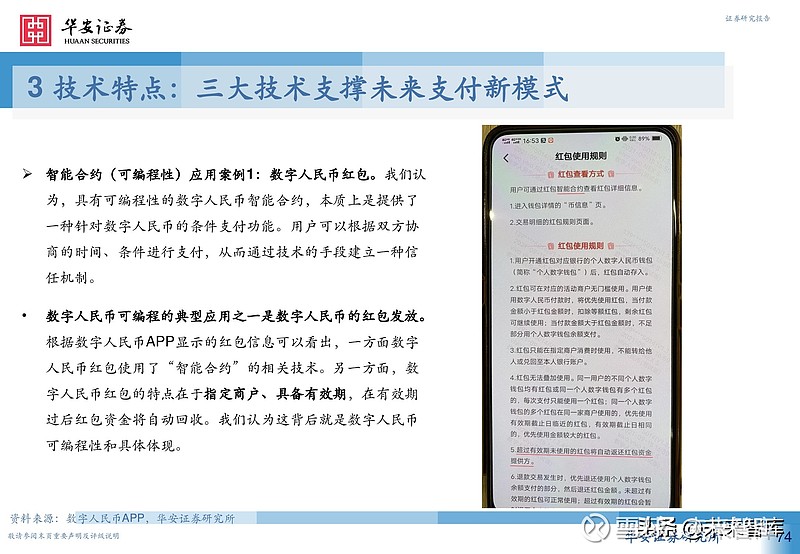

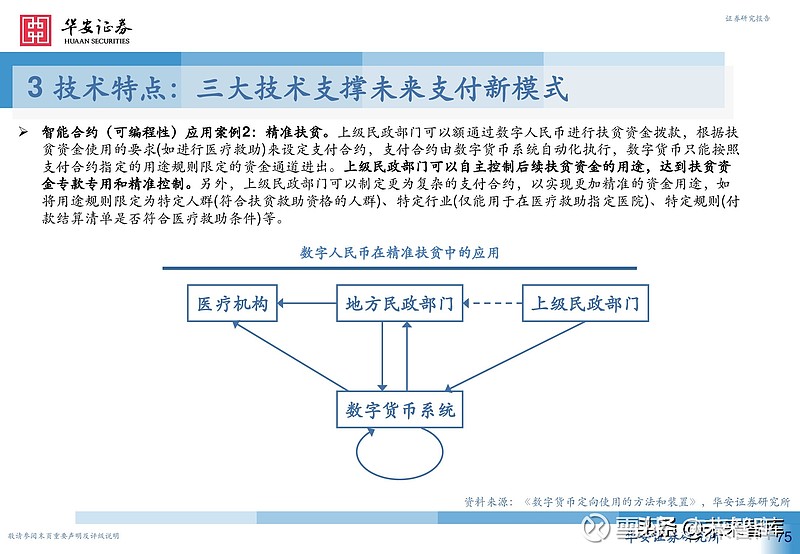

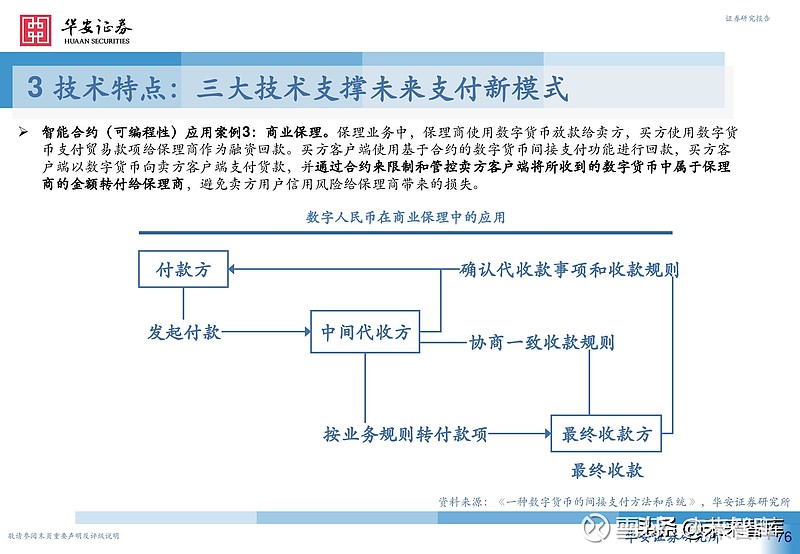

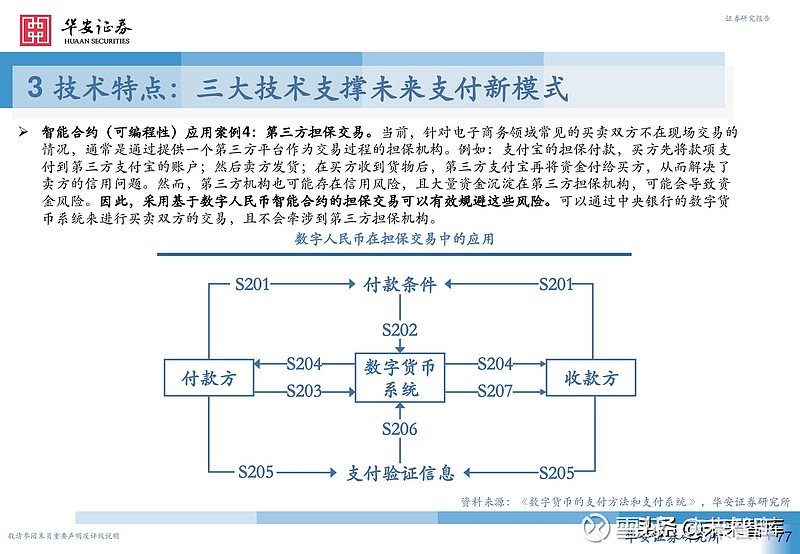

3 技术特点:三大技术支撑未来支付新模式

4 试点示范:数字人民币应用场景不断拓宽

5 生态建设:产业升级带来广阔投资机会

报告节选:

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论