人特么都跌成脑震荡了。

The man fell into a fucking concussion.

这是前些天币圈大地震后,绝大部分投资者的集体症状——到现在脑瓜子都嗡嗡的。

These are the collective symptoms of the majority of investors — and so far the brain is buzzing — in the wake of the previous massive earthquake in the currency ring.

也难怪,24小时内,比特币险些跌穿3万美元关口,一夜回到今年1月的价格位置。马斯克的亲大儿狗币,跌幅一度达到42%,投资者冲到一美元的美梦继续落空,狗币价格大幅回落到28美分。主流大币之一的以太币也下跌了27%,跌至2475美元。

No wonder, in 24 hours, Bitcoin was on the verge of collapsing over $30,000, returning overnight to the price position of January this year. Mask’s pro-kid dog-coin fell by 42% at a time, investors continued to evaporate their dream of a dollar, and the dog price fell sharply to 28 cents. Ether, one of the major coins, also fell by 27%, to $2475.

EOS、艾达币等跌幅都接近50%。还有一些空气币因为价格过低,在交易平台上的价格甚至直接显示为0。

EOS, Aidaco, etc., have fallen close to 50%. Some air currency, because it is too low, even shows zero directly on the trading platform.

根据币安数据,19日24小时市场爆仓额约19.3亿美元,有近22.7万人成为爆仓受害者。

According to currency security data, about $1.93 billion was spent on a 24-hour market explosion on 19 days, and nearly 227,000 people were victims of the explosion.

社交媒体上,币圈的散户投资者们哀嚎一片。

In social media, the money-circumstance diaspora investors mourned.

随便找个币友群打开,就能看见各种哭丧。

You can see all kinds of tears if you can find a coin to open it.

当然,纯炒币亏损还不算什么,最怕的就是炒币还加杠杆,一加就是五倍十倍二十倍,有些神仙还50倍、75倍的,反向几点个就爆仓,人打游戏爆装备,他玩币圈爆一脸鼻涕眼泪。

Of course, it's nothing, but it's a five-fold ten-twenties-twenties-twenties-thirty-thirty-thirty-thirty-thirty-thirty-thirty-thirty-thirty-thirty-thirty-thirty-thirty-thirty-thirty-thirty-thirty-thirty-thirty-thirty.

很多人在恐慌之余都想问一句,Why?为什么会暴跌?

A lot of people want to ask in the middle of a panic, Why? Why did they fall?

不少媒体和所谓的“专业人士”把原因归结于近期国内三个有关部门发布的公告:

A number of media outlets and so-called “professionals” have attributed their reasons to recent announcements issued by three national authorities:

中国互联网金融协会、中国银行业协会、中国支付清算协会联合发布《关于防范虚拟货币交易炒作风险的公告》。

The China Internet Finance Association, the China Banking Association and the China Payment Settlement Association jointly issued a bulletin on protection against the risks of virtual currency transactions.

的确,此时三部门张贴告示,确实给了本就处于跌势的币圈沉重一击。

Indeed, the announcement of the three sectors at this time did give a heavy blow to the currency circle that was already in decline.

但是,请注意,这绝对不是主因。更不是传言国家要禁币圈的前兆。

Note, however, that this is not the main reason. Nor is it a precursor to the rumour that the country is sealing currency circles.

因为官方层面的介入是必须的,意料之中的。

Because intervention at the official level is necessary and unexpected.

为什么?

Why?

最明显的一个原由,包括中国在内的亚洲年轻人都在炒币:韩国每三个年轻人就有一个在币圈,香港全球加密货币交易量世界第一,泰国已经成为了全东南亚的加密货币中心。

One of the most obvious causes is that young Asians, including China, are squeezing their currency: South Korea has one in every three young people in a currency ring, Hong Kong has the world's largest global volume of encrypted currency transactions, and Thailand has become an encrypted currency centre for all of South-East Asia.

以亚洲占全球60%以上人口的数量,可以说是不折不扣的全球币圈第一大韭田。

With Asia accounting for more than 60 per cent of the world's population, it can be described as the largest global currency.

东亚小青年在519前几天的生活画像是这样的:大清早从几平蜗居的床上醒来,发现自己又被割了,哭天抢地一番后,抹抹眼泪继续加仓。

The pictures of young East Asians in the days before 519 were like this: early in the morning, they woke up from a few snail beds and found themselves cut again, and after crying and crying, tears continued to pile up.

晚上欧美庄家们从一百平米的床上醒来,看了一眼手机:“噢哟,韭菜涨势喜人啊。”反手开一张百倍做空单然后拿筹码继续砸盘。

At night, the O'Americans woke up from a 100-metre bed and looked at their cell phone, "Oh, the pickles are so exciting." And they opened a 100-fold blank list and took the chips and continued to smash the plate.

