人们不会为技术买单, 而是会为承载着技术和创新的故事买单. Crypto 的繁荣的关键不在于这是多新颖的技术, 而是背后将传统革新, 将中心化秩序推翻, 对经济艺术政治重新思考的思潮.

The key to Crypto's prosperity is not that it's new technology, but that it's that it's behind traditional innovation, that it's centralizing order, that it's re-thinking economic and artistic politics.

在本文我们会以时间顺序重新回顾在?Crypto 发展史中那些重要的 “故事”. 本文一共探讨了约 40 篇文章, 全文字数约 1.5 万字, 推荐阅读时间约 50 分钟.

In this paper, we will re-examine in chronological order those important “treats” in the history of Crypto's development. A total of about 40 articles, a full text of about 15,000 words, are recommended for reading for about 50 minutes.

The Sovereign Individual —— James Dale Davidson / William Rees-Mogg

One-liner: 具有主权的个人将会崛起.

One-liner: Sovereign individuals will rise...

如果说《雪崩》启发了元宇宙的概念, 那么《主权个人》启发了比特币.

If Avalanche inspires the concept of the meta-cosmos, then Sovereign Personal inspires Bitcoin.

这是一本看到了世界未来的书. 书中讲到了未来是无序的, 数字技术会让世界的竞争性, 不平等和不稳定性大大增强, 让社会更加分裂, 让政府逐渐萎缩.

It's a book that sees the future of the world. It says that the future is disorderly, that digital technology will make the world more competitive, that inequality and instability will grow, that society will become more divided, and that government will contract.

书中梳理了人类社会结构的根本逻辑, 指出随着数字技术的发展, 传统组织对暴力, 知识及财富的垄断, 将逐渐瓦解, 去中心化和具有主权的个人将会崛起.

The book sums up the fundamental logic of the fabric of human society, pointing out that, as digital technology develops, the monopoly of traditional organizations on violence, knowledge and wealth will break down and decentralised and sovereign individuals will rise.

书中对 Crypto, 电子战, 和智能手机等都做了一些精准预测. 他们设想了一种加密的数字货币, 是独一无二, 匿名, 可验证的, 同时可以在无国界的全球市场上交易. 这很可能给了中本聪比特币的灵感. 在熊市, 推荐大家阅读.

Crypto, Electronic Warfare, smartphones, etc., have some precision predictions in the book. They imagine an encrypted digital currency that is unique, anonymous, verifiable, and that can be traded on a global market without borders.

1997 年是混乱无序的一年, 是 Crypto 宇宙大爆炸前的虚无状态, 但 Crypto 的思想已经开始萌芽.

"Strong" 1997 was a chaotic year, a pre-Crypto void, but Crypto's mind was beginning to germinate.

Bitcoin: A Peer-to-Peer Electronic Cash System?—— Satoshi Nakamoto (比特币的创造者)

One-liner: 比特币是一个点对点的电子现金系统, 是 Crypto 的起源.

One-liner: Bitcoin is a point-to-point electronic cash system, which is the origin of Crypto.

对于这篇白皮书, 我没有什么能概括的, 每个人都应该去时常温习和精读比特币的白皮书.

I have nothing to generalize about this white paper, and everyone should study and read bitcoin's white paper from time to time.

化名为中本聪的神秘人创造了一个点对点的电子现金系统, 让区块链在 2008 年诞生. 比特币引发了 “范式转变, 现在支撑着一个数万亿美元的产业”, 并向世界展示了主权, 金融, 和自由之间的关系, 引发了成千上万的变革和创新. 尽管过去了 13 年多, 我们还是能从其中精简的语言, 通俗易懂的概念, 和绝妙的设计中汲取养分.

The mysterious man named Bentine created a point-to-point electronic cash system, which gave birth to the block chain in 2008. Bitcoin triggered a "model shift, which now supports a trillion-dollar industry" and showed the world that the relationship between sovereignty, finance, and freedom has triggered thousands of changes and innovations. Despite the fact that over 13 years, we have been able to extract nutrients from the streamlined language, popular and understandable concepts, and wonderful design.

2008 年比特币的白皮书可以说是 Crypto 的圣经, 比特币也仿佛像被赋予了宗教意味一样, 无数次死而复生, 凤凰涅槃.

The 2008 Bitcoin White Paper can be said to be Crypto's Bible, and Bitcoin, like being given religious meaning, has come back to life numerous times, Phoenix.

没人能说清楚中本聪是谁, 就像我们无法理解 “道” 到底是什么. 接着, 比特币诞生了, 比特币就是 “一”, 是 Crypto 的初始状态, 看似简单但却将密码学技术的精华都结合得浑然一体. 接着继续 “二生三, 三生万物”, 将万物创造出来, 找到各自的和谐状态.

And then, when bitcoin was born, bitcoin was "one," it was the initial state of Crypto, and it seemed simple, but it combined the essence of cryptography. And then it went on to "two, three, three, three," to create everything, to find harmony.

2008 年是 Crypto 的元年, 是启蒙的一年, 比特币和 Crypto 诞生的一年.

The year 2008 is the year of Crypto, the year of enlightenment, the year of the birth of Bitcoin and Crypto.

Bitcoin?—— Fred Wilson (Union Square Ventures 创始人)

One-liner: 比特币是一个非常有趣的投资机会.

Bitcoin is a very interesting investment opportunity..........................................................

Fred Wilson 在这篇文章中提到了对比特币的概念的赞同, 认为比特币作为一种货币基于对算法和网络的信心的理念非常好.

Fred Wilson, in this article, referred to the endorsement of the concept of bitcoin, saying that bitcoin as a currency was a very good idea based on confidence in algorithms and networks.

他说在他和他在 USV 的同事看来, 一种公平且透明的网络构建的替代货币是一个即将实现的想法. 他认为比特币值得观察, 但是货币与政府真正脱钩会产生重大影响, 所以还是要谨慎, 但是依旧是一个非常有趣的投资机会.

He said that, in his view with his colleagues in USV, a fair and transparent network of alternative currencies was an idea that was about to be realized, and he thought that Bitcoin was worth observing, but that the true decoupling of money with the government would have a significant impact, so be careful, but it would still be a very interesting investment opportunity.

对于当时比特币的币价, 他点评到, 可以说比特币失败了 (居然从 29 美元归零到了 13 美元), 也可以说我们刚刚经过了膨胀期望期, 价格回归到了比特币真正的价值. 有趣的是, 目前比特币的价格在三万美元以上.

As for the bitcoin price at that time, he points out that bitcoin has failed (from 29 to 13 dollars), or that we've just passed the boom period, and the price has returned to bitcoin's true value. Interestingly, the price of bitcoin is now over $30,000.

这篇文章的评论区也极其精彩, 我们可以看看 2011 年的人对比特币是有哪些思考, 质疑, 和辩论的.

The review section of this article is also excellent, and we can see what the 2011 people of Bitcoin thought, questioned, and debated.

2011 年是远见者对 Crypto 探索的一年, 比特币开始逐渐吸引开拓者的目光, 而他们认为 Crypto 的主要作用会是一种替代掉央行的替代货币.

"Strong" 2011 was a year of visionary exploration of Crypto, and Bitcoin began to draw the attention of pioneers, and they thought that Crypto's main role would be to replace the central bank with an alternative currency.

Coinbase?—— Chris Dixon (a16z crypto 创始人)

One-liner: Coinbase 会是比特币的重要基础设施.

One-liner: Coinbase will be an important infrastructure for Bitcoin.

Chris Dixon 在这篇文章中揭示了媒体对比特币和技术人员对比特币的理解之间的对比. 媒体大多认为比特币是一个 scam, 而在硅谷, 比特币被极客认为是一项重大的技术突破.

Chris Dixon, in this article, reveals the contrast between the understandings of the media of the bitcoin and the technologist of the bitco. Most media think that bitcoin is a scam, while in Silicon Valley, bitcoin is considered by the extremes as a major technological breakthrough.

他指出互联网为 Crypto 系统提供了空间, 但是并没将电子现金的传输方式给成功完成. 比特币解决了电子现金服务的交易费昂贵以及欺诈猖獗的问题. 同时比特币是一个可以开发新技术的平台, 他预测了一些潜在的应用, 比如针对订阅和广告费用的小额支付, 机器和机器之间的交易 (听起来完全是智能合约), 和为所有人提供金融服务 (听起来完全是 DeFi).

He pointed out that the Internet provided space for the Crypto system, but did not allow the transfer of electronic cash to be successfully completed. Bitcoin solved the high transaction costs and fraud of electronic cash services. Bitcoin was a platform for the development of new technologies, and he predicted some potential applications, such as small payments for subscriptions and advertising, machine-to-machine transactions (which sound entirely smart contracts), and financial services for all.

文章的末尾, 他认为比特币需要一个杀手级应用来扩散其传播, 所以宣布了 a16z 对 Coinbase 的领投. 他认为 Coinbase 可以显著加速比特币的扩散, 同时让互联网进入发明和机遇的新阶段.

At the end of the article, he thought that Bitcoin needed a killer-class application to spread it, so he announced a16z to Coinbase, and he thought Coinbase could significantly accelerate the spread of Bitcoin, while allowing the Internet to enter a new phase of invention and opportunity.

Why I‘m interested in Bitcoin?—— Chris Dixon

One-liner: 比特币可能可以革新金融设施.

在上一篇文章发布十几天后, Chris Dixon 又表达了自己为什么对比特币产生兴趣的原因. 有些人认为比特币火热单纯是因为自由主义者的支持, Chris Dixon 赞同了很多比特币的早期支持者都是自由主义者, 同时很多重要的计算机领域的运动都是因为意识形态而受到支持.

A few days after the last article was published, Chris Dixon said why Bitcoin was interested. Some people thought that bitcoin was hot just because liberals supported it, that Chris Dixon agreed that many of the early supporters of bitcoin were liberals, and that many important computer movements were supported because of ideology.

他不认为比特币的终极目的是替代美联储. 他觉得如果想用科技改变金融, 那么就不仅仅要在现有的基础上建立新增的服务, 而是要彻底重新构建一个新系统和新秩序.

He did not think that the ultimate purpose of Bitcoin was to replace the Fed, and he felt that if technology was to change finance, it was not just to build new services on the existing ones, but to completely re-establish a new system and order.

他最初认为比特币是一个投机泡沫以及互联网黄金. 但是他突然意识到比特币正在重建整个支付行业. 他非常看好小额支付的应用.

He initially thought that Bitcoin was a speculative bubble and Internet gold, but suddenly he realized that Bitcoin was rebuilding the entire payment industry, and he looked very good at the application of small payments.

他最后强调, 科技改善金融的唯一方式就是重建一个不依赖其他现有设施的新服务. 比特币是一个非常有效的改善方式, 是一个值得运行的实验.

He concluded by emphasizing that the only way science and technology can improve finance is to rebuild a new service that does not depend on other existing facilities. Bitcoin is a very effective way to improve, and it's a worthwhile experiment.

2013 年是 Crypto 的早期基础设施和认知建设的一年, 这一年 Coinbase 拿到了 a16z 的投资. 随着大众对比特币的关注提升, 两种对立的声音开始产生, 一部分人坚定认为 Crypto 是个 scam, 而远见者对比特币的认知开始逐渐清晰, 开始思考 Crypto 的未来.

