自2022年11月2日晚间CoinDesk报道Alameda Research和FTX的资产负债表不合理,到11月11日晚间FTX官方宣布FTX US、Alameda Research Ltd和大约130家其他附属公司(合称“FTX集团”)根据《美国破产法》第二章在特拉华州地区开启破产程序,已过去10日。

From the evening of 2 November 2022, CoinDesk reported that Alameda Research and FTX balance sheets were not reasonable, until the evening of 11 November, when FTX officially announced that FTX US, Alameda Research Ltd and some 130 other subsidiaries (collectively known as the “FTX Group”) had opened insolvency proceedings in the Delaware region under Chapter II of the United States Bankruptcy Code, 10 days had passed.

10天里Alameda Research和FTX相关的事态不断反转,直到11月9日凌晨加密社区终于确认FTX交易所资金储备存在巨大缺口,随即FTX交易所的用户便因挤兑无法提现。

The events associated with Alameda Research and FTX were reversed for 10 days, until the encryption community finally confirmed in the early hours of 9 November that there was a huge shortfall in the FTX exchange fund reserve, and the users of the FTX exchange were unable to collect the funds due to a run-off.

对此,多个加密平台对因为FTX平台暴雷而遭遇资产损失的用户抱以同情之心,也有平台尽自己最大努力帮助资产被困用户打开逃生通道。前有币安欲通过收购避免FTX暴雷对加密行业带来的影响,后通过尽调放弃收购。后有波场创始人、火币全球顾问孙宇晨发起为部分用户提供逃生通道。

In response, several encryption platforms sympathize with users who have suffered asset losses as a result of FTX platform thunders, and others do their best to help asset-suffering users open the escape route. There was an attempt to avoid the impact of FTX thunders on the encryption industry by acquiring money before giving up the acquisition at all.

孙宇晨帮助部分用户逃出生天始末

Sun Woo helped some users escape at the beginning of their lives

11月9日午时,火币和波场DAO联合发布公告称,火币和波场DAO决定永久1:1刚性承兑所有FTX平台内波场系代币(TRX、BTT、JST、SUN、HT),帮助所有FTX用户恢复常态。会根据用户填写的表单为根据,与FTX平台协调对账关于TRX、BTT、JST、SUN、HT代币的提现事宜。

At noon on 9 November, a joint communiqué issued by the Gun and Wavefield DAO stated that it and the Wavefield DAO had decided to pay permanently 1:1 rigidly all FTX platforms in the intra-waved areas (TRX, BTT, JST, SUN, HT) to help all FTX users restore normality. Based on the forms filled in by the user, reconciliations on TRX, BTT, JST, Sun, HT-deals will be coordinated with the FTX platform for the presentation of TRX, BTT, JST, HT.