怎么着,前几个月你们多头赚爽了,现在又把中国人摁在里面坑空头?

What, you made a lot of money in the last few months, and now you're putting the Chinese in there?

资本主义镰刀两头割,太不讲武德了吧。所以国家层面当然要出手,这个动作可以解读为示警,或者说为即将到来的崩盘浇油,却绝非导致519大跌的主因。

Capitalist sickle cut his head off. So, of course, we have to do something at the national level, which can be interpreted as a warning, or as a fuel for the impending collapse, but not as a major cause of the 519th fall.

实际上就像股市一样,当前几个月获利太多之后,总要有个宣泄口去进行回调。你就拿比特币来说,连续6个月走阳线,积累了大量的获利盘。并且到19号之前,没出现过特别大的调整。

In fact, as in the stock market, after a few months of too much profit, there's always a blowback. In the case of bitcoin, six months in a row, you've accumulated a lot of profits. And before the 19th, there was no particularly large adjustment.

以它今年的最高点6万美元计,全球2100万枚比特币市值大概在1万2千亿美元左右,不仅超过中国持有的美国美债,而且在2020年全球各国GDP排行里,处于西班牙和墨西哥之间,排名全球前15。

At its highest point of $60 million this year, the global market value of 21 million bitcoins is about $12,000 billion, not only exceeding the US dollar debt held by China, but also ranked among Spain and Mexico in the top 15 global GDP rankings in 2020.

股市从17世纪初的阿姆斯特丹交易所算起,到现在发展了四五百年有这样的规模不足为奇,但是作为金融新贵,币圈的势头实在太猛,降温势在必行。

Since the Amsterdam Exchange at the beginning of the seventeenth century, it is not surprising that the stock market has grown on such a scale for 400 or 500 years now, but as a new financial asset, the currency circle is so strong that it is imperative to cool down.

更何况币圈里杠杆合约不断,动辄几十倍的涨跌,对于整个币圈生态是非常不健康的,这次暴跌有极大一部分因素,就是因为这些“狂野西部”式的杠杆交易。

Even more so is the fact that leverage contracts in the currency circle continue to rise and fall several dozen times, which is very unhealthy for the entire ecology of the currency ring, and that this collapse has a significant part to play because of these “wild west” leveragings.

如加密货币金融服务提供商AmberGroup美洲负责人JefferyWang周三表示:“我们看到很多更高的杠杆头寸在短时间内被平仓。这是一个巨大的冲击,如果市场想要继续走高,可能有必要从过度杠杆化的头寸中去除一些泡沫。”

For example, JefferyWang, head of the encrypt money financial service provider Amber Group America, said on Wednesday: “We see a lot of higher leverage positions down in a short period of time. This is a huge shock, and if markets are to continue to move up, it may be necessary to remove some bubbles from overleveraging positions.”

一言蔽之,519的行情既在降温,又在挤泡沫。让高杠杆的狗不得House。

In a nutshell, 519 moves are both cooling and foaming. Keeping highly leveraged dogs out of the house.

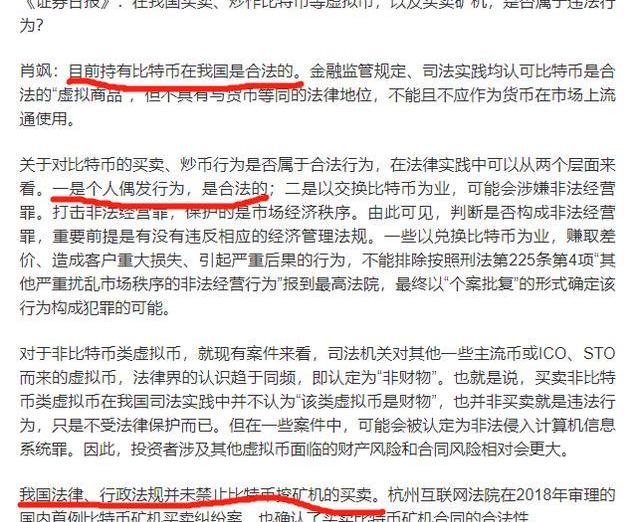

话说到这,我们冷静下来在转头看看之前的新闻,就不难发现国家从来都没有对比特币交易有过限制,只不过一直在强调风险而已。金融监管规定、司法实践均认可数字货币是合法的“虚拟商品”,但不具有与货币等同的法律地位,不能且不应作为货币在市场上流通使用。

By the way, when we calmly look at the news before turning around, it is easy to see that the country has never had a limit on transactions in bitcoin, but has been emphasizing risks. Financial regulation, judicial practice, recognizes digital money as a legitimate “virtual commodity” but does not have a legal status equivalent to that of money, and cannot and should not be used as a currency in the market.