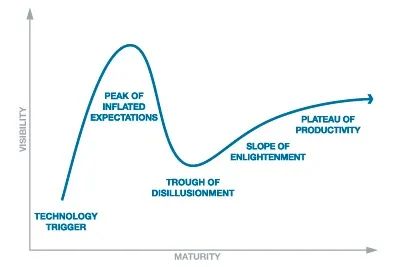

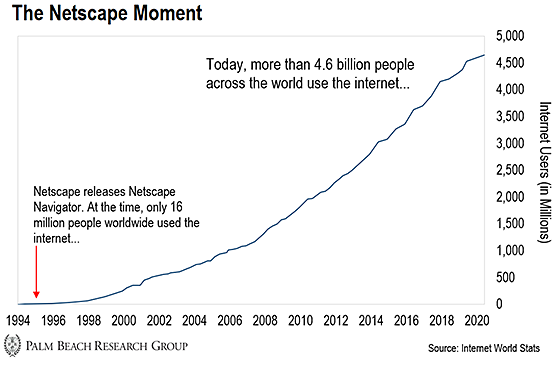

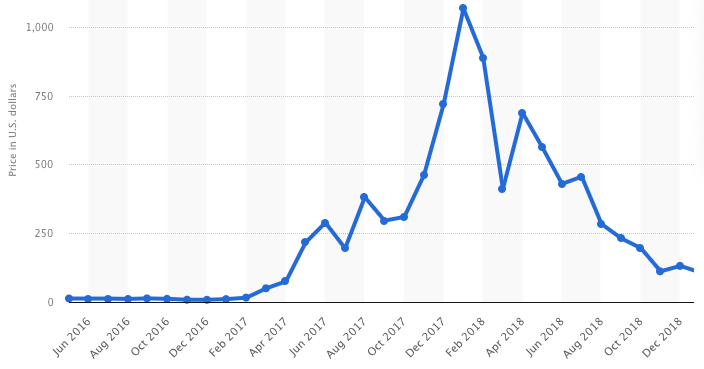

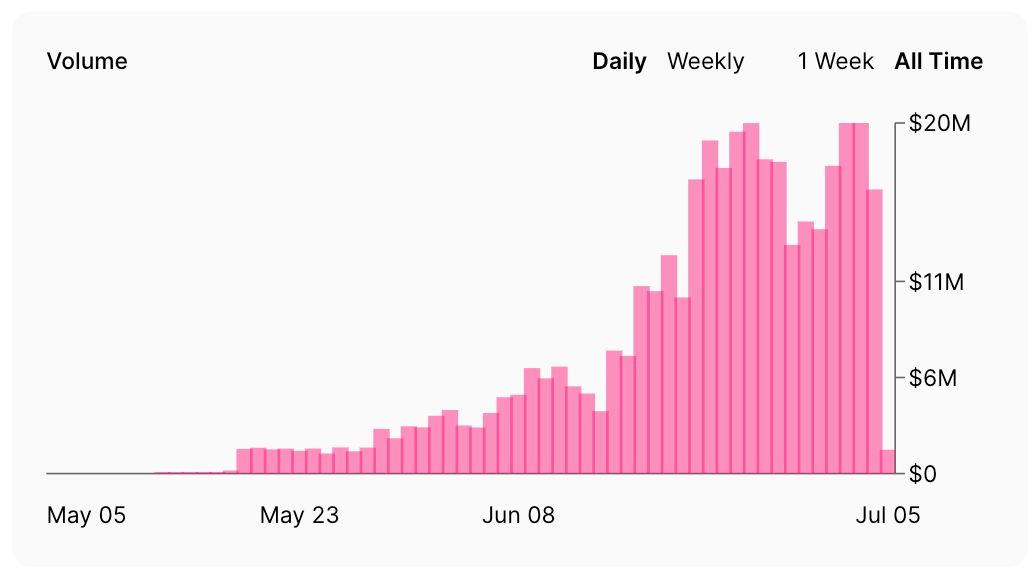

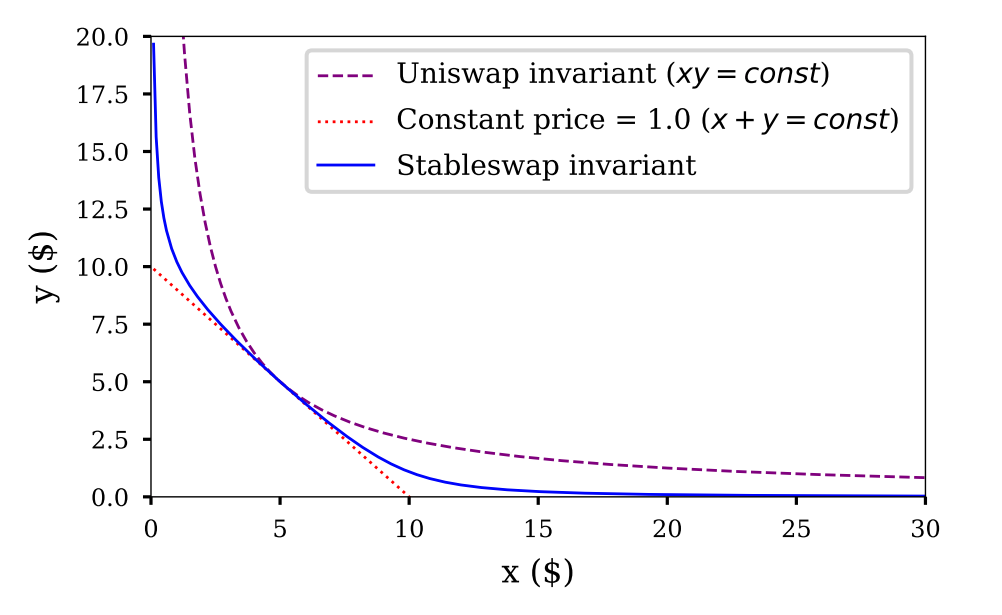

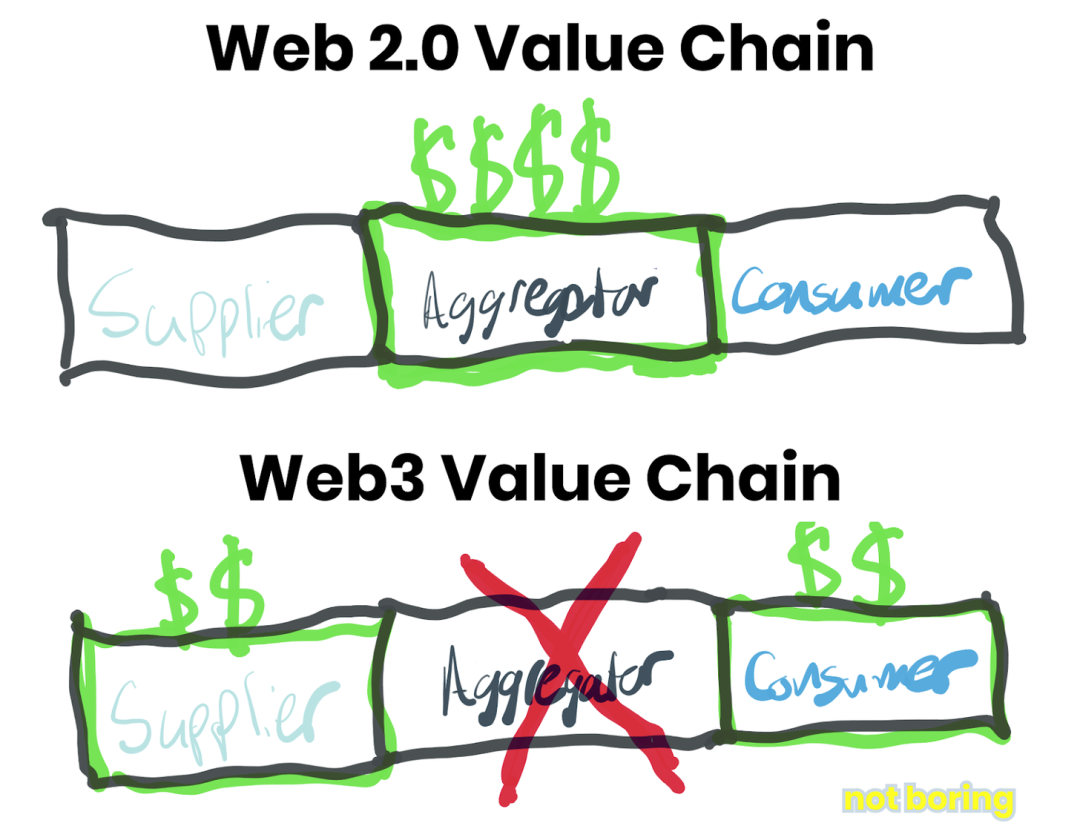

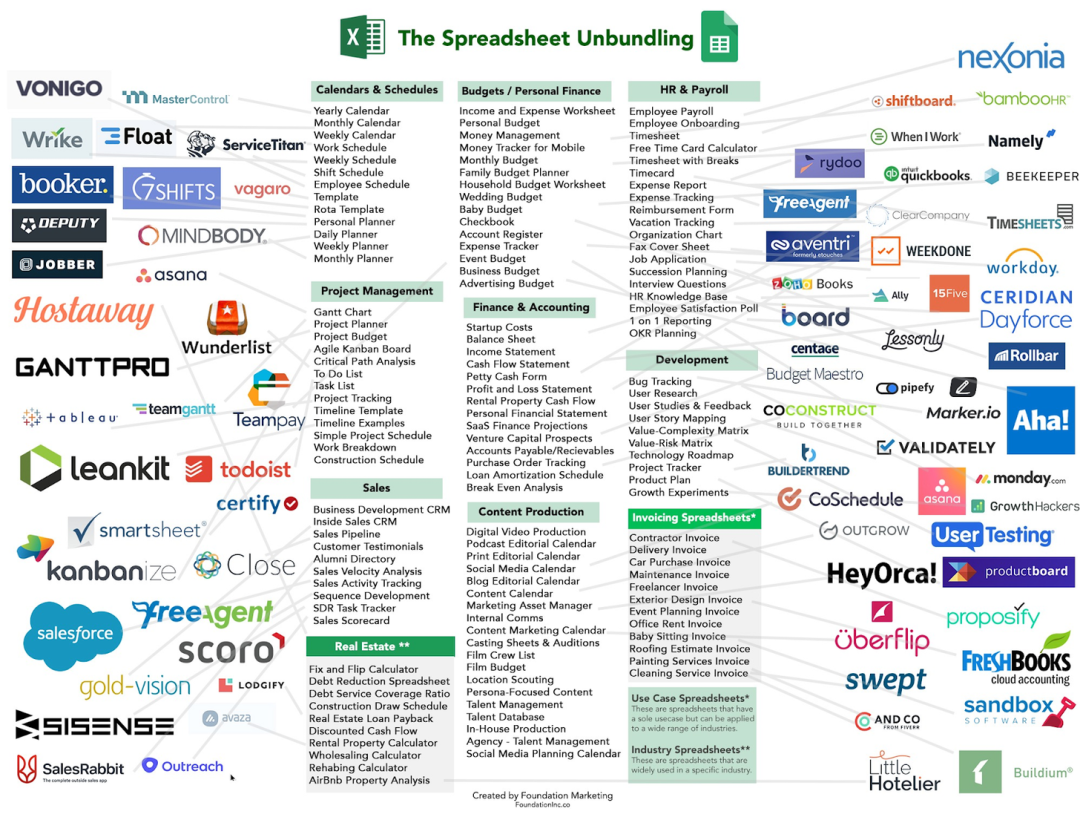

One-liner: 比特币有着颠覆性. One-liner: Bitcoinissubversive. “一项神秘的新技术出现了, 似乎不知从何而来, 但实际上是几乎匿名的研究人员二十年紧张研发的结果. 政治理想主义者将解放和革命的愿景投射到它身上; 建制派精英们对它投射蔑视和蔑视. 另一方面, 技术人员, 书呆子被它吓呆了. 他们看到了其中的巨大潜力, 并整晚和周末都在修补它. 最终, 主流产品、公司和行业出现了将其商业化; 其影响变得深远; 后来, 许多人想知道为什么其强大的承诺从一开始就不那么明显. ” Marc Andreessen 说的是什么技术? "A mysterious new technology appears to have emerged from nowhere, but it is actually the result of 20 years of intense research and development by almost anonymous researchers. Political idealists project the vision of liberation and revolution on it; Caste elites project contempt and contempt for it. On the other hand, technologists, nerds are scared by it. They see the great potential in it and fix it all night and weekend. 1975年的个人电脑, 1993年的互联网, 以及他相信, 2014年的比特币. Personal computers in 1975, Internet in 1993, and he believed, the 2014 Bitcoin. Marc Andreessen, 一个对 Web 真正了解的人 (除了创办 a16z 以外, 他还写了 Mosaic 和创办了网景), 看到了比特币技术的颠覆性, 去中心化, 网络效应, 和对现有秩序的重塑. Marc Andreassen, a man who really knows about Web (in addition to creating a16z, he wrote Mosaic and created a web view), saw the subversion of bitcoin technology, decentralizing, network effects, and reshaping the existing order. 2014 年依旧是对比特币加强认知的一年. Marc Andreessen 这个现代互联网的 “创造者” 奠定了后来者对比特币理解的基础, 之后对比特币的理解与他所设想的未来几乎无异. One-liner: 以太坊会是更值得投资的 Crypto. One-liner: The Etherms are more worth investing in Crypto. Fred Ehrsam 将重点的关注从比特币聚焦到了以太坊上. 比特币的设计太过于完美, 任何改动都仿佛是画蛇添足, 真正的除了钱包和交易所之外的完备应用无法在比特币上诞生. 以太坊能提供完整的计算环境, 从而支撑起了无数的区块链上应用. Fred 提到了在以太坊上建立的 DAO 组织, 也就是在文章发布一个月后遭到攻击导致以太坊分叉的那个. Fred Ehrsam focused his attention from bitcoin to the Etheria. Bitcoin was too perfect a design, and any changes seemed to be more than a snake, and real applications other than wallets and exchanges could not be born on bitcoin. The Etheria could provide a complete computing environment, thus supporting countless applications in the chain. Fred referred to the DAO organization that was set up in Etheria, the one that was attacked a month after the article was published and that caused the division of Ether. 比特币作为 Crypto 的先驱, 让以太坊得以诞生. 以太坊的智能合约相比比特币的 “智能合约” 更加简单易用, 更加方便开发, 社区更繁荣. 同时 Fred 也指出了, 以太坊的核心开发人员比比特币更加健康, 社区心态更加谦虚, 方向上更加有一致性. Bitcoin, as a pioneer of Crypto, has given birth to Etheria, which is easier to use, easier to develop, and more prosperous to the community than Tetco's smart contracts. Fred also pointed out that Etheria's core developers are healthier than Bitcoin, more modest and more consistent in their direction. 除了这些优点, Fred 也提到了以太坊的一些潜在风险: 资金量还不如比特币高, 尚未经历治理危机 (文章发布一个月后经历了), 因为功能更复杂所以风险更大, 可能会将共识改成 PoS (虽然五年后还是没换), 和网络拓展非常难 (这个问题已被各种 Layer2 慢慢解决). In addition to these advantages, Fred also referred to some of the potential risks of Etheria: the amount of money is not as high as Bitcoin, it has not experienced a governance crisis (a month after the publication of the article), it is more risky because it is more complex, it may change the consensus to PS (though it has not changed in five years), and it is very difficult to expand the network. Fred 没有给以太坊和比特币是竞争还是互补关系下定论, 他认为以太坊的潜力巨大, 他对任何特定的链都不“忠诚”, 只想要任何给世界带来最大利益的东西. Fred did not judge whether Ether and Bitcoin were competing or complementary, and he thought that Ether was a huge potential, that he was not “faithful” to any particular chain, and that he wanted anything that would benefit the world the most. Fred 最后总结说 Crypto 的变化速度正在加快. Crypto 的愿景非常大, 要为整个世界创建一个更好的交易网络. Crypto 与互联网本身一样, 不是一家出售产品的公司, 而是一系列有朝一日会连接每个人的协议. 而且, 像互联网一样, 它的发展需要更长的时间, 但影响将是巨大的. Fred concluded by saying that Crypto's speed of change is accelerating. Crypto's vision of creating a better trading network for the whole world. Crypto, like the Internet itself, is not a selling company, but a series of agreements that will one day connect everyone. And, like the Internet, it takes longer to develop, but the impact will be enormous. 还有就是他在一年后的 2017 年写了一篇文章, 内容主要是:?区块链是元宇宙的基础层. And he wrote an article a year later, in 2017, about: One-liner: 协议 > 应用. One-liner: protocol & gt; application. Joel Monegro 在 Fat Protocols 这篇文章中探讨了一个观点, 那就是 Web2 的结构中, 基于协议的应用的价值非常大, 而协议的价值很小, 区块链中这个情况则会被扭转. Joel Monegro, in Fat Protocols, discussed the idea that in the structure of the Web2, the application based on the protocol was very valuable, and the agreement was very small, and the situation in the block chain would be reversed. 区块链中协议层的价值占比更大, 给了协议之间的公开性, 数据共享性和互操作性的巨大提升. 例如比特币和以太坊这样的协议 (当然也比如一两年后的 Uniswap 和 AAVE 等) 的价值比链上应用的价值更大, 应用更成功, 人们就会觉得这个协议的潜力还有待发掘. 代币经济在其中起到了一个非常正向的作用. 投资者对协议的投机行为会让协议上的应用生态更加繁荣. The value of the agreement layer in the block chain is greater, giving the agreement openness, data sharing and interoperability a great increase. For example, the value of agreements like Bitcoin and Etheria (and, of course, Uniswap and AAVE a year or two later) is greater than the value applied in the chain, and their application is more successful, and people feel that the potential of the agreement has yet to be realized. 2016 年, 在以太坊的慢慢崛起下, 人们对整个区块链的 “网络” 有了更多的想象力. 对区块链的构建不再是停留在钱包或交易所等基础设施, 而是开始思考基于一个完备的环境中, 能构建怎样的协议. 这个时候道变成了加密精神, 一变成了项目创作者, 二是社区, 三是生态参与者. In 2016, under the slow rise of Ether, there was more imagination about the “network” of the entire block chain. The building of the block chain was no longer an infrastructure such as a wallet or an exchange, but rather a beginning to think about what an agreement could be built on the basis of a perfect environment. 这一年的思潮特别激烈, 在本文中对每篇文章只做简单概括, 有时间大家可以自行精读汲取知识. This year was a year of particularly intense thinking, where each article is simply summarized, and there is time for you to read and learn your own knowledge. Hayden Adams 当时被西门子辞退了, 他很难过, 去找好朋友 Karl Floersch (当时在以太坊基金会工作). 好朋友却祝贺他, 机械工程是夕阳产业了, 以太坊才是未来, Hayden 应该去尝试写合约. Hayden 说自己也不会写代码啊. Karl 说学学就行了, 反正当时也没多少人了解以太坊和智能合约. Karl 成功说服了 Hayden 去玩以太坊, Hayden 学了两个月的 Solidity 和 JavaScript, 决定做个大项目, 做 Vitalik 在很多地方提到过的去中心化交易所. 17 年底, Hayden 做出了?Demo, 长这样, 就是 Uniswap. Hayden Adams was fired by Siemens, and he was upset, and went to his best friend, Karl Floersch, who congratulated him on the fact that mechanical engineering was a sunset industry, and that it was the future, and Hayden should try to write the contract. Hayden said he wouldn't write the code. One-liner: 代币价值体现在治理, 货币政策, 调整激励措施. One-liner: The value of the token is reflected in governance, monetary policy, adjustment incentives. Fred Ehrsam 在这篇文章中探讨了代币模型的价值. Fred Ehrsam discussed the value of the token model in this article. 他认为代币的价值主要体现在: 治理, 货币政策, 调整激励措施. He believes that the value of the tokens is mainly in governance, monetary policy, adjustment of incentives. 同时他指出, 与早期的互联网初创企业一样, 一些代币没有意义.?每 1 次大获成功, 就会有 3 次小成功和 100 次失败. At the same time, he pointed out that, like early Internet start-ups, some tokens don't make sense. Every single big success, there's three small successes and 100 failures. 代币模型的基本原理是宝贵而强大的, 允许社区管理社区本身和经济体制, 并以强大的方式团结社区, 使开放系统蓬勃发展. The philosophy behind the token model is valuable and powerful, allowing the community to manage the community itself and the economic system, and to unite the community in a powerful way that allows the open system to flourish. One-liner: Token > Equity. Balaji Srinivasan 首先在文章开头提出了一个点: 代币不是股权, 而是与付费 API 密钥类似. 与传统的融资手段相比, 代币代表着更高的流动性, 更大的受众, 也为一些新型项目的融资开辟了空间. Balaji Srinivasan first made a point at the beginning of the article: the tokens are not equity, but are similar to paying API keys. In contrast to traditional means of financing, the tokens represent a higher degree of mobility, a larger audience, and a space for financing new projects. 接着他一一阐述为什么代币从 2017 年开始会越来越成功: He then explained why the tokens had become more and more successful since 2017: 四年的基础设施建设打下了夯实基础 Four years of infrastructure construction has created a solid foundation. 代币与区块链的原生货币相比更具有多样性和灵活性 The tokens are more diverse and flexible than the original currency of the block chain. 代币购买者实际上在买私钥 (相比传统的方式更加具有隐私和安全) Proponents are actually buying private keys. 代币和付费 API 类似 (代表着某种服务的访问权) It's a token and a fee. It's like an API. 代币是对所有新科技 (开源组织, 小项目, DAO) 的融资模型, 而不仅仅是对于初创企业 The token is a financing model for all new technologies (open source organizations, small projects, DAOs), not just for start-ups. 相比传统金融, 代币是无法被稀释的 The tokens cannot be diluted compared to traditional finance. 所有美国人都可以买代币 All Americans can buy tokens. 所有网上冲浪的人都可以买代币 Every surfer on the Internet can buy a token. 代币流动性特别好 The tokens are very mobile. 代币会把融资去中心化 The tokens will decentralize the financing. 代币模型是一种比免费更好的商业模式, 能让早期用户获得收益 The token model is a better business model than free, with benefits for early users. 代币购买者其实就是投资者, 就像网络上的博主其实就是新时代的记者一样 Proponents are investors, just like Internet bloggers are journalists of the new era. 代币让技术始终被摆在商业前面 The tokens keep the technology in front of the business. 代币是直接由持有者自己监管的 The tokens are directly regulated by the holder itself. 代币可能被用于付费或者一些 VIP 服务 The tokens may be used for payment or some VIP services. 他总结到, 代币这个领域还在非常早期, 很可能几周内就有剧烈波动. 但是世界在变化, 代币代表了未来 1000 倍的价值提升. He concluded that the field of tokens was still very early, and it was likely to be volatile in a few weeks, but the world was changing, and the tokens represented a 1,000-fold increase in value in the future. One-liner: 代币会是公开网络的必备设计. One-liner: The token will be a necessary design for an open network. Chris Dixon 在这篇文章中从比特币和以太坊的代币谈到了代币的作用: 代币可以管理和资助开放服务, 使网络参与者之间的激励措施保持一致, 代币的网络效应给整个系统带来了正向循环. Chris Dixon, in this article, talks about the role of tokens from bitcoin and from Etherno: they manage and finance open services, they align incentives among network participants, and the network effect of the tokens is creating a cycle for the entire system. 加密代币目前是小众市场, 并且备受争议. 如果按目前的趋势继续下去, 代币很快会被公认为开放网络的必备设计, 将开源协议的社会效益和封闭网络的财务和架构效益相结合. 对于那些希望获得企业家、开发人员和独立创作者的访问的人来说, 代币是很有希望的一个事物. If the current trend continues, it will soon be recognized as a necessary design for open networks, combining the social benefits of open-source agreements with the financial and structural benefits of closed networks. For those who want access to entrepreneurs, developers and independent creators, it is a promising thing. One-liner: 好的代币模型很重要. One-liner: A good token model is important. Vitalik Buterin 在文章中分析了几个项目的代币模型. Vitalik 以 Maidsafe, Ethereum (我分析我自己), BAT, 和 Gnosis 为例, 总结了一些好的代币销售模式: 1. 估值的确定性. 2. 参与的确定性. 3. 限制筹集的金额. 4. 没有中央银行. 5. 销售的效率. 然而 1 和 2 不能同时满足, 3, 4 和 5 也不一定能同时满足. Vitalik Buterin, in his article, analysed the currency models of several projects. Vitalik, in the case of Maidsafe, Etheeum (I analysed myself), Bat, and Gnosis, summarized some of the good currency sales patterns: 1. Valuation certainty. 2. Participation certainty. 3. Limitation of the amount raised. 4. 5. Efficiency of sales. 5. However, 1 and 2 cannot be met at the same time, 3, 4 and 5 may not be satisfied at the same time. Vitalik 建议代币销售中也可以采取其他三个聪明的方法, 1. 反向荷兰拍, 并且把未售出的代币作为空投或者捐赠而使用出去; 2. 保留剩下的代币, 以自动化形式解决 “中央银行” 问题, 比如拿去做池子; 3. 进行有上限的销售, 限制每个人的购买数量, 这就需要 KYC. Vitalik 也建议项目进行多轮的代币销售, 让用户有更多的时间来查看哪些团队和项目值得投资. Vitalik suggests that three other smart methods can also be used in the sale of tokens: 1. Inversely shoot in the Netherlands and use unsold coins as airdrops or donations; 2. Retain the remaining tokens and resolve the “Central Bank” problem in an automated manner, such as making a pool; 3. Conduct a capped sale, limiting the amount of purchases per person, which would require KYC. Vitalik to recommend multiple rounds of currency sales, giving users more time to see which teams and projects are worth investing. One-liner: 2017 年是 Crypto 的网景时刻. One-liner: 2017 is Crypto's Web View. 在加密货币的网景时刻这篇文章中, Elad Gil 将 2017 年 ICO 热潮与 Netscape 的 IPO 相比, 是互联网时代和加密时代的真正开端. In this article, Elad Gil compares the ICO boom in 2017 with the IPO of Netscape, which is the real beginning of the Internet age and the encryption age. 2017 年的 Crypto 步入了网景时刻, 在他看来, 比特币真的成为了数字黄金, 以太坊的生态让整个加密市场更加扩大, ICO 为项目筹集了大量资金支持, 除了 Crypto 和机器学习以外没有其他的好创业市场了, 无数的暴富故事, 资本在不断涌入. Crypto went online in 2017, and it seemed to him that Bitcoin really became digital gold, that the ecology of the Tai Hoku made the entire encryption market even wider, that ICO raised a lot of financial support for the project, that there was no good business market beyond Crypto and machine learning, that there were countless stories of rich people, that capital was pouring in. One-liner: Permissionless 很重要. One-liner: Permissionless is important. Alok Vasudev 的这篇文章非常短. 他的主要观点就是区块链和 Crypto 的 Permissionless 让他觉得是它们最让人兴奋的特点. Alek Vasudev's article is very short, and his main point is that the chain of blocks and Crypto's Permissionless make him feel the most exciting feature of them. Linux 是 Permissionless 的, Web 是 Permissionless 的, PC 是 Permissionless 的. 相反的是, 移动应用是需要苹果谷歌的 Permission 的, VR 是需要 Facebook、HTC 和索尼的 Permission 的, AI 在算法层面 Permissionless 但是训练数据是由垄断企业控制的. Linux is permissionless, Web is permissionless, PC is permissionless. Conversely, mobile applications need apple Google permission, VR needs Facebook, HTC and Sony permission, AI at the algorithmic level is permissionless but training data is controlled by the monopoly. 区块链就是一个完全开源公开的数据库, 一个不受审查不受垄断的生产工具. 这篇文章实际上也隐含着 Web2 科技到 Web3 范式的转变. The block chain is a completely open and open database, an uncensored and unmonopolized production tool. This article actually implies a shift from Web2 technology to the Web3 paradigm. One-liner: DAO > Firm. Nick Tomaino 在这篇文章中阐述了一个观点, 就是以比特币为首的一些项目其实也推出了开源分散组织的概念 (比如 DAO 以及开源开发组织). 在颠覆金融系统之外, 中本聪所创造的比特币也会颠覆公司的形式. Nick Tomaino wrote in this article that projects led by Bitcoin actually introduced the concept of open-source decentralized organizations (e.g. DAO and Open-source Development Organization). Beyond destabilizing the financial system, Bintco created the form of a company. 经济学家通常认为, 公司的存在有两个主要原因: 尽量减少交易成本以及汇总资本和人员. 公司在几十年以来都是人们协作首选的形式, 但是比特币在没有公司的情况下蓬勃发展, 背后没有公司, 没有中央组织支持, 而是通过代码 (组织规则) 和激励措施 (代币) 将包括矿工、开发人员、用户的参与者聚集到一起, 共同创造价值. Economists often argue that there are two main reasons for the company's existence: minimizing transaction costs and pooling capital and people. Companies have been the preferred form of collaboration for decades, but Bitcoin thrives without a company, with no company behind it, no central organization, but through codes (rules of organization) and incentives (diplomatics) that will bring together miners, developers, users and participants to create value together. 