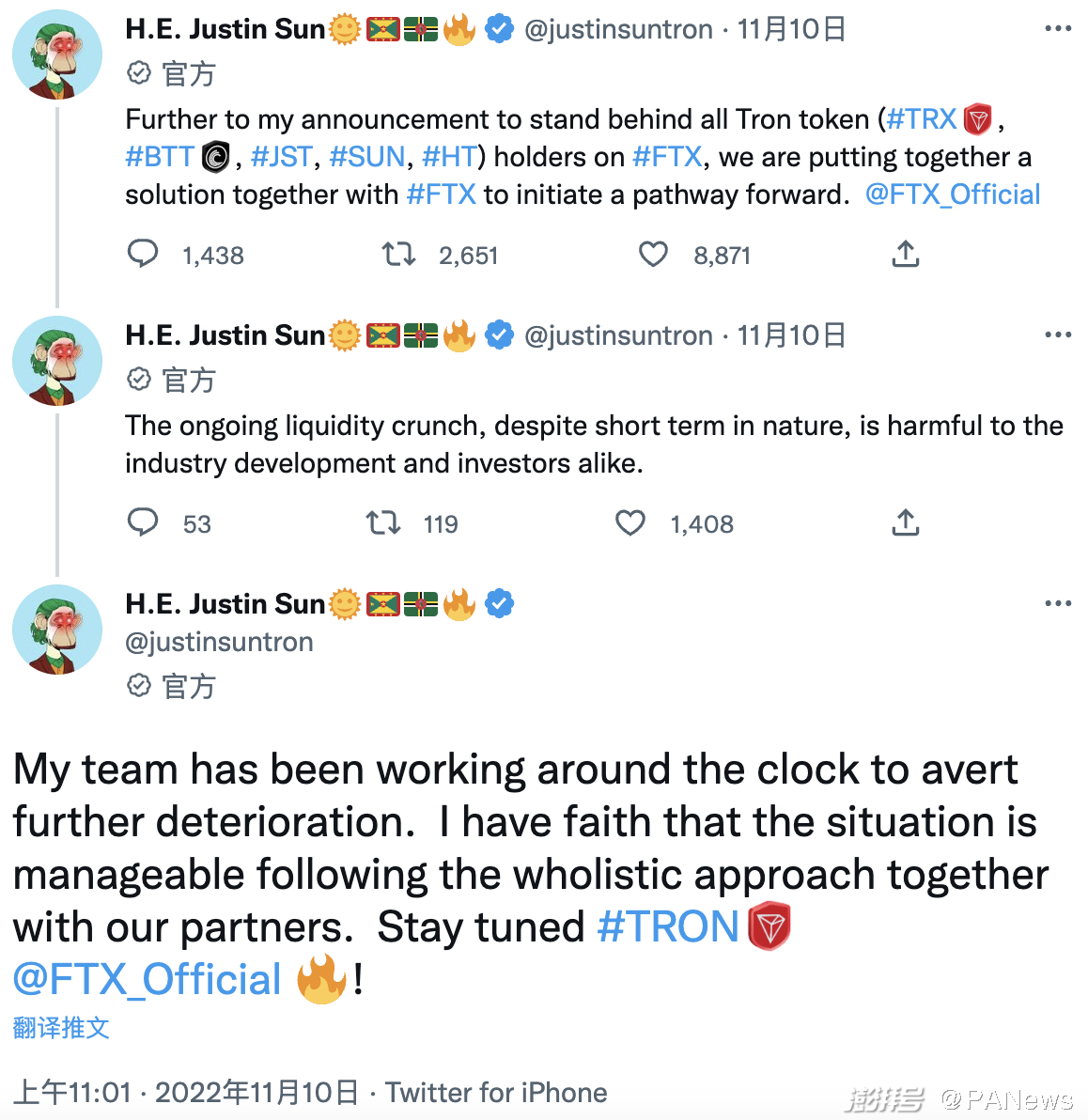

11月9日晚间,孙宇晨在PANews举办的TS活动“入职满月,孙哥述职报告”中表示,愿意向FTX伸出援手,帮助行业玩家度过难关。11月10日,孙宇晨在推特上表示除了宣布支持FTX上所有波场系代币(TRX、BTT、JST、SUN、HT)持有者之外,会与FTX一起制定一个解决方案,以启动前进的路径。

On the evening of November 9, Sun Woo-jin expressed his willingness to reach out to FTX to help industry players through the TS campaign, “Being in full, Sun Ko-shu,” held in PANews. On November 10, Sun Woo-mun on Twitter indicated that, in addition to announcing support for all FTX holders of TRX, BTT, JST, SUN, HT, etc., a solution would be worked out with FTX to start the way forward.

11月10日午间,孙宇晨发推表示FTX平台上TRX交易已恢复,提款功能也将开通。紧跟着发推称JST、SUN、HT在FTX上的交易也已恢复。

In the middle of the afternoon of November 10, Sun Woo announced that the TRX transactions on the FTX platform had been restored, and that the withdrawal function would be opened. The transactions on FTX immediately after the presumably JST, SUN, and HT had been restored.

获得此信息后便有批量FTX用户将个人资产全部转换为TRX等火币刚性承兑代币,在FTX开放对应代币的提现通道后完成了资产转移。

Upon obtaining this information, a batch of FTX users converted all their personal assets into TRX-type coin rigidities, and completed the transfer of assets after FTX opened up the cash route for its counterpart.