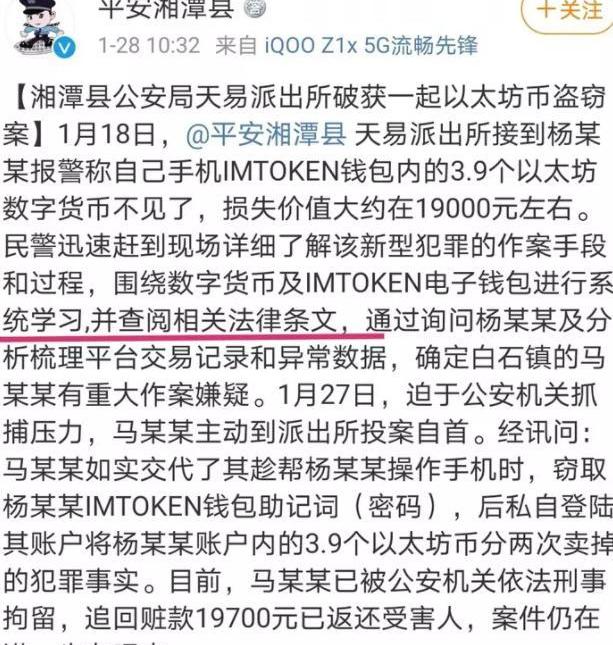

这种态度,从近两年部门多方侦破数字货币盗窃案,不遗余力为受害者追回损失也能佐证,官方是认可数字加密货币作为公民合法虚拟资产这一点的。

This attitude, supported by the multiplicity of investigations into digital currency thefts in the sector over the past two years, has spared no effort to recover losses for the victims, and the official endorsement of digital encrypted currency as a legitimate virtual asset for citizens.

政策面不仅认可数字加密货币,我们在“十四五规划”的大纲要里,也可以看到上层布局新技术的决心:

Not only does the policy side recognize digital cryptographic currencies, but we can also see in the 14th Plan's broad outline the determination of new technology in the top configuration:

“十四五”将是数字经济大发展大繁荣的五年,也会是区块链创新加速、构建生态、广泛落地、纳入监管的五年。《十四五规划纲要》明确了技术创新、平台创新、应用创新、监管创新这四大区块链创新方向,将进一步加快数字中国的建设步伐,助推社会主义现代化建设。

The 14th Five-Year Plan provides a clear direction for technological innovation, platform innovation, application of innovation, and regulation of innovation, which will further accelerate the construction of digital China and contribute to the modernization of socialism.

既然国家和政策已经肯定了未来的方向,作为投资者还有什么好担心的呢?

Now that the future direction of the State and policies has been confirmed, what is to be worried about as an investor?

至于本次519暴跌,除开以上所说的,对接下来的市场发展也未尝不是好事。

With regard to this 519 drop, aside from what has been said above, it is not a good thing for the next market development.

往回倒两年,2017年9月4日中国人民银行等七部委发布《关于防范代币发行融资风险的公告》。2017年9月4日比特币当天下跌11%,之后持续下行,到9月15日最低2979美元,12天最大跌幅:35%。之后企稳回升,造就一轮牛市,创出历史新高21525美元。

Two years later, on 4 September 2017, the People’s Bank of China and seven other ministries issued a communiqué on the prevention of the risk of financing the issuance of tokens. Bitcoins fell by 11 per cent on the same day on 4 September 2017, and then continued to fall down, reaching a low of $2979 on 15 September, with the largest fall of 12 days: 35 per cent.

2018年11月14日到12月15日的走势,比特币也是出现连续的下跌,最低3155美元,一个月左右跌幅51%。但之后企稳,逐步回升,创出新高。

The trend between 14 November and 15 December 2018 was followed by a consecutive decline in Bitcoin, with a minimum of $3155 and a 51 per cent drop in about one month. But then it stabilized, gradually rebounded and reached a new height.

还有2020年的“312事件”,在情绪踩踏下,3月13日创出阶段新低3800美元,其他币也是纷纷大跌。但之后企稳,逐步回升,创出新高。

There was also the “312 incident” in 2020, which, under the emotional step of March 13, was a new low of $3,800, with other currencies falling. After that, however, it stabilized, gradually rebounded, and reached a new height.