比特币是具有公司的优点 (最小化交易成本、汇总资本和共享资本以及为贡献者提供工作保障) 的组织结构的第一个例子, 并结合去中心化的所有权, 不受控制的数据以及受到制衡的决策权的优点. 比特币在全球范围内提供给人们赚钱机会, 并且建立明确的激励机制, 创造了公司无法实现的去中心化的新产品 (无法被 censor 的数字货币). Bitcoin is the first example of an organizational structure with corporate merits (minimizing transaction costs, pooling capital and sharing capital and providing job security for contributors), combined with decentralised ownership, uncontrolled data and balanced decision-making power. Bitcoin provides people with opportunities to earn money on a global scale, and has clear incentives to create new products that companies cannot centralize (not allowed to be casor's digital currency). 然而, 这种分散式组织架构的缺点也很明显: 分散决策很难很慢, 很难衡量参与者真正的贡献, 权力下放导致了很多滥用... However, the shortcomings of this decentralized organizational structure are also evident: decentralized decision-making is difficult to take slowly, it is difficult to measure the real contribution of the participants, decentralization leads to a lot of abuse... Nick Tomaino 最后总结说 2017 年是分散式组织的早期, 未来这种协作形式会渗透到主流, 越来越多新的分散组织会建立起来, 传统的公司也会在未来慢慢转型过渡到 Crypto 化的分散组织. Nick Tomaino concluded that 2017 was the early part of a decentralized organization, that this form of collaboration would permeate the mainstream in the future, that a growing number of new decentralized organizations would be established, and that traditional companies would gradually transition to a decentralized organization with Crypto in the future. One-liner: 大银行玩不明白区块链. One-liner: Big banks don't understand block chains. Elad Gil 在这篇小短文里揭露了很多现实中的问题. 自从 2013 年 Crypto 进入行业视野中以后, 大银行就是这么对待区块链的 (据我所知, 直到 2021 年, 仍旧很多中国银行以及金融公司都依然是这样): Elad Gil exposes many of the real problems in this brief article. Ever since Crypto entered the industry perspective in 2013, big banks have treated the block chain this way (as far as I know, until 2021, many Chinese banks and financial companies still do): 成立一个区块链团队. Set up a block chain team. 让区块链团队做一条私有链, 并且始终处于做 Demo 阶段. Let the block chain team make a private chain, and it's always in the Demo phase. 让 CEO 能够大夸特夸区块链团队, 说 “我们是有那个区块链啥的东西, 有团队专门在做”. "We have that block chain or something, we have a team working on it." Elad 也说, 大银行为了满足客户的需求, 开始利用 Crypto 来开发比如 ETF, 代币托管, 对冲基金, 衍生品交易所的产品. 他总结到银行和其他中介对 Crypto 的采用速度会越来越快. Elad also said that large banks had started to use Crypto to develop products such as ETFs, token trusts, hedge funds, derivatives exchanges, and he concluded that banks and other intermediaries were going to use Crypto faster and faster. Elad 在最后也调侃了这些大机构, 他说这些全球银行的董事会会议总是以马丁尼酒结束, 并且说纽约的马丁尼比旧金山的好很多, 而且波士顿的特别好. 他还说这些董事会成员都穿着西装带着单片眼镜, 有点像玩大富翁 (其实他就是想说这些机构的垄断). 最后他认真地说, 区块链和智能合约会改变 Crypto 以外的金融体系, 但是需要很长时间. Elad, in the end, interrogated these big institutions, said that the board meetings of these global banks always ended with martinis, and said that Martini in New York was much better than San Francisco, and Boston was special. He also said that the board members were wearing suits with single glasses, sort of like Monopolies. Finally, he seriously said that block chains and smart contracts would change the financial system outside Crypto, but it would take a long time. One-liner: 去中心化的含义在于容错性, 抗攻击, 防串通. One-liner: centralization means tolerance for error, resistance to attack, prevention of collusion. Vitalik 探讨了去中心化的含义. 谈论软件的去中心化的含义的时候, 我们可以从架构, 管理, 和逻辑上去考量. 架构上指的是物理上服务器的分布, 政治上指的是有多少人控制了这些服务器, 逻辑上指借口和数据结构是否合理. Vitalik explores the meaning of decentralisation. When talking about the meaning of decentralization of software, we can think about it from architecture, management, and logic. Structure refers to the distribution of physical servers, politics refers to how many people control these servers, and logic points to the rationality of excuses and data structures. 本质上, 去中心化的重要条件是容错性, 抗攻击, 防串通. Essentially, the key condition for centralization is tolerance, resistance to attack, prevention of collusion. 关于容错性, 区块链系统其实也需要在多个方面进行去中心化才能真正达到. 我们需要多个客户端实现, 民主化的技术讨论论坛, 尽量利益不相关的开发和研究人员, 挖矿算法必须降低中心化风险, 和摆脱硬件集中风险 (用 PoS). With regard to fault tolerance, block chain systems actually need to be decentralised in many ways in order to be truly achieved. We need multiple clients, a forum for democratic technical discussion, development and researchers with as little interest as possible, mining algorithms must reduce the risk of centralization, and we must move away from the risk of hardware concentration. 对于抗攻击, 一个很直观的例子就是, 如果你用枪顶着一个人, 让他交钱, 那他可能要命不要钱了; 但是如果去中心化的情况下, 你得用枪指着十个人, 威胁成本就高了十倍. 去中心化程度越高, 攻击成本和防御成本的比例越高. 所以 PoS 的抗攻击性比 PoW 更高, 因为硬件很容易被检测和攻击, 代币则更容易隐藏. One of the most straightforward examples of resistance to attack is that if you put a gun on a man and let him pay, he'll probably die without money; but if you go to the center, you have to point a gun at ten people, and the threat costs are ten times higher. The more central you go, the higher the cost of attack and defense costs. So Pos is more aggressive than Pow, because hardware is easy to detect and attack, and the money is easier to hide. 最后一个最复杂的就是防串通. 一个简单的防串通的例子就是反垄断法. 区块链中的串通的例子就是, 大矿工可能会聚在一起, 去以大量的算力来推动一些不利于网络的事情. 但是区块链的一个优点就是, 开发人员不在同一家公司, 不在同一间房间里工作, 所以不会像传统的软件公司那样, 可以随心所欲地修改规则. One simple example of collusion is antimonopoly law. One example of collusion in block chains is that big miners may come together to push something against the network with a lot of arithmetic. But one of the advantages of block chains is that developers don't work in the same company, not in the same room, so they don't change the rules at will, like traditional software companies. Vitalik 最后也提出了疑问. 以太坊的社区能在去中心化地情况下飞快地硬分叉网络, 但是如何促进和更加改善这种良好的协调呢? Vitalik finally asked the question. The community in Ethio can move fast and hard fork in a decentralised situation, but how can this good coordination be promoted and improved? One-liner: 以太坊的入门. One-liner: Introduction to Etheria. Linda Xie 教你入门以太坊. Linda 谈到了比特币与以太坊的异同, 以太坊上的身份和存储, 社交媒体, 权限管理, 公司管理和筹资应用. 相信你应该已经很了解了, 这里就不赘述啦 Linda Xie taught you how to enter Etheria. Linda talked about the differences between Bitcoin and Ether, in his identity and storage, social media, competency management, corporate management and fund-raising applications. 2017 年是 ERC-20 的一年, 以太坊和比特币的币价一飞冲天, 生态也开始繁荣, 越来越多的 DApps 开始了自己的 ICO, 越来越多 DAO 组织开始建立. 我们再次进入了混乱无序的氛围, 各种问题层出不穷. 一些对区块链和 Crypto 深信不疑的人开始重新思考 Crypto 的优点和最初的出发点. The year 2017 was one of the ERC-20s, where the Etherno and Bitcoin currencies were flying, and the ecology began to flourish, and more and more Dapps started their own ICOs, and more and more DAOs began to build. One-liner: 去中心化很重要. One-liner: It's important to go to the center. Chris Dixon 在这篇文章中, 虽然标题是说去中心化的重要性, 但是其实主要是在谈论 Web3 这个概念, 在 2018 年. Chris Dixon, in this article, although the title is about the importance of decentralisation, is basically talking about the concept of Web3, in 2018. Web1, 1980 - 2000 年, 服务建立在互联网社区建立的开放协议上. Web1, 1980-2000, services were based on open protocols established by the Internet community. Web2, 21 世纪初到现在, 盈利性互联网公司, 构建的软件和服务远远超过了开放协议. 随着移动应用的爆发, 用户从开放服务完全迁移到了这些更加复杂和中心化的服务上. 这些中心化服务的技术非常好, 但是扼杀了创新, 降低了互联网的趣味性和活力, 也通过数据的窃取以及算法偏见等造就了更加紧张的社会局势. Web2, from the beginning of the 21st century to the present, for profit Internet companies, built software and services far more than open protocols. With the outbreak of mobile applications, users have moved completely from open services to these more complex and central services. These central services are very skilled, but they kill innovation, reduce the interest and vitality of the Internet, and create even more tense social situations through data theft and arithmetic bias. “Web3”, 通过一套完美的激励措施, 让技术创造力和激励设计相交叉, 在未来几十年可能重新颠覆和替换现有的 Web2 格局. Crypto 网络结合了 Web1 和 Web2 的优点, 提供了社区治理的去中心化网络和超过中心化服务的更强的服务. Crypto 网络使用区块链的共识来更新和维护状态, 使用 Crypto 来激励参与者, 开发者和应用使用者. Crypto 网络使用开源代码和社区治理的方式保持增长中的去中心化. 当参与者想要退出时, 就可以直接出售所有代币, 或者通过分叉协议来退出. Crypto 网络使网络参与者团结起来, 共同实现网络的增长和 Token 的升值. 但是目前 Crypto 网络的性能问题依旧是瓶颈 (当然 L2 22 已经可以解决这个问题). “Web3”, through a perfect set of incentives, to bring technology creativity and incentive design together, may destabilize and replace existing Web2 patterns in the coming decades. Crypto network combines the advantages of Web1 and Web2 to provide community governance with decentralized networks and stronger services that exceed central services. Crypto network uses the consensus of block chains to update and maintain the status, and Crypto to motivate participants, developers and application users. Crypto network uses open source codes and community governance to keep growing decentralised. When participants want to quit, they can sell all the indials directly or, by way of a split agreement, exit. Crypto network unites the network participants to achieve the growth of the network and the Token appreciation. But the current Crypto network performance problem remains a bottle (of course, L2 22 can be solved). 说去中心化网络应该赢和会赢是两回事. Chris 说它们会赢的真正原因是: Web3 开发者在构建真正的创新应用. Crypto 网络会赢得企业家和开发人员的心 (也就是, 会有, 真正的社区和为爱发电的人). 随着协议对新的贡献者的吸引, 协议的生态和成熟度会成倍增长. Crypto 网络存在的多个正循环将网络的各个角色都激励了起来, 加快了社区的发展速度. 当最终 Crypto 网络对开发者和企业的吸引力大于 Web2 大公司的吸引力后, 它可以调动更多的资源 (22 年 Web3 开发者的总数远远低于亚马逊的员工数), 甚至超过大公司的开发速度. Chris said that the real reason why they would win is that Web3 developers build real innovation applications. Crypto networks win the hearts of entrepreneurs and developers (i.e. there will be, real communities and people who love to generate electricity). As protocols attract new contributors, the ecological and maturity of the protocols multiplys. Crypto networks have multiple positive cycles that inspire the various players of the network and accelerate the development of the community. When eventually the Crypto network is more attractive to developers and businesses than Web2 big companies, it can mobilize more resources (22 years of Web3 developers are far less likely than Amazon workers), even beyond the speed of development of large companies. Chris 也承认, 去中心化的网络不是解决所有问题的灵丹妙药, 而是提供了比中心化系统更好的方案. Chris also admits that decentralizing the network is not a panacea for all problems, but offers a better solution than centralizing the system. One-liner: 区块链已经很颠覆. One-liner: Block chains have been disrupted. Balaji Srinivasan 指出, 虽然区块链在当时已经解决了无数的问题, 创造了数十亿美金的市场, 但是一些很聪明的人依旧去声称区块链不好, 或者没有用, 或者它不好, **没有用, 认为区块链就是一个泡沫, 会昙花一现. Balaji Srinivasan pointed out that, while the block chain had solved numerous problems at the time, creating billions of dollars in the market, some smart people still claimed that the block chain was bad, or no use, or that it was bad, ** no use, thinking that the block chain was a bubble, and that it was a bubble. Balaji 认为高度有价值的技术通常在前往顶峰的路上会经历无情的消极情绪. 高增长伴随着高波动和更高的预期, 导致炒作周期和明显的高估期, 直到最终该技术在全球范围内无处不在. 然后, 新的批评不再是关于时尚或缺乏效用, 而是关于不可避免的垄断, 直到下一次破坏出现在地平线上, 循环重新开始. Balaji believes that technology of high value is usually subjected to relentless negative emotions on its way to the peaks. High growth is accompanied by high volatility and higher expectations, leading to a cycle of frenzy and a clear period of overestimation, until the technology is finally everywhere in the world. Then, new criticism is no longer about fashion or ineffectiveness, but about inevitable monopolies, until the next destruction comes on the horizon, and the cycle recommences. 区块链在当时已经至少在三个数十亿美元的部门提供了 10x 的改进, 在数字黄金, 国际电汇和众筹方面. The block chain provided 10x improvements in sectors that had already been at least $3 billion at the time, in digital gold, international wire transfers and crowds. Balaji 总结到只是因为区块链已经做了如此多的创新, 他才希望它能做得更多. Balaji concluded that it was only because so many innovations had been made in the block chain that he wanted it to do more. One-liner: 没有理想的稳定币. One-liner: There is no ideal currency of stability. Haseeb Qureshi 说有用的货币应该是交换媒介, 记账单位和价值存储的货币. 加密货币在作为价值存储或记账单位上相当糟糕. 因此我们需要与美元等稳定资产挂钩的稳定币. Haseeb Qureshi says that the useful currency should be the exchange medium, the unit of account and the currency where the value is stored. 稳定币无法一直保持稳定, 但是在一定市场行为范围内可以保持稳定. 每个机制的关键问题就是能支撑多大的波动? 泡沫和空气币总归要崩, 毕竟长远来说我们都死了, 所以如果一个稳定币就算只持续了 20 年, 也可以说是稳定的. 稳定币主要要看四个方面: 能承受多少波动? 维护系统有多麻烦? 分析波动范围是否容易? 交易员如何透明观察市场状况? 后两个点非常重要, 决定了是否会导致死亡螺旋. 理想的稳定币应该能够承受巨大的市场波动, 维护成本不应极高, 应该易于分析稳定参数, 并对交易员和套利者透明. The key question for each mechanism is how much volatility can be sustained? The bubbles and air coins are going down, after all, and we're all dead in the long run, so if a stable currency lasts only 20 years, it's going to be stable. 如何设计一个稳定币呢? 稳定币的分类包括三个大类: 法币抵押币, Token 抵押币和非抵押币. How to design a stable currency? The classification of stable currency includes three broad categories: French currency collateral, Token mortgage and non-collateral currency. 法币抵押币: 100% 稳定, 最简单, 链上不会受攻击, 但是集中化, 清算麻烦, 高度监管, 需要定期审计来保持透明度. 100% stability, the simplest, chain-free, but concentration, clearing troubles, highly regulated, requires regular audits to maintain transparency. Token 抵押币: 更去中心化, 清算廉价, 非常透明, 可以上杠杆, 但是暴跌会自动清算, 价格并不是最稳定, 与 Token 关联度很大, 资本效率低, 最复杂. Token Mortgage: More centralization, cheap clearing, very transparent, leverageable, but crashes automatically settle, prices are not the most stable, linked to Token, inefficient capital, most complex. 非抵押币: 无需抵押品, 大多数去中心化且与其他资产无关, 但是需要持续增长, 容易受宏观影响, 难以分析稳定度, 有一定复杂度. Non-collateral currency: no collateral, mostly decentralised and not related to other assets, but sustained growth, vulnerability to macro-level influence, difficulty in analysing stability, some complexity. Hasseb 认为理想的稳定币应该是这样的: 没有理想的稳定币. 我们不应该试图尽早挑选赢家, 而是鼓励更多的稳定币实验. Crypto 教会了我们, 未来很难预测. Hasseb believes that the ideal stable currency should be: there is no ideal stable currency. We should not try to pick winners as soon as possible, but encourage more stable currency experiments. Crypto teaches us that the future is hard to predict. 2018 年, 漫长的熊市来了, 这一年经典的观点和故事突然就少了. 看衰者觉得自己太明智了, 看穿了泡沫, 坚持者们依旧在 Crypto 领域深耕, 建设基础设施, 继续提高认知, 为之后的爆发继续做准备, 他们依旧在探索 Crypto 的优点和本质. In 2018, the long city of bears came, and all of a sudden, the classics and stories of the year were missing. The losers thought they were too smart, saw through the bubbles, and the insistents were still plowing in the Crypto area, building infrastructure, continuing to raise awareness, continuing to prepare for the outbreak, and still exploring the virtues and essence of Crypto.

