每经记者 文巧 每经编辑 兰素英

Every journalist, every writer, every editor, Ransu-Yin.

当地时间6月21日,知名投资产品发行商ProShares在美国推出首个与做空比特币挂钩的ETF——ProShares做空比特币策略ETF(The ProShares Short Bitcoin Strategy ETF,BITI)。该ETF在纽约证券交易所以“BITI”的代码进行交易,费用比率为0.95%。这只ETF上市首日收盘上涨3.45%,报39.84美元。

On June 21, local time, ProShares, a well-known producer of investment products, introduced in the United States the first ETF-ProShares, an empty bitcoin strategy, ETF (The ProShares Short Bitcoin Strategy ETF, BITI). The ETF deals with BITI code at a cost ratio of 0.95 per cent. This is an increase of 3.45 per cent to $39.84.

而对于偏爱共同基金(mutual fund)的投资者,ProShares的附属共同基金公司ProFunds也在当天推出了做空比特币策略共同基金(the Short Bitcoin Strategy ProFund,BITIX)。

For investors who favour mutual funds, ProFunds, a subsidiary of ProShales, also launched the Common Fund for Empty Bitcoin Strategy (the Short Bitcoin Strategy ProFund, BITIX) that same day.

据悉,2021年10月,ProShares曾推出美国首个与比特币挂钩的ETF——ProShares比特币策略ETF(The ProShares Bitcoin Strategy ETF,BITO)。这只多头比特币ETF当时在短短两天内就吸引了超过10亿美元的投资。据《金融时报》,这使得BITO在当时成为ETF发行历史上最热门的ETF之一。值得一提的是,就在BITO推出几周之后,比特币就创下历史高位,在去年11月达到68700美元/枚。

In October 2021, ProShares was reported to have launched the first United States-linked ETF-ProShares bitcoin strategy ETF (The ProShares Bitcoin Strategy ETF, BITO). This large bitcoin ETF attracted more than $1 billion in just two days. According to the Financial Times, this made BITO one of the most popular ETFs in its history. It is worth mentioning that just a few weeks after the introduction of BITO, Bitco reached a historic high of $68,700 in November last year.

然而,今年以来,比特币已经历了长达6个月的下跌行情。上周末,比特币再度走弱,一度跌至17599美元/枚,创下2020年12月以来最低水平,较2021年11月历史高位的回落幅度高达74%。

However, Bitcoin has experienced a six-month fall since this year. Last weekend, Bitcoin again weakened, once to $17,599 per piece, reaching its lowest level since December 2020, with a drop of 74 per cent compared to its historic high in November 2021.

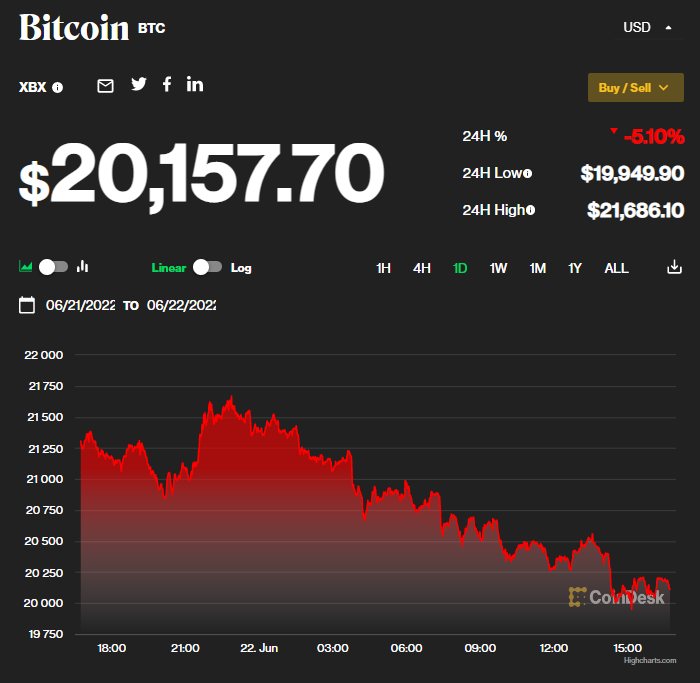

6月21日,比特币开启一定程度的反弹,收复2万美元重要关口。据CoinDesk数据,截至发稿,比特币价格为20157.7美元/枚,但较历史高位仍下跌约70%。

On 21 June, Bitcoin opened a certain level of rebound, recovering $20,000 at a critical point. According to CoinDesk, by the time of the release, the price of Bitcoin was US$ 2015 7.7 per piece, but it was still about 70 per cent lower than its historical height.