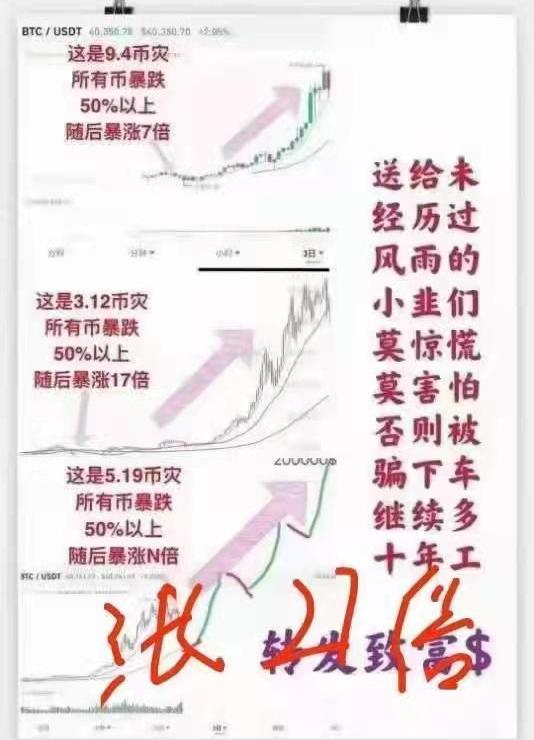

94币灾之后数字货币暴涨7倍,312暴跌后暴涨17倍,放在美联储开闸放水,全球通胀盛行的今年,涨27倍也绝非不可能!

A sevenfold increase in digital currency in the wake of the 94-dollar disaster, a 17-fold increase in the 312-shock fall, and a 27-fold increase in global inflation this year.

快人一步就要现在开始布局,才能享受到翻盘后的喜悦。

One step at a time, we're going to have to start the layout before we can enjoy the turnover.

当然,币市永远是逆人性思考的,你越痛苦才会酝酿出越赚钱的机会,能够坚持的人往往凤毛麟角。所以这个市场比股市还要残酷,人家是八二开,它是十零开,赢者通吃、败者食尘!

Of course, the currency market is always anti-human thinking, and the more painful it is for you to create opportunities to make money, and the more likely it is for those who can hold on to it. So this market is more cruel than the stock market, it's 88, it's zero, the winner eats and the loser eats.

作为普通投资者,上班就已经很痛苦了,我们当然不太、希望赚钱还那么痛苦。相比之下,顺人性的挖矿自然是更好的选择。

As ordinary investors, it is already painful to go to work, and of course we are not, and we want to earn as much money as we are. By contrast, soft mining is, of course, a better option.

这里的原因不外乎有四:

There are four reasons for this: .

1.挖矿有稳定收入的,可以实现无回撤的100倍涨幅;

1. A 100-fold increase in the non-repatriation of a mine that has a steady income from mining;

2.挖矿的收益符合人性的即时满足,每日都有收益,不需要等待收益;

2. The proceeds of mining are readily met in a humane manner and are available on a daily basis without waiting for the proceeds;

3.每台矿机每天都有固定收益相当于躺赚;

3. Every mine machine has a fixed daily income equivalent to that of lying down;

4.矿机越挖越值钱,覆盖成本后可以实现白赚挖出的币。

4. The mining machine is more valuable than it is, and the cost can be covered so as to achieve the value of the excavated currency.

就像莱比特CEO江卓尔说的那样:人性的缺点让炒币或者囤币都很难赚钱,甚至还会出现亏损。对于散户来说在市场中没有任何优势。而90%的矿工几乎可以吃掉整个牛市。

As Lebitt CEO Jiangdjoll said: Human shortcomings make it difficult to earn money or to hoard it, and even lose it. There is no advantage in the market for the homeless. And 90% of the miners can almost eat the entire cow market.

在这其中,已经上线120家交易所的Filecoin,凭借其独特的全网前置或后置质押以及销毁机制,练就逆天的“不怕跌”特性。5月19号Filecoin币价也同步大跌,全网却算力大幅增长,矿工热情不减!

Of these, Filecoin, which is already on-line in 120 exchanges, uses its unique web-based pre- or post-priming and destruction mechanisms to practice the “no fear of falling” character. The price of Filecoin on May 19 has also fallen simultaneously, but the net has grown dramatically, and the miners have not lost their enthusiasm!

未来随着存储数据的不断增长,和释放的fil币不断增多,到了一定高峰后,会趋于稳定,到时参与的厂商会更多,存储的数据会加大,在市场需要的推动下,币价必然会上涨,这是不可压制的历史必然性。

In the future, as data are being stored and the amount of filtrian coins released is increasing, it will stabilize at a certain peak, more chambers of commerce will be involved, more data will be stored, and currency prices will inevitably rise, driven by market needs, which is an inexorable historical necessity.

此时布局Filecoin,加入挖矿的稳定行列,就像2011年比特币才10块钱的时候挖矿,一定能挖到你实现财富自由和阶级跃升的阶梯!

Now, the layout of Filecoin, joining the steady process of mining, like the one in 2011 when Bitcoin was only 10 dollars, must be able to dig up the ladder to make your fortune free and class high!

标签:比特币加密货币LECECO杭州女子花300万买比特币yhhh加密货币是不是局3023filecoin币是哪国的CHECOIN

Label: bitcoin

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论