据一位社区用户详述个人资产逃生经历:起初因为是FTX平台的早期用户,对FTX有感情和强烈的信任,所以起初可以逃生时选择了立于危墙之下。等到FTX挪用用户资产成为事实之后后悔不已,当孙宇晨宣布为HT、TRX等代币的持币用户开放逃生通道后,他一直密切关注火币和FTX的充提通道。

According to a community user who detailed his personal asset escape: initially, because of his early user of the FTX platform and his emotional and strong trust in FTX, he could have survived under the Wall. When FTX’s misappropriation of the user’s assets became a fact, he regretted it, and since Sun Woo’s announcement of HT, TRX, etc., that currency-holding users had opened the escape route, he kept an eye on the fire money and FTX.

在孙宇晨开放火币逃生通道的第一时间,该用户便将账户里所有的资产交易为TRX和HT(当时有大量的用户有此操作,这也是为什么当时FTX平台和火币之间TRX价差6-10倍),随后转出至火币完成逃离。

During the first time that Sun Woo opened the fire escape route, the user transferred all the assets in the account to TRX and HT (a large number of users did so at the time, and that was why the difference between the TRX price between the FTX platform and the tender was 6-10 times greater) and then moved out to the tender to complete the flight.

于部分用户而言,能在个人资产深陷困境时有一线逃离通道实属幸运。于火币平台而言,为用户提供逃生通道收获了更多一份信任和好感。

For some users, it is fortunate to be able to escape a line of passage when personal assets are in deep trouble. For the gun platform, providing an escape route for users has gained a greater sense of trust and goodwill.

此后,孙宇晨也在社交媒体披露在与FTX创始人SBF沟通援助事宜。据金十报道,11月11日傍晚孙宇晨表示:“已准备好为FTX提供数十亿美元的援助。我们需要对FTX进行充分的调查。仍在与FTX就进一步计划进行谈判。”只是现今FTX已宣布进入破产程序,援助计划或许只能中断。

Sun Woo-ming has since announced in the social media that he is communicating with the founder of FTX, the SBF. According to Kim X, Sun Woo-morning on the evening of 11 November said: "We are ready to provide billions of dollars of aid to FTX. We need to conduct a full investigation into FTX. Further plans are still under negotiation with FTX. Only today FTX has declared bankruptcy proceedings, and the aid program may only be suspended.

火币平台能救行业用户于危机之时,离不开其自有的资金储备实力。如推特博主Colin Wu所言:火币在山西事件和清退中国用户时,完成了刚性兑付(据悉,两次兑付资产额共有250亿美金)。而且火币前创始人李林完成谢幕,说明在交接清算时火币平台无资金缺口。

As Twitter blogger Colin Wu put it, the gun money was paid hard when Shanxi events and China’s users were cleared out (an asset of $25 billion was said to have been paid twice). Li Lin, a former founder of the gun money, completed the cover-up, suggesting that there was no funding gap for the gun platform at the time of handover and liquidation.

反观关于FTX面临的流动性危机,11月10日晚间FTX创始人SBF发表的道歉信中提到:FTX内部关于银行相关账户的标签做得很差,导致对用户杠杆率的判断与现实大大偏离。FTX以为的杠杆为0倍,可随时交付的美元流动性为平均每日提款额的24倍;实际杠杆为1.7倍,流动性是周日提款额的0.8倍。

In contrast to the liquidity crisis faced by FTX, on the evening of 10 November, the founder of FTX, SBF, mentioned in an apology letter that: FTX's internal labelling of bank-related accounts was poor, leading to a significant departure from the judgement and reality of user leverage. FTX thought that it was a zero-fold leverage, with readily available dollar liquidity 24 times the average daily withdrawal; actual leverage was 1.7 times and liquidity 0.8 times the amount raised on a Sunday.