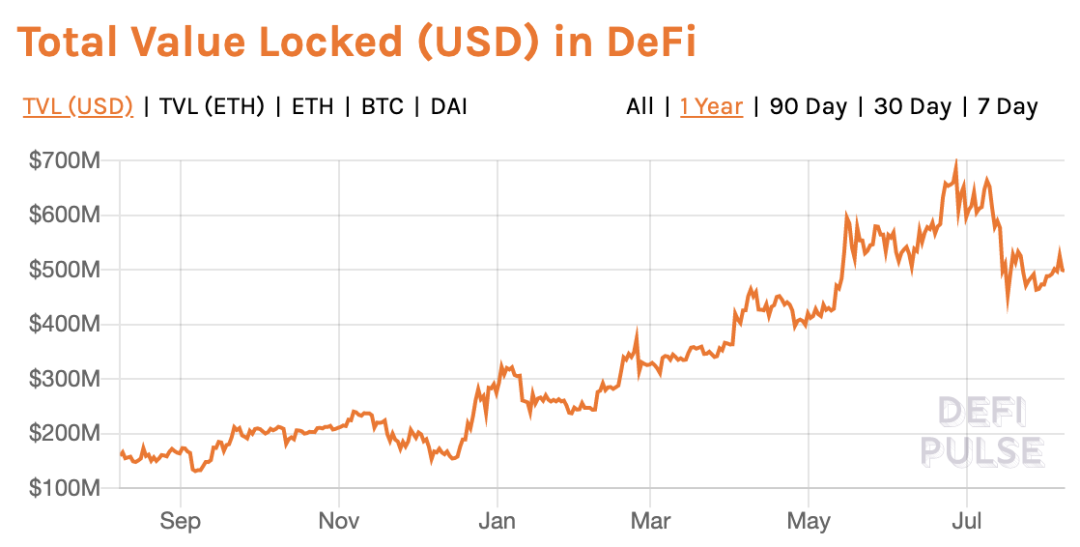

One-liner: 区块链是 Web 更好的数据库. One-liner: Block chains are a better web database. Balaji 通过数据库的角度来阐述了区块链的重要性. 有些开发人员说区块链只是糟糕的数据库, 为啥不用性能高, 又成熟的 PostgreSQL 呢? 怀疑论者觉得区块链是又慢又笨又贵的数据库. Balaji describes the importance of block chains from a database perspective. Some developers say block chains are bad databases, why don't they have high performance and mature PostgreSQLs? Doubters think block chains are slow, stupid, expensive databases. Balaji 反驳到, 公链是大规模的多客户端数据库, 同时每个用户都是根用户. 这样的数据库有助于存储用户之间的共享状态, 尤其是当这些数据很宝贵的时候, 比如说, 钱. Balaji rebuts that the public chain is a large multi-client database, and that every user is a root user. Such a database helps to store the sharing status among users, especially when these data are valuable, for example, money. 同时, 公链的数据是公开开放的, 任何人都可以读取公链中的所有数据来创建块浏览器, 任何人都可以使用自己的钱包写入公链. 任何有互联网连接的用户都可以阅读. 任何拥有一些 BTC 的人都可以编写事务. 任何拥有足够计算能力的人都可以开采比特币块. 这就是公链的含义: 每个用户都是根用户. At the same time, the data in the public chain is open, and anyone can read all the data in the public chain to create a browser, and anyone can use their wallet to write into the public chain. Any user with Internet connections can read it. Anyone with some BTC can write the business. Anyone with enough computing power can extract bitcoins. That's what the public chain means: every user is a root user. One-liner: DeFi 是金融的未来. One-liner: DeFi is the future of finance. Linda Xie 谈了 DeFi 的未来. DeFi 旨在重建许多现有金融体系 (例如借贷、贷款、衍生品), 但以一种通常自动化的方式, 并删除中间人. 文章中涵盖了 DeFi 的一些发展方向以及一些可能出现的可能性. Linda Xie talks about the future of DeFi. DeFi aims to rebuild many of the existing financial systems (e.g. loans, loans, derivatives), but in a way that is usually automated, and deletes intermediaries. Some of the directions of DeFi and possible possibilities are covered in the article. 抵押: 对 DeFi 的主要抱怨之一是, 需要过度抵押才能获得贷款. 谁会想锁上这么多资本? 这是对资本的极低效使用, 许多人一开始就没有额外的资金. 然而, DeFi中已经锁定了 5 亿美元?(今天点进链接的话, 可以看到是, 750 亿), 这表明需要使用它. 大家目的主要是为了上杠杆. Linda 认为当时还在 DeFi 的早期, 没有相关的 DID 和声誉系统, 一旦有了更好的身份和声誉系统, 抵押品的要求就会下降 (Lens Protocol?). One of the main complaints against DeFi is that over-collateralization is needed to obtain a loan. Who wants to lock up so much capital? This is an extremely inefficient use of capital, and many people have no extra money from the start. 可组合性: DeFi 最独特的方面之一是可组合性, 可以像乐高片段一样相互插入, 并创建全新的内容. Combinability: One of the most unique aspects of DeFi is collusiveness, which can be inserted into each other like a Lego clip, and create a whole new content. 资产: Linda 很喜欢把比特币等资产的代币化版本引入 DeFi. 她试想之后传统投资者会将不同资产以代币化形式表示, 然后进行 DeFi 操作. Linda was very fond of introducing a monetized version of assets like Bitcoin into DeFi. She thought that after that, traditional investors would express different assets in a monetized form, and then do the DeFi operation. 风险: Linda 认为 DeFi 风险很大, 毕竟涉及到合约的可组合性以及各种新的协议造成的复杂性. 还有抵押品价格下跌的风险, 以及日后监管的风险. 她认为可以用一些去中心化的保险项目来对冲一些风险. Risk: Linda thinks that DeFi is very risky, after all, about the combinability of the contract and the complexity of the new agreements, the risk of falling collateral prices, and the risk of future regulation. She thinks that some decentralised insurance projects can be used to hedge some of the risks. 最后, Linda 总结当时还在 DeFi 的早期, 但潜力巨大. DeFi 让很多被排除在传统金融之外的人能够获得金融产品, 也创造出了许多新的金融产品. 很多对 DeFi 的抱怨其实只是因为当时太早期了, 开发人员与用户之间的相互吸引让她对 DeFi 的未来很看好. Finally, Linda summed up in the early days of DeFi, but with great potential. DeFi gave many people who were excluded from traditional finance access to financial products and created many new ones. One-liner: 化名经济很重要. One-liner: The economics of aliases are important. Balaji 在这个演讲里讲述了化名经济 (不是匿名经济). 化名就比如你在 Discord 和 Reddit 里的身份. In this speech, Balaji described the economics of aliases, which are not anonymous, like your identity in Discord and Reddit. 他探讨了化名对一个现实世界里的人的重要性. 银行账户在存储资产, 你的真实身份在存储信用和声誉, 而银行账户只有你可以去改变, 身份的声誉是除你以外的所有人来决定的. He explored the importance of aliases to people in a real world, bank accounts are storing assets, your real identity is storing credit and reputation, and the bank accounts are only you can change, and the reputation of identity is determined by everyone but you. Balaji 认为人的资产, 言论, 和身份是应该独立分开的. 他以推特为例, 说明了可以通过零知识证明来将人的声誉 (粉丝等) 移植到一个化名身份上, 就像资产的转移一样简单. 这就可以实现隐私与声誉的平衡, 成功将身份和声誉分开了. Balaji thought that people's assets, words, and identities should be separate, and he used Twitter as an example of how a person's reputation could be transplanted to an alias by proof of zero knowledge, as simple as a transfer of assets. That would balance privacy with reputation, and succeed in separating identity from reputation. 2019 年, 依旧是 Crypto 寒冬. 大部分人会想, Crypto 已经没有发展空间了, 价值就该如此. 长时间的冷淡让大多数的从业者都失去了信心, 但是依旧有人在绝望之谷中保持了独立的思考, 在黎明前的黑暗中, 依然在坚持输出观点, 探索不同领域和畅想未来. In 2019, it was still the winter of Crypto. Most people would think that Crypto no longer had room for development, and that value would be so. One-liner: 可信中立性很重要. One-liner: Credible neutrality is important. Vitalik Buterin 探讨了可信中立性的重要性. 人们会对政府的安排, 项目代币的分配, 和审查制度和意识形态感到不安. 这实际是可信中立性缺失而导致的一种不安全感. 我们需要一种新的机制 (算法加激励) 来保证可信中立性. Vitalik Buterin explores the importance of credible neutrality. People are troubled by government arrangements, the allocation of project tokens, and censorship and ideology. This is actually a sense of insecurity caused by the absence of credible neutrality. We need a new mechanism to guarantee credible neutrality. 中立性其实就可以简单理解成公平, 但是中立和公平从来不是完全的. 可信中立性当然还要可信, 也就是机制的设计能说服大部分的普通人, 同时也透明化, 和持久. Neutrality can be understood simply as fairness, but neutrality and fairness are never complete. Credible neutrality, of course, must be credible, that is, mechanisms can be designed to convince most ordinary people, but also transparent, and lasting. 一个可信的中立性的构建需要满足以下特性: A credible neutral construction needs to meet the following characteristics: 不要将特定人员或特定结果写入机制 (输入应该更多是参与者的输入, 而不是硬编码的规则) Do not write a particular person or result into the mechanism. 开源和可公开验证 (零知识证明非常好地得到了这一点以及隐私) Open source and publicly verifiable. 保持简单 (这反而是最复杂的) Keep it simple. 不要经常更改 Do not change often 可信中立性的有效性也很重要. 我们任何的创造都是需要做到有效的, 而不是单纯为了可信中立性而生. 我们的东西要真正地能用, 和能解决问题. It's also important to be credible and neutral that any of our creations be effective, not simply for the sake of credible neutrality, and that our things be truly useful and solve problems. Vitalik 总结到, 确保系统最终不会赋予少数人权力变得越来越重要. 我们可以创造可信的规则系统, 那我们就必需保证可信中立性, 有效性和去中心化. Vitalik concludes that it is becoming increasingly important to ensure that the system does not end up empowering minorities. We can create a credible system of rules, and then we need to guarantee credible neutrality, effectiveness and decentralisation. One-liner: DeFi 的入门. One-liner: Introduction to DeFi. 这篇文章是非常详细和清晰的对 DeFi 的一些基础知识介绍, 以及入门手册. 这里就不多阐述了. This article is very detailed and clear about some of the basics of DeFi, as well as the introduction manual. One-liner: 所有权经济是 Web 的下一个大叙事. One-liner: Ownership economy is the next big narrative of Web. Jesse Walden 在这篇文章中谈了所有权经济. Variant Fund 的投资逻辑也是专注于所有权经济. 他认为所有权经济是 Crypto 和消费软件的下一个前沿. Jesse Walden, in this article, talks about the ownership economy. The investment logic of Variant Fund is also focused on the ownership economy. He thinks the ownership economy is the next frontier of Crypto and consumer software. 现在大多数的平台都不是为用户所拥有的. 随着个人在价值创造中的作用越来越普遍, 互联网的下一个进化方向会转向不仅由用户创造, 运营和资助的软件, 这些软件还会由用户拥有. Most platforms are not now owned by users, and as the role of individuals in value creation becomes more common, the next direction of the Internet will be to move to software that is not only created, operated and funded by users, which will also be owned by users. 所有权是用户以更深入的方式为产品做出贡献的强大动力, 有助于确保随着时间的推移产品更好地与用户保持一致, 从而使平台更加增长和保持创造力, 建立网络效应. Ownership is a powerful incentive for users to contribute to products in a more in-depth manner, helping to ensure that products are better aligned with users over time, thereby increasing the platform's growth and creativity, building network effects. 从 IP, HTTP, HTML, 到 RSS, BitTorrent (数据分发的创新) 协议的创新充满了破坏性. 消费者想要, 那么所以破坏性的协议出现了. Crypto 也是一种颠覆性的协议创新, 让我们能像 BitTorrent 分发数据包一样分发价值和所有权. From IP, HTTP, HTML, to RSS, BitTorrent (Innovation in data distribution) the innovation of the protocol is destructive. Consumers want it, so the destructive agreement comes up. Crypto is also a subversive protocol innovation that allows us to distribute value and ownership like BitTorrent distributes the data package. 比特币和以太坊成功的核心就是用户所有权. 矿工, 用户和开发者可以真正拥有这个平台, 赚取价值. 代币的经济激励让协议的发展变得飞速. 所有权经济的典型代表还有 Celo, Binance, Compound, Uniswap, Reddit 等. The core of the success of Bitcoin and Etheria is user ownership. Miners, users and developers can really own this platform and earn value. 软件正在吞噬世界, 个人所有权经济叙事在吞噬软件. Software is devouring the world, personal ownership economic narratives are devouring software. One-liner: 比特币并非完美. One-liner: Bitcoin's not perfect. >/strang' Matt Huang 阐述了比特币的一些公开质疑. 对于一个事物, 必须要坚持辩证思维, 而不是钻牛角尖, 看不到事物的另一面. 尽管比特币经过十几年的发展, 已经让投资者赚得盆满钵满, 但它依然有争议. Matt Huang set out some of the public questions about Bitcoin. For one thing, it's got to stick to a dialectic thinking, not to drill the horns, and not to see the other side of the thing. Although Bitcoin has developed for more than a decade, it's got investors full of money, but it's still controversial. 为什么这个时代需要比特币? 因为我们需要一个新的金融系统. 金钱的这个概念是人类思维的最伟大的发明 (另一个是写作). 金钱的主要功能是存储价值, 这让购买力跨越了时间和地理位置. 黄金一直被认为是价值存储的介质. 纸币和美元的统治力主要是取决于对政府的信任. Because we need a new financial system, the concept of money is the greatest invention of human thinking (the other is writing), money's primary function is to store value, which transcends purchasing power over time and geography, gold has always been considered a medium of value storage, and the power of banknotes and dollars depends primarily on trust in government. 比特币作为一种去中心化的资产, 结合了黄金稀缺, 货币性质, 与数字可转让性, 拥有巨大价值存储潜力. 它稀缺, 便携, 可互换, 可分割, 耐用, 被广泛接受 (这个倒是还没有凸显). 除此之外, 比特币是数字化, 可编程, 抗审查的. Bitcoin, as a decentralised asset, combines gold scarcity, monetary nature, and digital transferability, with huge storage potential for value. It's scarce, portable, interchangeable, severable, durable, and widely accepted. Besides, bitcoin is digital, programmed, resistant to censorship. 比特币作为金融泡沫, 也说得通. 泡沫资产是内在价值被高估的资产, 那么所有货币资产都是泡沫资产, 黄金也是泡沫资产. 货币可以被想象成一个永不破灭的泡沫, 法币, 黄金或比特币的价值都依赖于集体信仰. As a financial bubble, it makes sense. Foam assets are inherently overvalued assets, so all monetary assets are bubble assets, gold is bubble assets. Currency can be imagined as an unbreakable bubble, French currency, gold or bitcoin values depend on collective beliefs. 比特币的 11 年历史中有四个泡沫: There are four bubbles in the 11-year history of Bitcoin: 2011: 1 → 31 → 2 美元 2011: 1 ff 31 ff 2 United States dollars 2013: 13 → 266 → 65 美元 2013: 13 — 266 — 65 United States dollars 2013 - 2015: 65 → 1242 → 200 美元 2013 - 2015: 65 — 1242 — 200 dollars 2017 - 2018: 1000 → 19500 → 3500 美元 2017 - 2018: 1000 19500 US$ 3,500 每次泡沫的破灭都导致了更广泛的信仰, 扩大了比特币作为未来价值存储器的潜力. 但是比特币存在了较多风险: 广泛接受度, 波动性, 监管, 技术风险, 竞争风险, 未知性. Each burst of bubble leads to a broader belief, expanding the potential of Bitcoin as a future value memory, but bitcoin has more risk: wide acceptance, volatility, regulation, technological risk, competitive risk, uncertainty. 在了解了比特币的优势和风险后, 我们能更加去评估风险和回报, 更加看懂比特币. After understanding the advantages and risks of Bitcoin, we can assess risks and returns more, and understand bitcoin better. One-liner: 标题概括得很好了. One-liner: The title is very general. Fred Ehrsam, Blake Robbins, Jesse Walden 讨论了 Crypto 与创作者与社区. Fred Ehrsam, Blake Robbins, Jesse Walden discussed Crypto with creators and communities. 他们的一些精彩观点有: Some of their brilliant ideas are: 人们在猜测想法, 而不是交付真正的产品. People are guessing, not delivering real products. 粉丝社交活动和经济激励是下一代互联网的重要组成部分. The social activities of fans and economic incentives are an important part of the next generation of the Internet. 比特币本质上是金融性的, 但首先是一个社会社区. Bitcoin is essentially financial, but first it's a social community. 将创作者经济金融化是非常值得探索的. Financialization of the creator's economy is highly worth exploring. 名声是一种自我强化的现象, 尤其是在算法世界中. Honour is a self-enhanced phenomenon, especially in the arithmetic world. 创作者很可能是从分配开始, 而不是众筹. The creator probably starts with distribution, not crowds. 