图片来源:Coindesk截图

“正如最近所市场表明的那样,比特币可能还会贬值,”ProShares在6月20日发表的一篇新闻稿中写道。“BITI为看空比特币的投资者提供了潜在获利或对冲其加密货币头寸的机会,投资者能够通过在传统经纪账户中购买ETF,方便地获得比特币的空头敞口。”

“As the market has recently shown, bitcoin may also depreciate,” ProShares wrote in a press release issued on 20 June. “BITI offers investors who watch bitcoin a potential profit or an opportunity to hedge their encrypted monetary positions, and investors can easily access Bitcoin's empty head exposure by purchasing ETFs in traditional brokerage accounts.”

在ProShares的BITI推出之前,Horizons ETF曾于去年4月在加拿大多伦多证券交易所上市过一只做空比特币的ETF——BetaPro Inverse Bitcoin ETF(BITI)。据《金融时报》,这只ETF自去年11月以来,已经实现高达142%的回报率。

Prior to ProShares' BITI, Horizons ETF had listed an ETF-BetaPro Inversion Bitcoin ETF (BITI) as an empty bitcoin on the Canadian Toronto Stock Exchange last April. According to the Financial Times, this only ETF has achieved a return of up to 142 per cent since last November.

另一只与做空比特币挂钩的交易所交易产品(ETP)是在欧洲上市的21Shares Short Bitcoin ETP(SBTC),自去年11月以来的回报率也达到了127%。

Another exchange trade product (ETP), linked to empty bitcoin, is 21 Shares Short Bitcoin ETP (SBTC) listed in Europe, with a return of 127 per cent since November last year.

据数据分析公司Glassnode在本周最新发布的报告,在比特币上周大跌后,无论是链上的DeFi市场,还是链下的交易所、贷款机构、对冲基金,很多都陷入了资不抵债、流动性不足或被清算的境地。

According to the data analysis company Glasnode's latest report released this week, many of the DeFi market on the chain, as well as the chain exchanges, lending institutions and hedge funds, were caught in debt overhang, in insufficient liquidity or in liquidation after Bitcoin fell last week.

上述报告的数据显示,在6月16日至18日的三天内,比特币投资者每天的变现亏损金额超过24亿美元,三天总计亏损达73.25亿美元(约合人民币491.87亿元),创下了比特币历史上规模最大的变现亏损金额。

According to the above-mentioned data, in the three days between 16 and 18 June, Bitcoin investors lost more than $2.4 billion on a daily basis, with a combined loss of $7.325 billion (approximately 49,187 million yuan) for three days, creating the largest realized loss in Bitcoin's history.

实际上,比特币的大跌只是加密货币和其他数字资产惨遭“血洗”的一个例子。根据TrackInsight的数据,加密交易所交易产品管理的全球资产总额已从去年11月195亿美元的高位跌至89亿美元,跌幅高达54%。

Indeed, the sharp fall in bitcoins is just one example of the “bloodwashing” of encrypted money and other digital assets. According to TrackInsight, the total global assets managed by the encrypt exchange traded products fell from a high of $19.5 billion in November last year to $8.9 billion, a fall of 54%.

不过,虽然加密货币市场遭遇重大冲击,但加密货币ETP的投资者似乎还没有做好认输的准备。TrackInsight创始人菲利普?马莱斯(Philippe Malaise)表示,尽管今年迄今(加密货币ETP)的平均回报率为-46%,但加密货币ETP今年仍在吸引资金流入。据TrackInsight统计的数据,在截至6月21日的过去4周内,(加密货币ETP)每周的净流入都是正数,总计达到5.07亿美元。

However, despite major shocks to the encrypt currency market, investors in the encrypt currency ETP do not seem to be ready to accept it. The founder of TrackInsight, Philippe Malaise, indicated that despite the average return of 46% so far this year (encrypted currency ETP), the encrypt currency ETP continued to attract capital inflows this year.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论