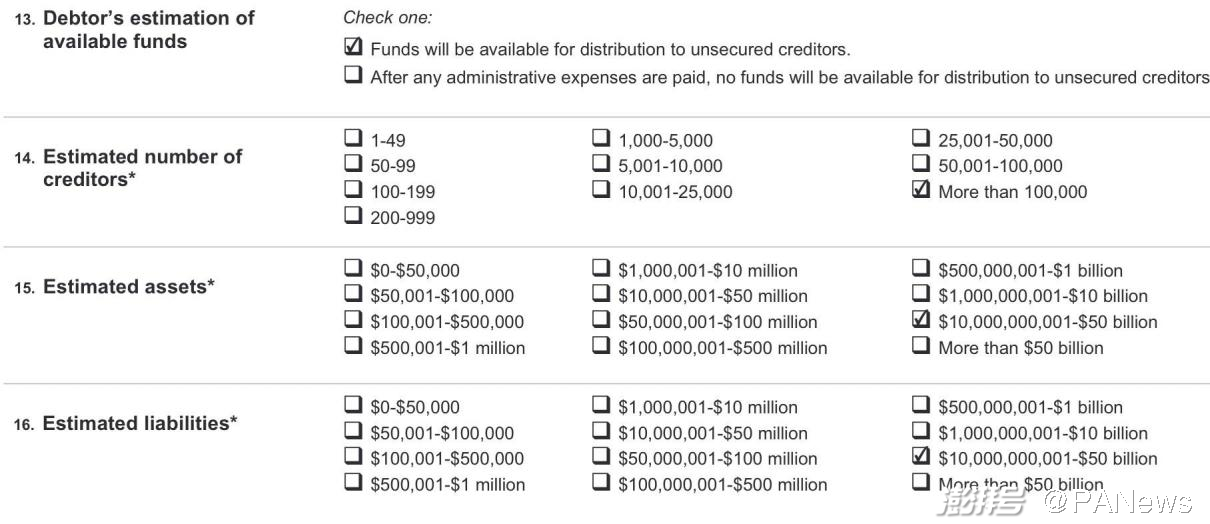

FTX宣布进入破产程序后,据法院文件显示,加密对冲基金Alameda Research列出的资产和负债估值在100亿至500亿美元之间。其亏空数额之大,令加密社区愕然。由此可见,Alameda是多么的激进,多么的置风控于不顾。

When FTX was declared subject to insolvency proceedings, court documents showed that the assets and liabilities listed in the encryption hedge fund Alameda Research were valued at between $10 billion and $50 billion. The amount of its deficit was overwhelming for the encryption community. Thus, how radical Alameda was and how reckless it was.

老牌交易所为何屹立至今?

Why does the old exchange stand up to this day?

如币安联合创始人兼Binance Labs负责人何一所言,来自传统金融背景的人认为使用客户资金是正常的,但加密货币不是银行。简单地将加密货币视为货币或股票可能会导致风险管理出现问题——类似于将您的私钥放入保险库并希望这能保证安全。

People from traditional financial backgrounds believe that the use of customer funds is normal, but encrypted money is not a bank. Simply treating encrypted currency as money or stock may cause risk management problems – similar to placing your private key in a vault and hoping that it will be safe.

现实是,大多数快速起起落落的团队都是来自TradFi世界的“blue blood”,属于极少数可能与监管机构进行最佳沟通的人。这些人的衰落对处于起步阶段的加密货币行业造成了极其不公平的偏见。直到那些人跌倒的那一刻,他们都不知道自己为什么跌倒,只是希望“牛市来了,我不会死”。

The reality is that most of the fast-starting and falling teams are “blue black” from the TreadFi world and are among the very few people who might best communicate with regulators. The decline of these people has created a highly unfair bias against the crypto-currency industry at the start-up stage. Until the moment those people fall, they do not know why they fell, but rather hope that “the cow market is coming, I will not die.”

而火币已在加密行业存续了近10年,币安自创立已有5年。都从各种抹黑、行业风险中走过。火币经历了山西事件和中国用户资产清退;币安2019年被盗7000个比特币。此后依然在行业发展中不断壮大,源自老牌交易所们能屹立对安全和风控的注重和投入,对风险的敬畏,这是业务长期发展的前提和保障。

Fire money has been in the encryption industry for almost 10 years, and it has been created for five years. It has all gone through a variety of blackouts and industry risks.