拥有不完善的原型是一种精神拐杖, 能帮助人们适应一个新模式. Having an imperfect prototype is a spiritual crutch that helps people adapt to a new model. 社区将像数字民族或国家一样形成. Communities will form like digital nations or nations. One-liner: AMM 是个很好的临时垫脚石. One-liner: AMM is a good temporary stepping stone. Uniswap 从本质上来说, 是一个很傻的 x * y = k 的做市机器人. 但是它已经是世界上最大的 DEX. Uniswap is essentially a stupid x* y & #61; k city robot, but it's already the largest DEX in the world. Uniswap 的原理就是, 只要略微偏离实际汇率, 那么套利者就会让汇率回归正常. Uniswap 还有个很傻的事情就是无常损失, 做池子通过手续费赚钱, 但是又通过无常损失赔钱, 也就是需求对你有用但是价差对你不利. Uniswap's theory is that, with a slight deviation from the real exchange rate, the arbitrager will return the exchange rate to normal. Uniswap, and one stupid thing, is to make a profit by making a pool of money through a fee, but also by making a profit through anomalous loss, which is that demand is useful to you but price differentials are bad to you. Uniswap 通过简单的 300 行代码, 风靡了 DeFi, 使用无需许可的方式, 给任何人提供服务, 同时也不需要任何预言机. Uniswap 的之后也有了一堆有特色的后裔, 各有千秋. Uniswap, through a simple 300-line code, has the wind of DeFi, in a way that does not require permission to serve anyone, and does not need any prophesy machine. Uniswap 无法区分零售或者套利, 在无论如何的市场条件下, 都遵从 x * y = k. 例如 Uniswap 这样的最简单的 CFMM, 会赢得稳定币这个方向, 因为完全不需要运营, 集成, 和人力成本. 部署合约, 就会自动运行, 计算成本和 gas 费用也是用户支付 (比 Jump Trading 牛逼多了). 只要在这样的情况下, 做到有 Jump Trading 的 80% 好就足够了. Uniswap cannot distinguish between retail sales or arbitrage, in any case, subject to x* y & #61; k. For example, the simplest CFM like Uniswap would win the direction of stabilizing the currency, because there is no need to operate at all, integration, and manpower costs. Deployment contracts would run automatically, and calculating costs and gass would also be paid by the user (more than Jump Trading). In this case, 80% of Jump Trading would be enough. Haseeb 认为 Uniswap 击败订单簿有四个原因: 简单, 监管少, 提供流动性很容易, 易于创建激励. 尽管如此, 他认为 Uniswap 的成功不会永远持续下去, AMM 和 CFMM 可能只是一个技术上的过渡, 只是一个临时垫脚石. Haseeb believes that Uniswap beats the order book for four reasons: it's simple, less regulated, it's easy to provide liquidity, and it's easy to create incentives. Nevertheless, he believes that Uniswap's success will not last forever, and that AMM and CFM may be just a technical transition, just a temporary stepping stone. One-liner: 以太坊的 MEV 是很可怕的掠食者. Ether's MEV is a terrible predator. 以太坊是一个可怕的黑暗森林, 有着各种顶端掠食者. 这些掠食者采用套利机器人, 来获利, MEV 一词也因此诞生. Etherwood is a terrible, dark forest with a variety of top predators, who use holstered robots to profit, and the term MEV was born. 有人意外将 Uniswap 流动性发给了合约地址, 由于这些顶端掠食者正在虎视眈眈地盯着内存池里的交易, 所以将流动性从合约中取出来是一件不简单的事情. 作者和一些合约工程师制定了一个混淆计划, 写了一个智能合约, 但是还是解救失败了. Uniswap's mobility was unexpectedly sent to the contract address, and because these top predators are staring at the transactions in the memory pool, it's not easy to take it out of the contract. The author and some of the contract engineers developed a confusion plan, wrote a smart contract, but failed to rescue it. 最终他们得到的教训是: 黑暗森林中的怪物是真实的, 链上的操作不容得闪失, 不能依赖正常的基础设施, 以太坊的未来会更加可怕. 但是这个未来是可以通过 VDF 和重新修改后的 MEV 来改善的. In the end, they learned that monsters in the dark forest are real, that chain operations cannot be lost, that they cannot rely on normal infrastructure, that the future of Ethio will be even more terrible, but that the future can be improved through VDF and remodified MEV. 2020 年这一年发生了很多事情, 全球性的疫情爆发, 各国央行的疯狂放水拯救经济, 很多热钱慢慢流入了 Crypto 领域, 在这一年的年底, 牛来了. 无数新鲜血液, 不止是资金, 还有热血沸腾的年轻人流入了 Crypto 圈. 区块链的 NFT 和 DeFi 的基础设施已经完备, 系好安全带, 起飞上月球了. A lot of things happened in 2020, a global outbreak, the central bank's madness to save the economy, a lot of hot money flowing into the Crypto field, and, at the end of the year, the cow came. Numerous fresh blood, not only money, but also hot young people flowing into the Crypto Circle. The NFT and DeFi infrastructure of the chain is in place, the safety belts are in place, the moon is on the way. 2021 年有非常多的精彩文章, 由于篇幅的限制, 本文只提炼精华中的精华. In 2021, there were a lot of wonderful articles, which, due to space constraints, only refined the essence of the essence. One-liner: 如何度过牛熊转换. One-liner: How to get past the cow bear switch. Fred Ehrsam 教你如何度过牛熊转换. 我们需要以身作则专注于任务, 做好主要的事情, 进行压力测试, 考虑筹款, 谨慎团队扩张, 通过多个渠道证实消息, 为马拉松做好准备. Fred Ehrsam taught you how to get past the cow bear switch. We need to lead by example, do the main thing, do stress testing, think about fund-raising, carefully team expansion, through multiple channels, prepare for marathons. 每个周期过去之后, 整个市场都会更加强大, 在熊市, 就需要做好准备, 抓住机会. When every cycle passes, the whole market becomes stronger, and in Bear City, it needs to be prepared, to seize the opportunity. One-liner: 开放元宇宙的价值无穷. One-liner: The value of the open meta-cosmos is infinite. Packy McCormick 从 Web3 聊到了开放元宇宙的价值链. Packy McCormick talked about the value chain of the open metaspace from Web3. Web3 是互联网的下一个形态, 用 Crypto 来达成共识与标准, 通过社区治理来建立去中心化的互操作性网络, 同时也赋予了用户自我主权身份. Web3 is the next form of the Internet, using Crypto to build consensus and standards, to build decentralised interoperability networks through community governance, and to give users self-sovereign identity. 现在的元宇宙却看起来更像封闭的 Web2 模式, 是封闭的. 开放元宇宙最重要的是数字化以及个人数据的可移植性和互操作性, 正如 NFT 的价值不是由中心化平台中介, 而是由用户决定的一样. Now the metacosystem looks more like a closed Web2 mode, and it's closed. The most important thing about open metacosystems is digitization and the portability and interoperability of personal data, just as the value of NFTs is determined not by centralizing platforms, but by users. 开放元宇宙的价值链会是直接的研发, 零售, 和营销, 去掉了很多的中间环节. 这场开放元宇宙的运动会是资本主义且理想主义的. The value chain of the open meta-cosm will be direct research and development, retailing, and marketing, taking away a lot of the middle lines. The open meta-cosm movement will be capitalist and idealistic. One-liner: MEV 的原理和影响. One-liner: The rationale and effects of MEV. Charlie Noyes 详细探讨了 MEV 的概念. MEV 是 Miner Extractable Value 的意思, 是衡量矿工在区块内整理交易可以赚取的利润, 比如复制套利者的交易来自己盈利, 这可能会导致其他机器人也发起竞标. Charlie Noyes elaborates on the concept of MEV. MEV is a Miner Extracable Value, which is a measure of the profits that miners can earn by organizing transactions within blocks, such as copying arbitrage to make their own profits, which may lead to other robots competing. MEV 对以太坊和普通用户是有害的. 下图中是已实现的 MEV 收益, 现实中的 MEV 行为其实更高. MEV is harmful to Ether and ordinary users. The following figure shows the realization of the MEV benefits, and the actual MEV behavior is even higher. 目前 MEV 主要是通过矿工来做 Uniswap 的套利, 还有就是从一些智能合约中窃取资金. 未来, MEV 可能会越来越危险, 矿工会更多地冒险去进入危险地带, 导致各种不同的 MEV 以及勾结操作. 这是一种无形的对用户的税收, 是恶性的操作, 同时在本质上对共识造成了不稳定性. At present, the MEV is mainly a arbitrage of Uniswap through miners, and it's stealing money from some smart contracts. In the future, the MEV may become increasingly dangerous, and mine unions take more risks to enter dangerous areas, leading to different MEVs and colluding operations. It's an invisible tax on users, a vicious operation, and it essentially creates instability for consensus. MEV 的产生是区块链的复杂性和状态性所导致的通病. 一个理想的解决方案就是在应用层面进行更好的设计, 或者通过提高安全激励 (EIP-1559) 来减轻 MEV. MEV 是一个非常值得探索的道路. MEV is generated by the complexity and state of the block chain, and an ideal solution is to design better at the application level, or to reduce MEV. MEV by improving security incentives (EIP-1559) is a very worthwhile path to explore. One-liner: NFT 是区块链上无法复制的文件系统. One-liner: NFT is a file system that cannot be copied on the block chain. Jesse Walden 认为思考 NFT 的一个简单方法是将其当作区块链上的无法复制的文件. Jesse Walden thinks that a simple way to think about NFT is to treat it as an uncopyable file on the block chain. NFT 使得拥有数字媒体资产变得可能, 就像拥有比特币等数字货币资产一样. NFT 会让创作者, 受众, 开发人员在数字所有权的市场中赚取更多的收益. NFT makes it possible to own digital media assets, just like digital money assets like bitcoin. 一个常见的对 NFT 的批评就是 NFT 作品可复制. 但是其实文件被复制和查看得更多, 文化价值就更大. One of the most common criticisms of NFT is that NFT works are replicable, but in fact documents are copied and viewed more, and culture is more valuable. NFT 的价值和比特币一样, 信仰者越多, 价值就更高. 长远来看, DeFi 是金融乐高, NFT 是媒体乐高. NFT 的发展刚刚开始. In the long run, DeFi is financial and NFT is media Lego, and the development of NFT is just beginning. One-liner: NFT 具有巨大的粉丝经济潜力. Chris Dixon 引用了 1000 个真正粉丝的例子, 展示了 NFT 的巨大潜力. NFT 可以加速创作者直接从粉丝处赚取收益的趋势, 为创作者提供了更好的经济学, 去除了中介, 启用粒度价格分层, 让用户真正拥有 NFT. Chris Dixon cites the example of 1,000 true fans, showing the great potential of NFT. NFT can accelerate the trend of creators to earn direct earnings from fans, providing better economics for creators, besides intermediaries, to activate the particle price layer, and to give users real ownership of NFT. One-liner: DAO 的入门. One-liner: Introduction to DAO. Linda Xie 的入门教程都写得非常好, 这次她介绍了 DAO 的概念, 应用, 工具, 未来, 和潜在的问题. Linda Xie's introductory curriculum was very good, and this time she introduced DAO concepts, applications, tools, the future, and potential problems. One-liner: 认受性的风险与潜力. One-liner: Recognition of the risks and potential of sexuality. Vitalik Buterin 论述了区块链与认受性 (Legitimacy) 的关系, 以及如何利用认受性. Vitalik Buterin discusses the relationship between block chains and acceptance, and how to use acceptance. 比特币和以太坊网络的开支模式是严重的资源错配. 给矿工的收益远远超过研发的费用. 虽然比特币和以太坊生态能集资数十亿美元, 但是在资金的使用上非常奇怪和难以理解. The pattern of spending on Bitcoin and Ethernet is a serious mismatch of resources. Revenues to miners far exceed the cost of R & D. Although Bitcoin and Etherconomic energy have raised billions of dollars, it is very strange and difficult to understand how money is used. 很多情况下, 代币不是最终为密钥所有的, 而是由某种社会契约所有的 (比如 VC). 这些社会契约就是认受性 (Legitimacy), 支配着社会地位的博弈. 这个概念其实就是大众所接受的某个结果, 且某个人都预期别人会这样做. 认受性可能是强权带来的, 连续性带来的, 公平性带来的, 或者程序、绩效、参与所带来的. In many cases, the token is not ultimately owned by the key, but by a social contract (e.g. VC). These social contracts are about acceptance, the game of social status. 我们可以利用认受性的概念来支持公共设施和公共物品的资助. 比如 NFT 就是一个很好的例子, 对艺术家, 或者组织来说是很大的福音. We can use the concept of acceptance to support the financing of public facilities and goods, like NFT, which is a good example of a great evangelical for artists, or for organizations. One-liner: Crypto 是个很好玩的游戏. Crypto is a fun game. Packy McCormick 在本文中讨论了区块链上的游戏. Crypto 是一个很好玩的游戏, 一个数十亿人在线玩的游戏. 社交媒体是这个游戏的清晰体现. Packy McCormick discusses in this paper the game on the block chain. Crypto is a fun game, a game that billions of people play online. Social media is a clear expression of the game. 成功的电子游戏的设计需要有频繁反馈循环, 可变结果, 控制感, 与和元游戏的连接 (最重要). 互联网就是一个无限的游戏, 在推特, YouTube, Discord, 工作中扮演自己, 积累身份. 比如马斯克就是一个很好的玩家. Successful video games need to be designed with frequent feedback loops, variable outcomes, control perceptions, connections to meta games (most importantly). The Internet is an infinite game, playing itself in Twitter, YouTube, Discord, working, building identities. Crypto 是互联网游戏内的资金. 越是关心自己的身份, 就越可能打开新的可能性, 越是会受到 NFT 的吸引. The more you care about your identity, the more you can open up new possibilities, the more you're attracted to NFT. 对这个游戏, 不用太认真, 不用等到完美时机再跳进来, 而是慢慢学习, 慢慢积累. You don't have to be serious about this game, you don't have to wait until the perfect time to jump in, you learn and accumulate. One-liner: 印度和 Crypto 都是非常有潜力的市场. One-liner: India and Crypto are very promising markets. Balaji Srinivasan 在这三篇系列文章中聚焦了印度与 Crypto 的关系, 以及印度未来的巨大 Crypto 潜力. Balaji Srinivasan focused on India's relationship with Crypto in these three series, as well as India's great future Crypto potential. One-liner: 以太坊的价值全解. One-liner: Not Boring 深度剖析了以太坊的价值. Not Boring analyzed Ether's value in depth. 以太坊是一台去中心化的世界计算机, 是 Web3 的支柱, 也是互联网货币, 以太坊网络的所有权, Crypto 这一伟大的在线游戏中常用的货币, Yield-generating, 价值存储, 对 Web3 的赌注. Ether is a decentralised world computer, the backbone of Web3, the Internet currency, the ownership of the network, Crypto, the currency commonly used in this great online game, Yield-gendering, value storage, bets on Web3. 以太坊和 Excel 这个产品其实很像, 能养活几万亿美元的生态. 在 ETH2.0 的拐点上, Packy 认为 Web3 将继续增长, 以太坊升级将会顺利进行, 以太坊会依然是 Web3 的主要 L1. The products of Ether and Excel are quite similar, and they can feed hundreds of billions of dollars of ecology. At the turn-off point of ETH 2.0, Packy thinks that Web3 will continue to grow, that Etherm upgrading will go well, and that the Etherm will remain the main L1. One-liner: Web3 的定义. One-liner: Definition of Web3 Chris Dixon 完整定义了 Web3. Web3 是一个可以被开发者和用户以代币形式所拥有的互联网. Chris Dixon fully defines Web3. Web3 as an Internet that can be owned by developers and users in the form of tokens. 