火币:晒出35亿美金资产,不会限制用户提币

币安赵长鹏发出所有加密货币交易所都应该做默克尔树储备金证明的呼吁后,火币顾问孙宇晨回应称火币在一个月前已经做过,且乐意响应赵长鹏的提议再做第三次。随后在推特上披露三个链上地址,称这3个地址有48,555枚BTC。并表示该部分资产仅占火币拥有的高价值资产总额的不到3%,包括BTC、USD、稳定币、短期国库券。 In response to a call from Sun Woo, a gun consultant, to the effect that all encrypted currency exchanges should be certified as Merkel Tree Reserves a month ago, was pleased to respond to Zhao’s offer for a third time. Three chain addresses were released on Twitter, stating that they had 48,555 BTCs. They said that the portion of the assets represented less than 3% of the high value of the assets owned by the gun, including BTC, USD, stable currency, and short-term treasury bills. 11月13日,Huobi官方公告,展示部分主要资产储备情况,包括超过3.2万枚BTC、27.4万枚ETH、8.2亿枚USDT、97亿枚TRX。本次公布总资产约合35亿美元左右。随后针对链上的代币转移,Huobi向PANews表示,用户资产安全、交易及充提均正常运转,不对用户的充提做任何限制。 On November 13, Huobi's official announcement showed some major asset reserves, including more than 32,000 BTCs, 274,000 ETHs, 820 million USDTs, and 9.7 billion TRXs. The total declared assets amounted to about $3.5 billion. Subsequently, Huobi stated to PANews that the user's assets were safe, traded and replenished, without any restriction on the user's claims. 币安:冷热钱包有比特币47.5万枚,以太坊480万枚 11月10日币安在官方博客公布截止2022年10月11日08:00 (北京时间)的资产储备明细。快照显示,比特币约47.5万枚,以太币约480万枚 ,USDT约176亿枚,BUSD约217亿枚,USDC约6亿枚,BNB约5800万枚。 其中还公布了带有链接的钱包详细列表以供查看。 On November 10, it published on its official blog an inventory of assets at 08:00 (Beijing time) as of October 11, 2022. A snapshot shows that about 475,000 bitcoins, about 4.8 million in Queens, about 17.6 billion in USDT, about 217 billion in BUSD, about 600 million in USDC, and about 58 million in BNB. 同时,币安创始人赵长鹏周五在印度尼西亚金融科技峰会上表示,交易所提高透明度可能有助于提振投资者信心,监管机构扩大审查范围很重要。币安已承诺披露其储备证明,并于周四公布了其大部分冷热钱包地址的详细信息。币安正在考虑披露其内部审计方法,而不仅仅是 KYC 或 AML。 At the Indonesian Financial Science and Technology Summit on Friday, the founder of the currency, Zhao Chang Peng, stated that it was important for the exchange to increase transparency to help boost investor confidence, and for regulators to expand their scrutiny. The currency had promised to disclose its stock certificates and released detailed information on Thursday about most of its cold wallet addresses. The currency was considering disclosing its internal auditing methods, not just KYC or AML. 随着币安等交易所披露冷热钱包地址,也有多家交易所跟进。OKX官方表示在30天内发布储备金证明。当然也有个别老牌交易所因为短时未能始终如一的坚守底线,如AEX等交易所因挪用用户资产杠杠挖矿而导致用户资金无法兑付。 There are also a number of exchanges following up with the disclosure of cold and hot wallet addresses by exchanges such as the currency. OKX officials have indicated that they will issue a certificate of reserve within 30 days. There are, of course, a few old exchanges that have not been able to maintain a consistent bottom line for short periods, such as exchanges such as AEX, which have been unable to pay because of the diversion of the user’s assets to mine. 越来越多的中心化交易所因为此次FTX暴雷而公开储备金证明,公开冷热钱包地址,这是加密行业的良性循环。作为用户,我们只能时刻保持警惕,当有风吹草动时坚决摒弃个人的非理性感受,坚决不立于危墙之下。使用一个经过历史验证的放心的交易所应该成为我们投资策略最重要的一条。 As users, we can only remain vigilant, obstinately rejecting individual irrationality when it comes to action, and determined not to stand below the walls of danger. The use of a historically proven trusted exchange should be one of the most important aspects of our investment strategy. (题图来源:视觉中国) (Technology source: Visual China)

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论