为什么 Web3 重要? 因为去中心化重要 (可以回过头来看他 2018 年写的那篇文章). 在 Web3 中, 所有权和控制都是去中心化的, 人们可以通过拥有代币来拥有服务 (NFT 和 FT). Because decentralisation is important. In Web3, ownership and control are decentralised, and people can have services through the possession of tokens (NFTs and FTs). Web3 是之前的 Web 的优点的融合体. 我们是很早的参与者. Web3 is the combination of the strengths of the former Web. One-liner: 标题概括得很好了. One-liner: The title is very general. Linda Xie 探讨了最大的创新: 可组合性. Linda Xie explores the greatest innovation: collusiveness. DeFi 的例子展现了货币乐高的可组合性. 通过智能合约的使用, Token 可以跨各个应用来使用, 从贷款到衍生品. 对开发人员来说, 通过可组合性, 可以在其他项目的基础上构建产品, 比如在游戏中添加 DeFi 组件, 在 DeFi 中添加游戏. NFT 的金融化也提供了无限的可组合性, 与资金利用率. Mirror 和 Zora 的协作让互相的生态都得到了各自的优势. The example of DeFi shows the combinability of the money gloom. Through the use of smart contracts, Token can be used across applications, from loans to derivatives. For developers, through collusiveness, products can be built on the basis of other projects, such as the inclusion of the DeFi component in the game, the addition of the game in the DeFi. The financialization of NFT also provides unlimited combinability, with the use of funds. Mirror and Zora collaborates with each other to the advantage of each other's ecology. 可组合性就像互联网一样, 根本上的改变了行业, 打开了一个新的充满可能性的全新世界. 接下来只需要留给创意. Combinability, like the Internet, fundamentally changed the industry, opened up a new world of possibilities, and then left it to creativity. One-liner: Crypto-native 的游戏. One-liner: Crypto-native game. Crypto 不是一个渐进式的创新, 而是打开了新世界的大门. 游戏是新兴技术的领先指标, 是风险相对较低的可探索未来的一个领域, 允许更快的迭代循环. Crypto is not an incremental innovation, but opens the door to a new world. The game is a leading indicator of emerging technology, an area where risks are relatively low and the future can be explored, allowing for faster iterative cycles. 真正 Crypto-native 游戏会使用区块链作为存储, 智能合约实现游戏逻辑, 根据开放生态原则来开发, 包含数字资产. Real Crypto-native games use block chains as storage, smart contracts achieve game logic, are developed in accordance with open ecology principles, and contain digital assets. One-liner: 以太坊扩容的终局. One-liner: End of Vitalik 解读了以太坊扩容的终局. Vitalik read the end of Ether's expansion. 对于类似 BSC, Solana 这样的区块链来说, 需要更多的 Rollup. 为了 TPS 和更好的用户体验, 这些区块链不得不会在出块上减少去中心化程度, 因此当我们拥有更多的 Rollup 解决方案的时候, 我们就可以从验证这个角度来去中心化地来验证 (跑轻节点等) 出块阶段的中心化节点是否值得信任. For blocks like BSC, Solana, more Rollup. For TPS and better user experience, these blocks would have to be less centralized on the surface, so when we have more Rollup solutions, we can verify from this perspective that the centralization nodes of the block phase are trusted. 对于以太坊, Rollup 是个不可避免的趋势, 但是也会在出块上慢慢中心化. 一种可能性是一个 Rollup 统治了 Layer2 生态, 这就和刚刚所说的 BSC 等区块链的情况一样了. 另一种可能性就是百花齐放, Rollup 都在竞争和合作, 这样会导致为了 MEV, 矿工去做好多个 Rollup 的节点, 技术强的节点会慢慢垄断作为 Rollup 节点的这个任务. One possibility is that one Rollup dominates the Layer2 ecology, just like the BSC and so on. The other possibility is that flowers are on the run, that Rollup is competing and cooperating, which will lead the miners to do a number of Rollup nodes for MEV, and that the technocratic nodes will slowly monopolize this task as Rollup nodes. 这几个路线都走向了同一个结果: 区块生产是中心化的, 但验证是去信任和去中心化, 以及防审查的. All of these routes lead to the same result: block production is central, but verification is trust and decentralisation, and censorship. One-liner: Crypto 的投资逻辑. One-liner: Crypto's investment logic. Cobie 提出了和 Packy 类似的观点, 牛市 Crypto 的投资是和玩电子游戏类似的. Cobie made a point similar to Packy, and Crypto's investment is similar to playing video games. Crypto 投资的游戏主要包含了以下两个好玩的元游戏: 以太坊与以太坊杀手游戏和 NFT 项目游戏. 这其实就是在 2021 年的两个投资的大趋势. 最大的赢家是了解这两个元游戏以及背后原理的人. The Crypto investment game consists mainly of two interesting meta-games: the Ether and Ether Killer games and the NFT project games. This is actually the two major investment trends in 2021. The biggest winners are those who know the games and the principles behind them. 2020 年的元游戏是 DeFi Summer, 年底变成了 BTC, 然后又变成了 DeFi 的复兴, Shit Coin, Alt L1, 和复古 NFT. 当玩家没有识别正确的元游戏时, 就输了. 一个元游戏从长期投资开始, 到流行, 最后由模仿者层出不穷而结束. The 2020 game was DeFi Summer, which became BTC at the end of the year, and then DeFi's renaissance, Shit Coin, Alt L1, and antiquated NFT. When the player didn't recognize the correct meta game, he lost. A meta game began with long-term investments, and ended with a lot of mimeographers. 了解元游戏背后原理也非常重要. 比如 LOL 中有段时间 Nocturne 很强势, 那么你就可以一直用这个英雄, 直到他不再强势. 去理解 Avax 和 Sol 的 DeFi 的区别是非常重要的, Sol 和 Avax 没有大的区别, 但是 Avax 的生态是更面向社区的, 因此才让持有者真正收获了收益. It's also important to understand the principles behind the meta game. For example, there's time in LOL for Nocturne to be strong, so you can use this hero until he's no longer strong. It's important to understand the difference between Avax and Sol's DeFi, Sol and Avax, no big difference, but Avax's ecology is more community-oriented, which is why the holders actually reap the benefits. 去向成功者学习是赢得游戏非常重要的一点. 同时, 去观察社区. 以及 Crypto 领域外的一些技巧: 新上线资产大概率涨, 链上分析, 鲸鱼钱包观察...... Learning from the successful is a very important point of winning the game, and at the same time, watching the community... and some of the techniques outside the Crypto field: new online assets are probably up, chain analysis, whale wallets are watching... Cobie 也推荐了几种赢得游戏的小技巧: Cobie also recommended a few little tricks to win the game: 尽早识别元游戏, 随着时间推移增加持有. A meta-recognition game as early as possible, increasing holdings over time. 暂时的失败之后, 就休息一下, 将精神转移到新事物上. After a temporary failure, take a break, and turn the spirit into something new. 交易员可以使用元游戏来退出或者重新平衡长期头寸. Dealers can use meta games to exit or rebalance long-term positions. 元游戏可以帮助决定哪些资产适合利用衍生品交易. A meta game can help decide which assets are suitable for dealing with derivatives. 我们需要独立思考, 来识别思维中的偏见, 这很可能需要很长时间. We need to think independently, to identify prejudices in our minds, which may take a long time. 当元游戏是所有参与者的共识的时候, 已经晚了. It's too late when the game is the consensus of all the players. One-liner: Crypto 化的风险投资. One-liner: Cryptoized venture capital. Mirrortable 的概念主要就是 Crypto 化的 Cap Table. The concept of Mirrortable is primarily Crypto-Cypto-Captable. 天使投资中涉及到很多 Web2 的工具 (Docusign 等), Web3 中有更多成熟并且更强的工具. 当前的各种 PDF, 邮件, 表格非常过时且混乱, 对个人来说维护成本非常高. Web3 的理想投资流程可以打通各个投资的链路, 将链上和链下的组件都整合起来. There are a lot of Web2 tools involved in angel investment (Docusign et al.) and more mature and powerful tools in Web3. Various current PDFs, emails, tables are very outdated and confusing, and maintenance costs are very high for individuals. The ideal Web3 investment process can connect investments and integrate components on and under the chain. 这会是一个巨大的赛道 (最近 EthSign 融了 1200 万美元). It's gonna be a huge track. 2021 是刺激的一年, 币价上上下下好多次, 大家也在 Edging 了这么多次之后, 失去了敏感度. 但是这是 Crypto 广泛进入普通人视野的一年. 街上随处可见的比特币售卖机, 大交易所对体育队伍的各种一掷千金的赞助, 无数的禁令和监管也被冷不丁砸在 Crypto 头上. “Web3” 的叙事给 Crypto 正明, 大家觉得自己真是对抗 “Web2” 寡头的正义使者 (但是不得不承认大多数人只是为了赚快钱), 无数宏大的叙事让加密货币的投资者深信不疑, 各个生态 (不止是比特币和以太坊) 也有了自己的信徒. "Strong" 2021 was a year of excitement, money went up and down many times, and people lost their sensitivity after Edging, but it was a year of Crypto's wide access to ordinary people. 这一年还没过去, 发生在昨天, 所以推荐直接阅读这些文章, 跟进 Crypto 最新的发展. The year hasn't passed, and it happened yesterday, so it's recommended to read these articles directly, follow up on Crypto's latest developments. One-liner: 标题概括得很好了. One-liner: The title is very general. 这篇文章我就不详细介绍了. 但是这篇对 2021 年 NFT 的复盘, 有 32 页, 足以证明 NFT 在 2021 年有多火热. I'm not going to go into this article in detail, but this copy of the 2021 NFT, with 32 pages, is enough to prove how hot NFT was in 2021. One-liner: 灵魂绑定的 NFT. One-liner: soul bound NFT. 作为魔兽世界老玩家, Vitalik 通过灵魂绑定的概念, 来讨论去中心化身份认证相关的内容. As an old gamer in the world of monsters, Vitalik discusses the content of decentralised identification through the concept of soul binding. 灵魂绑定的概念如果用到 NFT 上, 那么 NFT 就是无法转让的. (实际上, 对于一些人来说, 某些 NFT 已经是他们的灵魂绑定之物了, 比如 richerd.eth 就说自己无论如何也不会卖 CryptoPunk #6046, 这已经是他的 identity 的一部分了, 可以详细看这个 Thread) If the concept of soul binding is used on NFT, then NFT is untransferable. (In fact, for some people, some NFT is already their soul binding, for example, richer.eth says that he would never sell CryptoPunk #6046, which is already part of his identity, so look at this Thread in detail.) Vitalik 探讨了 POAP, CityDAO, 和 Adidas 的抢先购买 NFT. 他说对当今的 Crypto 的普遍批评就是一切是以金钱为导向的, 限制了围绕物品的文化的吸引力和可持续性. 在 Crypto 圈中实现一种围绕不可转移性来设计的方案, 能解决这个问题. 但是, 赚钱是吸引人进入 Crypto 圈的一个很大因素, 所以不可转移性 (意味着无法炒作) 与吸引力和现在的普遍设计有着一些矛盾. Vitalik discussed POAP, CityDAO, and Adidas' pre-purchase of NFT. He said that the widespread criticism of Crypto today was that it was all money-oriented and limited the attractiveness and sustainability of the culture surrounding the goods. One-liner: 标题概括得很好了. One-liner: The title is very general. Jacob Horne 提出了一个新概念, Hyperstructure, 这会是 Crypto 的新心智模型. Jacob Horne proposed a new concept, Hyperstructure, which would be a new mental model for Crypto. 区块链创造了 Hyperstructure 的架构, 区块链上的协议就是 Hyperstructure. 它们无法被关停, 免费使用 (gas 不算), 有价值积累, 有激励, 无需许可, 多方获利, 可信中立. Block chains create the structure of Hyperstructure, and the protocol on the block chain is Hyperstructure. They can't be shut down, they can't be used for free (gas not counting), they're valuable accumulation, they've got incentives, they don't need permission, they're profitable, they're credible neutral. Hyperstructure 会服务数百万个接口, 价值可以反哺生态, 构建上协议优先, 流动性高, 赋予参与者所有权与治理权, 构建周期长. Hyperstructure will serve millions of interfaces, value can counterfeasible ecology, build agreements first, be highly mobile, give participants ownership and governance, and build cycles long. Jacob 将 Hyperstructure 比作社会的基础设施, 认为它会是互联网时代创造出的造福后代的美丽基础. 我们正在进入一个全新的领域, 我们应该拥抱这个未知的变化. Jacob compares Hyperstructure to the infrastructure of society, believing that it will be a beautiful foundation for future generations created by the Internet age. We're entering a completely new field, and we should embrace this unknown change. One-liner: 下一代社交网络. Varun 探讨了下一代社交网络充分的权力下放, 网络的去中心化, 名称注册的去中心化, 和项目早期成员的有效激励. Varun explores the full decentralization of the next generation of social networks, the decentralisation of networks, the decentralization of name registrations, and effective incentives for early members of the project. 2022 刚开始, 但是我状态爆炸的推特关注列表让我感觉, 这一切都发展的太快了. 在一个熊市的氛围里, 一些 PPT 项目都能融到好几百万美金. 不同的新的话题涌现, zk, NFT, 基础设施, Alt-EVM, DeFi, 监管...... 政治, 经济形势, 人文...... 都太疯狂了, 但是我相信, 之后只会更加疯狂. 从 1997 年到 2022 年, Crypto 有了越来越多样化社群, 各个观点开始由点到面, 波及的领域从比特币领域开始, 越来越广, 拓展到了人文、经济、政治..... Crypto 在崩溃、融合、新生的循环中, 螺旋上升. From 1997 to 2022, Crypto became a more diverse community, starting from the point to the face, from the point to the point, from the point to the point, to the area of bitcoin, to the wider, to the human, economic, political... 通过对 Crypto 游戏的赢家的观点的观察, 我们发现, 其实在这些长远的 Foresight 中有着无数的财富密码. 在他们的文章和推特发布的两三年后, 我们才会恍然大悟: “原来是这样.” 我们想出来的精彩 idea, 在 3, 4 年前就被提出和讨论过很多了. By looking at the view of the winner of the Crypto game, we found that in these long-term Foresight there were countless pieces of wealth code. Two or three years after their articles and tweets, we realized: "That's the way it was," the idea that we came up with was raised and discussed a lot three, four years ago. 但是这其实无所谓, 我们所要做到的就只需要是去学习和思考. The more you learn, the more you earn; the more you know, the more you grow. 闻道无先后. The more you learn, the more you learn; the more you know, the more you grow. 感谢 Dan Romero 创建了 Crypto Readings 的阅读列表. 本文内容均基于阅读列表所写. Thanks to Dan Romero for creating a reading list of Crypto Readings. The text is based on the reading list. 1997: https://book.douban.com/review/13489362/ https://bitcoinmagazine.com/culture/bitcoin-and-the-sovereign-individual-thesis 2008: https://cointelegraphcn.com/news/bitcoin-white-paper-turns-13-years-old-the-journey-so-far https://www.sohu.com/a/457337744_120340030 2021: https://www.sohu.com/a/507780263_121118710 中文推特:https://twitter.com/8BTC_OFFICIAL 英文推特:https://twitter.com/btcinchina Discord社区:https://discord.gg/defidao 电报频道:https://t.me/Mute_8btc 电报社区:https://t.me/news_8btcWhy Bitcoin Matters?—— Marc Andreessen (a16z 创始人)

Ethereum is the Forefront of Digital Currency?—— Fred Ehrsam (Paradigm 和 Coinbase 的创始人)

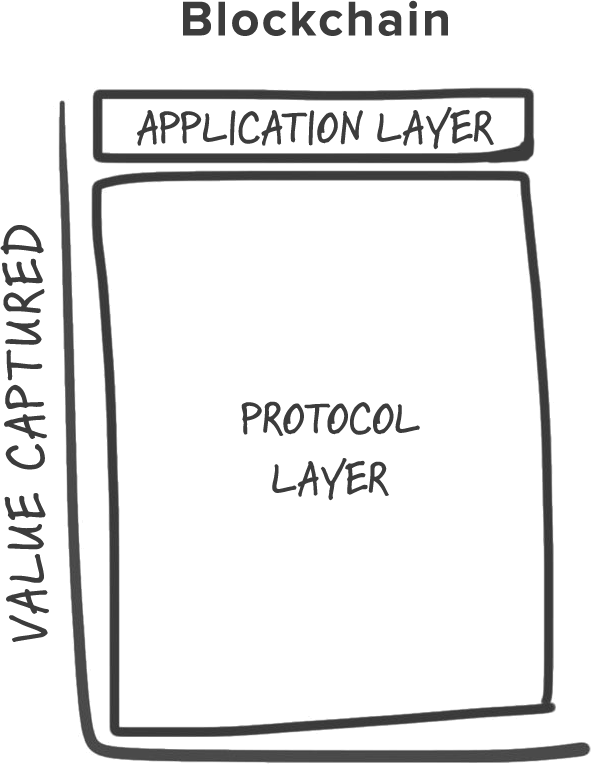

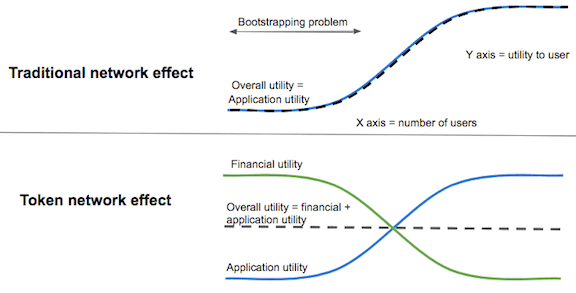

Fat Protocols?—— Joel Monegro (Placeholder VC 创始人)

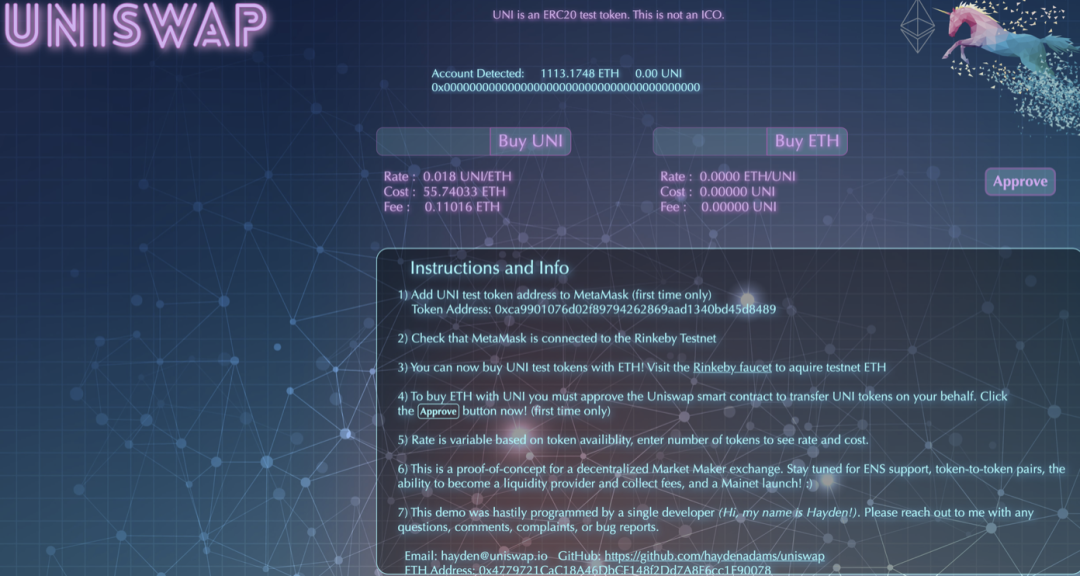

番外篇:?2017 年的 Uniswap

Value of the Token Model?—— Fred Ehrsam

Thoughts on Tokens?—— Balaji Srinivasan (前 Coinbase CTO, 前 a16z GP)

Crypto Tokens: A Breakthrough in Open Network Design?—— Chris Dixon

Analyzing Token Sale Models?—— Vitalik Buterin

Cryptocurrency’s Netscape Moment?—— Elad Gil (Solo Capitalist)

Permissionless?—— Alok Vasudev

The Slow Death of the Firm?—— Nick Tomaino (1confirmation 创始人)

Big Banks And Blockchain?—— Elad Gil

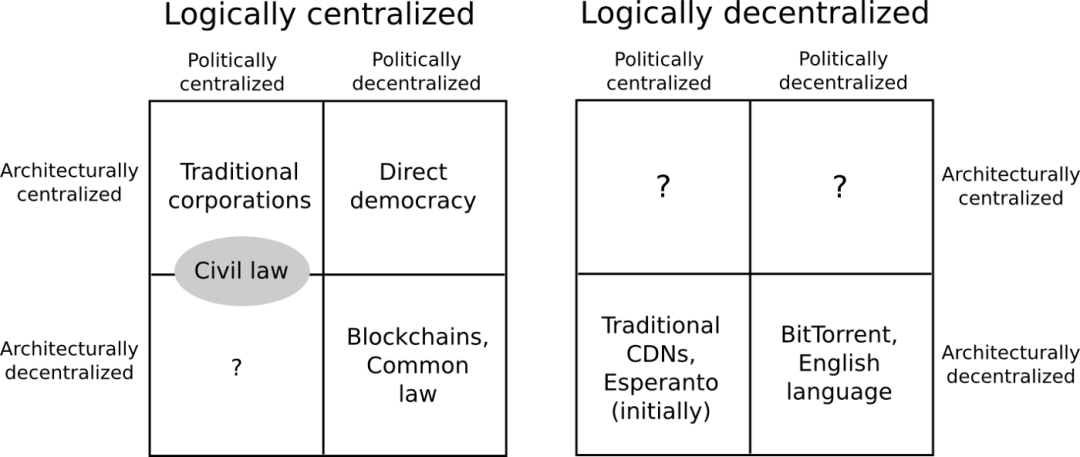

The Meaning of Decentralization?—— Vitalik Buterin

A beginner’s guide to Ethereum?—— Linda Xie

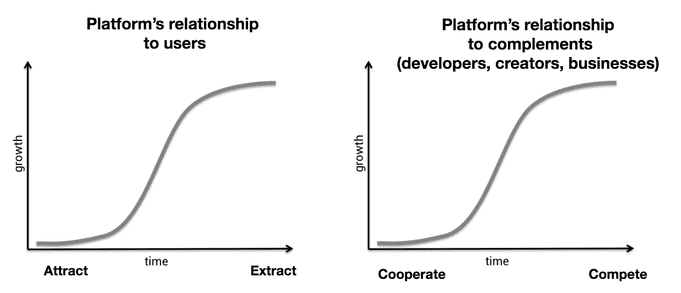

Why decentralization matters?—— Chris Dixon

And What Has the Blockchain Ever Done for Us—— Balaji Srinivasan

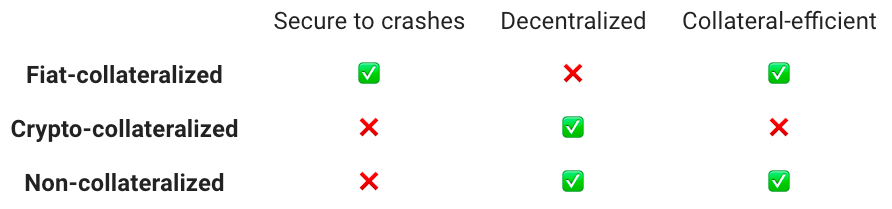

Stablecoins: designing a price-stable cryptocurrency?—— Haseeb Qureshi (Dragonfly Capital GP)

Yes, You May Need a Blockchain?—— Balaji Srinivasan

The future of decentralized finance?—— Linda Xie

The Pseudonymous Economy?—— Balaji Srinivasan

Credible Neutrality As A Guiding Principle?—— Vitalik Buterin

A Beginner’s Guide to Decentralized Finance (DeFi)?—— Sid Coelho-Prabhu

The Ownership Economy?—— Jesse Walden (Variant Fund 创始人)

Bitcoin for the Open-Minded Skeptic?—— Matt Huang

Creators, Communities, and Crypto?—— Fred Ehrsam

What explains the rise of AMMs—— Haseeb Qureshi

Ethereum is a Dark Forest?—— Dan Robinson and Georgios Konstantopoulos

Surviving Crypto Cycles?—— Fred Ehrsam

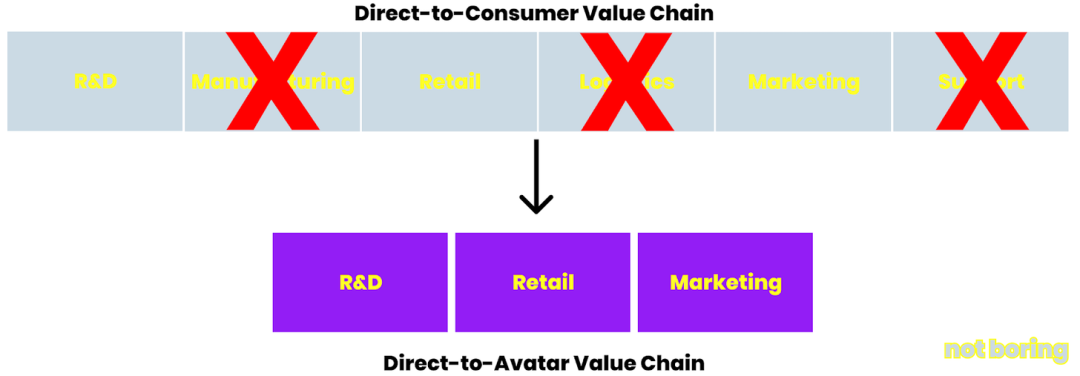

The Value Chain of the Open Metaverse?—— Packy McCormick (Not Boring 创始人)

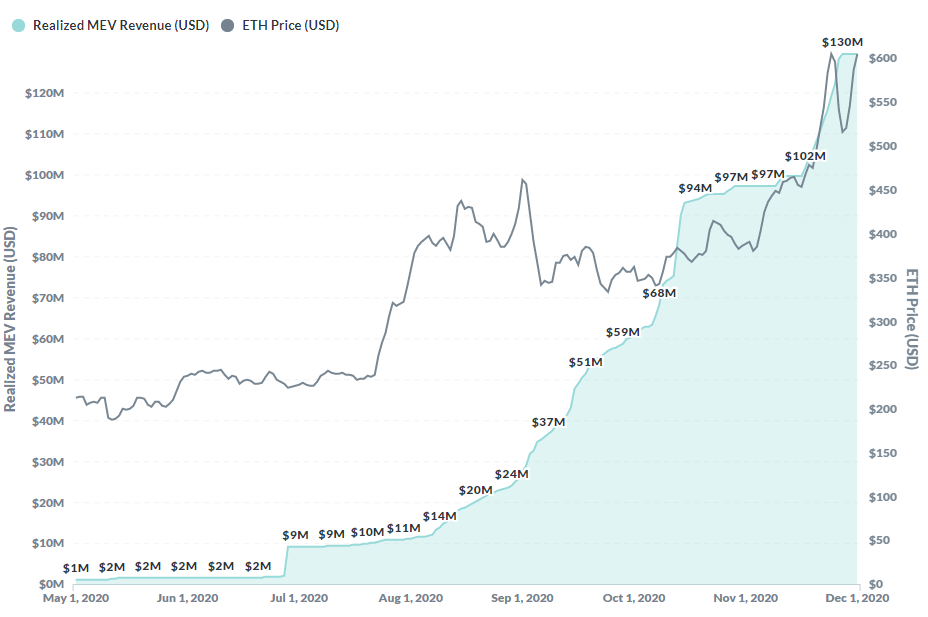

MEV and Me?—— Charlie Noyes

NFTs make the internet ownable?—— Jesse Walden

NFTs and A Thousand True Fans?—— Chris Dixon

A beginner’s guide to DAOs?—— Linda Xie

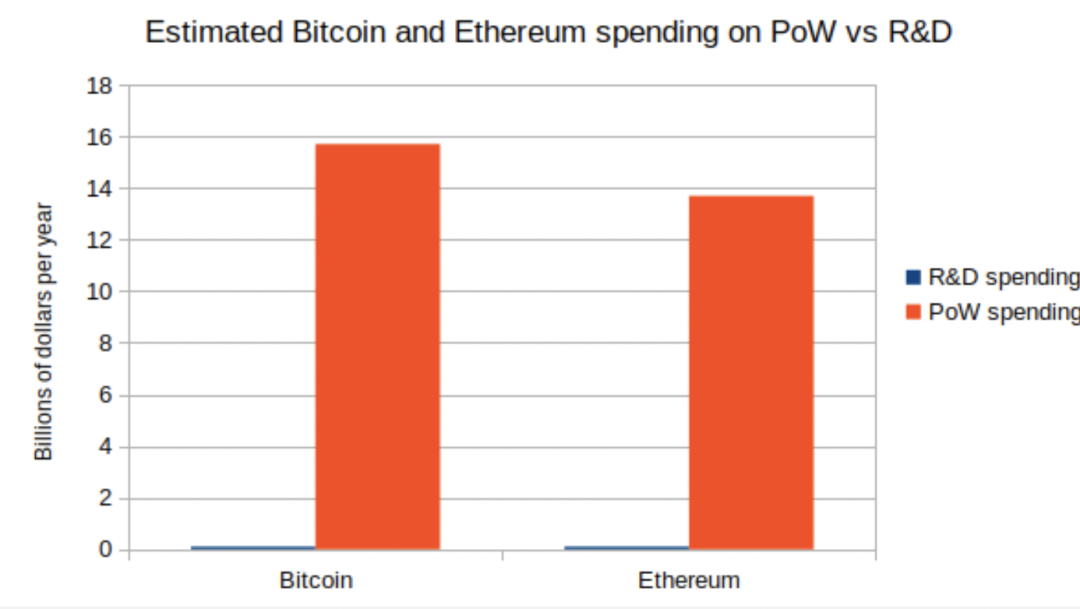

The Most Important Scarce Resource is Legitimacy?—— Vitalik Buterin

The Great Online Game?—— Packy McCormick

India & Crypto series?—— Balaji Srinivasan

Own the Internet?—?by Packy McCormick

Why web3 matters?—— Chris Dixon

Composability is Innovation?—— Linda Xie

The Strongest Crypto Gaming Thesis?—— gubsheep

Endgame?—— Vitalik Buterin

Trading the metagame?—— Cobie

The Mirrortable?—— Balaji Srinivasan

2021 NFT Year in Review?—— 1confirmation

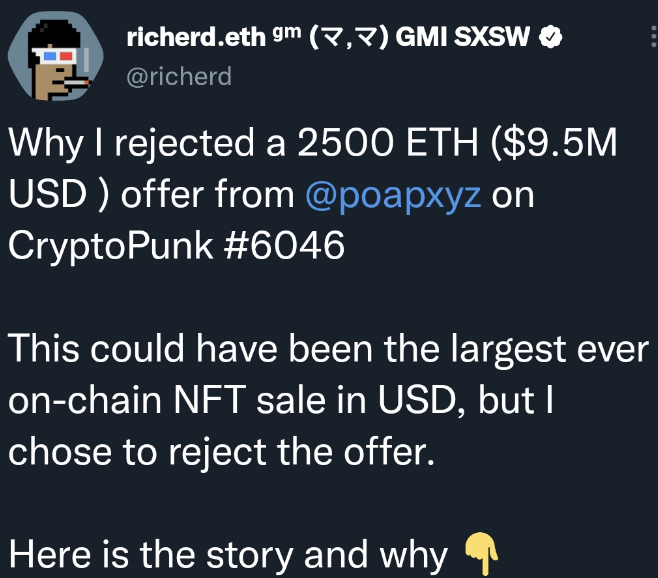

Soulbound?—— Vitalik Buterin

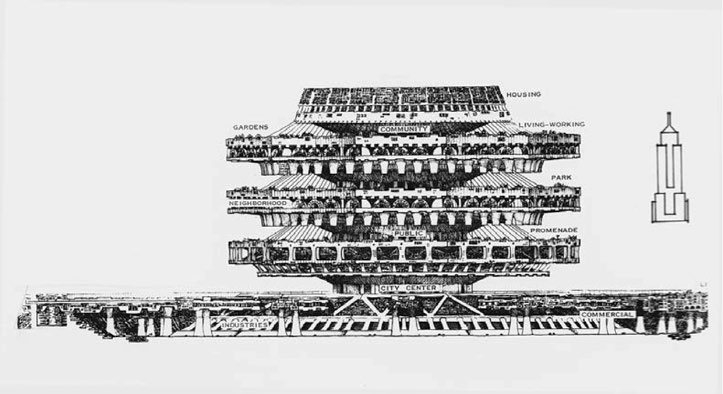

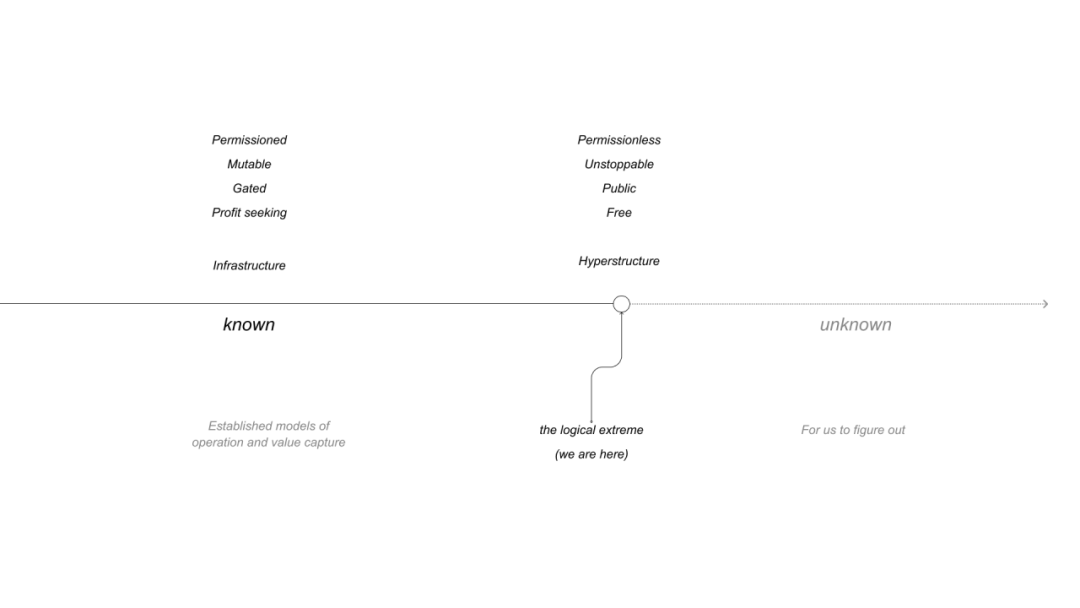

Hyperstructures?—— Jacob Horne (Zora 创始人)

Sufficient Decentralization for Social Networks?—— Varun Srinivasan

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论